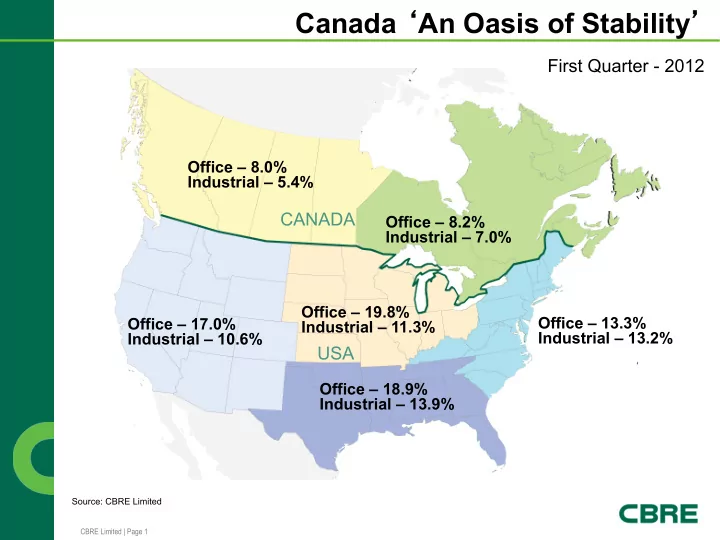

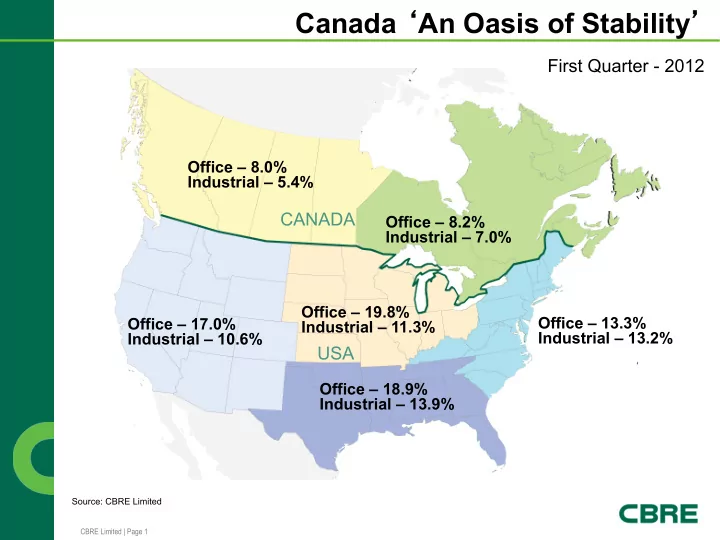

Canada ‘ An Oasis of Stability ’ First Quarter - 2012 Office – 8.0% Industrial – 5.4% CANADA Office – 8.2% Industrial – 7.0% Office – 19.8% Office – 13.3% Office – 17.0% Industrial – 11.3% Industrial – 13.2% Industrial – 10.6% USA Office – 18.9% Industrial – 13.9% Source: CBRE Limited CBRE Limited | Page 1

Vacancy Moving Down from Cyclic Highs Vacancy improving in all sectors except retail Vacancy and Availability Rates Previous Peak Year Back to “ Natural Peak/Year 2011Q4 "Natural Rate" Year Rate ” Office 16.9 / 2010 19.6 / 1991 13 to14 2014 16.0 Industrial 11.9 / 2004 9 to 10 2015 13.6 14.5 / 2010 13.2 13.2 / 2011 Retail 11.3 / 1992 9 to 10 2017 5.2 7.4 / 2009 6.8 / 2003 5 to 6 2011 Multifamily 37.9 42.5 / 2002 32 to 34 44.5 / 2009 2012 Hotels Sources: CBRE-EA 2011Q4 Outlook Report CBRE Limited | Page 2

Bell Tower CBRE Limited | Page 3

Bell Tower and Oxford Tower CBRE Limited | Page 4

Oxford Tower CBRE Limited | Page 5

1630 Prospect Place CBRE Limited | Page 6

1614 Prospect Place CBRE Limited | Page 7

Northwest Business Park (NWBP) CBRE Limited | Page 8

Moving Towards Undersupplied Source: CBRE-EA Canada Outlook 4Q 2011 CBRE Limited | Page 9

Office Towers In The Pipeline Source: CBRE Limited CBRE Limited | Page 10

Industrial Space In The Pipeline Source: CBRE Limited CBRE Limited | Page 11

Calgary NEW DOWNTOWN OFFICE DEVELOPMENTS 2014 - 2016 Hines Oxford Cadillac Fairview Brookfield Matthews Development 2015: Eau Claire 2016: Calgary 2017: Herald Site 2014: 8 th Ave. Pl. 2016: Bow South Tower City Centre – west tower 841,000 SF 600,000 SF 820,000 SF 1,200,000 SF 400,000 SF Permitting/ Permitting/ Permitting/ Permitting/ U/C 2014 Preleasing 2015 Preleasing 2016 Preleasing Preleasing 2017 Completion Completion Completion 2016 Completion Completion CBRE Limited | Page 12

Vancouver NEW DOWNTOWN OFFICE DEVELOPMENTS 2014 - 2016 Oxford Properties Bentall Kennedy TELUS/Westbank Credit Suisse/Swissreal Manulife Pattison/Reliance 2014: MNP Tower 2015: 745 Thurlow Street 2015: TELUS Gardens 2015: The Exchange 2015-2016: 980 Howe 2015-2016: Burrard Gateway 270,000 SF 365,000 SF 448,000 SF 400,000 SF 270,000 SF 204,000 SF Under Construction Under Construction Under Construction Permitting/Preleasing Permitting/Preleasing Permitting/Preleasing 2014 Completion 2015 Completion 2015 Completion 2015 Completion CBRE Limited | Page 13

Canadian Investment Transactions ($B) Market 2007 2008 2009 2010 2011 Vancouver $3.6 $2.9 $2.9 $3.1 $3.4 Calgary $6.0 $3.8 $1.4 $1.6 $2.5 Edmonton $2.8 $2.2 $1.2 $2.0 $2.4 Toronto $10.9 $7.3 $3.9 $7.6 $9.6 Ottawa $2.1 $0.7 $0.9 $1.0 $0.9 Montreal $4.7 $3.5 $1.9 $3.0 $3.4 Halifax $0.5 $0.2 $0.1 $0.3 $0.5 National $32.1 $21.7 $13.0 $19.5 $23.6 Source: CBRE Limited/RealNet Canada CBRE Limited | Page 14

2011 National Investment Sales Approach 2004 Levels APARTMENT HOTEL INDUSTRIAL OFFICE RETAIL TOTAL %CHANGE 2003 $30.0 $1.2 $14.3 $46.7 $28.8 $120.9 - $46.4 $58.1 $35.4 $181.0 2004 $51.4 $16.6 $21.8 $76.1 $50.4 $216.3 78.9% $17.0 $24.3 2005 $92.1 $28.6 $39.7 $109.1 $51.9 $321.3 48.5% 2006 $90.0 $36.5 $45.0 $141.3 $51.3 $364.1 13.3% 2007 $96.6 $62.0 $51.9 $209.2 $65.0 $484.7 33.1% 2008 $39.4 $11.9 $23.5 $57.7 $20.8 $153.3 -68.4% 2009 $16.5 $3.3 $10.1 $18.0 $12.2 $60.2 -60.8% 2010 $34.2 $12.7 $17.7 $44.8 $19.7 $129.2 114.7% 2011 $46.4 $17.0 $24.3 $58.1 $35.4 $181.0 40.1% 2011 TOTALS Source: Real Capital Analytics *2011 Unaudited, figures in Billions. CBRE Limited | Page 15

Canadian Cross-Border Capital in the U.S. Total Total Market Country Total Props Total Volume Props Volume Canada 935 $30,788.6 Manhattan 12 $5,632.0 *Volume in Millions of $ Boston 26 $3,215.0 Los 16 $2,795.8 Angeles San Diego 13 $1,726.1 Houston 40 $1,681.0 Phoenix 80 $1,054.2 DC 7 $969.5 No NJ 11 $884.6 San Jose 8 $829.2 Other 722 $12,001.2 Total 935 $30,788.6 *Volume in millions of $ Sources: Real Capital Analytics, Properties over $2.5 million tracked since 2007. Updated 2.21.12. CBRE Limited | Page 16

Cap Rate Compression Not Going Away Crazy! Sane? Source: CBRE Limited CBRE Limited | Page 17

Cap and Interest Rates Linked Source: CBRE Limited, Bank of Canada CBRE Limited | Page 18

Lack of Interest Source: Bank of Canada CBRE Limited | Page 19

National Cap Rate vs. 10-yr Bond Yield Source: CBRE Limited, Bank of Canada CBRE Limited | Page 20

Comparing Institutional Performance Source: Yahoo! Finance CBRE Limited | Page 21

Recommend

More recommend