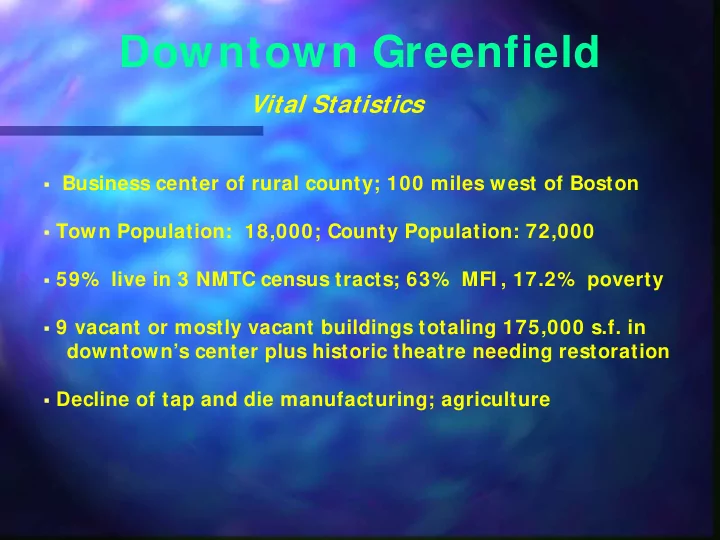

Downtown Greenfield Vital Statistics � Business center of rural county; 100 miles west of Boston � Town Population: 18,000; County Population: 72,000 � 59% live in 3 NMTC census tracts; 63% MFI , 17.2% poverty � 9 vacant or mostly vacant buildings totaling 175,000 s.f. in downtown’s center plus historic theatre needing restoration � Decline of tap and die manufacturing; agriculture

Downtown Greenfield Building Renovation Project March 9, 2010 Downtown Greenfield Building Renovation Project March 9, 2010

Barriers to Redevelopment • Small buildings, multiple owners • Costly renovation • Low rents • Weak market—who would lease the space? • I nsufficient return to private investment • Lack of experience with tax credit finance • I nefficiency of complex financing for small buildings

“This is the most exciting thing that’s happened to Greenfield in 35 years!” Programmatic Solution • Same financing structure/ docs. for all projects • NMTC/ HTC/ SHTC • Single Leveraged Lender: local bank • Same attorney, accountant, consultants • Nonprofit special member with tax credit experience-- bookkeeping, SHTC proceeds, additional leveraged lender • SHTC bridge lender: MHI C

Greenfield Example - New Markets/ Historic Tax Credit Financing Structure Hard Debt: Equity: Soft Loan: Hard Debt: Equity: Soft Loan: Local bank MHIC Investors Local nonprofit Local bank MHIC Investors Local nonprofit $1,584,889 $1,509,033 $361,250 $1,584,889 $361,250 $1,509,033 (Senior Debt) (owns 100% of Fund) (Subordinate Debt) (Senior Debt) (Subordinate Debt) (owns 100% of Fund) Debt Service payments MHIC New Markets Fund IV, LLC MHIC New Markets Fund IV, LLC (owns 99.99% of CDE) (owns 99.99% of CDE) MHIC Qualified Equity NMTCs, HTCs, Cash Managing Investment (QEI), Distributions (interest) Member $3,429,451 (0.01%) MHIC New Markets NE MHIC New Markets NE CDE I LLC CDE I LLC $425,210 Note A $1,584,889 Equity HTCs, Note B $361,250 Investment Interest Guaranteed Note C $851,880; Note D $103,338 Master Tenant, LLC payments Master Tenant, LLC 100% owned by CDE; 100% owned by CDE; QALICB, LLC Individual non-member QALICB, LLC Individual non-member $425,210 manager (Owns real estate) manager (Owns real estate) MT Loan Local Nonprofit, Subtenant subleases commercial Subtenant subleases commercial Individual managing member Special member space; residential tenants sublease 99% owner, contributing space; residential tenants sublease 1% owner, contributing $63,750 residential units $108,000 cash equity residential units cash equity

Two Buildings Treated as Single Building • Factors similar to those set forth in recent Private Letter Ruling • Two buildings contiguous; share an elevator/basement • Buildings financed under a common plan of financing • Buildings operated/managed as a unified project under a single set of books and records with shared service contracts • Buildings share common parking under an agreement with the City of Greenfield • The result is that two buildings can be combined for purposes of determining whether they constitute “residential rental property”

Commercial/ Residential Lease Structure • Pro forma rents for buildings: 1-3 Bank Row: $79,800 commercial; $27,600 residential 19-23 Bank Row: $24,000 commercial; $48,000 resid. 25-27 Bank Row: $57,327 commercial; $0 residential • At pro forma rents, one building has 33% commercial and the other has 75% commercial. • Master commercial sublease to developer affiliate with a base rent sufficient to yield 31% commercial rents plus additional rent payable from excess cash flow. • Treating 19-23 and 25-27 Bank Row as a single building boosts commercial rents from 33% to 63%.

Recommend

More recommend