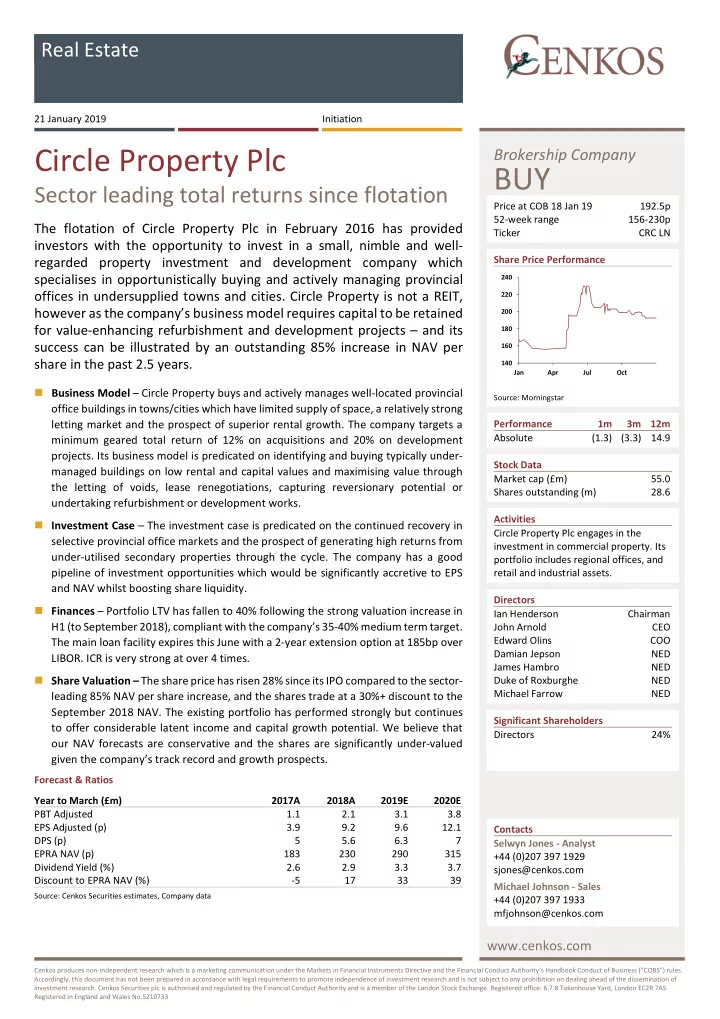

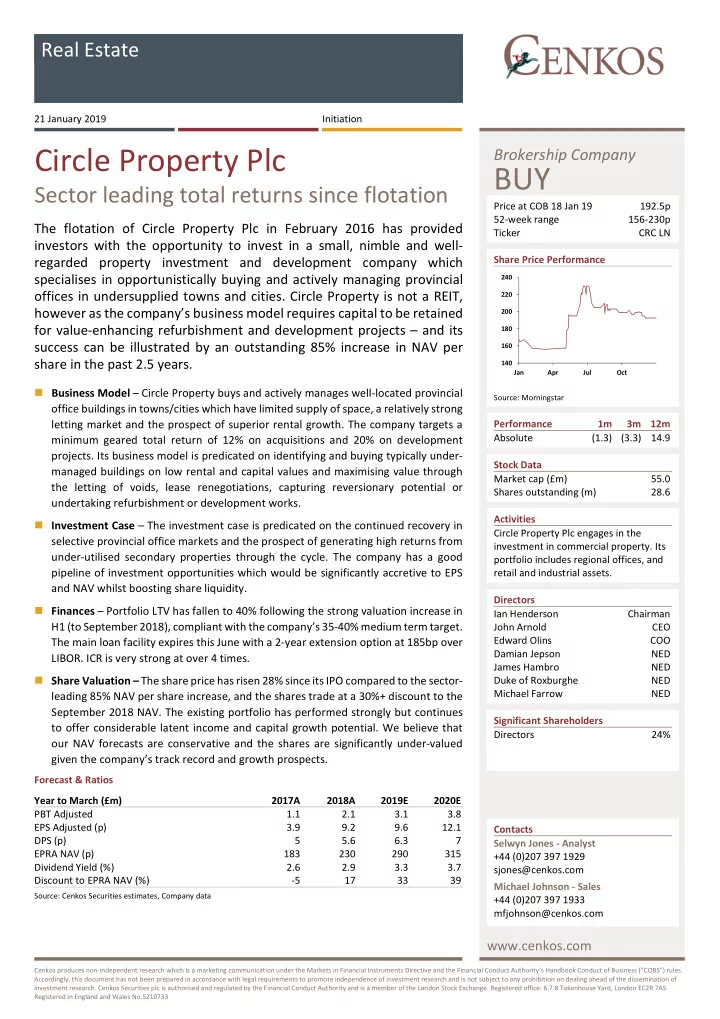

Real Estate 21 January 2019 Initiation Circle Property Plc Brokership Company BUY Sector leading total returns since flotation Price at COB 18 Jan 19 192.5p 52-week range 156-230p The flotation of Circle Property Plc in February 2016 has provided Ticker CRC LN investors with the opportunity to invest in a small, nimble and well- Share Price Performance regarded property investment and development company which specialises in opportunistically buying and actively managing provincial 240 offices in undersupplied towns and cities. Circle Property is not a REIT, 220 however as the company’s business model requires capital to be retained 200 for value-enhancing refurbishment and development projects – and its 180 success can be illustrated by an outstanding 85% increase in NAV per 160 share in the past 2.5 years. 140 Jan Apr Jul Oct Business Model – Circle Property buys and actively manages well-located provincial Source: Morningstar office buildings in towns/cities which have limited supply of space, a relatively strong letting market and the prospect of superior rental growth. The company targets a Performance 1m 3m 12m Absolute (1.3) (3.3) 14.9 minimum geared total return of 12% on acquisitions and 20% on development projects. Its business model is predicated on identifying and buying typically under- Stock Data managed buildings on low rental and capital values and maximising value through Market cap (£m) 55.0 the letting of voids, lease renegotiations, capturing reversionary potential or Shares outstanding (m) 28.6 undertaking refurbishment or development works. Activities Investment Case – The investment case is predicated on the continued recovery in Circle Property Plc engages in the selective provincial office markets and the prospect of generating high returns from investment in commercial property. Its under-utilised secondary properties through the cycle. The company has a good portfolio includes regional offices, and pipeline of investment opportunities which would be significantly accretive to EPS retail and industrial assets. and NAV whilst boosting share liquidity. Directors Finances – Portfolio LTV has fallen to 40% following the strong valuation increase in Ian Henderson Chairman H1 (to September 2018), compliant with the company’s 35-40% medium term target. John Arnold CEO Edward Olins COO The main loan facility expires this June with a 2-year extension option at 185bp over Damian Jepson NED LIBOR. ICR is very strong at over 4 times. James Hambro NED Share Valuation – The share price has risen 28% since its IPO compared to the sector- Duke of Roxburghe NED Michael Farrow NED leading 85% NAV per share increase, and the shares trade at a 30%+ discount to the September 2018 NAV. The existing portfolio has performed strongly but continues Significant Shareholders to offer considerable latent income and capital growth potential. We believe that Directors 24% our NAV forecasts are conservative and the shares are significantly under-valued given the company’s track record and growth prospects. Forecast & Ratios Year to March (£m) 2017A 2018A 2019E 2020E PBT Adjusted 1.1 2.1 3.1 3.8 EPS Adjusted (p) 3.9 9.2 9.6 12.1 Contacts DPS (p) 5 5.6 6.3 7 Selwyn Jones - Analyst EPRA NAV (p) 183 230 290 315 +44 (0)207 397 1929 Dividend Yield (%) 2.6 2.9 3.3 3.7 sjones@cenkos.com Discount to EPRA NAV (%) -5 17 33 39 Michael Johnson - Sales Source: Cenkos Securities estimates, Company data +44 (0)207 397 1933 mfjohnson@cenkos.com www.cenkos.com Cenkos produces non-independent research which is a marketing communication under the Markets in Financial Instruments Directive and the Financial Conduct Authority’s Handbook Conduct of Business (“COBS”) rules. Accordingly, this document has not been prepared in accordance with legal requirements to promote independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. Cenkos Securities plc is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: 6.7.8 Tokenhouse Yard, London EC2R 7AS Registered in England and Wales No.5210733

Circle Property Plc 21 January 2019 Contents Company History 3 Investment Strategy 4 Investment Portfolio 5 5 94% of gross assets invested in provincial offices Largest properties 5 Kent Hills Business Park, Milton Keynes (40% of gross assets) 5 6 Somerset House, 37 Temple Street, Birmingham (15% of gross assets) 36 Great Charles Street, Birmingham (4% of gross assets) 6 Other Office Assets 7 Company Structure 8 Valuation and Forecasts 10 Financials 12 www.cenkos.com 2

Circle Property Plc 21 January 2019 Company History Circle Property was founded in 2002 by current CEO, John Arnold and Non-Executive Director, James Hambro. The assets were transferred into a closed ended property unit trust registered in Jersey pre-the financial crisis in 2006 (Circle Property Unit Trust or CPUT) and the company subsequently raised £10.5m of equity growth capital from a range of approximately 20 investors. Based on its property unit trust price CPUT significantly outperformed during the 2008-09 economic and property market downturn. CPUT had de-geared prior to the sharp valuation falls and as a result its Unit price fell “just” 35% to 65p in this period. The IPD and CBRE property indices recorded average property valuation falls of over 45% which, with leverage, led to huge NAV per share falls for all listed property companies and REITs. Nine of the largest 10 REITs by market capitalisation were forced to raise additional equity capital from shareholders to support ailing balance sheets and protect banking covenants, the sole exception being Derwent London. Circle Property’s good stock selection and active portfolio management allowed its trust price (NAV) to recover significantly post the global financial crisis – from 100p in 2011 to over 150p at the time of its IPO in February 2016. The executive team has remained small. Property director, Edward Olins joined CEO, John Arnold in 2006 as COO and the Board was supplemented prior to the IPO by the appointment of Executive Chairman Ian Henderson, formerly CEO of the largest REIT share Land Securities. Other NEDs are James Hambro, The Duke of Roxburghe, Michael Farrow and the recently appointed Damian Jepson. Since IPO the EPRA NAV has increased from £43.2m to £77.9m as at September 2018 without raising any additional equity capital. Being a relatively small, but a highly nimble company has undoubtedly helped as generating income and capital growth from a small number of properties can significantly boost total returns - and Circle Property has added substantial value to a number of its previously under-utilised regional office buildings as detailed later in this report. www.cenkos.com 3

Circle Property Plc 21 January 2019 Investment Strategy Circle Property’s strategy is to opportunistically identify, acquire and add value to under-utilised regional office buildings located in or around major conurbations. There is a lack of competition for small to medium sized regional offices which are typically too small for institutional funds and too large for private investors – Circle’s sweet spot for individual property acquisitions is between £5m and £15m. Regional offices are currently the second best performing property sub-sector after light industrial and warehouses. Capital value growth in 2018 was over 5% giving a total return of over 11%, according to the CBRE Monthly Index and 94% of Circle’s portfolio comprises this sector. The company targets a minimum geared total return of 12% on acquisitions and 20% on development projects. Property investment acquisition requirements as set out on the company’s website are as follows: For individual assets: Well located provincial offices in city centres or business parks located throughout the UK. Short dated leases, vacant or part vacant properties. Rent reviews within the next 2 years or outstanding reviews. Imminent break options or future break options within the next 2 years. Tenants out of occupation. Weak/non-bankable covenants as tenants in good quality buildings. Office development opportunities – either sites, options or partly completed schemes where the property’s location justifies the risk. For Portfolios: Well located provincial office buildings. Part secure income/part vacant or short let income. In addition, the company will consider joint ventures with land owners, occupiers or agents. It is important to note that Circle Property is a property investment and development company but not a REIT. Its business model, which focuses on generating total returns from a combination of income and capital, requires capital to be retained for value-enhancing refurbishment and development projects. REITs are required to distribute at least 90% of their rental profit to shareholders – a ratio which would currently inhibit the company’s strategy of acquiring properties which require meaningful amounts of capital to undertake refurbishment, extension or development works. www.cenkos.com 4

Recommend

More recommend