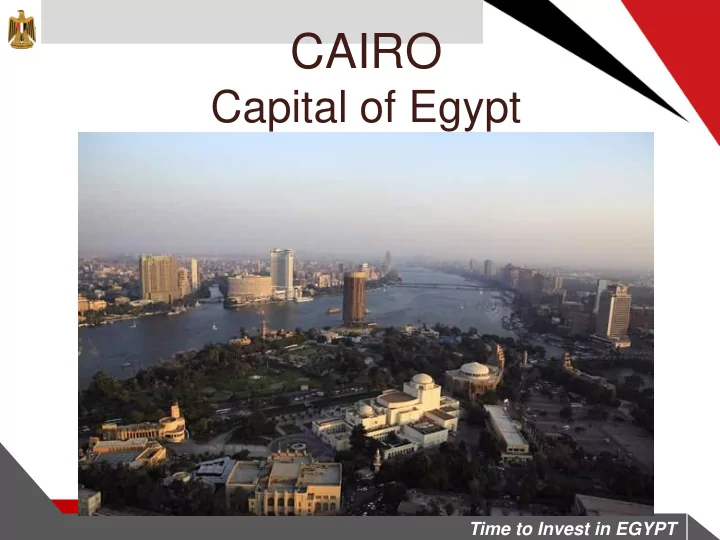

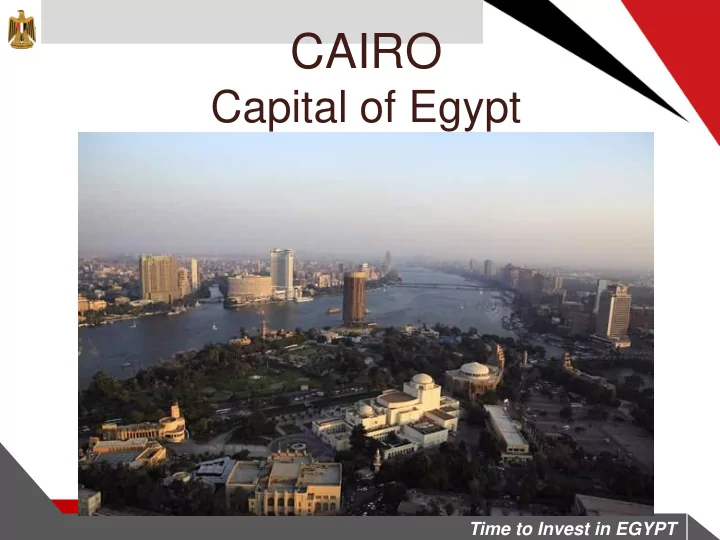

CAIRO Capital of Egypt Time to Invest in EGYPT

I Egypt: An attractive country for investors II An attractive value proposition A strategically ideal geographical location A competitive destination A unique network of Free-Trade Agreements A young and qualified workforce III Egypt: Priority to investors Time to Invest in EGYPT

Integrated Economy Time to Invest in EGYPT

Competitive costs Corporate & Income Tax Rate in Competitive salaries Egypt and other countries (%) (average) US$ per month 3787 2736 3046 + 47% 1081 1226 530 393 360 302 Source: World Bank 2012 Time to Invest in EGYPT

Workforce Population : around 100 million 60% of the Population under the age of 30 Steady growth of English, French, and German learning. Time to Invest in EGYPT

ALEXANDRIA The pearl of the Mediterranean Time to Invest in EGYPT

I Egypt: an attractive country for investors II An attractive value proposition III priority to investors SE Zone An environment favourable to conducting business Time to Invest in EGYPT

Special Economic Zone in Egypt Incentive benefits in SE Zone – special economic zone. • The ZONE is strategically located on the main international ocean trade routes, promises to be a key benchmark in the evolution of Egypt. • 5% flat tax rate on personal income tax and 10% tax on all activities within the zone • Zero Import Duties . • Zero Export duties when exporting out of Egypt . • Zero Export duties on domestic components when sold in Egypt. • Integrated custom and tax administration, licensing, and dispute settlement. (CR) Time to Invest in EGYPT

Business Environment • 5 main investor protection schemes endorsed by GAFI. Investor • 52 Double Tax Avoidance Agreements. • 111 Investment Protection Agreements. Protection • Member of OECD Investment Committee. • Member of MIGA (Multilateral Investment Guarantee Agency). • A stimulus ( incentives) package introduced by The Ministry of Industry to facilitate investments in the industrial sector Legal Legal • Lifting the security approval requirement for media companies. Reforms Reforms • The issuance of the new financial tool “SUKUK”.( Bunds) • processing reforms related to the technical operations at GAFI`s one stop shop Incentive • Incentives for taxpayers on the full or partial payment of Tax their deferred income/sales taxes System Time to Invest in EGYPT

The SCZone will be a world class value added services hub which will offer enhanced opportunities for investment across all economic sectors. 15 key sectors 10 th Ramadan Dry port Projects ( total pre-operating capital 1. costs: US$ 515 million) 2. Agribusiness (Capital costs: US$ 850 million) 3. Automotive ( Capital costs: US$ 850 million) 4. Combined cycle gas turbine (Project cost: US$ 1125 million) 5. Domestic appliances & Consumer electronics ( Capital Costs: US$ 142.5 million) 6. East Port Said Port (Capital costs: US$ 1453 million) 7. Ismailia Dry Port Projects (Pre-operating Capital: US$ 220.87) 11 Time to Invest in EGYPT

8. Open Cycle Gas Turbine Power Station (Project Cost: US$ 500 million) 9. Solar PV Fields (Project Cost: US$ 5.42 billion) 10. Textiles (Capital Expender: US$ 75 million) 11. Waste To Energy Incineration Plants (Projects Cost: US$ 495.5) 12. New Waste Water Treatment Plants (Projects Cost: US$ 225 million) 13. Provision of Additional waste water Treatment Capacity (Project Costs: US$ 231.5 million) 14. Wind Farms (Project Costs: US$ 1066 million) 15. General manufacturing ( SCZone allows investor access over 1.6 billion consumer in Europe, Gulf, East and Southern Africa and Asia). 12 Time to Invest in EGYPT

WHY THE SCZone? 1. At the heart of international trade The SCZone benefits from its strategic location along one of the world’s main trading routes. Complemented by world-class ports, high-quality logistics services and preferential trade agreements, the SCZone allows investors to efficiently, and competitively, access over 1.6 billion consumers in Europe, the Gulf, East and Southern Africa and Asia. 2. Access to Domestic Market Egypt has a large and growing domestic market of some 90million people. With rising standards of living, the purchasing power of the domestic market will drive growth in many sectors. 3. Workforce Egypt has a huge, competitively priced workforce available to meet investor requirements. 4. High Quality infrastructure and linkages State of the art infrastructure services- including power, water, wastewater, telecommunication and transport linkages- will be offered to investors. 13 Time to Invest in EGYPT

SCZone 5. A supportive institutional Framework Created under Law No.83 of 2002, as amended in 2015, SCZone will be governed by the General Authority for the Suez Canal Economic Zone. an autonomous body with executive powers of regulation and approval, including full authority to oversee all areas of operation, staffing, funding and development of partnerships with developers. 6. One-Stop Shop Services Unified and streamlined procedures and processes designed to minimise delays and costs to the investor, 7. Investment Incentives and Other Benefits Investment and tax incentives will be offered to prospective partners and investors, including a multitude of preferential rates and business set-up and support services. * Now , If you want more details , we will have a look about SCZone during Q&A session :- 14 Time to Invest in EGYPT

Ladies & Gentlemen! Egypt has different models of foreign investment:- PPP (Public Private Partnership) 1. Model of PPP Unit Under the umbrella of ministry of Finance 2. Incentives for investment in Upper Egypt • Allocation for lands for free in upper Egypt • Employment incentives • Amount of Egyptian pound 15000 ($2000) for every actual job opportunity provided by the project at a maximum of 70% of the total annual wages. This is applicable to the new projects and expansions of existing projects. 3. Streamlined Procedure issued by ministry of industry & Trade:- industrial license 15 Time to Invest in EGYPT

4. Key investment supportive laws:- • Labor law in Egypt • Law on protection of intellectual property Rights • Law on Protection of competition and prevention of Monopoly Practices 5. Industrial Modernization Centre (IMC):- Support industrial enterprises (small & medium enterprises), individually and sectorally, according to business development plans through Comprehensive Programes aiming at sustainable Growth. IMC grants € 100,000 for each project in different Stage of the project life. www.imc.egypt.org 16 Time to Invest in EGYPT

Thank you for your attention Embassy of The Arab Republic of Egypt Commercial Office – New Delhi Phne : 011- 26873818 : 011- 26887126 Fax: 011-26885922 Mob: 8826690088 17 E- mail : newdelhi@ecs.gov.eg Time to Invest in EGYPT

Recommend

More recommend