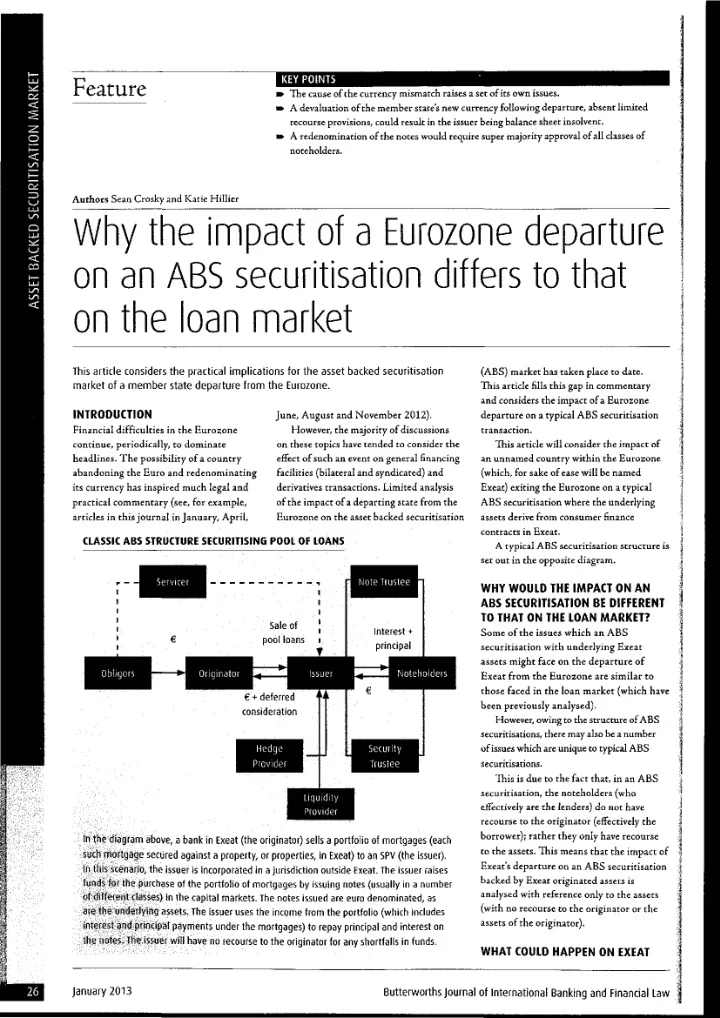

K E Y POINTS Feature The cause of the currency mismatch raises a set of its own issues. A devaluation of the member state's new currency following departure, absent limited recourse provisions, could result in the issuer being balance sheet insolvent. A redenomination of the notes would require super majority approval of all classes of noteholders. Authors Sean Crosky and Katie Hillier Why the impact of a Eurozone (departure on an ABS securitisation differs to that on the loan nnarket This article considers the practical implications for the asset backed securitisation (ABS) market has taken place to date. market of a member state departure from the Eurozone. This article fills this gap in commentary and considers the impact of a Eurozone INTRODUCTION June, August and November 2012). departure on a typical ABS securitisation Financial difficulties in the Eurozone However, the majority of discussions transaction. continue, periodically, to dominate on these topics have tended to consider the This article will consider the impact of headlines. The possibility of a country effect of such an event on general financing an unnamed country within the Eurozone abandoning the Euro and redenominating facilities (bilateral and syndicated) and (which, for sake of ease will be named its currency has inspired much legal and derivatives transactions. Limited analysis Exeat) exiting the Eurozone on a typical practical commentary (see, for example, of the impact of a departing state from the ABS securitisation where the underlying articles in this journal in January, April, Eurozone on the asset backed securitisation assets derive from consumer finance contracts in Exeat. CLASSIC ABS STRUCTURE SECURITISING POOL OF LOANS A typical ABS securitisation structure is set out in the opposite diagram. Note Trustee WHY WOULD THE IMPACT ON AN ABS SECURITISATION BE DIFFERENT TO THAT ON THE LOAN MARKET? Sale of Interest + Some of the issues which an ABS pool loans principal securitisation with underlying Exeat assets might face on the departure of Obligors Originator Noteholders Exeat from the Eurozone are similar to those faced in the loan market (which have € + deferred been previously analysed). consideration However, owing to the structure of ABS securitisations, there may also be a number Security Hedge of issues which are unique to typical ABS Provider Trustee securitisations. This is due to the fact that, in an ABS securitisation, the noteholders (who Liquidity effectively are the lenders) do not have Provider recourse to the originator (effectively the borrower); rather they only have recourse In the diagram above, a bank in Exeat (the originator) sells a portfolio of mortgages (each to the assets. This means that the impact of such mortgage secured against a property, or properties, in Exeat) to an S P V (the issuer), Exeat's departure on an ABS securitisation in this scenario, the issuer is incorporated in a jurisdiction outside Exeat. The issuer raises backed by Exeat originated assets is funds for the purchase of the portfolio of mortgages by issuing notes (usually in a number analysed with reference only to the assets of different classes) in the capital markets. The notes issued are euro denominated, as (with no recourse to the originator or the are the underlying assets. The issuer uses the income from the portfolio (which includes assets of the originator). interest and principal payments under the mortgages) to repay principal and interest on the notes. The issuer will have no recourse to the originator for any shortfalls in funds. WHAT COULD HAPPEN ON EXEAT January 2013 Butterworths Journal of International Banking and Financial Law

Feature LEAVING THE EURO? discussions regarding the impact on a whether the issuer needs to be placed into member state leaving the Eurozone is some form of liquidation. This could result As mentioned earlier, under an ABS securitisation, the income from the assets the potential devaluation of the member in further losses to the noteholders. is used to repay the notes issued by the state's new currency following departure. Arguably, given the reason for Exeat's Exchange rates and foreign issuer. Where the assets and the notes are departure from the Eurozone, the exchange exchange swaps denominated in the same currency, there is rate for € to E$ (which would presumably no currency mismatch. Where this is not Even assuming that the insolvency point was the case, currency swaps based on a certain mirror that set at the implementation of not a concern for the issuer, there still would the single currency arrangements) would be exchange rate will often be put in place be the matter of managing liabilities in one unlikely to hold. The E$ may fall in value so at closing which effectively mitigate the currency with assets in another currency. that an exchange rate set at €1 = E$l, may, currency mismatch which would otherwise The issuer may be able to exchange its E$ for exist in the securitisation. in an extreme example, reset to €1 = E$4, € on the foreign exchange market. However, or worse. However, in the event of Exeat as seen in a number of the Eurosail deals departing the Eurozone, it is highly likely The impact of devaluation on an ABS following the collapse of Lehman Brothers, that obligations owed by parties based in securitisation is self-evident. When this is not a straight forward process. Exeat would be redenominated in the new ABS securitisations are structured, Even with effective currency exchange currency (which we will call E$). We expect the amount of debt raised by the issuer management, where devaluation occurs, that this is particularly true for consumer will be less than the value of the assets sooner or later such decrease in the asset finance obligations, as it is unlikely that underlying the structure. However, the values (and their cash flows) would be a Exeat would expect its consumers to over-collateralisation is generally limited, shortfall of income to liabilities, which would continue to meet their obligations under such that 90 of notes may be issued backed cause a payment default in the structure. mortgages or other consumer financings in a currency no longer the official currency Where a structure has the benefit of limited recourse of Exeat. provisions, this situation may not be problematic... Even though the mortgages underlying the ABS securitisation have been sold to an issuer SPV incorporated outside Exeat, by assets with a value of 100. As the As an alternative to ongoing FX and as such, are no longer owned by the noteholders only have recourse to the assets, management, the issuer could enter into V; Exeat bank which originated them, the a E$/€ swap, which would give it comfort any devaluation of the E$ would result in a expectation is that the mortgages would fall in the value of the underlying assets in that on each payment date it would be able be subject to compulsory redenomination, terms of € value. to exchange its income in E$ into € to settle as liabilities of consumers in Exeat. This its liabilities. However, it is likely that the redenomination would result in a currency counterparty to any such E$/€ currency Solvency considerations mismatch between the income of the issuer swap would charge a high premium for the This raises questions regarding the (which would be redenominated in E$) swap, representing an additional cost to the solvency position of the issuer. Taking and the liabilities due to the noteholders issuer. The issuer would need to consider into account the new €/E$ exchange rate, (which would remain denominated in this cost against the potential costs of the issuer's liabilities are likely to exceed Euros - typically the documentation does entering into periodic foreign exchange its assets. Where a structure has the not include provisions which allow for trades on the spot market. benefit of limited recourse provisions, this compulsory redenomination of the notes on situation may not be problematic (as the Further, there may be a shortage of redenomination of the underlying assets). issuer would know that its liabilities are counterparties willing to enter into a E$/€ effectively limited to its assets). However, currency swap, irrespective of the size of Currency devaluation where issuers are unable to issue notes the premium. If the notes are subject to a credit rating (which is often the case in On the basis of the above analysis, on with limited recourse provisions (as was ABS deals), the countetparty would need redenomination of currency in Exeat, the case with English issuing vehicles to have a certain minimum rating. It may our ABS would be subject to a currency prior to the implementation of Taxation be that this is less of a concern, as the mismatch. As mentioned, in ABS deals, of Securitisation Companies Regulations issues set out in this analysis may impact one can structure around currency 2006), this devaluation may result in the the rating of the notes. However, in the mismatches. However, the cause of this issuer being balance sheet insolvent. When abstract, there is currently a shortage of currency mismatch raises a set of its own combined with potential cash-flow issues, appropriately rated financial institutions issues. this may mean that the directors of the that are willing to provide swaps to ABS One issue which is common to all issuer need to consider in a timely manner January 2013 Butterworths journal of international Banl<ing and Financial Law

Recommend

More recommend