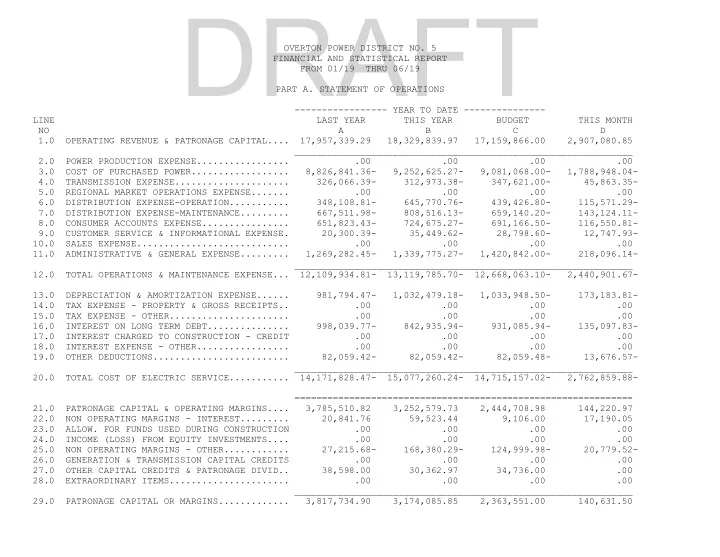

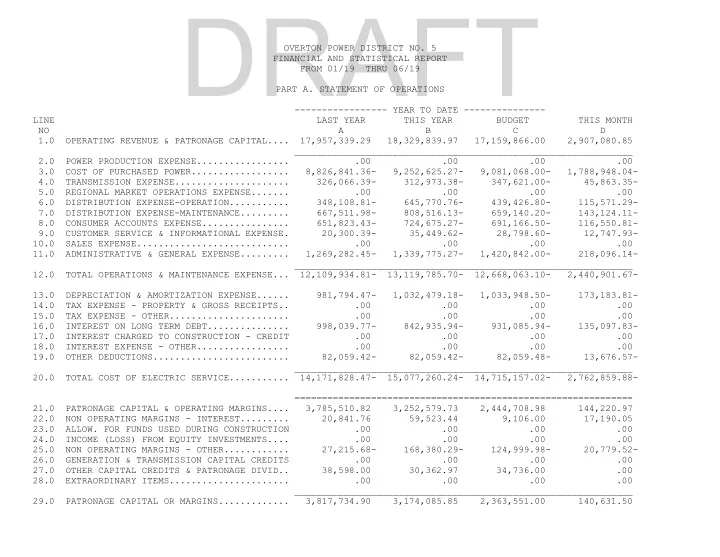

DRAFT OVERTON POWER DISTRICT NO. 5 FINANCIAL AND STATISTICAL REPORT FROM 01/19 THRU 06/19 PART A. STATEMENT OF OPERATIONS ----------------- YEAR TO DATE --------------- LINE LAST YEAR THIS YEAR BUDGET THIS MONTH NO A B C D 1.0 OPERATING REVENUE & PATRONAGE CAPITAL.... 17,957,339.29 18,329,839.97 17,159,866.00 2,907,080.85 ______________________________________________________________ 2.0 POWER PRODUCTION EXPENSE................. .00 .00 .00 .00 3.0 COST OF PURCHASED POWER.................. 8,826,841.36- 9,252,625.27- 9,081,068.00- 1,788,948.04- 4.0 TRANSMISSION EXPENSE..................... 326,066.39- 312,973.38- 347,621.00- 45,863.35- 5.0 REGIONAL MARKET OPERATIONS EXPENSE....... .00 .00 .00 .00 6.0 DISTRIBUTION EXPENSE-OPERATION........... 348,108.81- 645,770.76- 439,426.80- 115,571.29- 7.0 DISTRIBUTION EXPENSE-MAINTENANCE......... 667,511.98- 808,516.13- 659,140.20- 143,124.11- 8.0 CONSUMER ACCOUNTS EXPENSE................ 651,823.43- 724,675.27- 691,166.50- 116,550.81- 9.0 CUSTOMER SERVICE & INFORMATIONAL EXPENSE. 20,300.39- 35,449.62- 28,798.60- 12,747.93- 10.0 SALES EXPENSE............................ .00 .00 .00 .00 11.0 ADMINISTRATIVE & GENERAL EXPENSE......... 1,269,282.45- 1,339,775.27- 1,420,842.00- 218,096.14- ______________________________________________________________ 12.0 TOTAL OPERATIONS & MAINTENANCE EXPENSE... 12,109,934.81- 13,119,785.70- 12,668,063.10- 2,440,901.67- 13.0 DEPRECIATION & AMORTIZATION EXPENSE...... 981,794.47- 1,032,479.18- 1,033,948.50- 173,183.81- 14.0 TAX EXPENSE - PROPERTY & GROSS RECEIPTS.. .00 .00 .00 .00 15.0 TAX EXPENSE - OTHER...................... .00 .00 .00 .00 16.0 INTEREST ON LONG TERM DEBT............... 998,039.77- 842,935.94- 931,085.94- 135,097.83- 17.0 INTEREST CHARGED TO CONSTRUCTION - CREDIT .00 .00 .00 .00 18.0 INTEREST EXPENSE - OTHER................. .00 .00 .00 .00 19.0 OTHER DEDUCTIONS......................... 82,059.42- 82,059.42- 82,059.48- 13,676.57- ______________________________________________________________ 20.0 TOTAL COST OF ELECTRIC SERVICE........... 14,171,828.47- 15,077,260.24- 14,715,157.02- 2,762,859.88- ============================================================== 21.0 PATRONAGE CAPITAL & OPERATING MARGINS.... 3,785,510.82 3,252,579.73 2,444,708.98 144,220.97 22.0 NON OPERATING MARGINS - INTEREST......... 20,841.76 59,523.44 9,106.00 17,190.05 23.0 ALLOW. FOR FUNDS USED DURING CONSTRUCTION .00 .00 .00 .00 24.0 INCOME (LOSS) FROM EQUITY INVESTMENTS.... .00 .00 .00 .00 25.0 NON OPERATING MARGINS - OTHER............ 27,215.68- 168,380.29- 124,999.98- 20,779.52- 26.0 GENERATION & TRANSMISSION CAPITAL CREDITS .00 .00 .00 .00 27.0 OTHER CAPITAL CREDITS & PATRONAGE DIVID.. 38,598.00 30,362.97 34,736.00 .00 28.0 EXTRAORDINARY ITEMS...................... .00 .00 .00 .00 ______________________________________________________________ 29.0 PATRONAGE CAPITAL OR MARGINS............. 3,817,734.90 3,174,085.85 2,363,551.00 140,631.50

DRAFT OVERTON POWER DISTRICT NO. 5 FINANCIAL AND STATISTICAL REPORT FROM 01/19 THRU 06/19 PART C. BALANCE SHEET LINE NO ASSETS AND OTHER DEBITS LIABILITIES AND OTHER CREDITS 1.0 TOTAL UTILITY PLANT IN SERVICE 113,864,426.89 30.0 MEMBERSHIPS .00 2.0 CONSTRUCTION WORK IN PROGRESS 3,653,152.45 31.0 PATRONAGE CAPITAL .00 3.0 TOTAL UTILITY PLANT 117,517,579.34 32.0 OPERATING MARGINS - PRIOR YEAR 42,188,111.73- 4.0 ACCUM PROV FOR DEP & AMORT 36,132,892.08- 33.0 OPERATING MARGINS-CURRENT YEAR 3,114,562.41- 5.0 NET UTILITY PLANT 81,384,687.26 34.0 NON-OPERATING MARGINS 59,523.44- 35.0 OTHER MARGINS & EQUITIES 17,208,801.05- 6.0 NON-UTILITY PROPERTY (NET) .00 36.0 TOTAL MARGINS & EQUITIES 62,570,998.63- 7.0 INVEST IN SUBSIDIARY COMPANIES .00 8.0 INV IN ASSOC ORG - PAT CAPITAL 3,073,674.45 37.0 LONG TERM DEBT - RUS (NET) .00 9.0 INV IN ASSOC ORG OTHR GEN FND .00 (PAYMENTS-UNAPPLIED .00 ) 10.0 INV IN ASSOC ORG - NON GEN FND .00 38.0 LNG-TERM DEBT-FFB-RUS GUAR .00 11.0 INV IN ECON DEVEL PROJECTS .00 39.0 LONG-TERM DEBT OTHER-RUS GUAR .00 12.0 OTHER INVESTMENTS .00 40.0 LONG TERM DEBT - OTHER (NET) 38,691,502.20- 13.0 SPECIAL FUNDS .00 41.0 LNG-TERM DEBT-RUS-ECON DEV NET .00 14.0 TOT OTHER PROP & INVESTMENTS 3,073,674.45 42.0 PAYMENTS - UNAPPLIED .00 43.0 TOTAL LONG TERM DEBT 38,691,502.20- 15.0 CASH - GENERAL FUNDS 4,111,810.02 16.0 CASH - CONSTRUCTION FUND TRUST .00 44.0 OBLIGATION UNDER CAPITAL LEASE .00 17.0 SPECIAL DEPOSITS .00 45.0 ACCUM OPERATING PROVISIONS .00 18.0 TEMPORARY INVESTMENTS 12,972,202.86 46.0 TOTAL OTHER NONCURR LIABILITY .00 19.0 NOTES RECEIVABLE (NET) .00 20.0 ACCTS RECV - SALES ENERGY(NET) 3,307,485.80 47.0 NOTES PAYABLE .00 21.0 ACCTS RECV - OTHER (NET) 61,269.60 48.0 ACCOUNTS PAYABLE 1,738,358.50- 22.0 RENEWABLE ENERGY CREDITS .00 49.0 CONSUMER DEPOSITS 238,300.00- 23.0 MATERIAL & SUPPLIES-ELEC & OTH 1,216,271.29 50.0 CURR MATURITIES LONG-TERM DEBT .00 24.0 PREPAYMENTS 110,288.38 51.0 CURR MATURIT LT DEBT ECON DEV .00 25.0 OTHER CURRENT & ACCR ASSETS .00 52.0 CURR MATURITIES CAPITAL LEASES .00 26.0 TOTAL CURRENT & ACCR ASSETS 21,779,327.95 53.0 OTHER CURRENT & ACCRUED LIAB 1,262,779.48- 54.0 TOTAL CURRENT & ACCRUED LIAB 3,239,437.98- 27.0 REGULATORY ASSETS .00 28.0 OTHER DEFERRED DEBITS 3,173,079.73 55.0 REGULATORY LIABILITIES .00 56.0 OTHER DEFERRED CREDITS 4,908,830.58- 29.0 TOTAL ASSETS & OTHER DEBITS 109,410,769.39 57.0 TOTAL LIABILITIES & OTH CREDIT 109,410,769.39-

DRAFT OVERTON POWER DISTRICT No. 5 CASH BREAKDOWN June-19 BEGINNING BALANCE $ 5,398,354 Petty Cash $ 1,700 Bank of Nevada - Checking $ 3,497,486 Bank of Nevada - Payroll $ 23,825 America First Credit Union $ 58,637 America First Credit Union $ 30,163 America First Credit Union $ 67 ENDING BALANCE $ 3,611,877 NET DIFFERENCE IN CASH FROM PRIOR MONTH $ (1,786,477) Investments Bank of Nevada $ 8,472,136 2.30% CFC Short Term Investment $ 1,000,000 2.79% Matures 7/19 CFC Short Term Investment $ 1,000,000 2.75% Matures 8/19 CFC Short Term Investment $ 1,000,000 2.71% Matures 9/19 CFC Short Term Investment $ 1,000,000 2.58% Matures 10/19 America First Credit Union $ 500,000 2.96% Matures 9/19 Liabilities Customer Deposits $ (238,300) Work Order Deposit $ (2,983,144) Work Order Construction done $ 536,961 Refunds to State $ (3,430) Future Projects Funding $ (2,365,000) Debt Reduction Funding $ (500,000) Approved 2018 Projects/Purchases $ (400,582) NV Energy Future Transmission Costs $ (1,075,013) Total Available Cash $ 5,055,505

DRAFT OVERTON POWER DISTRICT No. 5 MISCELLANEOUS June-19 Connection Fees Quantity Amount Mar-19 28 $ 16,775.58 Apr-19 39 $ 16,506.80 May-19 46 $ 19,404.83 Jun-19 12 $ 6,863.40 Current Billing Arrangements Quantity Amount Mar-19 28 $ 4,563.56 Apr-19 56 $ 8,512.08 May-19 59 $ 6,767.37 Jun-19 64 $ 9,486.24 Round Up Program Virgin Valley Moapa Valley Jun-19 $ 1,444.34 $ 1,075.46

DRAFT OVERTON POWER DISTRICT No. 5 Number of Customers Summary By Month Net Account Total Total Change Accounts Accounts 2019 2018 for month January 25 15,991 15,599 February 5 15,996 15,624 March 55 16,051 15,644 April 3 16,054 15,675 May 28 16,082 15,686 June 6 16,088 15,663 July 15,714 August 15,775 September 15,778 October 15,852 November 15,906 December 15,966

DRAFT OVERTON POWER DISTRICT No. 5 Ratios June-19 Current Minimum Goal Median By Size MDSC 2.93 1.35 1.85 2.19 Equity as a % of Assets 57.19% 39.50% 65.00% 47.73 TIER 4.77 1.25 6.00 3.19

Recommend

More recommend