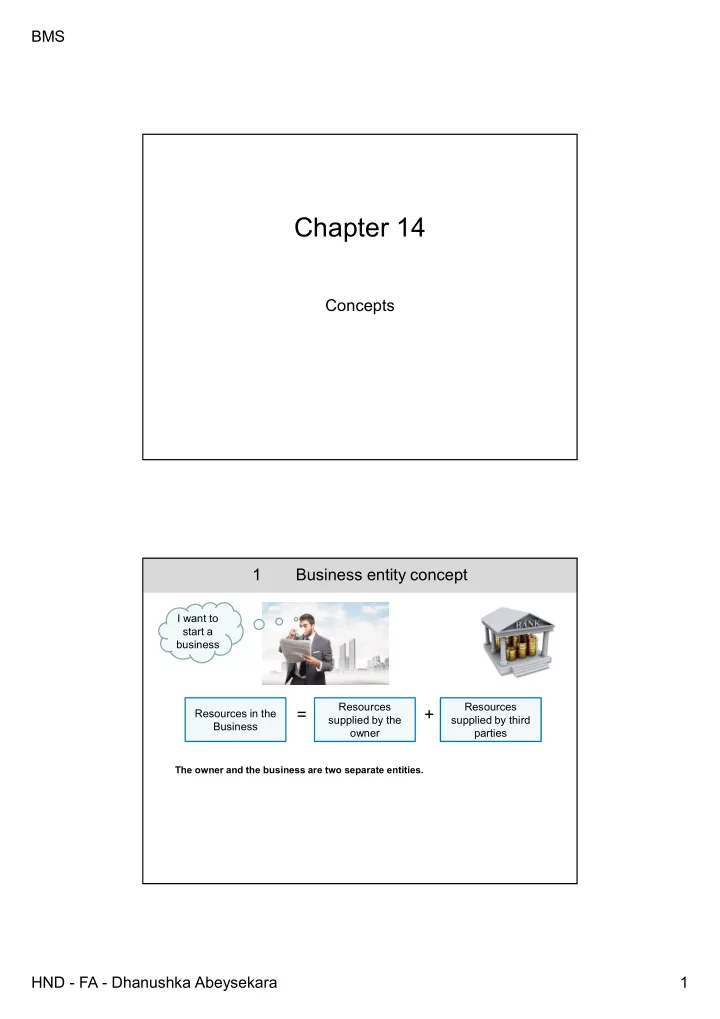

BMS Chapter 14 Concepts 1 Business entity concept I want to start a business Resources Resources = + Resources in the supplied by the supplied by third Business owner parties The owner and the business are two separate entities. Liabilities Assets = Capital + HND - FA - Dhanushka Abeysekara 1

BMS 2 Money measurement concept Income statement $ $ Sales 10,200 Cost of sales Opening inventory 0 Purchases 8,900 Closing inventory (1,200) (7,700) Gross profit 2,500 Other Expenses Wages 170 Rent 80 Advertising 25 (275) Net profit 2,225 An item or transaction can be shown in financial statements if it can be measured in money terms only 3 Historic cost concept Historic cost Bought for $100,000 Revaluation Today's value $250,000 Assets of the business should be kept at its original value (value at the date of purchase) HND - FA - Dhanushka Abeysekara 2

BMS 4 Objectivity concept I can’t put my ideas into financial statements The objective of financial statements is to show true and fair view to users. Therefore the financial statements should be prepared with the relevant rules, regulations, standards, laws etc… Someone's personal views can not be used when fianancial statements are prepared 5 Dual aspect concept Every transaction has double effect on the business. HND - FA - Dhanushka Abeysekara 3

BMS 6 Realization cooncept Sale of goods on credit An income is realised when the right receive cash is established. Sales on credit is recognised as an income because the buyer agrees to pay for the goods. 7 Periodicity concept Income statement for the year ended 31 Dec 2003 Statement of financial position as at 31 Dec 20X3 Any transaction or item can be recognised related to a time period HND - FA - Dhanushka Abeysekara 4

BMS 8 Accruals concept Electricity paid paid $250 $600 January January $150 $400 Outstanding Overpaid February $150 $400 $50 Income and expenses related to a period should be accounted in that particular period irrespective of whether they have been received or paid in cash. 9 Matching concept Income statement Sales 10,200 Cost of sales Opening inventory 0 Purchases 8,900 Closing inventory (1,200) (7,700) Income should be matched with the expenditure incurred to earn that income HND - FA - Dhanushka Abeysekara 5

BMS 10 Materiality concepts This separately identifies the significant and insignificant items and transaction. Eg: Eventhogh the stationary items are non current assets by definition, they are charged in the profit or loss statement as expenses because they have a smaaler value 11 Stable monetary unit concept It is assumed that the currencies used to prepare financial statements are stable over time (However in practice they fluctuate every day) HND - FA - Dhanushka Abeysekara 6

BMS 12 Going concern concept A business continues its operations for the foreseeable future (at least another year) 13 Consistency concept Depreciate using reducing balance method Depreciate using Straight line method Similar items should be treated in a similar way. HND - FA - Dhanushka Abeysekara 7

BMS 14 Prudence concept Future losses should be recognised now. Future income should be recognised only when it is realised. HND - FA - Dhanushka Abeysekara 8

Recommend

More recommend