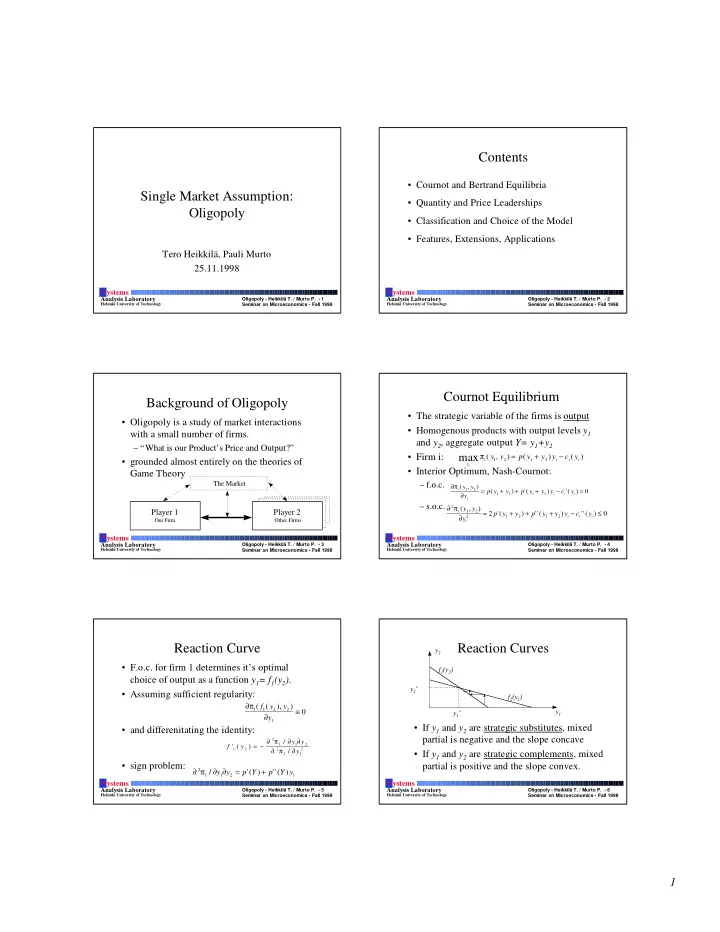

Contents • Cournot and Bertrand Equilibria Single Market Assumption: • Quantity and Price Leaderships Oligopoly • Classification and Choice of the Model • Features, Extensions, Applications Tero Heikkilä, Pauli Murto 25.11.1998 S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 1 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 2 Helsinki University of Technology Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Seminar on Microeconomics - Fall 1998 Cournot Equilibrium Background of Oligopoly • The strategic variable of the firms is output • Oligopoly is a study of market interactions • Homogenous products with output levels y 1 with a small number of firms. and y 2 , aggregate output Y= y 1 +y 2 – “What is our Product’s Price and Output?” π = + − • Firm i: max ( y y , ) p y ( y ) y c y ( ) • grounded almost entirely on the theories of i 1 2 1 2 i i i y i • Interior Optimum, Nash-Cournot: Game Theory The Market – f.o.c. ∂π ( y y , ) = + + + − = i 1 2 p y ( y ) p '( y y ) y c '( y ) 0 ∂ 1 2 1 2 i i i y i – s.o.c. ∂ π 2 ( , ) y y Player 1 Player 2 1 2 = + + + − ≤ i 2 p y '( y ) p ''( y y ) y c ''( y ) 0 ∂ 2 1 2 1 2 i i i y Our Firm Other Firms i S ystems S ystems Analysis Laboratory Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 3 Oligopoly - Heikkilä T. / Murto P. - 4 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Reaction Curve Reaction Curves y 2 • F.o.c. for firm 1 determines it’s optimal f 1 (y 2 ) choice of output as a function y 1 = f 1 (y 2 ) . y 2 * • Assuming sufficient regularity: f 2 (y 1 ) ∂π ( f ( y ), y ) ≡ 1 1 2 2 0 y 1 y 1 * ∂ y 1 • If y 1 and y 2 are strategic substitutes, mixed • and differenitating the identity: partial is negative and the slope concave = − ∂ π ∂ ∂ 2 / y y 1 1 2 f ' ( y ) ∂ π ∂ 1 2 2 2 / y • If y 1 and y 2 are strategic complements, mixed 1 1 • sign problem: partial is positive and the slope convex. ∂ π ∂ ∂ = + 2 / y y p Y '( ) p ''( ) Y y 1 1 2 1 S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 5 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 6 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 1

The Problem of The Solution of Stability Stability 0 0 = • At time t=0, ( y , y ) firm 1 thinks: 1 0 • Sufficient condition for local stability: y f ( y ) 1 2 1 1 2 = ∂ π 2 ∂ π 2 2 1 • After that, t=1, firm 2 thinks: y f ( y ) 1 1 2 2 1 ∂ 2 ∂ ∂ = − y y y t t 1 y f ( y ) • In general: > 1 1 2 0 i i j ∂ π ∂ π 2 2 2 2 • If it converges to the Cournot-Nash ∂ ∂ ∂ 2 y y y 1 2 2 Equilibrium, the illutrated equilibrium is stable. • “Almost” necessary condition, method is • Leads to dynamical system: α ∂π dy ( y y , ) more like ad hoc. = 1 1 1 2 1 ∂ dt y 1 • Real dynamic analysis requires repeated ∂π dy ( y , y ) 2 = α 2 1 2 ∂ 2 dt y game analysis. 2 S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 7 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 8 Helsinki University of Technology Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Seminar on Microeconomics - Fall 1998 Solution of Introduction of Comparative Statics Comparative Statics ∂ π 2 ∂ π 2 − 1 1 • Cramer’s Rule gives: ∂ ∂ ∂ ∂ y a y y • Profit function of the firm 1 is shifted by a 1 1 2 ∂ π 2 2 0 ∂π parameter a . ∂ ∂ ( y a ( ), y a a ( ), ) 2 y y = 1 1 2 = 0 1 2 ∂ ∂ ∂ π ∂ π 2 2 y a 1 1 1 • The Sign : ∂ 2 ∂ ∂ y y y ∂π ( y a ( ), y ( ), ) a a 1 1 2 ∂ ∂ π 2 = ∂ π ∂ π 2 1 2 sign y 2 2 0 = 1 1 ∂ sign y a 2 2 y ∂ ∂ ∂ ∂ ∂ ∂ 2 y y y 2 a 1 2 2 1 • and after differentiating • Applied to duopoly model: ∂ π ∂ π 2 2 ∂ y π 1 = + − ∂ π 1 1 2 ( y , y , ) a p y ( y ) y ay 1 ∂ ∂ ∂ = − 1 2 1 2 1 1 2 ∂ 1 y y y a – marginal cost increase will reduce Cournot 1 1 2 ∂ ∂ ∂ y a ∂ π ∂ π 2 2 y 1 ∂ π 2 2 Equilibrium Output: 2 2 0 y a = − 1 ∂ 1 ∂ ∂ ∂ 2 a y y y ∂ ∂ 1 2 2 1 S ystems S ystems Analysis Laboratory Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 9 Oligopoly - Heikkilä T. / Murto P. - 10 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Application of Cournot: Monopoly vs. Pure Competition Welfare Cournot f.o.c. for several firms: • Cournot industry produces inefficiently low n ∑ + − = 0 = level of output since price exceeds marginal p Y ( ) p Y y '( ) c '( y ) Y y i i i i = i 1 cost. dp y 1 + = i p Y ( ) c '( y ) • The ouput level of symmetric Cournot i i dY p equilibrium with constant marginal costs dp Y y 1 + = = i [ ] p Y ( ) p s c '( y ) s [ ] maximizes: = − + + − i i i i dY Y W Y ( ) p Y ( ) c Y ( n 1 ) U Y ( ) cY ε = p dp s • A competitive industry maximizes utility 1 + = i p Y ( ) c '( y ) ε i i Y dY minus costs, monopoly maximizes profits. S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 11 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 12 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 2

Bertrand Equilibrium Characteristics of Bertrand • The relevant strategic Variable: Price • One-shot game: sealed bids, one or some get all and the game ends. • Constant marginal costs, assume c 2 > c 1 , • For the Firm 1 p 1 =c 2 as long as p 1 >c 1 . • Demand curve facing Firm 1: • Mixed strategies: < if p p D p ( ), 1 2 1 = = – propability distribution over the prices of the if p p d p p ( , ) D p ( ) / , 2 1 2 1 1 2 1 other companys > 0 , if p p 1 2 – choose own probability distribution to p 1 c 1 c 2 p 2 { maximise expected profits ? π 2 $ S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 13 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 14 Helsinki University of Technology Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Seminar on Microeconomics - Fall 1998 Example: A Model of Sales Example: A Model of Sales The Mixed Strategy Equilibrium Stating Profit Equation • Each firm has zero marginal costs and fixed costs k. • Expected Profits: [ ] ∫ ∞ • On the market exists: π = − + + − p ( 1 F p ( ))( I U ) pF p U ( ) k f p dp ( ) 0 – Informed Customers ( I ) • Every Price, actually charged in the – Uninformed Costomers ( U ) equilibrium strategy, must yield the same • Symmetric Equilibrium. Each Firm has the same expected profit: mixed Strategy. π = − + + − p ( 1 F p ( ))( I U ) pF p U ( ) k • F(p) cumulative distribution function of the price in + − − π p I ( U ) k • or = Equilibrium strategy, f(p) propability density function. F p ( ) pI S ystems S ystems Analysis Laboratory Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 15 Oligopoly - Heikkilä T. / Murto P. - 16 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Example: A Model of Sales The Grade of Substitutes , Introduction of Variables The End of the Solving • The propability that a firm would charge a • Consumer’s inverse demand functions: ( ) = 1 F r = α − β − γ price less or equal to r is 1: p y y 1 1 1 1 2 π = − = α − γ − β – which gives: rU k p y y 2 2 1 2 2 + − ( ) • Direct demand functions: p I U rU – and after substituting: = ( ) F p = − + y a b p cp pI 1 1 1 1 2 ru = + − = • Setting , we get ( ) = + − u U / I y a cp b p F p 1 u 2 2 1 2 2 p = + • Index of product differentiation: • Expression is zero at p ru / ( 1 u ) γ 2 β β ( ) = 0 ≤ 1 2 F p p p • so ( ) = 1 ≥ F p p r S ystems S ystems Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 17 Analysis Laboratory Oligopoly - Heikkilä T. / Murto P. - 18 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 Helsinki University of Technology Seminar on Microeconomics - Fall 1998 3

Recommend

More recommend