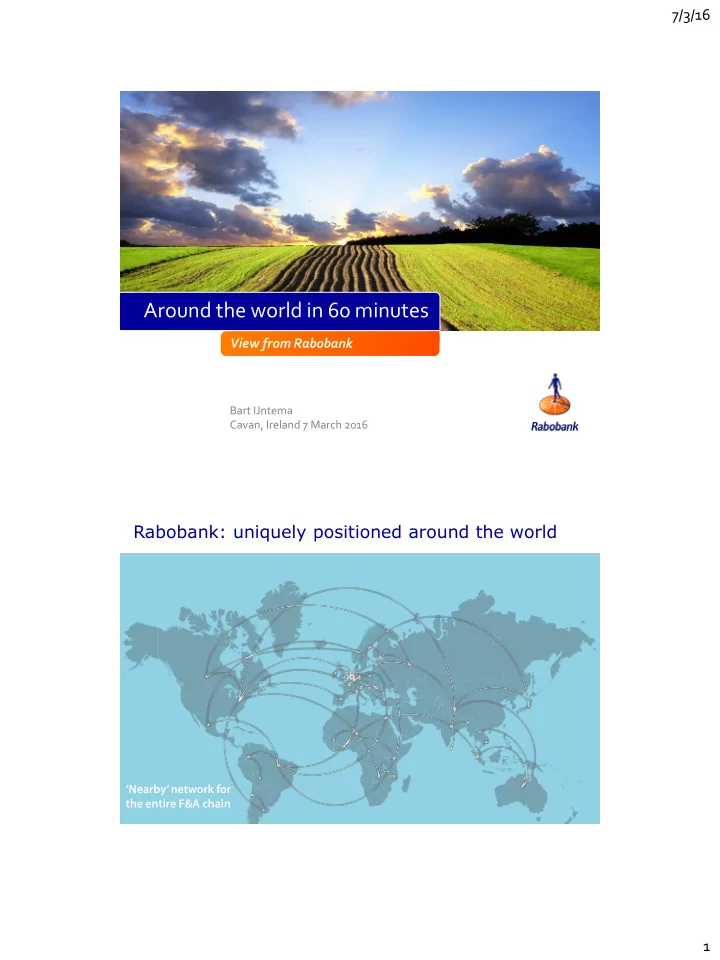

7/3/16 Around the world in 60 minutes View from Rabobank Bart IJntema Cavan, Ireland 7 March 2016 Rabobank: uniquely positioned around the world ‘ Nearby ’ network for the entire F&A chain 1

7/3/16 Rabobank: uniquely positioned throughout the chain From product centric, to customer centric , to value chain centric FARM INPUTS PRIMARY SECTOR TRADE & EXPORT PROCESSING RETAIL FAR, Global Sector Bankers building Global Relationships. F&A knowledgeable Relationship Managers building local relationships Markets, M&A, Products, Client Solutions Rabobank: focussing on Food and Agri industry globally Committed through clear strategy: Banking for Food Leading global F&A bank Servicing value chain world wide Long term relation Societally involved Culture & customer focus – F&A in our DNA Our cooperative & F&A roots 2

7/3/16 Who is Bart? Food and Farming in the spotlights... 3

7/3/16 4 Global Challenges Food Security Relevance Economical Societal Building blocks Increase the Improve access to Stimulate Enhance availability of Food food balanced nutrition stability Contribution Rabobank And of course… Earth’s pin code is changing ... 5 2015 2050 4 2 1 1 1 1 1 Europe America Africa Asia 4

7/3/16 Importance The world is growing with 5 million more mouths to feed Agricultural land per every month capita has halved since the 1960’s That’s a city the size of Singapore Need to produce more with less ecological impact …But there is no equal distribution… China & India together host 40% of the world population on 20% of the world’s arable land, with only 10% of the global renewable water resources Distribution of arable land distribution of population Africa3 Africa3 Other Other China China S+C America S+C America India Russia Russia Oceania EU11 Indonesia EU27 US+Canada India Oceania US+Canada Indonesia ...implying that trade will increase Source: FAO, UN 10 5

7/3/16 …And, World’s agricultural land is limited ... and declining... to 0.5 ha per capita in 2050? 0.5 ? 2050 11 Importance 1 / 3 Almost 800 million of globally produced food people are is wasted … chronically hungry … due to lack of know-how, improper handling, transportation or storage 158 New born inhabitants /min. Of which 154 from expanding populations in emerging and developing regions 6

7/3/16 ... 95% of this growth towards 2050 will take place in developing regions: first Asia, >2030 Africa Importance Roughly one in every six More than 1.4 billion people Americans suffer from a are overweight, 1/3 of whom foodborn are obese disease Less than 5% of Dutch children eats the recommended daily amounts of fruits and vegetables 7

7/3/16 Importance Price volatility is especially disadvantageous Every 20 years for people in developing regions who spend up the number of to 75% of their income on food people depending on Prices of agricultural Risk and return are 1 farmer, commodities remain unevenly distributed doubles volatile throughout the chain More with less Increase food production … ...and halve the ecological impact 8

7/3/16 More with Less: food loss and waste About 1 out of 4 calories produced gets lost or wasted globally In developed regions: much by consumer; in developing regions: much in supply chain Food loss and waste per capita (kcal/day) 1,600 Kcal/day 1,200 800 400 0 Macro economical relevance Agro & Food sector: 10% of the Dutch economy and employment In 2030 the global food In 2050 the demand for expenditure will have food will have grown grown with with at least 70% 60% Conclusion: Abundance of opportunities? 9

Competitive Positions Exchange Rate Volatility Impacting but volatility to stay End to commodity boom, Index exchange rate, Q3 2015 = 100 USDcents/bushel 100 110 120 130 140 150 160 60 80 90 1.400 1.600 2.000 70 1.000 1.200 1.800 200 400 600 800 3-1-2014 0 3-2-2014 3-3-2014 3-4-2014 3-5-2014 3-6-2014 Wheat CBOT 3-7-2014 3-8-2014 3-9-2014 3-10-2014 3-11-2014 3-12-2014 3-1-2015 Corn CBOT EUR 3-2-2015 3-3-2015 3-4-2015 AUD 3-5-2015 3-6-2015 3-7-2015 Soybeans CBOT BRL 3-8-2015 3-9-2015 3-10-2015 GBP 3-11-2015 3-12-2015 3-1-2016 3-2-2016 3-3-2016 Wheat UK 3-4-2016 3-5-2016 3-6-2016 3-7-2016 3-8-2016 3-9-2016 3-10-2016 0 50 100 150 200 250 300 350 400 450 500 3-11-2016 3-12-2016 GBP/tonne 20 19 7/3/16 10

7/3/16 Farmer crop plans vary worldwide US (MidWest) US (Great Plains) France Corn 18% Soybeans Corn Fallow Wheat 50% 50% 50% 50% Barley 20% Wheat 62% Brazil (Mato Grosso) Australia (NSW) Poland Canola rapeseed 14% 18% Soy + safrinha corn in the Barley same year 14% 40% wheat Soy only 56% barley 60% 26% Wheat 72% Farmer margins down worldwide but not to the same degree US (MidWest) US (Great Plains) France 3.500 1.000 2.500 Gross margin Gross margin Gross margin 900 3.000 800 2.000 Land rent Land rent Land rent 2.500 700 600 1.500 USD/ha 2.000 USD/ha EUR/ha Fuel costs Fuel costs Fuel costs 500 1.500 400 1.000 Crop 300 Crop Crop 1.000 protection protection protection 200 500 500 Seed 100 Seed Seed - - - '00-10 2011 2012 2013 2014 2015 2016 '00-10 2011 2012 2013 2014 2015 2016 '00-10 2011 2012 2013 2014 2015 2016 Fertiliser Fertiliser Fertiliser Brazil (Mato Grosso) Australia (NSW) Poland 6.000 800 5.000 Gross margin margin gross margin 4.500 700 5.000 4.000 600 Land rent Land rent land rent 3.500 4.000 500 3.000 AUD/ha PLN/ha BRL/ha Fuel costs Fuel costs fuel costs 2.500 3.000 400 2.000 300 2.000 Crop Crop crop 1.500 200 protection protection protection 1.000 1.000 100 Seed Seed 500 seed - - - '04-10 2011 2012 2013 2014 2015 2016 03-10 2011 2012 2013 2014 2015 2016 2010 2011 2012 2013 2014 2015 2016 Fertiliser Fertiliser fertiliser 11

7/3/16 Summary outlook field crop margins US Brazil US shows another poor year in the Midwest and Brazilian margins at high levels, but credit issues slight recovery in the Great Plains impact farming negatively • Midwest margins will fall back to the lowest level • The depreciation of the Brazilian real results in in more than ten years attractive farmer margins despite rising input costs • Margins in the Great Plains are expected to recover slightly due to higher yields while prices • Farmers negatively impacted by credit remain stable availability issues Europe Australia Dutch margins recovering, French margins stable Australian margins are expected at acceptable but Polish margins touching lower levels levels • European field crop margins also under pressure, but still above the long term average. • Relatively strong global wheat prices combined with a weakening Australian dollar are keeping • Lower rapeseed prices negatively impacting Australia’s farmer margins at acceptable levels Polish farmers, while recovery of potato prices supports Dutch margins 23 Global Outlook – Dairy Currently low prices due to temporarily over supply. Re-balance in supply/demand and price expected in H2 2016. • Chinese buyers increased purchases forcing up global prices and accumulating considerable stocks. • Russian embargo on dairy products imports from many dairy exporters. • The resulting over production of milk has lead to an extended period of low prices which will continue until inventories are normalised and markets re- balance, this may take until 2H 2016. 24 12

Recommend

More recommend