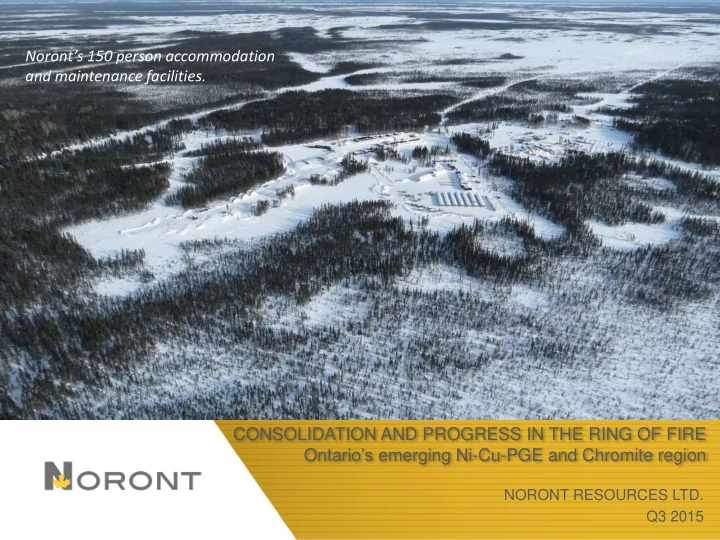

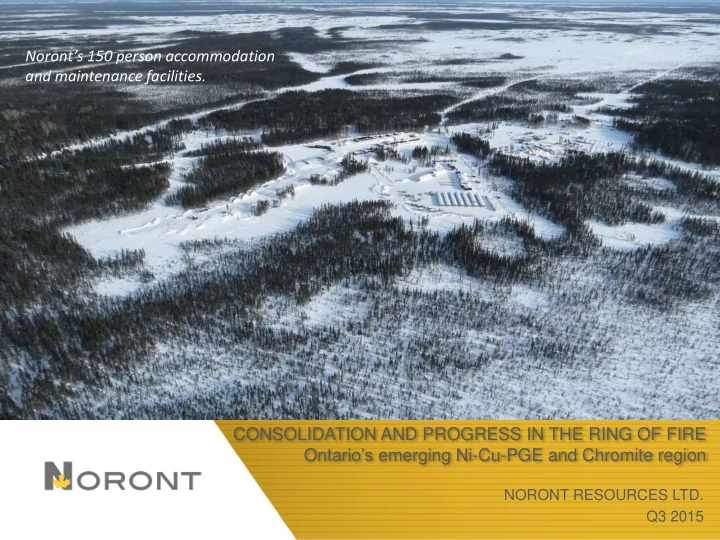

Noront’s 150 person accommodation and maintenance facilities. CONSOLIDATION AND PROGRESS IN THE RING OF FIRE O ntario’s emerging Ni -Cu-PGE and Chromite region NORONT RESOURCES LTD. Q3 2015 1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION This presentation includes certain “forward - looking information” within the meaning of applicable Canadian securities legislation. Examples of such forward-looking information includes information regarding the timing, extent and success of exploration, development and mining activities, conclusions of economic evaluations (including those contained in the Technical Report, as defined herein), project financing requirements, project permitting, planned infrastructure for the Ring of Fire region and the estimated and anticipated economic impact of Noronts mineral projects. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the impact of general business and economic conditions; risks related to government and environmental regulation, actual results of current exploration and development activities, changes in project parameters as plans continue to be refined; problems inherent to the marketability of base and precious metals; industry conditions, including fluctuations in the price of base and precious metals, fluctuations in interest rates; government entities interpreting existing tax legislation or enacting new tax legislation in a way which adversely affects the Company; stock market volatility; competition; risk factors disclosed in the Company’s most r ecent Management’s Discussion and Analysis and Annual Information Form, available electronically on SEDAR; and such other factors d escribed or referred to elsewhere herein, including unanticipated and/or unusual events. Many such factors are beyond Noront’s ability to control or predict. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate as actual results and future events could differ materially from those reliant on forward-looking information. All of the forward-looking information given in this presentation is qualified by these cautionary statements and readers are cautioned not to put undue reliance on forward-looking information due to its inherent uncertainty. Noront disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by law. This forward- looking information should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing or other relevant issues. Matt Downey, P.Geo, Senior Geologist of Noront , Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI -43- 101”), has reviewed and approved for the technical information contained in this presentation. 2

NORTH AMERICA’S NEXT BASE METALS & PGE CAMP Key Facts: • 100 % Focused on Ontario’s “Ring of Fire” Region • First staked claims in 2003 • Discovered Eagle’s Nest Ni -Cu- (DeBeers) (Goldcorp) (Noront) PGE deposit in 2007 • Completed Positive Feasibility (Goldcorp) Study on Eagle’s Nest in 2012 • Amended “Terms of Reference” approved by Ontario (Glencore) (New Gold) Government in June 2015 (North American Palladium) (Barrick) (Goldcorp • and Lakeshore) Purchased Cliff’s Ring of Fire Chromite assets in 2015 for (Alamos) US$27.5M (financed by Franco (Vale & Glencore) Nevada) 3

CONSOLIDATION OF THE “RING OF FIRE” CAMP Deep pipeline of projects in multiple commodities PROJECT PIPELINE Kyle McFaulds Blackbird JJJ Blue Jay Black Thor Big Daddy Black Label Preliminary Feasibility Macfadyen Economic Analysis Future Options Cr Cu-Zn Ti-V Diamond Au Ni-PGE 4

NORONT MANAGEMENT & BOARD MANAGEMENT Alan Coutts 25+ years of domestic and international experience in mine development and operations with President & CEO Falconbridge, Noranda and most recently Managing Director, Australasia with Xstrata Nickel. Stephen Flewelling 30 years of experience in all aspects of exploration, feasibility planning, project development, SVP, Mining & Projects construction, and operations. Former SVP, Projects & Exploration at Glencore/Xstrata. Greg Rieveley A finance executive with over 15 years in the mining and retail industries. Former VP, Business CFO Development at Harry Winston Diamond Corporation. Colin Webster 20+ years of environmental and operations management experience. Former Director of Aboriginal, VP, Sustainability Government and Community Relations for the Canada & USA Region at Goldcorp Inc . BOARD Paul Parisotto Chairman of the board of Noront Resources, President and CEO of Calico Resources Corporation. Darren Blasutti President & CEO of Americas Silver, Former SVP, Corporate Development at Barrick Gold Corporation. Ted Bassett 40+ years in mine engineering and project management with SNC Lavalin, Inco & BHP Tom Anselmi Former President and COO for Maple Leaf Sports & Entertainment Dave Thomas Managing Director at Resource Capital Funds (RCF). Yuanqing Xu General Manager of Strategy and Planning for Baosteel Resources International. Sybil Veenman Former SVP, and General Counsel at Barrick Gold Corporation. Alan Coutts President & CEO of Noront Resources Ltd. 5

CORPORATE INFORMATION Overview Listing: TSX V Symbol: NOT September 30 th , 2015: $0.34 52 Week High: $0.67 52 Week Low: $0.25 Market Cap ~ $84M Shares O/S: ~ 247.1 M Shares F/D: ~ 270.7 M Debt 1,2 : US $42 M Major Shareholders Resource Capital Fund: 21.38% Baosteel: 9.23% 1. RCF Loans (secured by parent company): US$15 M convertible @ CDN0.45/share; US$2 million can be rolled into next equity offering 2. Franco Nevada Loan: US$25 M secured by assets of wholly owned subsidiary 6

WHERE ARE WE NOW? Trade-off studies being completed for revised Feasibility study Eagle’s Nest Ni-Cu-PGE Active discussions with First Nation communities and government on regional infrastructure plan. Infrastructure Projects Strategic analysis of chromite opportunity progressing to PEA Chromite Revised exploration strategy defining first phase of regional Exploration exploration program Environmental ToR approved – Additional scientific and community studies Eagle’s Nest to be done; 3 years of baseline studies completed. Assessment Ni-Cu-PGE Permitting Establishing approach to negotiations with First Nation Impact Benefit communities Agreement Debt Discussions with Banks regarding Project Financing for Eagle’s Nest Project. Finance Equity Evaluating interim financing options. 7

RING OF FIRE’S FIRST DEVELOPMENT: EAGLE’S NEST Nickel-Copper-PGE Deposit N • Noront’s first development project will be the high-grade, S Portal Area Esker Camp 2.5km to Airstrip feasibility positive, Eagle's Nest Ni-Cu-PGE Mine with an 11-20 Surface year life. • Nickel sulphide deposit with significant by-product credits, 200m 0 Elev positioned to become a low cost (first quartile) nickel producer • Traditional 3,000 tpd, blast-hole open stope underground mine with paste backfill • Tailings will be returned underground; no surface tailings pond • Production Aggregate source for construction/road to be located Ramps underground and provide additional void for tailings . -500 Elev 700m • Currently updating 2012 feasibility study to optimize & improve capex estimate confidence: Meters below surface ‒ Concentrator will be on surface (previously underground) ‒ Simplification of mill flow sheet (1 vs. 2 circuits) ‒ Minimize up-front capital (just-in-time aggregate 1200m -1000 Elev production) Eagle’s Nest ‒ Acquired Cliff’s 150 person camp to be used for Resource Model construction housing North – South Section 1 - Please see the report titled “NI 43 -101 Technical Report Feasibility Study McFaulds Lake Property Eagle’s Nest Looking East Project James Bay Lowlands Ontario, Canada,” dated October 19, 2012 (with an effective date of September 4, 2012) (the “Technical Report”) for details regarding the anticipated mining methods and life -of-mine of the Eagle's 0 250m 500m Nest project. A copy of the Technical Reportmay be accessed under Noront’s company profile on SEDAR at www.sedar.com 1570m -1500 Elev 8

Recommend

More recommend