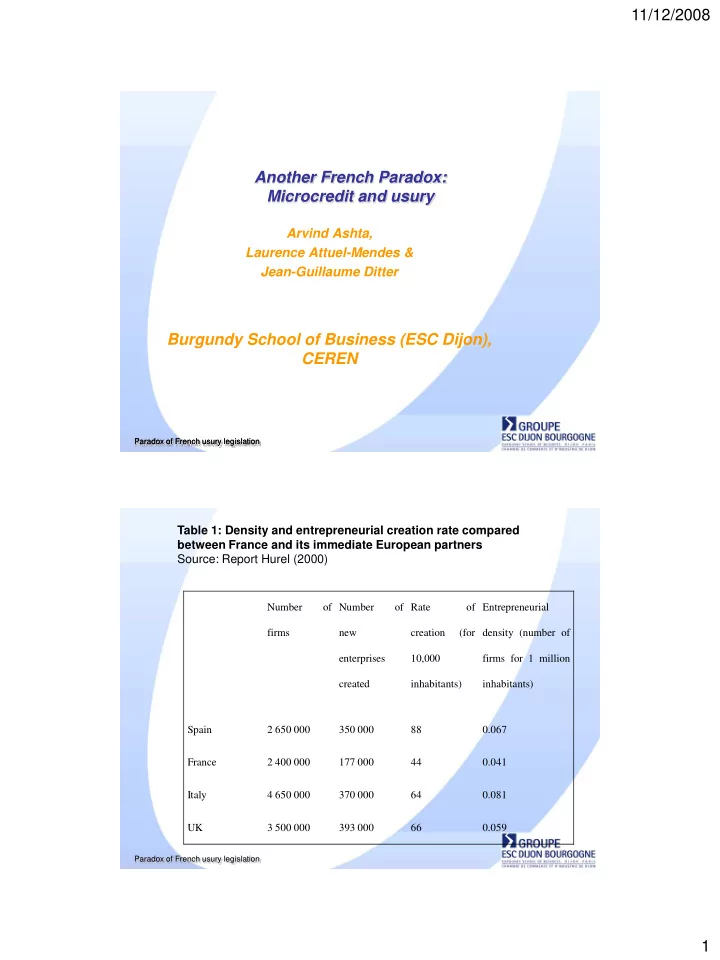

11/12/2008 Another French Paradox: Microcredit and usury Arvind Ashta, Laurence Attuel-Mendes & Jean-Guillaume Ditter Burgundy School of Business (ESC Dijon), CEREN Paradox of French usury legislation Paradox of French usury legislation Table 1: Density and entrepreneurial creation rate compared between France and its immediate European partners Source: Report Hurel (2000) Number of Number of Rate of Entrepreneurial firms new creation (for density (number of enterprises 10,000 firms for 1 million created inhabitants) inhabitants) Spain 2 650 000 350 000 88 0.067 France 2 400 000 177 000 44 0.041 Italy 4 650 000 370 000 64 0.081 UK 3 500 000 393 000 66 0.059 Paradox of French usury legislation 1

11/12/2008 The growth of credit may not materialise if credit rates remain capped by usury laws Interest Supply rates E r* r u Usury Unsatisfied ceiling demand Demand Loan Amount b a c Paradox of French usury legislation Table3: Comparative usury legislation Source: Information extracted from Hurel (2003). Countries with no Countries having usury usury laws laws US Germany Canada Spain UK Italy Austria France Note, the US has no usury limits at the federal level, but individual States may still have limits from time to time. Paradox of French usury legislation 2

11/12/2008 France removed usury ceilings • For loans to enterprises : 2003 • For business loans to individuals : 2005 • Therefore – Microcredit should have boomed – Interest rates on business loans should have increased Paradox of French usury legislation ADIE: Growth in Microcredit Activity Number of Growth in Year loans number Growth % 1990 34 1991 91 57 168% 1992 159 68 75% 1993 278 119 75% 1994 388 110 40% 1995 698 310 80% 1996 852 154 22% 1997 1276 424 50% 1998 1492 216 17% 1999 1929 437 29% 2000 2844 915 47% 2001 3563 719 25% 2002 4618 1055 30% 2003 5349 731 16% Not 2004 5587 238 4% exceptionally 2005 6740 1153 21% high growth 2006 7570 830 12% rates 2007 9853 2283 30% Source: ADIE (2008): Rapport d’Activité 2007 Paradox of French usury legislation 3

11/12/2008 Figure 2: Interest Rates and Usury Celings in France (2002-2007) Housing loans to individuals 9,00 usury ceilings 8,00 Fixed rate loans (average rate) 7,00 Interest rates (%) Fixed rate loans (usury ceiling) 6,00 5,00 Variable rate loans (average rate) 4,00 average rates Variable rate loans (usury 3,00 ceiling) 2,00 Bridge loans (average rate) 1,00 Bridge loans (usury ceiling) 0,00 2002 2003 2004 2005 2006 2007 Time (year centred on first quarter) Other loans to individuals Small loans of less than 1524 Euros (average rate) 25,00 Interest rates usury ceilings Small loans of less than 1524 20,00 Euros (usury ceiling) don't seem to Interest rates (%) 15,00 Overdraft, hire purchase and have gone up term loans of more than 1524 Euros (average rate) 10,00 Overdraft, dererred credit and exceptionally. term loans of more than 1524 Euros (usury ceiling) 5,00 average rates Personal loans of more than 1524 euros (average rate) 0,00 If they went up, 2002 2003 2004 2005 2006 2007 Personal loans of more than 1524 euros (usury ceiling) Time (year centred on first quarter) this may be Suppliers credit and Hire Loans to enterprises purchase (av erage rate) global interest Suppliers credit and Hire 16,00 purchase (usury ceiling) usury ceilings Variable rate Term loans (> rate rise 14,00 2yrs) (av erage rate) 12,00 Variable rate Term loans (> Interest rates (%) 2yrs) (usury ceiling) 10,00 Fixed rate term loans (> 2 yrs) 8,00 (av erage rate) Fixed rate term loans (> 2 yrs) 6,00 (usury ceiling) 4,00 Ov erdraft (av erage rate) av erage rates 2,00 Ov erdraft (usury ceiling) 0,00 2002 2003 2004 2005 2006 2007 Other short term loans (< 2 yrs) (av erage rate) Time (year centred on first quarter) Other short term loans (< 2 Paradox of French usury legislation Source: Bank of France data Figure 3: Interest spreads and maximum usury spreads in France (2002-2007) Housing loans to individuals 6,00 usury ceilings 5,00 Interest rates (%) Fixed rate loans (average rate) 4,00 Fixed rate loans (usury ceiling) Variable rate loans (average rate) 3,00 Variable rate loans (usury ceiling) Bridge loans (average rate) 2,00 Bridge loans (usury ceiling) 1,00 average rates 0,00 2002 2003 2004 2005 2006 2007 Time (year centred on first quarter) Other loans to individuals Small loans of less than 1524 25,00 Euros (average rate) usury ceilings 20,00 Small loans of less than 1524 Interest rates (%) Euros (usury ceiling) 15,00 Overdraft, hire purchase and term loans of more than 1524 Euros (average rate) 10,00 Overdraft, dererred credit and term loans of more than 1524 5,00 Euros (usury ceiling) average rates Personal loans of more than 1524 euros (average rate) 0,00 2002 2003 2004 2005 2006 2007 Personal loans of more than 1524 euros (usury ceiling) Time (year centred on first quarter) Suppliers credit and Hire purchase Loans to entreprises (average rate) Spreads seem to Suppliers credit and Hire purchase (usury ceiling) 12,00 usury ceilings Variable rate Term loans (> 2yrs) be reducing !!! (average rate) 10,00 Variable rate Term loans (> 2yrs) Interest rates (%) (usury ceiling) 8,00 Fixed rate term loans (> 2 yrs) (average rate) 6,00 Fixed rate term loans (> 2 yrs) (usury ceiling) 4,00 Overdraft (average rate) 2,00 average rates Overdraft (usury ceiling) 0,00 Other short term loans (< 2 yrs) 2002 2003 2004 2005 2006 2007 (average rate) Time (year centred on first quarter) Other short term loans (< 2 yrs) (usury ceiling) Paradox of French usury legislation Derived from bank of France data 4

11/12/2008 The Paradox • Why didn't interest rates increase ? • The paper discusses possible explanations Paradox of French usury legislation A. Classical explanations 1. Global interest rates decreased – Not borne by reality 2. Expansion in Money supply 3. Increased competition Paradox of French usury legislation 5

11/12/2008 Figure 4: The impact of an increase in supply of microcredit Interest Supply rates S1 E r* r u r** Demand Loan c’ b a Amount Paradox of French usury legislation B. Behavioral and Formal Institutional Explanations 1. Behavioral explanations linked to OSEO guarantees 2. Effect of Basel 2: Bankers take less risk 3. The doctrine of "abusive support" deters bankers 4. Protection of Over-indebtedness 5. Information Asymmetry and Limited Liability of Borrower Paradox of French usury legislation 6

11/12/2008 Step 1 in establishing OSEO guarantee effect Interest Supply rates E E r* r u G F OSEO r o determined rate (supply curve flattens) Demand r f Loan b a c d Amount Paradox of French usury legislation Figure 5: The effects of OSEO guarantees, transaction costs and reference dependence on supply and interest rates S3 Reference Dependence S2 Transaction costs Interest S0 rates E ’’ E ’ E r* r u F OSEO r o S1 determined rate (supply curve flattens) Demand r f Loan b a c d Amount Paradox of French usury legislation 7

11/12/2008 Reasons for rotation 1. Basle 2 Interest 2. Concept to abusive support Supply rates 3. Protection of over-indebted H G’ E r* r u F OSEO G r o determined rate (supply curve flattens) Demand Loan Amount b a c Paradox of French usury legislation Problem • Interest rates should have increased to G, but this did not happen • See Cofinoga, Sofinco etc for diversion of consumtion loans to business and the fungibility problem Paradox of French usury legislation 8

11/12/2008 Figure 7: High interest rates increase default risk: supply curve becomes steeper and later vertical Interest Supply rates H’ G’ E r* r u F OSEO r o determined rate (supply curve flattens) Demand Loan b a c Amount Paradox of French usury legislation Problem • There is no equilibrium ? • Multiple equilibriums Paradox of French usury legislation 9

11/12/2008 C. Softer institutional reasons 1. Religious factors lead to informal usury ceilings 2. The French bankers (like other French entrepreneurs) are low on risk taking 1. Therefore prefer not to lend 3. The French social security system encourages low risk taking and therefore the demand curve may be more elastic Paradox of French usury legislation Feedback Please provide feedback to arvind.ashta@escdijon.eu Paradox of French usury legislation 10

Recommend

More recommend