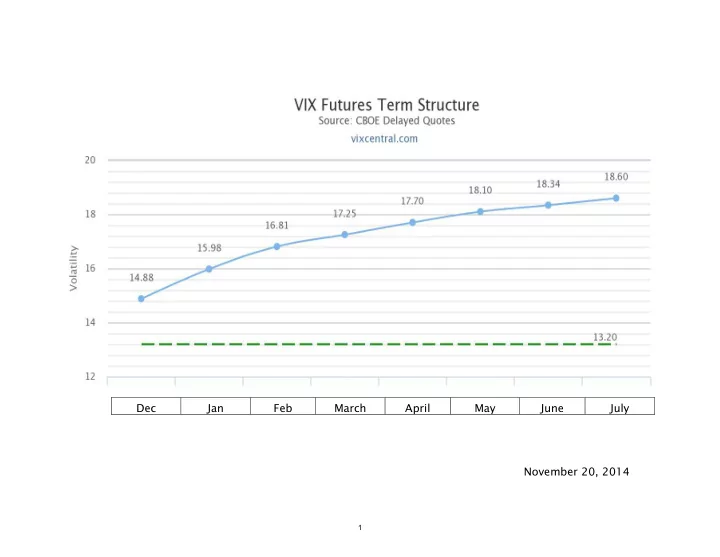

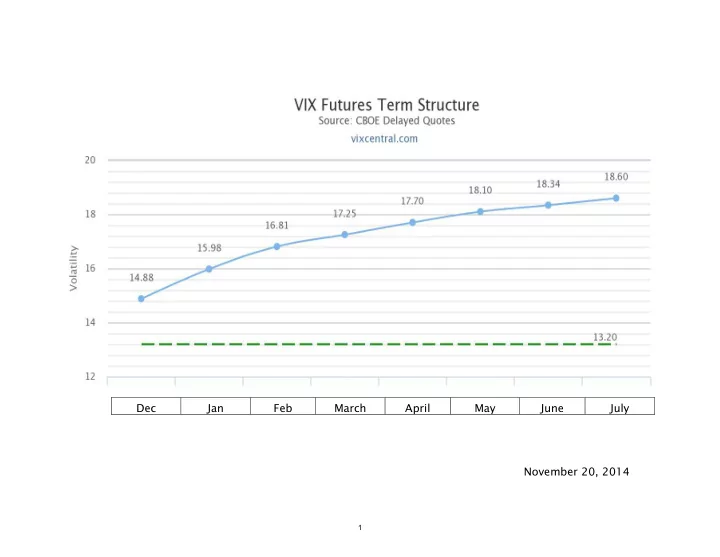

Dec Jan Feb March April May June July November 20, 2014 1

VIX Futures Historical Prices August 1, 2011 August 8, 2011 40 35 30 Volatility 25 20 15 0 30 60 90 120 150 180 210 Days to Expiration vixcentral.com 5 Day 1st 5 Day 4th 5 Day 5th 5 Day 6th 5 Day SPX % Start VIX End VIX 5 Day VIX % mo. future % mo. future % mo. future % mo. future % Return Value Value Move return return return return -13.0% 23.66 48.00 102.9% 76.6% 28.6% 21.2% 20.2% 2

Credit Suisse https://publications.credit-suisse.com/tasks/render/file/index.cfm?fileid=88F22B53-83E8-EB92- 9D555B7A27900DAC From Credit Suisse: In the Sourcebook, we identify 11 major spikes in the VIX, each associated with an economic or political crisis. For each crisis, Figure 10 shows the time taken in trading days for the VIX to revert from its peak volatility back to its (then) long-run mean. The longest reversion time was during the credit crunch/Lehman crisis, when it took 232 trading days (11 months). The average time was 106 trading days, or just under five months. Figure 10 also shows the “half - life,” or the time taken to revert half the way back to the mean. The average half-life was just 11 days. 3

4

Recommend

More recommend