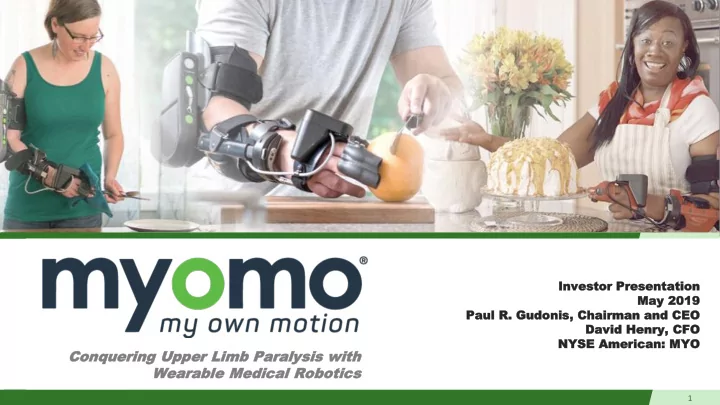

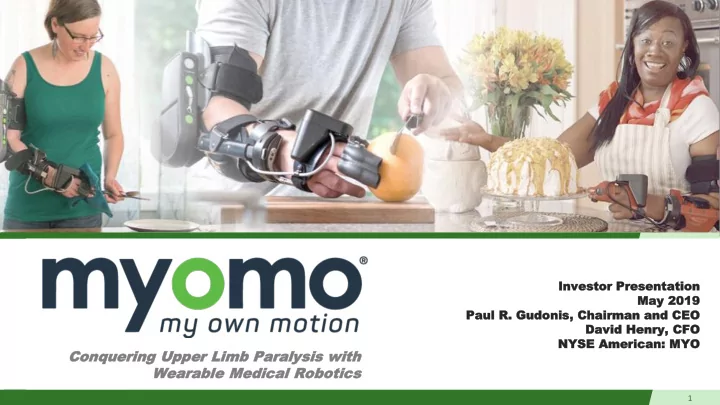

In Investor vestor Presen Presentation tation May ay 20 2019 19 Paul Paul R. . Gudo Gudonis nis, , Chairman hairman and and C CEO EO David avid He Henry, nry, CFO FO NYSE America NYSE merican: n: MYO Conq Conqueri ering g Up Uppe per r Limb Limb Para Paraly lysi sis s with with Wea Wearab rable e Me Medic dical al Robo Roboti tics cs 1

Legal Disclaimer This presentation contains forward-looking statements regarding the trading of the Company’s common stock on the NYSE American, the Company’s plans for the use of proceeds and advancing its product line, increasing its sales and marketing efforts and growing its business, and the Company's future business expectations, which are based upon the current estimates, assumptions and expectations of the Company’s management and its knowledge of the relevant market. The Company has tried, where possible, to identify such information and statements by using words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate” and other similar expressions and derivations thereof in connection with any discussion of future events, trends or prospects or future operating or financial performance, although not all forward-looking statements contain these identifying words. Forward-looking statements, which are included in accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, are only predictions and may differ materially from actual results due to a variety risks, uncertainties and other factors. These risks and uncertainties include, among others, risks related to the Company’s liquidity and financial position, the trading of its common stock, its new products, services, and technologies, government regulation and taxation, and fraud. More information about factors that potentially could affect Myomo's business and financial results are included in Myomo's Form S-1 Registration Statement filed with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

Why Invest in MYO Now? Large Unmet Medical Need: Upper Extremity Paralysis Only Commercially-Available Device to Restore Function • FDA Registered in US; CE Mark in Europe Reimbursed on Case-by-Case Basis by Commercial Payers; Approved by VA for Veterans • Awaiting Coverage Policy & Payment by Medicare for New Codes Effective January 1st National Rollout Underway in US with Direct-to-Patient Marketing • Increasing Pipeline; Higher ASP and Gross Margin Record Revenue and Gross Margin in 2018 • Significant Revenue Growth Expected in 2019 3

News Story 4

Current Upper Extremity Treatment Options Rehabilitation ➢ Occupational Therapy ➢ Static Bracing ➢ Saebo ➢ Electrical Stimulation (Bioness) ➢ Stationary Robotics Medical ➢ Botox ➢ Baclofen 5

MyoPro Orthosis: How it Works Brain Movement Signal EMG Signal Processing Sensor 6

Large Market Opportunity* Total US Market Potential $10 B Total US Market Size 25% of 3M existing cases of upper extremity paralysis + $1.2 B New Incidences / Year 25% of 350k new cases each year BRACHIAL PLEXUS STROKE INJURY SPINAL CORD INJURY MULTIPLE Total Worldwide Market Potential SCLEROSIS $30 B Estimate Includes: TRAUMATIC US + EU + ROW CAUSES OF UPPER BRAIN INJURY EXTREMITY PARALYSIS *Source: Christopher and Dana Reeve Foundation Survey, ALS National Stroke Association, World Health Organization, and Myomo Base Model Estimates 7

Myomo Commercialization + Scale-Up Timeline 2018 2016 2017 2019 Scaling Up Raising National Rollout and Direct Controlled Growth Capital to Patient Advertising Introduction • Chief Commercial Officer & • IPO and Follow-on Offering • Growing Pipeline • MyoPro 1 Product Line National Sales Team = $19.2 M • Raised $5.6M • Limited # of US Markets • B2C Ads • MyoPro 2 Product Line • Clinical Research and Initial • International Distribution • CE Mark Reimbursements • 400 Screening Days • Applied to CMS for HCPCS • VA Approval • 200 Screening Days Codes • Pediatric Device Q4 • 2 HCPCS Codes Issued Revenue = Q1 $830K Revenue = $1.0M Revenue = $1.6M Revenue = $2.4M 165%↑ 8

Competitive Landscape of O&P and Robotics Only Commercially Available Upper Limb Product Line to Restore Function Prosthetics Orthotics Upper Upper Limb Limb Products Products Foot Drop Stance Control Exoskeletons Wheelchair Lower Lower Limb Limb Products Products Unit Volume 9

Manufacturing and Distribution DISTRIBUTION PRODUCT and MFG. Centers of Excellence O&P Clinics Direct Billing EU Distributors 10

Expanding O&P Distribution Footprint (Top 50 MSA’s) 11

Generating Leads with Digital Marketing 12

Facebook Ad Example #1 13

Facebook Ad Example #2 14

Organizing Screening Days Nationwide Which screening day would you like to attend? Wichita, Kansas - Wednesday, May 22nd Seattle, Washington - Thursday, June 6th New York Area - Multiple Dates Lansing, Michigan - Thursday, May 23rd Albany, New York - Thursday, June 6th Austin, Texas - Monday, May 6th Boston, Massachusetts - Thursday, May 23rd Walnut Creek, California - Tuesday, June 11th Portland, Oregon - Tuesday, May 7th San Francisco, California - Wednesday, June Spokane, Washington - Friday, May 24th Royal Oak, Michigan - Tuesday, May 7th Portland, Maine - Friday, May 24th 12th Raleigh, North Carolina - Wednesday, May Traverse City, Michigan - Friday, May 24th Boston, Massachusetts - Wednesday, June 12th 8th St. Louis, Missouri - Friday, May 24th San Jose, California - Thursday, June 13th Southern Vermont - Thursday, May 9th Sacramento, California - Wednesday, May 29th Ann Arbor, Michigan - Thursday, June 13th Ann Arbor, Michigan - Thursday, May 9th Traverse City, Michigan - Friday, June 14th Livonia, Michigan - Wednesday, May 29th Seattle, Washington - Thursday, May 9th Pittsburgh, Pennsylvania - Wednesday, May East Lyme, Connecticut - Tuesday, June 18th Belleville, Illinois - Thursday, May 9th 29th Salt Lake City, Utah - Wednesday, June 19th Warner Robins, Georgia - Monday, May 13th New York City, New York - Wednesday, May Livonia, Michigan - Wednesday, June 19th Southern New Jersey - Tuesday, May 14th 29th Boston, Massachusetts - Thursday, June 20th Minneapolis, Minnesota - Tuesday, May 14th Spokane, Washington - Friday, June 21st Nassau County, New York - Thursday, May 30th Los Angeles, California - Wednesday, May Bakersfield, California - Thursday, May 30th Grand Rapids, Michigan - Friday, June 21st 15th Springfield, Missouri - Thursday, May 30th St. Louis, Missouri - Monday, June 24th San Francisco, California - Wednesday, May Santa Clarita, California - Friday, May 31st Sacramento, California - Tuesday, June 25th 15th Austin, Texas - Monday, June 3rd Southern New Jersey - Tuesday, June 25th San Jose, California - Thursday, May 16th Detroit, Michigan - Tuesday, June 25th Hartford, Connecticut - Tuesday, June 4th Munster, Indiana - Thursday, May 16th Royal Oak, Michigan - Tuesday, June 4th Bakersfield, California - Tuesday, June 25th Houston, Texas - Friday, May 17th Portland, Oregon - Tuesday, June 4th Nassau County, New York - Wednesday, June Grand Rapids, Michigan - Friday, May 17th Chicago, Illinois - Tuesday, June 4th 26th Columbia, Missouri - Friday, May 17th Madison, Wisconsin - Wednesday, June 5th Clinton Township, Michigan - Wednesday, June Walnut Creek, California - Tuesday, May 21st 26th Milwaukee, Wisconsin - Wednesday, June 5th 15 Salt Lake City, Utah - Wednesday, May 22nd Santa Clarita, California - Thursday, June 27th

More Screening Days Growing Patient Pipeline . Screening Days in 2018-2019 140 120 100 80 60 40 20 0 Q1 Q2 Q3 Q4 Q1 16

Strong Growth in Quarterly Revenues (YoY) 1,000,000 +63% 900,000 +165% 800,000 700,000 +106% +25% 600,000 500,000 400,000 300,000 200,000 100,000 0 1Q 2Q 3Q 4Q 2016 2017 2018 2019 17

… And Increased ASP and Gross Margin % ASP GM% 79% $23,700 65% $22,000 Q1 2018 Q1 2019 Q1 2018 Q1 2019 Catalysts: Product Mix / Channel / Direct Billing 18

Product Development to Expand Market ADULTS (MyoPro2 JUNE 2017) ADOLESCENTS (JUNE 2018) PEDIATRICS (2019E) 19

Reimbursement by Various Payers Commercial Payers Military Medicare Approvals on Case by Approved for Vets Issued New Case Basis HCPCS Codes Billed by O&P Provider 40+ VAMC’s Pending Coverage and Payment Amt. New Direct Billing 20

Growing # MyoPro Units in Reimbursement Process Screening Insurance Authorization Order 354 306 New Unit Adds in Q1 111 222 139 Previous Cases Pending 243 92 222 Reimbursement 167 92 6/30/18 9/30/18 3/31/19 12/31/18 21

Recommend

More recommend