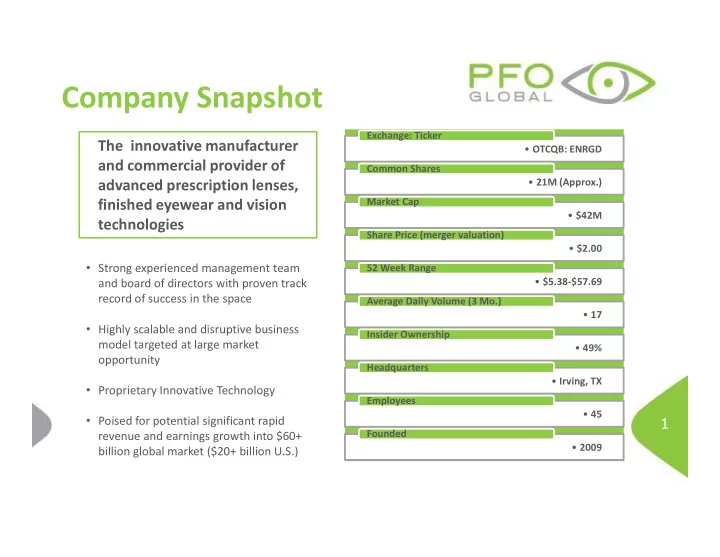

Company Snapshot Exchange: Ticker The innovative manufacturer • OTCQB: ENRGD and commercial provider of Common Shares advanced prescription lenses, • 21M (Approx.) Market Cap finished eyewear and vision • $42M technologies Share Price (merger valuation) • $2.00 � Strong experienced management team 52 Week Range • $5.38-$57.69 and board of directors with proven track record of success in the space Average Daily Volume (3 Mo.) • 17 � Highly scalable and disruptive business Insider Ownership model targeted at large market • 49% opportunity Headquarters • Irving, TX � Proprietary Innovative Technology Employees • 45 � Poised for potential significant rapid 1 Founded revenue and earnings growth into $60+ • 2009 billion global market ($20+ billion U.S.)

Merger Update � Acquisition/Merger with OTC public ENRG completed � Name changed to PFO Global, Inc. � $2 share merger price with a market cap of $42 million � Trading symbol currently ENRGD; request to change to PFOG submitted to FINRA � Response expected soon � New share issuances per the merger agreement have been mailed by the stock transfer agent � Extremely limited trading until new share certificates are received and trading restrictions expire � Hillair Capital $4 million investment completed � Required debt restructuring completed: THANK YOU NOTEHOLDERS! 2

Changes to Noteholders � Notes � All notes continue per the terms of the executed amendments � There is a one time option to convert notes to common stock now (by July 30) at a conversion price of $1.60 � If you do not elect to convert now, the notes continue per the terms in the note agreements, as amended � To convert, complete the note “Form of Exercise Notice” provided in the amendment package (or request a replacement from DJS or PFO) � Warrants � Class A Warrants � New warrant documents are in preparation to reflect a $1.60 strike price and the number of common shares � Class B Warrants � Converted to common shares as part of the merger. Class B warrant holders will receive a new share certificate to replace the warrant 3 � Class C Warrants � New warrant documents are in preparation to reflect a $2.20 strike price and the number of common shares

Recent Progress � Vision Care Direct (VCD) � Account is growing with new accounts weekly � Vision Source � PFO was a speaker and participant at Vision Source Exchange in Phoenix April 29 – May 2, 2015 � 1,500 Vision Source members attended � Over 150 Vision Source members opened accounts with PFO in 3 days � MES Vision (Medical Eye Services) � Commercial agreement signed on May 21, 2015 � Roll out staged during July-December 2015 � OD Excellence (ODX) � PFO is co-hosting the ODX International Vision Conference on August 27-29, 2015 in San Diego and expects to become a supplier to certain ODX members � RNF International 4 � PFO signed agreement with RNF International on May 6, 2015 to provide complete prescription eyewear to certain hospitals in Russia � Ordering website converted into Russian language; samples of European frames ordered; program ramp up anticipated in 4Q 2015

Recent Progress � Over 425 new eye care providers have opened accounts with PFO since January 1, 2015 (as of July 15, 2015) � Over 150 new eye care providers opened accounts after the Vision Source Exchange in Phoenix on April 29 and May 2, 2015 5

Near Term Objectives � Penetrate existing networks and managed care program accounts (March Vision Care, MES Vision, OD Excellence, Vision Care Direct and Vision Source) and begin RNF International production � Translate new accounts to increased revenue � Approximately $1.5 million monthly revenue at 40% gross profit margin required for break- even EBITDA � Our goal is to effectuate an up-list transaction, if and when PFO has achieved certain listing requirements 6

Recommend

More recommend