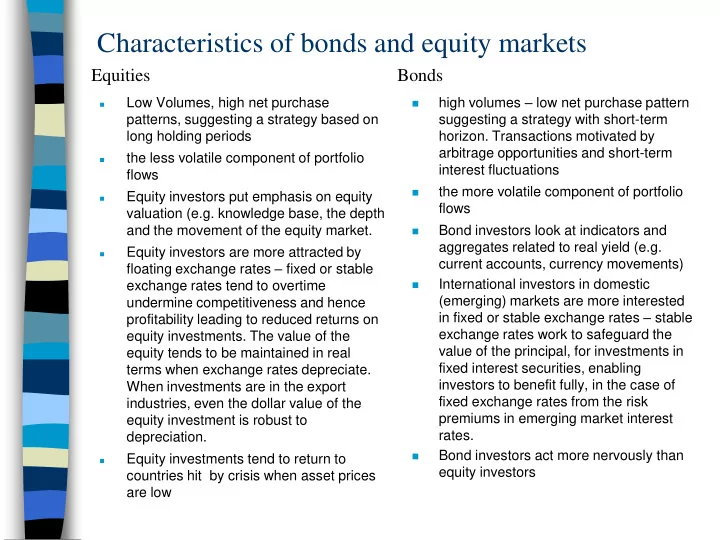

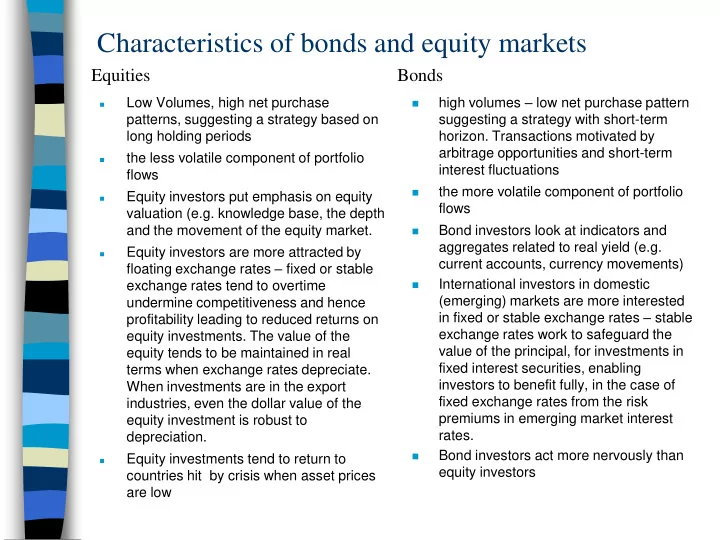

Characteristics of bonds and equity markets Equities Bonds high volumes – low net purchase pattern Low Volumes, high net purchase patterns, suggesting a strategy based on suggesting a strategy with short-term long holding periods horizon. Transactions motivated by arbitrage opportunities and short-term the less volatile component of portfolio interest fluctuations flows the more volatile component of portfolio Equity investors put emphasis on equity flows valuation (e.g. knowledge base, the depth and the movement of the equity market. Bond investors look at indicators and aggregates related to real yield (e.g. Equity investors are more attracted by current accounts, currency movements) floating exchange rates – fixed or stable International investors in domestic exchange rates tend to overtime (emerging) markets are more interested undermine competitiveness and hence in fixed or stable exchange rates – stable profitability leading to reduced returns on exchange rates work to safeguard the equity investments. The value of the value of the principal, for investments in equity tends to be maintained in real fixed interest securities, enabling terms when exchange rates depreciate. investors to benefit fully, in the case of When investments are in the export fixed exchange rates from the risk industries, even the dollar value of the premiums in emerging market interest equity investment is robust to rates. depreciation. Bond investors act more nervously than Equity investments tend to return to equity investors countries hit by crisis when asset prices are low

A summary of the properties of different forms of capital flows F o rm o f ca p ita l flo w C o st C o n d itio n a lity R isk -sh a rin g In tellectu a l Im p a ct o n V u ln e ra b ility p ro p erty in vestm en t to R eversa l O fficia l M D B s L o w to su b -co m m ercial Y es O n ly in tere st risk S o m e N o rm a l C /I b reak d o w n N o B ilateral Z ero to lo w U su ally O n ly in tere st risk S o m e N o rm a l C /I b reak d o w n N o P riv a te F D I H ig h est P o ssib le Y es Y es 1 0 0 % p lu s M in im al P o rtfo lio eq u ity H ig h N o Y es N o S u b sta n tial L im ited S u p p lier cred it S u b -co m m ercial N o N o N o N o rm a l C /I b reak d o w n N o B an k cred it: a S y n d icated C o m m ercial N o N o N o N o rm a l C /I b reak d o w n Y es, d ep en d in g o n m atu rity T rad e cred it C o m m ercial N o N o N o N o rm a l C /I b reak d o w n M in im al In ter-b an k C o m m ercial N o N o N o N o rm a l C /I b reak d o w n E x tre m e a B o n d s C o m m ercial N o N o N o N o rm a l C /I b reak d o w n Y es, d ep en d in g o n m atu rity a) E x cep t th at a fix ed in tere st rate p laces in tere st risk o n th e le n d er. S o u rce: W illia m so n (2 0 0 1 )

Is FDI necessarily a good thing? the volatility of FDI provides little information about the volatility of the capital account an increase in FDI has not made capital accounts more stable areas of doubt exist around the sustainability, herding and the risk of servicing the liabilities which FDI creates Foreign investors can hedge their earnings and protect the value of their assets or engage in outright speculation by borrowing locally and pledging physical assets as collateral and buying foreign assets and/or foreign loans equity can be traded, with little distinction between the long term and short term

Sequencing the Composition of Capital Flows Very poor countries would be better off with official assistance, FDI directed towards natural resources and trade credit. The next stage involves the previous flows plus bank finance in the form of syndicated credits to the sovereign and FDI for purposes other than natural extraction. Middle income countries can include portfolio equity and bonds- new investors: pension funds and mutual funds, access foreign banks and issue foreign bonds and trade shares on developed country markets. In the final stage of development access to the interbank market, certificates of deposit and commercial paper. It is a stage when investment banks and hedge funds become active. The more expensive forms of capital inflow are worth the additional costs as a higher interest rate pales into insignificance in comparison to the cost of capital.

Recommend

More recommend