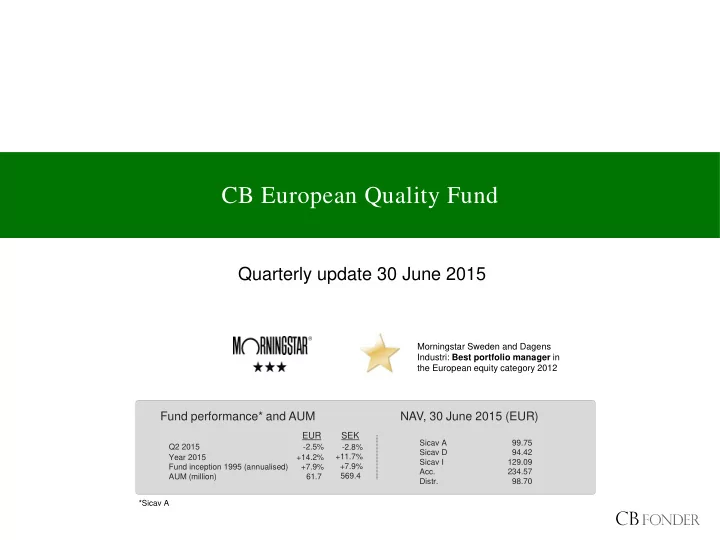

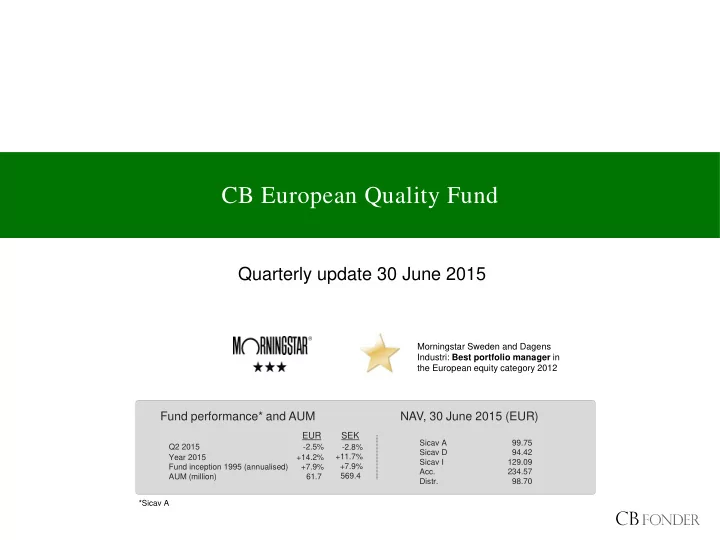

CB European Quality Fund Quarterly update 30 June 2015 Morningstar Sweden and Dagens Industri: Best portfolio manager in the European equity category 2012 Fund performance* and AUM NAV, 30 June 2015 (EUR) EUR SEK Sicav A 99.75 Q2 2015 -2.5% -2.8% Sicav D 94.42 +11.7% Year 2015 +14.2% Sicav I 129.09 +7.9% Fund inception 1995 (annualised) +7.9% Acc. 234.57 569.4. AUM (million) 61.7. Distr. 98.70 *Sicav A

The strategy and the team CB European Quality Fund About CB European Quality Fund The team Carl Bernadotte A long-only equity fund with a focus on European quality growth Portfolio manager & owner companies >25 years’ experience The strategy was launched in 1995 Born 1955 Owns shares in CB European Quality Fund Concentrated portfolio (20-33 holdings) and a long-term perspective Marcus Grimfors Benchmark: MSCI Europe Net Portfolio manager Objective: Lower standard deviation than benchmark 7 years’ experience Objective: Outperform benchmark over 12 months Born 1981 Owns shares in CB European Quality Fund About CB Fonder Alexander Jansson Portfolio manager & CEO Company founded in 1994 7 years’ experience Family owned, acting under the supervision of the Swedish Born 1983 Owns shares in CB European Quality Fund Financial Supervisory Authority Guidelines: active, ethical and long-term Erik Allenius Somnell Business development An ethical and sustainable framework is applied in the portfolio 3 years’ experience management Born 1984 The team is based in Stockholm, Sweden; all fund administration Owns shares in CB European Quality Fund is performed in Luxembourg 2

Performance: The fund and the index CB European Quality Fund The fund returned -2.5% in the first quarter; during the last 12 months the fund has returned +15.3%. The fund performed poorly until September last year, but has since then outperformed for three consecutive quarters. We have seen a trend reversal in the sense that the fund’s quality growth strategy has outperformed in a sharply rising market in Q4 2014 and Q1 2015 (+4.7% and +0.5% outperformance respectively) as well as in a falling market in Q2 2015 (+0.8% outperformance). The fund and the benchmark index, 1 year (EUR) The fund and the benchmark index, Q2 2015 (EUR) +15.3% +13.5% -2.5% -3.3% +0.8% +1.6% Source: MSCI, CB Fonder 3

Performance: The fund and the index CB European Quality Fund The fund (EQF) and the benchmark index, 10 years (EUR) The fund has – mostly due to Kay ratios (10 years) EQF Index the strong risk-on rally in the Standard deviation, % 12.52 14.71 market between the summer of 2012-summer of 2014 – Sharpe (0%) +0.43 +0.40 underperformed against the Max drawdown, % -45.78 -54.10 benchmark index, but has a Beta against MSCI Europe +0.69 positive alpha due to the low Alpha against MSCI Europe, % p.a. +1.30 beta (0,69). The fund’s risk- Consistency with MSCI Europe, % 50.00 adjusted return, Sharpe, is higher than that of the index. Tracking error, % 8.66 Information ratio -0.06 Source: MSCI, CB Fonder 4

Analysis: Stress in Greece – not in the rest of PIGS CB European Quality Fund The – Libor/OIS-spread (blue line) a Different indicators of stress: The Libor/OIS-spread and the Spanish-German 10Y-bond spread measurement of stress in the banking – peaked following the Lehman system bankruptcy and rose again sharply during the euro crisis 2011-2012. This time the spread is unchanged. The Spanish-German 10Y-bond spread (orange line) – a measurement of stress in the bond market – rose more than 500 bps during the euro crisis 2011-2012. Despite Greece’s missed IMF payment and the expiry of the bailout programme, the Spanish-German spread has hardly moved. The Greek-German 10Y-bond spread (grey Source: Bloomberg, CB Fonder; data for the period 2007-03-02 – 2015-07-07 line) has risen more than 1 000 bps … Unlike 2011-2012 there is no sign of The exposure against Greece has been capital flight – except from Greece sharply reduced in the private sector One explanation for the lack of contagion (so far) is that today, the private sector do not show any signs of stress; in 2011- 2012 the PIGS countries suffered from capital flight. This time, only Greece has suffered (heavily). Another explanation is that the exposure against Greece has been sharply reduced in the private sector since 2011 (~70% lower). Source: Deutsche Bank Research Source: Deutsche Bank Research 5

Analysis: Europe – the recovery is on track CB European Quality Fund A weak euro and a low oil price is a tailwind for Europe, which is reflected in an improved economic indicator such as the PMI (red line) and increased retail trade (black line), see left graph below. PMI, a leading indicator, has historically had high correlation with profit growth in Europe, see right graph below. Todays’ levels (53-54) have historically indicated an EPS growth of 10-20% in Europe. Todays’ PMI -levels signals 10-20% EPS growth Europe is benefitting from a low oil price and a weak in Europe euro Source: Deutsche Bank Research Source: GS Global Investment Research 6

Analysis: Allocation – Europe versus the U.S. CB European Quality Fund MSCI Europe relative to MSCI USA. Europe has performed better than the MSCI Europe relative to MSCI USA, in USD Periods of out-/underperformance U.S., with data going back to 1969. Time period Absolute return, USD Europe has four pronounced periods of MSCI MSCI Relative From To Europe USA return underperformance against the U.S., all 1 975- 02- 28 1 976- 1 0- 29 - 1 8% 30% - 37% of which have bottomed when the accumulated underperformance reached 1 976- 1 0- 29 1 978- 1 0- 31 76% - 4% 84% ~40% - the same level that was reached 1 978- 1 0- 31 1 985- 02- 28 34% 1 32% - 42% at year-end 2014. 1 985- 02- 28 1 990- 1 0- 31 283% 90% 1 02% We 1 990- 1 0- 31 1 999- 06- 30 224% 451 % - 41 % argue that a new period of outperformance has started for Europe – 1 999- 06- 30 2007- 1 1 - 30 1 02% 1 5% 75% and so far you have missed almost 2007- 1 1 - 30 201 4- 1 2- 31 - 8% 56% - 41 % nothing (+2% since the trough at year- 201 4- 1 2- 31 201 5- 06- 30 4% 1 % 2% end 2014/2015). Since 1969 there have been three periods of outperformance for Europe The three periods of outperformance for relative to the U.S. – now we are seeing the start of a fourth? Europe relative to the U.S. lasted Outperformance, Europe relative USA between 24 and 101 months and resulted in an accumulated relative outperformance of between 75 and 102 percent (see graph). The current period of outperformance (red line) mostly reminds of the period starting in 1999 (dark blue line). It could therefore be argued that there is no rush to buy Europe. On the other hand, with the same logic one could say that there is only upside risk for Europe … Number of months Source: MSCI, CB Fonder 7

Analysis: Allocation – Europe versus the U.S. CB European Quality Fund Based on market expectations (overnight indexed swap) the FED will start hiking interest rates in March 2016 and ECB in April 2018. At the beginning of 2014 the market expected that both the FED and ECB would start hiking rates in the summer of 2015 (where the curves converge in the graph below). The substantial divergence since then suggests continued good performance for Europe and the pendulum (after more than seven years of expansive US monetary policy) swings in favour of European equities compared to U.S. equities. The market expects the FED to hike interest rates in March 2016 and ECB to hike in April 2018 Source: Deutsche Bank Research 8

Recommend

More recommend