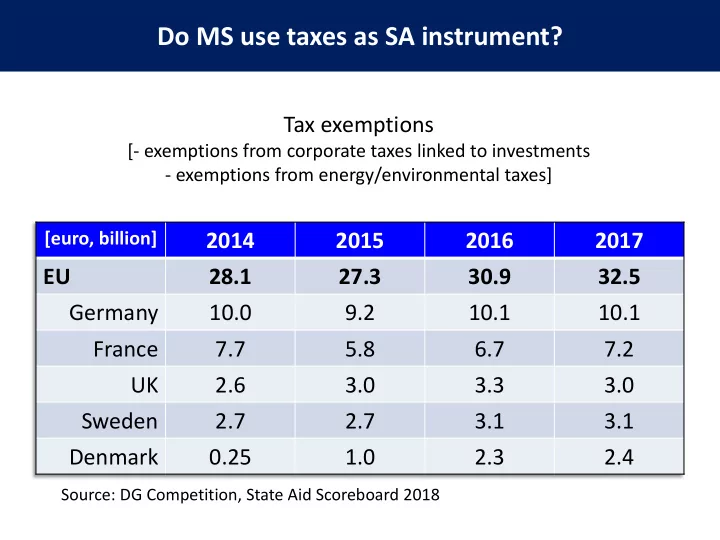

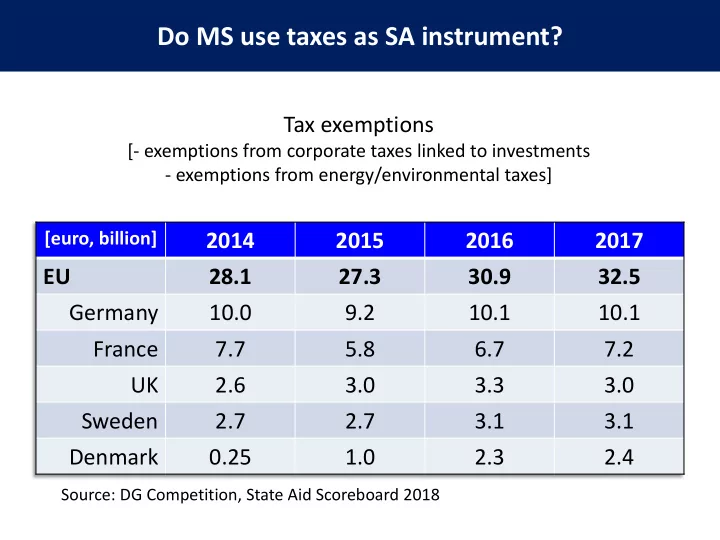

Do MS use taxes as SA instrument? Tax exemptions [- exemptions from corporate taxes linked to investments - exemptions from energy/environmental taxes] [euro, billion] 2014 2015 2016 2017 EU 28.1 27.3 30.9 32.5 Germany 10.0 9.2 10.1 10.1 France 7.7 5.8 6.7 7.2 UK 2.6 3.0 3.3 3.0 Sweden 2.7 2.7 3.1 3.1 Denmark 0.25 1.0 2.3 2.4 Source: DG Competition, State Aid Scoreboard 2018

Art 107(1): Incompatibility of aid with the internal market “Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market”

Applicability of Art 107(1): Four criteria Aid from public funds [granted by MS or through state resources] to undertakings [not individuals or households] Aid confers advantage [favouring] Aid is selective [to certain undertakings or production of certain goods] Aid affects trade between MS & distorts competition [criteria are cumulative, not alternative, (and exhaustive)]

Recent high-profile cases Decisions [amounts to be recovered]: • October 2015: Fiat, LU [EUR 23.1 mn] • October 2015: Starbucks, NL [EUR 25.7 mn] • January 2016: 35 MNCs, BE [EUR 900 mn] • Annulled by GC in T-131/16, Belgium v Commission • August 2016: Apple, IE [EUR 14.3 bn] • October 2017: Amazon, LU [EUR 282.7 mn] • June 2018: Engie, LU [EUR 120 mn] • September 2018: McDonald’s, LU No aid • December 2018: MNCs, Gibraltar [EUR 100 mn] On-going investigations: • UK: Controlled foreign companies [exemption of group financing] • Netherlands: IKEA • Netherlands: Nike • Luxembourg: Huhtamäki

… and many more Whole tax system: C-106/09 P, Commission v Gibraltar Taxes by regional authorities: C-88/03, Portugal v Commission Sectoral taxes: T-160/16, Groningen Seaports v Commission Turnover taxes: Commission decisions 2017/329 & 2018/160 Environmental taxes: C-233/16, ANGED; C-487/06 P, British Aggregates v Commission Property taxes: C-374/17, Finanzamt v A-Brauerei Carry forward losses: C-203/16 P, Heitkamp BauHolding v Commission Acquisition of foreign companies: C-20/15 P, Commission v World Duty Free Financial leasing: C-128/16 P, Commission v Spain

Tax autonomy v state aid compliance “The exercise of reserved powers cannot permit the unilateral adoption of measures prohibited by the Treaty” [6/69, France v Commission] Although base and rates of direct taxation not harmonised, tax measures must comply with Treaty [173/73, Italy v Commission; T-131/16, Belgium v Commission] MS are free to set their policy objectives [e.g. tax environmentally harmful activities] but they must comply with Treaty [C-487/06 P, British Aggregates v Commission]

What falls within scope of Art 107(1)? Taxes [i.e. charges] do not fall within scope of Art 107(1) unless they are linked (hypothecated) to aid measures [C-390/98, Banks] [However, Art 116 measures may apply to taxes] [C-174/02, Streekgewest Westelijk Noord Brabant; C-266/04, Nazairdis] Art 107(1) covers anything that reduces tax revenue [and satisfies all Art 107(1) criteria] : e.g. exemption from tax base, reduction of tax rate, accelerated depreciation, tax forgiveness, failure to collect tax, etc Art 107(1) applies to tax measures of all authorities at all levels of govt [C-248/84, Germany v Commission; C-88/03, Portugal v Commission; C-233/16, ANGED]

How do lower taxes result in transfer of state resources? Loss of tax revenue = “consumption” of state resources [T-67/94, Ladbroke v Commission; C-66/02, Italy v Commission] But, some tax measures may not be imputable to the state: e.g. EU exemption of aviation fuel from excise tax [T-351/02, Deutsche Bahn]

False arguments Tax reduction encourages more investment that results in increased tax revenues [cases of ES & PT autonomous regions] Loss of tax revenue made up by extra revenue from other taxes [173/73, Italy v Commission] Or, beneficiary is taxed more heavily by other taxes [T-427/04, France v Commission]

Any tax exemptions that fall outside scope of Art 107(1)? Beneficiaries are not undertakings • Charities: e.g. exemption from property taxes [C-74/16, Catholic Church; T-220/13 / C-622/16 P Montessori v Commission] • Individuals: e.g. reduction of individual tax liability [investment in risk finance measures]

How is “advantage” conferred? Advantage = Any reduction of costs normally borne in budgets of firms or any reduction of liabilities => Tax exemption places beneficiary in more advantageous position than its competitors [C-6/97, Italy v Commission] Advantage may be indirect; e.g. via employees or shareholders [C- 222/04, Fondazione Cassa di Risparmio San Miniato] False arguments: • Tax exemption offsets advantages enjoyed by competitors [C-393/04, Air Liquide Industries; T-335/08, BNP Paribas v Commission] • Investors free to decide whether to use tax exemption [C-156/98, Germany v Commission] • Tax exemption compensates for regulatory costs

But advantage = favourable treatment > unfavourable treatment “Cumulative effect” of “inseparable” provisions [T-865/16, Fútbol Club Barcelona v Commission] In 1990, Spanish football clubs converted into sports companies However, 4 clubs retained status of non-profit organisations • Subject to lower tax rate than sports companies On 26 Feb 2019, GC annulled Commission decision because it did not take into account the “cumulative effect” of “inseparable” provisions • Tax deduction for reinvested profits was lower for non-profit organisations

When is a tax measure selective? Selective measure ≠ general measure Measure with large number of beneficiaries in several sectors is not necessarily general [C-75/97, Maribel; C-143/99 Adria-Wien Pipeline; C-66/02, Italy v Commission] Measure with narrow scope can be general measure, if applicable to all liable tax payers; e.g. reduction of Danish tax on supply of surplus heating [N 271/2006] ; reduction of German landing charges [C-524/14 P, Commission v Hansestadt Lübeck]

How to determine selectivity? 3-step test 1. What is reference system? [to whom does it apply?] 2. Is measure a deviation or exception from reference system? [are beneficiaries and others comparable?] • No => not selective • Yes => prima facie selective 3. Is measure justified by nature or logic of tax system? [is exemption intrinsic in system?] • Yes => not selective • No => selective

Discretion of tax authorities A general tax measure becomes selective if tax authorities have discretion in its application [C-241/94, France v Commission (Kimberly Clark)] Authorities exercise discretion even if they do not behave arbitrarily [T-92/00, Alava v Commission; T-131/16, Belgium v Commission]

Discretion in advance tax rulings T- 131/16, Belgium v Commission [“excess profit exemption”] On 14 Feb 19, GC: Discretion makes tax rulings individual measures, not schemes Consequences: • Each tax ruling will have to be re-assessed individually • Has BE admitted that its tax authorities were acting arbitrarily?

If a tax measure contains SA, then what? It must fall within any of the categories of exception provided in Articles 107(2)&(3), 93, 106(2) Normally, tax exemptions are operating aid, unless linked to investment • Operating aid only exceptionally allowed And, SA measure may not contravene other provisions in the Treaty: e.g. by limiting benefits to locally registered or headquartered companies [C-307/97, Compagnie de Saint-Gobain; C-156/98, Germany v Commission]

Conclusion 1: Has the ECJ widened the boundaries of SA too much? Tax systems do not only aim to tax, but also to influence where, when and what kind of investments are made Consider the following measure adopted by a govt to pull economy out of recession: • Companies that increase their investment by 10% may benefit from accelerated depreciation Is this selective?

Before answering consider that … T-219/10, Autogrill v Commission: • GC: Commission failed to identify who was excluded from exception; i.e. exception it did not a priori exclude anyone C-20/15 P, Commission v World Duty Free: • ECJ: Although exception was of “general application”, the decisive issue was that undertakings in comparable situation were treated differently What is the relevant question? • Certain undertakings are treated differently ex post? • Or, certain undertakings are treated differently ex ante?

Conclusion 2: Sequence for application of SA rules Tax measure Stage 1: Stage 3: General? Yes State aid? Outcome No No aid Selective but within Yes nature or logic of system? No Stage 2: Linked to Compatible investment & compliant with aid? Operating aid? GBER or guidelines? Exempted Yes Compliant with GBER or guidelines? No Prohibited

Recommend

More recommend