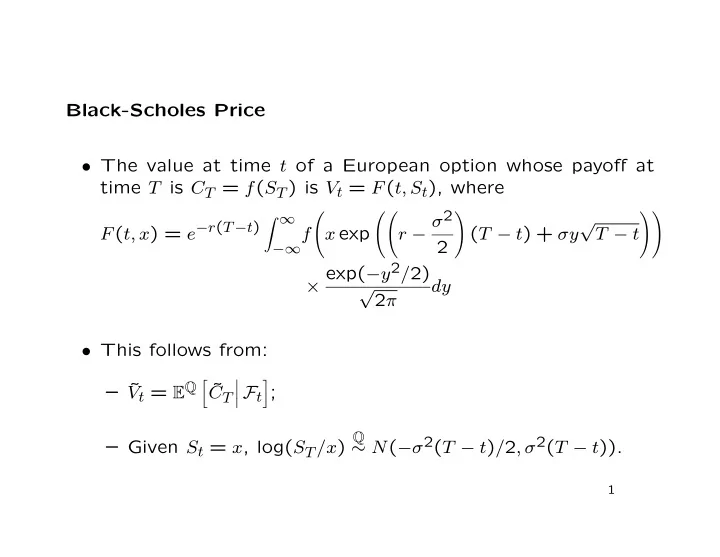

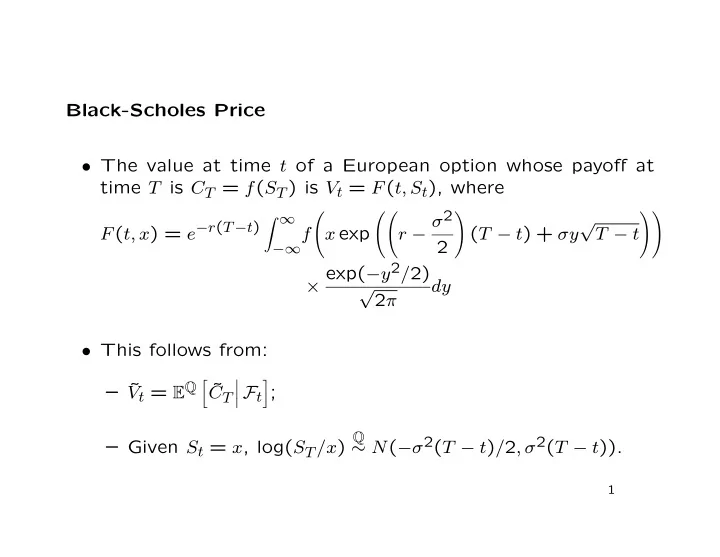

Black-Scholes Price • The value at time t of a European option whose payoff at time T is C T = f ( S T ) is V t = F ( t, S t ), where � ∞ r − σ 2 √ � �� � �� F ( t, x ) = e − r ( T − t ) −∞ f x exp ( T − t ) + σy T − t 2 × exp( − y 2 / 2) √ dy 2 π • This follows from: V t = E Q � � � – ˜ ˜ C T � F t ; � – Given S t = x , log( S T /x ) Q ∼ N ( − σ 2 ( T − t ) / 2 , σ 2 ( T − t )). 1

European call • If f ( S T ) = ( S T − K ) + , then F ( t, x ) = x Φ( d 1 ) − Ke − r ( T − t ) Φ( d 2 ) , where Φ is the cdf of the standard normal distribution, and � x � � r ± σ 2 � log + ( T − t ) K 2 σ √ T − t ( d 1 , d 2 ) = • Note that the price depends on the volatility σ ; could be: – estimated from historical data: historical volatility; – inferred from other option prices: implied volatility. 2

Replicating the claim C T F ( t, x ) = e − rt F ( t, xe rt ); then ˜ • Write ˜ V t = ˜ F ( t, ˜ S t ). • So F ( t, x ) = E Q [ ˜ ˜ F ( T, ˜ S T ) | ˜ S t = x ] . • Because d ˜ S t = σ ˜ S t dX t , the Feynman-Kac representation im- plies that 2 σ 2 x 2 ∂ 2 ˜ ∂ ˜ ∂t ( t, x ) + 1 F F ∂x 2 ( t, x ) = 0 . 3

• By Itˆ o’s rule, � T ∂ ˜ F F ( T, ˜ ˜ S T ) = ˜ F (0 , ˜ ∂x ( t, ˜ S t ) d ˜ S 0 ) + S t 0 � T ∂ 2 ˜ ∂ ˜ � � F S t ) + 1 F 2 σ 2 ˜ S 2 ∂t ( t, ˜ ∂x 2 ( t, ˜ + S t ) dt t 0 and the second integral vanishes. • So φ t = ∂ ˜ F S t ) = ∂F ∂x ( t, ˜ ∂x ( t, S t ) . • In particular, for a European call, φ t = ∂F ∂x ( t, x ) = Φ( d 1 ) . 4

The Greeks • Let π ( t, x ) be the value of a portfolio consisting of an asset with price S t = x and derivatives of (contingent claims based on) the asset. • The Greeks are: ∆ = ∂π Delta: ∂x Γ = ∂ 2 π Gamma: ∂x 2 Θ = ∂π Theta: ∂t ν = ∂π Vega (really nu): ∂σ 5

Foreign Exchange • How to price contracts and options on a foreign currency. • Suppose the domestic interest rate is r , the foreign interest rate is y , and the exchange rate is a geometric Brownian motion: B t = e rt ; Domestic bond: D t = e ut ; Foreign bond: Exchange rate: E t = E 0 exp( νt + σW t ) , where { W t } t ≥ 0 is P -Brownian motion. 6

• The exchange rate is not tradable, but S t = D t E t , the do- mestic value on day t of one foreign bond, is tradable. – Conveniently, it is also a GBM, so our existing methods can be used. • The discounted value process { ˜ S t } t ≥ 0 satisfies S t = e − rt S t = E 0 exp[( − r + u + ν ) t + σW t ] ˜ and is also a GBM. 7

• Define Q by d Q θW t − 1 � � � 2 θ 2 t � = exp , � d P � F t where − r + u + ν + 1 � � 2 σ 2 θ = /σ. • Then by Girsanov’s theorem △ = W t + θt X t is a Q -Brownian motion, and σX t − 1 � � 2 σ 2 t ˜ S t = E 0 exp is a Q -martingale. 8

• Example: a forward contract. We agree to buy one unit of foreign currency at time T with a strike price K . • Payoff is C T = E T − K , and the value of this at time t = 0 is C T ] = e − uT E 0 − e − rT K. E Q [ ˜ • Forward contracts are structured so that no money changes hands up front, so the strike must be K = e ( r − u ) T E 0 . 9

• Clearly the hedge is: – At t = 0 ∗ sell short e − uT foreign bonds; ∗ convert the proceeds to domestic at E 0 ; ∗ buy e − uT E 0 = e − rT K domestic bonds. – At t = T ∗ sell the domestic bonds for K ; ∗ exchange for one unit of foreign currency under the con- tract; ∗ use it to close the short position in the foreign bond. 10

• From the perspective of a foreign investor, the fair strike K is the same, and the hedge is the same. – The risk-neutral measure Q is different, but that is a tech- nicality caused by the change of numeraire . 11

Dividends • The basic Black-Scholes theory is for a stock that pays no dividends. – Many stocks do not pay dividends, e.g. Microsoft (for some years after IPO), Apple (recently announced re- sumption of its dividend). • When a stock pays a dividend that is proportional to the stock price , either continuously or at discrete times, immedi- ate reinvestment creates a portfolio with changing amounts of stock. 12

• If the stock price is GBM, so is the portfolio value. • A fixed dividend is more realistic, but does not yield closed form solutions. 13

Bonds • U.S. Treasury bonds have no default risk. – Their value depends on interest rates: value rises when rates fall. • Corporate bonds have both interest rate risk and default risk. • A zero coupon (or discount ) bond pays its principal amount at maturity, and nothing else. – Its value depends only on the rate for deposits to matu- rity T . 14

• Most bonds also make interest (or coupon ) payments at in- termediate times. – The value of a coupon-bearing bond depends on the in- terest rates for deposits to each of its payment dates. – Valuing a bond option requires a model for the whole yield curve (i.e., for the term structure of interest rates). • For both discount and coupon bonds, GBM is inadequate for many reasons, including its failure to capture pull to par: – As the bond approaches maturity, its value converges to its face amount, which is certain to be paid. 15

What is tradable? • A process { V t } t ≥ 0 is tradable if it is the value of some self- financing portfolio. – For instance, in the FX example, S t = D t E t is tradable, because we can buy one foreign bond at t = 0 and hold it. – But the exchange rate E t is not tradable, because there is no such portfolio. • Can we make that less heuristic? 16

• Given a riskless cash bond { B t } t ≥ 0 and a tradable asset { S t } t ≥ 0 , a process { V t } t ≥ 0 represents a tradable asset if and only if the discounted value { B − 1 � � Q , {F S V t } t ≥ 0 is a - t } t ≥ 0 t martingale, where Q is the measure under which the dis- counted asset price { B − 1 S t } t ≥ 0 is a martingale. t • Proof (of “if”): – by the martingale representation theorem, there exists a predictable { φ t } t ≥ 0 such that d ˜ V t = φ t d ˜ S t ; – if ψ t = ˜ V t − φ t ˜ S t , then V t = φ t S t + ψ t B t , and the portfolio can be shown to be self-financing. – So { V t } t ≥ 0 is the value of a self-financing portfolio. 17

• Proof (of “only if”): – if { V t } t ≥ 0 is the value of a self-financing portfolio, then there exist predictable { φ t } t ≥ 0 and { ψ t } t ≥ 0 such that V t = φ t S t + ψ t B t ; – as shown earlier, the self-financing property dV t = φ t dS T + ψ t dB t implies that d ˜ V t = φ t d ˜ S t , � � Q , {F S so { ˜ V t } t ≥ 0 is a t } t ≥ 0 -martingale. 18

Market price of risk • Suppose that multiple risky securities { S i t } t ≥ 0 trade in a mar- ket driven by a single P -Brownian motion { W t } t ≥ 0 : dS i t = µ i S i t + σ i S i t dW t . • Then their discounted processes must be Q -martingales for the same risk neutral measure Q . • That is, � � µ i − r X t = W t + t σ i for each i . 19

• So γ = µ i − r σ i is the same for each security; it is a characteristic of the market , not of the individual security . • The quantity γ is called the market price of risk : the excess mean return of an asset over the risk free rate per unit risk. – It is essentially the same as the Sharpe ratio . 20

Recommend

More recommend