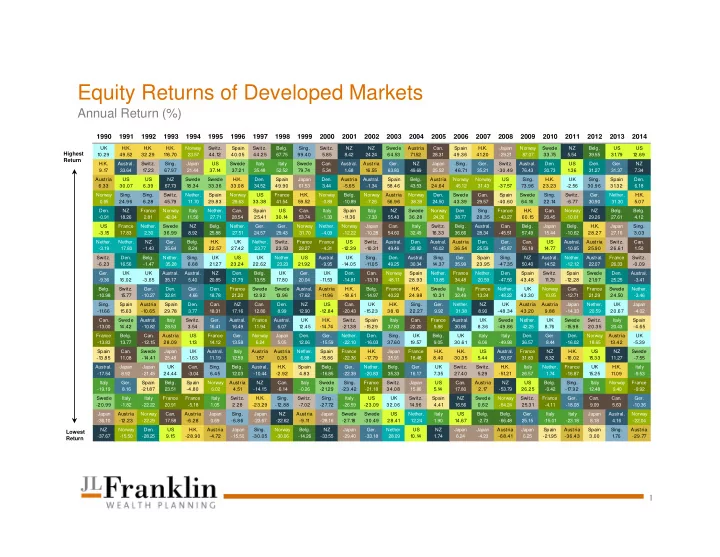

Equity Returns of Developed Markets Annual Return (%) 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 UK H.K. H.K. H.K. Norway Switz. Spain Switz. Belg. Sing. Switz. NZ NZ Swede Austria Can. Spain H.K. Japan Norway Swede NZ Belg. US US Highest 1 0.29 49.52 32.29 1 1 6.70 23.57 44.1 2 40.05 44.25 67.75 99.40 5.85 8.42 24.24 64.53 71 .52 28.31 49.36 41 .20 -29.21 87.07 33.75 5.54 39.55 31 .79 1 2.69 Return H.K. Austral. Switz. Sing. Japan US Swede Italy Italy Swede Can. Austral. Austria Ger. NZ Japan Sing. Ger. Switz. Austral. Den. US Den. Ger. NZ 9.1 7 33.64 1 7.23 67.97 21.44 37.1 4 37.21 35.48 52.52 79.74 5.34 1.68 1 6.55 63.80 49.69 25.52 46.71 35.21 -30.49 76.43 30.73 1 .36 31.27 31.37 7.34 Austria US US NZ Swede Swede H.K. Den. Spain Japan Den. Austria Austral. Spain Belg. Austria Norway Norway US Sing. H.K. UK Sing. Spain Den. 6.33 30.07 6.39 67.73 1 8.34 33.36 33.08 34.52 49.90 61.53 3.44 -5.65 -1.34 58.46 43.53 24.64 45.12 31.43 -37.57 73.96 23.23 -2.56 30.96 31 .32 6.18 Norway Sing. Sing. Switz. Nether. Spain Norway US France H.K. Norway Belg. Norway Austria Norway Den. Swede Can. Spain Swede Sing. Switz. Ger. Nether. H.K. 0.65 24.96 6.28 45.79 11.70 29.83 28.63 33.38 41.54 59.52 -0.89 -10.89 -7.26 56.96 38.39 24.50 43.39 29.57 -40.60 64.1 6 22.1 4 -6.77 30.90 31.30 5.07 Den. NZ France Norway Italy Nether. Can. Spain US Can. Italy Spain Italy NZ Swede Norway Den. Sing. France H.K. Can. Norway NZ Belg. Belg. -0.91 18.26 2.81 42.04 11.56 27.71 28.54 25.41 30.1 4 53.74 -1.33 -1 1 .36 -7.33 55.43 36.28 24.26 38.77 28.35 -43.27 60.1 5 20.45 -10.01 29.26 27.61 4.12 US France Nether. Swede NZ Belg. Nether. Ger. Ger. Norway Nether. Norway Japan Can. Italy Switz. Belg. Austral. Can. Belg. Japan Belg. H.K. Japan Sing. -3.1 5 17.83 2.30 36.99 8.92 25.88 27.51 24.57 29.43 31.70 -4.09 -12.22 -10.28 54.60 32.49 1 6.33 36.66 28.34 -45.51 57.49 15.44 -10.62 28.27 27.16 3.03 Nether. Nether. NZ Ger. Belg. H.K. UK Nether. Switz. France France US Switz. Austral. Den. Austral. Austria Den. Ger. Can. US Austral. Austria Switz. Can. -3.19 17.80 -1.43 35.64 8.24 22.57 27.42 23.77 23.53 29.27 -4.31 -1 2.39 -1 0.31 49.46 30.82 16.02 36.54 25.59 -45.87 56.18 1 4.77 -10.95 25.90 26.61 1.50 Switz. Den. Belg. Nether. Sing. UK US UK Nether. US Austral. UK Sing. Den. Austral. Sing. Ger. Spain Sing. NZ Austral. Nether. Austral. France Switz. -6.23 16.56 -1.47 35.28 6.68 21 .27 23.24 22.62 23.23 21 .92 -9.95 -1 4.05 -1 1 .05 49.25 30.34 1 4.37 35.99 23.95 -47.35 50.40 14.52 -12.12 22.07 26.33 -0.09 Ger. UK UK Austral. Austral. NZ Den. Belg. UK Ger. UK Den. Can. Norway Spain Nether. France Nether. Den. Spain Switz. Spain Swede Den. Austral. -9.36 1 6.02 -3.65 35.17 5.40 20.85 21.79 13.55 1 7.80 20.04 -1 1 .53 -14.81 -13.19 48.11 28.93 13.85 34.48 20.59 -47.56 43.48 1 1 .79 -1 2.28 21 .97 25.25 -3.41 Belg. Switz. Ger. Den. Ger. Den. France Swede Swede Austral. Austria H.K. Belg. France H.K. Swede Italy France Nether. UK Norway Can. France Swede Nether. -10.98 1 5.77 -10.27 32.81 4.66 18.78 21.20 1 2.92 1 3.96 17.62 -1 1 .96 -1 8.61 -14.97 40.22 24.98 1 0.31 32.49 13.24 -48.22 43.30 10.95 -12.71 21.29 24.50 -3.46 Sing. Spain Austria Spain Den. Can. NZ Can. Den. NZ US Can. UK H.K. Sing. Ger. Nether. NZ UK Austria Austria Japan Nether. UK Japan -1 1 .66 1 5.63 -1 0.65 29.78 3.77 18.31 17.16 12.80 8.99 12.90 -1 2.84 -20.43 -1 5.23 38.1 0 22.27 9.92 31.38 8.90 -48.34 43.20 9.88 -14.33 20.59 20.67 -4.02 Can. Swede Austral. Italy Switz. Ger. Austral. France Austral. UK H.K. Switz. Spain Italy Can. France Austral. UK Swede Nether. UK Swede Switz. Italy Spain -13.00 1 4.42 -10.82 28.53 3.54 16.41 16.49 11.94 6.07 1 2.45 -1 4.74 -21 .38 -1 5.29 37.83 22.20 9.88 30.86 8.36 -49.86 42.25 8.76 -1 5.98 20.35 20.43 -4.65 France Belg. Can. Austria US France Ger. Norway Japan Den. Ger. Nether. Den. Sing. UK Belg. UK Italy Italy Den. Ger. Den. Norway Austria UK -13.83 13.77 -12.15 28.09 1 .1 3 14.12 13.58 6.24 5.05 12.06 -15.59 -22.10 -16.03 37.60 1 9.57 9.05 30.61 6.06 -49.98 36.57 8.44 -16.02 18.65 1 3.42 -5.39 Spain Can. Swede Japan UK Austral. Italy Austria Austria Nether. Spain France H.K. Japan France H.K. H.K. US Austral. France NZ H.K. US NZ Swede -1 3.85 11.08 -1 4.41 25.48 -1 .63 11.19 12.59 1 .57 0.35 6.88 -1 5.86 -22.36 -1 7.79 35.91 18.48 8.40 30.35 5.44 -50.67 31.83 8.32 -1 6.02 1 5.33 11.27 -7.55 Austral. Japan Japan UK Can. Sing. Belg. Austral. H.K. Spain Belg. Ger. Nether. Belg. Ger. UK Switz. Switz. H.K. Italy Nether. France UK H.K. Italy -17.54 8.92 -21.45 24.44 -3.04 6.45 12.03 -10.44 -2.92 4.83 -16.85 -22.39 -20.83 35.33 16.17 7.35 27.40 5.29 -51 .21 26.57 1.74 -16.87 1 5.25 1 1 .09 -9.53 Italy Ger. Spain Belg. Spain Norway Austria NZ Can. Italy Swede Sing. France Switz. Japan US Can. Austria NZ US Belg. Sing. Italy Norway France -19.19 8.16 -21 .87 23.51 -4.80 6.02 4.51 -14.15 -6.14 -0.26 -21 .29 -23.42 -21.18 34.08 15.86 5.1 4 17.80 2.1 7 -53.79 26.25 -0.42 -1 7.92 12.48 9.40 -9.92 Swede Italy Italy France France Italy Switz. H.K. Sing. Switz. Sing. Italy US UK Switz. Spain NZ Swede Norway Switz. France Ger. Can. Can. Ger. -20.99 -1.82 -22.22 20.91 -5.18 1.05 2.28 -23.29 -1 2.88 -7.02 -27.72 -26.59 -23.09 32.06 1 4.96 4.41 16.56 0.62 -64.24 25.31 -4.11 -18.08 9.09 5.63 -10.36 Japan Austria Norway Can. Austria Japan Sing. Japan NZ Austria Japan Swede Swede US Nether. Italy US Belg. Belg. Ger. Italy Italy Japan Austral. Norway -36.10 -1 2.23 -22.29 17.58 -6.28 0.69 -6.86 -23.67 -22.62 -9.1 1 -28.16 -27.1 8 -30.49 28.41 12.24 1.90 1 4.67 -2.73 -66.48 25.15 -15.01 -23.18 8.18 4.16 -22.04 NZ Norway Den. US H.K. Austria Japan Sing. Norway Belg. NZ Japan Ger. Nether. US NZ Japan Japan Austria Japan Spain Austria Spain Sing. Austria Lowest -37.67 -15.50 -28.25 9.1 5 -28.90 -4.72 -15.50 -30.05 -30.06 -14.26 -33.55 -29.40 -33.18 28.09 1 0.1 4 1.74 6.24 -4.23 -68.41 6.25 -21 .95 -36.43 3.00 1 .70 -29.77 Return 1

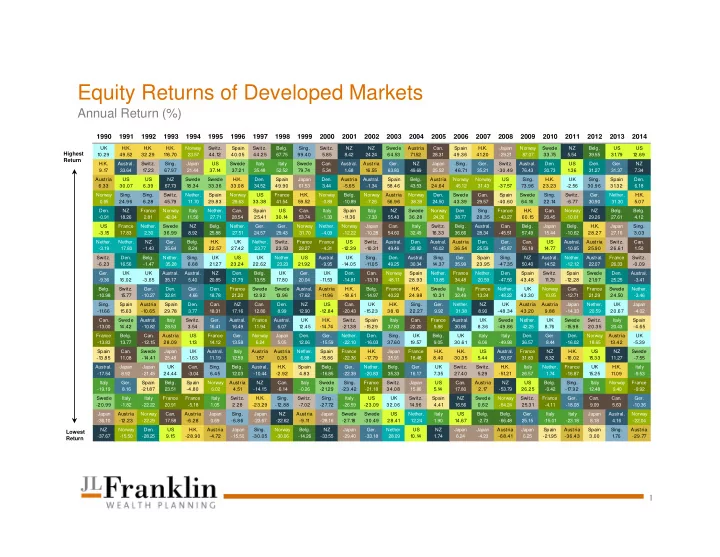

Equity Returns of Developed Markets Annual Return (%) 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Highest UK H.K. H.K. H.K. Norway Switz. Spain Switz. Belg. Sing. Switz. NZ NZ Swede Austria Can. Spain H.K. Japan Norway Swede NZ Belg. US US 1 0.29 49.52 32.29 1 1 6.70 23.57 44.1 2 40.05 44.25 67.75 99.40 5.85 8.42 24.24 64.53 71 .52 28.31 49.36 41 .20 -29.21 87.07 33.75 5.54 39.55 31 .79 1 2.69 Return US US 37.1 4 1 .36 US US US 30.07 6.39 -37.57 US 33.38 US 30.1 4 US -3.1 5 US US -1 2.39 1 4.77 US US 23.24 21 .92 US -1 2.84 US 1 .1 3 US US 5.44 1 5.33 US US 5.1 4 26.25 US -23.09 US US 28.41 1 4.67 NZ Norway Den. US H.K. Austria Japan Sing. Norway Belg. NZ Japan Ger. Nether. US NZ Japan Japan Austria Japan Spain Austria Spain Sing. Austria Lowest Return -37.67 -15.50 -28.25 9.1 5 -28.90 -4.72 -15.50 -30.05 -30.06 -14.26 -33.55 -29.40 -33.18 28.09 1 0.1 4 1.74 6.24 -4.23 -68.41 6.25 -21 .95 -36.43 3.00 1 .70 -29.77 2

Diversification Helps Take the Guesswork out of Investing Annual returns (%): 2000–2014 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Higher 31.0 12.3 7.6 60.6 33.8 34.5 36.0 39.8 8.8 79.0 28.1 9.4 18.6 38.8 32.0 Return You never know which markets will 9.0 8.4 5.1 56.3 33.2 23.5 32.6 12.4 6.6 44.8 26.9 3.4 17.9 32.4 13.7 8.3 7.3 3.6 47.3 26.0 14.5 25.7 8.2 4.7 33.7 20.9 2.3 17.1 25.8 4.9 outperform from year to year. 7.3 6.4 3.4 39.4 20.4 13.8 25.2 7.2 -33.8 28.5 19.2 2.1 16.4 21.0 1.9 -3.0 2.5 -2.0 36.2 18.3 4.9 18.4 6.3 -37.0 27.2 15.1 0.6 16.3 1.2 1.2 By holding a globally diversified -9.1 -2.4 -6.0 28.7 10.9 4.6 15.8 5.9 -39.2 26.5 8.9 -4.2 16.0 0.6 0.2 portfolio, investors are positioned to -9.9 -11.9 -15.8 2.0 2.7 3.1 4.3 5.5 -43.6 2.3 3.7 -12.2 2.1 0.3 -1.8 capture returns wherever -13.4 -13.6 -20.5 1.9 1.3 2.4 4.1 -1.6 -45.8 0.8 2.0 -14.7 0.9 -0.1 -4.3 Lower they occur. -30.6 -21.4 -22.1 1.5 0.8 1.3 3.8 -17.6 -53.2 0.2 0.8 -18.2 0.2 -2.3 -5.5 Return S&P 500 Index Russell 2000 Index Dow Jones US Select REIT Index MSCI World ex-USA Index (net div.) Dimensional International Small Cap index MSCI Emerging Markets Index (gross div.) BofA Merrill Lynch One-Year US Treasury Notes Index Barclays Treasury Bond Index 1-5 Years Citigroup World Government Bond Index 1-5 Years (hedged to USD) 3

Recommend

More recommend