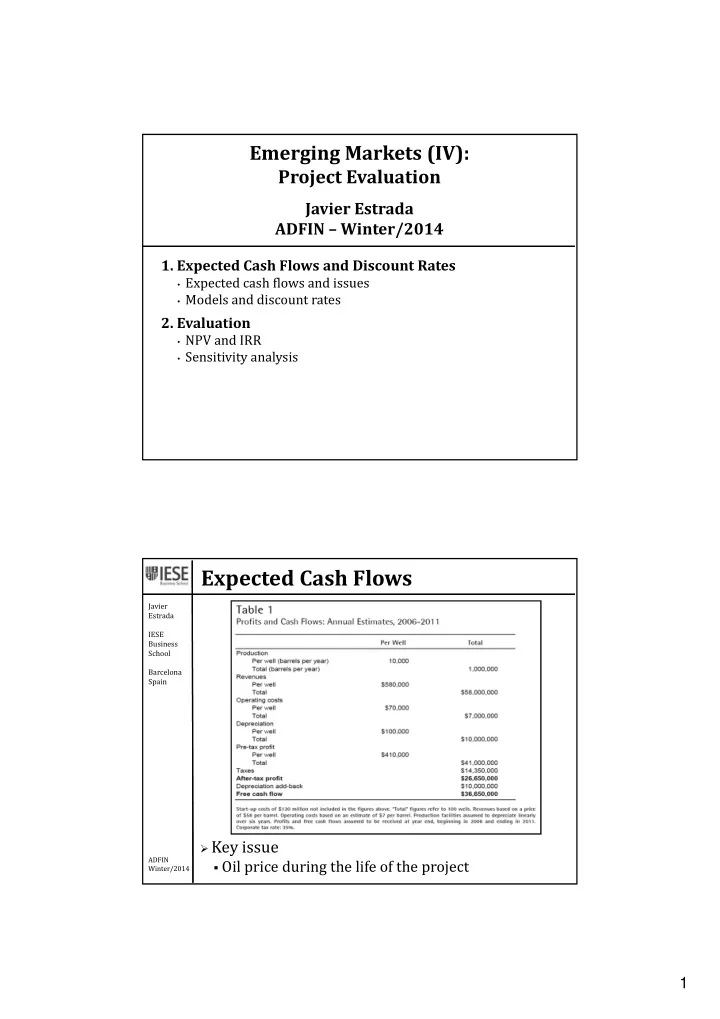

Emerging Markets (IV): Project Evaluation Javier Estrada ADFIN – Winter/2014 1. Expected Cash Flows and Discount Rates • Expected cash flows and issues • Models and discount rates 2. Evaluation • NPV and IRR • Sensitivity analysis Expected Cash Flows Javier Estrada IESE Business School Barcelona Spain Key issue ADFIN Oil price during the life of the project Winter/2014 1

Expected Cash Flows Javier Estrada IESE Business School $138 Barcelona Spain $110 $58 $36 ADFIN Winter/2014 Expected Cash Flows A couple of things to keep in mind Javier Estrada In general IESE Business • Cash flows are estimated first in the currency of the School country in which the investment takes place Barcelona Spain Then they are ‘somehow’ converted to expected cash flows in a strong currency In our case • Oil is priced in dollars and this eliminates one source of uncertainty ($a/$ exchange rate) • There remains huge uncertainty about the price of oil through the life of the investment Sensitivity analysis is critical ADFIN Winter/2014 2

Discount Rates Javier Estrada IESE Exxon Mobil Beta: 0.48 Business School Barcelona Spain Models L → R = R f + MRP⋅( β p · β c ) GE → R = ( R f + YS c ) + MRP⋅{(0.6)⋅( σ c / σ w )} GS → R = ( R f + YS c ) + MRP⋅{(1– ρ SB )⋅( σ c / σ w )} ADFIN SSB → R = { R f + [( γ 1 + γ 2 + γ 3 )/30]⋅ YS c } + MRP⋅ β p Winter/2014 Discount Rates Models Javier Estrada CAPM → R = 6.8% IESE Business L → R = 8.2% School Barcelona GE → R = 17.7% Spain GS → R = 18.4% SSB → R = 7.9% (γ 1 =γ 2 =γ 3 =0) → R = 12.9% (γ 1 =γ 2 =γ 3 =10) → R = 9.5% (γ 1 =γ 3 =0 / γ 2 =10) ADFIN Winter/2014 3

Evaluation IRR Javier Estrada 17.5% IESE Business NPVs School Barcelona CAPM → $42.9m Spain L → $35.5m GE → –$0.6m GS → –$2.6m SSB → $37.3m (γ 1 =γ 2 =γ 3 =0) → $15.2m (γ 1 =γ 2 =γ 3 =10) → $29.1m (γ 1 =γ 3 =0 / γ 2 =10) ADFIN Winter/2014 Sensitivity Analysis Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 4

Recommend

More recommend