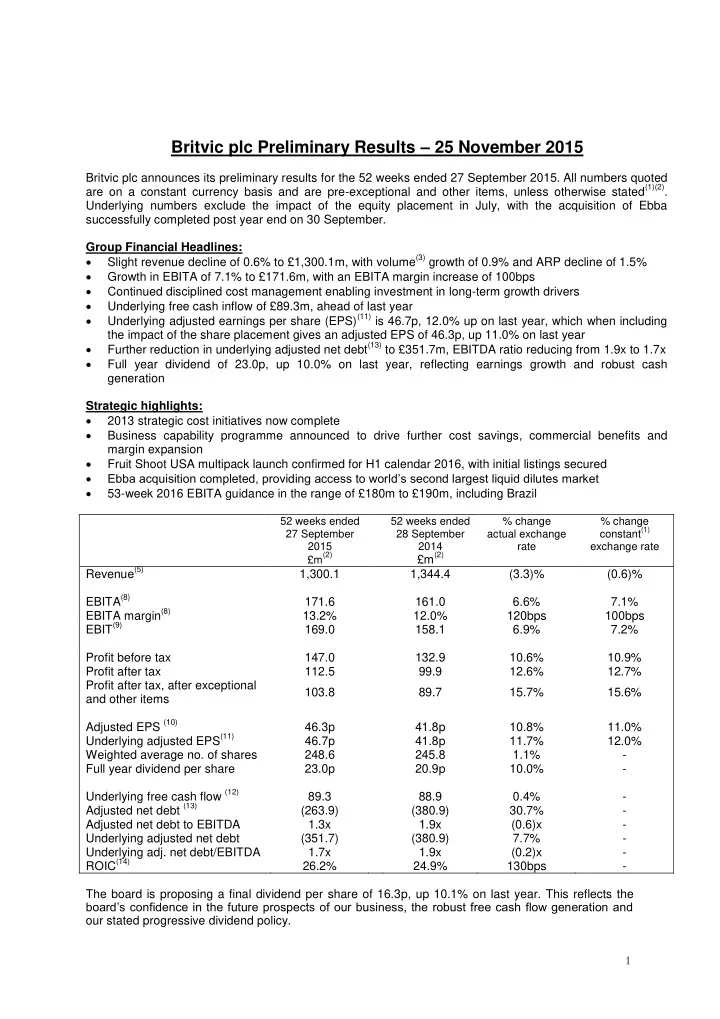

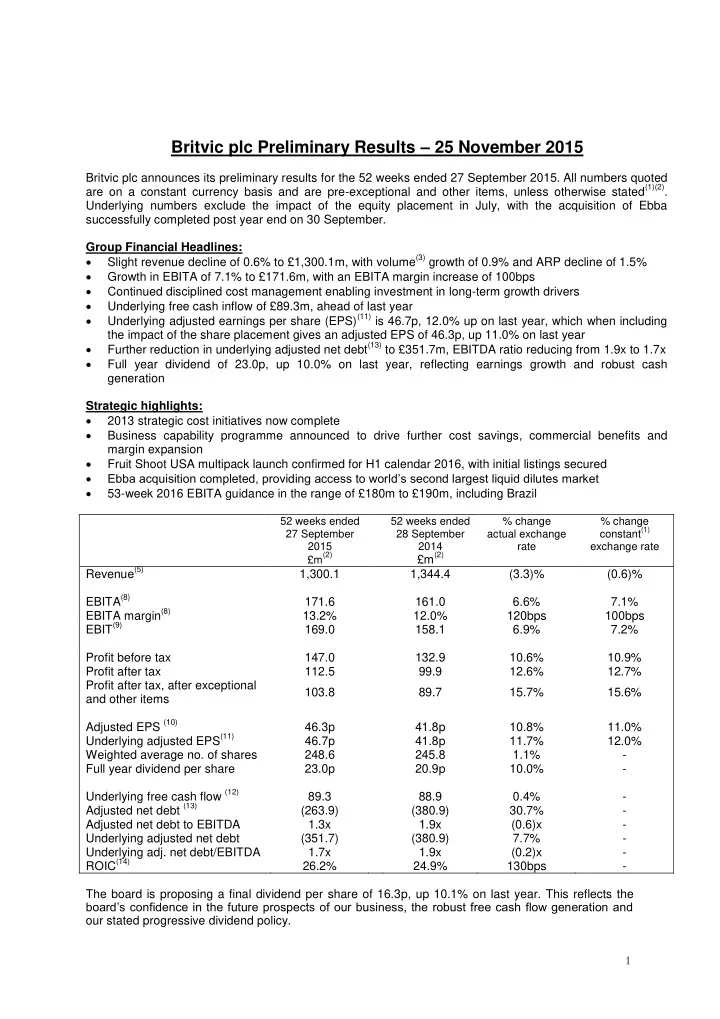

Britvic plc Preliminary Results – 25 November 2015 Britvic plc announces its preliminary results for the 52 weeks ended 27 September 2015. All numbers quoted are on a constant currency basis and are pre-exceptional and other items, unless otherwise stated (1)(2) . Underlying numbers exclude the impact of the equity placement in July, with the acquisition of Ebba successfully completed post year end on 30 September. Group Financial Headlines: Slight revenue decline of 0.6% to £1,300.1m, with volume (3) growth of 0.9% and ARP decline of 1.5% Growth in EBITA of 7.1% to £171.6m, with an EBITA margin increase of 100bps Continued disciplined cost management enabling investment in long-term growth drivers Underlying free cash inflow of £89.3m, ahead of last year Underlying adjusted earnings per share (EPS) (11) is 46.7p, 12.0% up on last year, which when including the impact of the share placement gives an adjusted EPS of 46.3p, up 11.0% on last year Further reduction in underlying adjusted net debt (13) to £351.7m, EBITDA ratio reducing from 1.9x to 1.7x Full year dividend of 23.0p, up 10.0% on last year, reflecting earnings growth and robust cash generation Strategic highlights: 2013 strategic cost initiatives now complete Business capability programme announced to drive further cost savings, commercial benefits and margin expansion Fruit Shoot USA multipack launch confirmed for H1 calendar 2016, with initial listings secured Ebba acquisition completed, providing access to world’s second largest liquid dilutes market 53-week 2016 EBITA guidance in the range of £180m to £190m, including Brazil 52 weeks ended 52 weeks ended % change % change constant (1) 27 September 28 September actual exchange 2015 2014 rate exchange rate £m (2) £m (2) Revenue (5) 1,300.1 1,344.4 (3.3)% (0.6)% EBITA (8) 171.6 161.0 6.6% 7.1% EBITA margin (8) 13.2% 12.0% 120bps 100bps EBIT (9) 169.0 158.1 6.9% 7.2% Profit before tax 147.0 132.9 10.6% 10.9% Profit after tax 112.5 99.9 12.6% 12.7% Profit after tax, after exceptional 103.8 89.7 15.7% 15.6% and other items Adjusted EPS (10) 46.3p 41.8p 10.8% 11.0% Underlying adjusted EPS (11) 46.7p 41.8p 11.7% 12.0% Weighted average no. of shares 248.6 245.8 1.1% - Full year dividend per share 23.0p 20.9p 10.0% - Underlying free cash flow (12) 89.3 88.9 0.4% - Adjusted net debt (13) (263.9) (380.9) 30.7% - Adjusted net debt to EBITDA 1.3x 1.9x (0.6)x - Underlying adjusted net debt (351.7) (380.9) 7.7% - Underlying adj. net debt/EBITDA 1.7x 1.9x (0.2)x - ROIC (14) 26.2% 24.9% 130bps - The board is proposing a final dividend per share of 16.3p, up 10.1% on last year. This reflects the board’s confidence in the future prospects of our business, the robust free cash flow generation and our stated progressive dividend policy. 1

Simon Litherland, Chief Executive Officer commented: “We have delivered another strong set of results, with margin growth and profit significantly ahead of last year, despite challenging market conditions. In all of our core markets, we continued to take volume and value share. I’m pleased to have completed the acquisition of Ebba in Brazil, which will create significant value for shareholders in the future. 2016 will see significant developments and investment in the drivers of our future growth. We have established the route to market for Fruit Shoot multi-pack in the USA, which we will launch in the first half of calendar 2016. We are also planning a major investment programme in GB, which will deliver further efficiencies and flexibility in our supply chain. We have seen a slow start to the year, reflecting the continued challenging market conditions. However, with our compelling marketing and innovation plans and our continued focus on disciplined cost management we are confident of increasing our profitability in 2016” . For further information please contact: Investors: Rupen Shah (PLC Finance and Investor Relations Director) +44 (0) 1442 284 330 Steve Nightingale (Director of Investor Relations) +44 (0) 1442 284 330 Media: Susan Turner (Director of Corporate Affairs) +44 (0) 7808 098579 Ben Foster/Rosie Oddy (Pendomer Communications) +44 (0) 203 603 5220 There will be a live webcast of the presentation given today at 10am by Simon Litherland (Chief Executive Officer), John Gibney (Chief Financial Officer) and Mathew Dunn (Chief Financial Officer-Designate). The webcast will be available at http://ir.britvic.com/, with a transcript available in due course. 2

Definitions (1) Where appropriate, comparative results are quoted using constant exchange rates. Constant currency change removes the impact of exchange rate movements during the period by retranslating prior year foreign currency denominated results of the group at current period exchange rates to aid comparability. (2) All numbers quoted are pre-exceptional and other items, unless otherwise stated. (3) Volume is defined as number of litres sold, excluding factored brands sold by Counterpoint in Ireland. No volume is recorded in respect of international concentrate sales. (4) ARP is defined as average revenue per litre sold, excluding factored brands and concentrate sales. (5) Revenue is defined as sales achieved by the group net of price promotional investment and retailer discounts. (6) Brand contribution is defined as revenue less material costs and all other marginal costs that management considers to be directly attributable to the sale of a given product. Such costs include brand specific advertising and promotion costs, raw materials, and marginal production and distribution costs. (7) Brand contribution margin is a percentage measure calculated as brand contribution, divided by revenue. Each business unit’s performance is reported down to the brand contribution level. (8) EBITA is defined as operating profit before exceptional and other items and amortisation. Only amortisation attributable to intangibles related to acquisitions is added back, in the period this is £2.6m (2014: £2.9m). EBITA margin is EBITA as a proportion of group revenues. (9) EBIT is defined as operating profit before exceptional and other items. EBIT margin is EBIT as a proportion of revenue. (10) Adjusted earnings per share amounts are calculated by dividing adjusted earnings by the average number of shares during the period. Adjusted earnings is defined as the profit/(loss) attributable to ordinary equity shareholders before exceptional and other items adjusted for the adding back of acquisition related amortisation. Average number of shares during the period is defined as the weighted average number of ordinary shares outstanding during the period excluding any own shares held by Britvic that are used to satisfy various employee share-based incentive programmes. The weighted average number of ordinary shares in issue for adjusted earnings per share for the period was 248.6m (2014: 245.8m). (11) Underlying adjusted earnings per share amounts are calculated by dividing adjusted earnings by the underlying average number of shares during the period. The underlying average number of ordinary shares excludes the impact of the share placement on 23 July 2015. (12) Underlying free cash flow is defined as net cash flow excluding movements in borrowings, dividend payments, exceptional and other items and proceeds from the share placement in July 2015. (13) Adjusted net debt is defined as group net debt, adding back the impact of derivatives hedging the balance sheet debt. (14) Return on invested capital (ROIC) is defined as operating profit after applying the tax rate for the period, stated before exceptional and other items, as a percentage of invested capital. Invested capital is defined as non-current assets plus current assets less current liabilities, excluding all balances relating to interest bearing liabilities and all other assets or liabilities associated with the financing and capital structure of the group and excluding any deferred tax balances and effective hedges relating to interest- bearing liabilities. 3

Recommend

More recommend