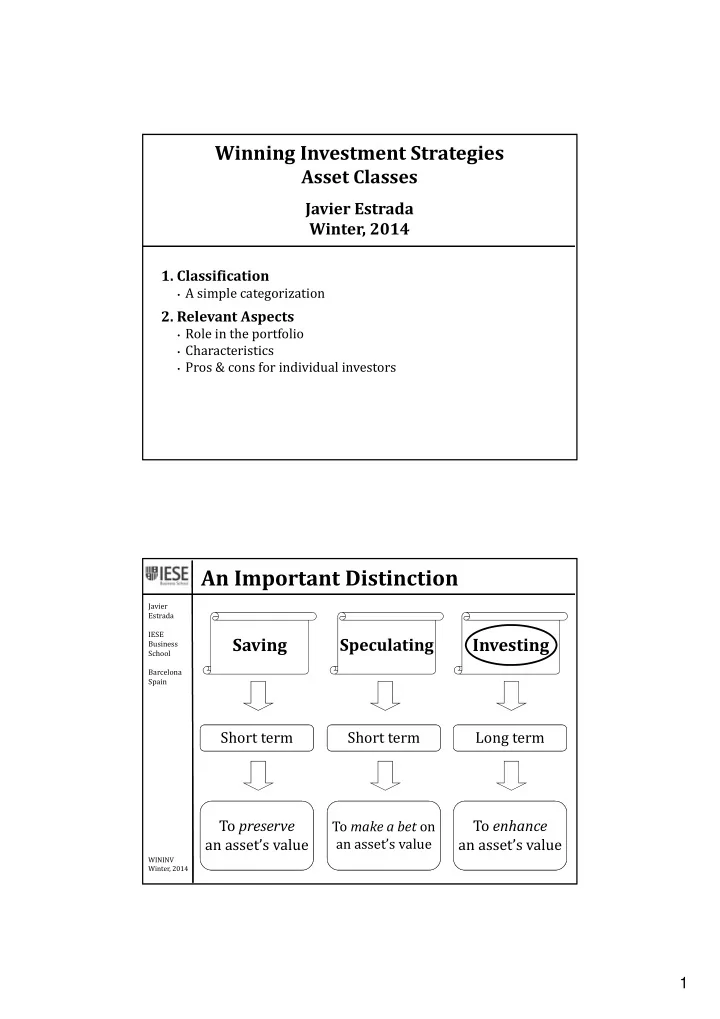

Winning Investment Strategies Asset Classes Javier Estrada Winter, 2014 1. Classification • A simple categorization 2. Relevant Aspects • Role in the portfolio • Characteristics • Pros & cons for individual investors An Important Distinction Javier Estrada IESE Saving Investing Speculating Business School Barcelona Spain Short term Short term Long term To preserve To enhance To make a bet on an asset’s value an asset’s value an asset’s value WININV Winter, 2014 1

The Investment Process Javier Estrada IESE Asset allocation Business School Barcelona Spain Security selection Market timing WININV Winter, 2014 A Simple Categorization Javier Estrada IESE Alternatives Business Stocks Bonds School (Others) Barcelona Spain Upside Protection Diversification These proportions determine most of the portfolio’s return WININV Winter, 2014 Go 2

A Simple Categorization Javier Estrada IESE Alternatives Business Stocks Bonds School (Others) Barcelona Spain Companies Commodities Regions Governments Real Estate Countries Companies Private equity Sectors … Art Sizes … Styles WININV Winter, 2014 Alternatives (Others) Javier Estrada A general comment IESE Business (More often than not ignored) School Barcelona Spain Do not use them for speculation • A directional bet on prices Use them for their diversification benefits • Low correlation to stocks and bonds WININV Winter, 2014 Go 3

Alternatives (Others) Javier Estrada Commodities IESE Business (Metals, energy, agriculture, …) School Barcelona Spain Prices are very volatile • Hence very difficult to forecast But their correlations to stocks/bonds are ‘low’ • Hence they are good portfolio diversifiers WININV Winter, 2014 Go Alternatives (Others) Javier Estrada Real Estate IESE Business Disadvantages for investment purposes School Barcelona Spain Low transparency • Heterogeneous/negotiable/discontinuous price Much lower liquidity than stocks and bonds Very high transaction costs WININV Winter, 2014 Go 4

Bonds – Return Javier Estrada The return of a plain ‐ vanilla bond IESE Business is trivial to estimate School Barcelona Spain The market price and future CFs are known • The IRR follows straightforwardly (Actually quoted together with the price) • The IRR is the annualized return to maturity WININV Winter, 2014 Bonds – Risk Javier Estrada Avoid a very common mistake IESE Business School Barcelona Spain Bonds, even the safest ones, are risky Capital losses are possible if the bond is not held until its expiration Even then, only the nominal return is locked (except in inflation ‐ protected bonds) WININV Winter, 2014 Go 5

Bonds – Credit/Default Risk Javier Critical variable: Ratings Estrada IESE Business School Barcelona Spain AAA AA A BBB BB B CCC CC C WININV Winter, 2014 Bonds – Credit/Default Risk Javier Ratings tend to be reliable Estrada IESE Business School Barcelona Spain When? • Plain‐vanilla bonds / In the medium to long term When not ? • Structured products / In the short term WININV Winter, 2014 6

Bonds – Other Types of Risk Javier Estrada Default risk is critical, IESE Business but also keep in mind School Barcelona Spain Market risk (May have to sell before maturity?) Liquidity risk (Easy to sell?) Reinvestment risk (Use of CFs?) Bond funds • Do not guarantee CFs or an IRR • Keep an eye on the average rating and maturity WININV Winter, 2014 Bonds – Risk & Return Javier Estrada Plain ‐ vanilla bonds IESE Business School Barcelona Spain A very simple financial asset The nominal return is known beforehand The risk is largely given by the rating WININV Winter, 2014 7

Stocks – Companies Javier Shares in individual companies Estrada IESE Disadvantages for individual investors Business School Barcelona Spain Broad diversification is very costly Valuation is very time consuming • DCF models are tricky to implement • Multiples are deceiving Focus on diversified groups of companies • Sectors, countries, regions, sizes, styles WININV Winter, 2014 Stocks – Regions Javier Estrada IESE Business School Barcelona Spain This list is far from exhaustive WININV Winter, 2014 8

Stocks – Countries Javier Estrada IESE Business School Barcelona Spain This list is far from exhaustive WININV Winter, 2014 Stocks – Sectors Javier Estrada IESE Business School Barcelona Spain This list is far from exhaustive WININV Winter, 2014 9

Stocks – Size & Style Javier Estrada Size Style IESE Business School Barcelona Spain Large cap Growth Mid cap Blend/Core Small cap Value Market cap Multiples Do not worry about precise definitions WININV Rely on the name/classification of the fund Winter, 2014 Stock – Size & Style Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 10

Stocks – Size & Style Javier Estrada IESE Business School Barcelona Spain Higher risk, higher return Higher risk, All 9 boxes higher return are investable WININV Winter, 2014 Go Stocks – Size & Style Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 11

In Short Considering 3 broad asset classes (stocks, bonds, Javier Estrada and alternatives) is enough for individual investors IESE Business Alternatives (Others) School • Do not use them for speculation (bets on future prices) Barcelona Spain • Use them for their diversification benefits • Keep in mind the negative characteristics of real estate for investment purposes (and remember REITs) Bonds • Essential in most portfolios • Provide a certain return (if held until maturity and there is no default) • Ratings are an essential tool to evaluate the default risk of plain ‐ vanilla bonds in the medium/long term WININV Winter, 2014 In Short Considering 3 broad asset classes … (Cont.) Javier Estrada Stocks IESE Business • Essential in most portfolios School • Focus on diversified groups of stocks (regions, countries, Barcelona Spain sectors, sizes, and styles) rather than on individual companies • All these groups of stocks are investable through a wide variety of financial products (MFs, IFs, ETFs) WININV Winter, 2014 12

Appendix Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 The Relevance of Asset Allocation Javier Estrada IESE Business School Barcelona Spain (*) Brinson, Singer, and Beebower, "Determinants of Portfolio Performance II: An Update." WININV Winter, 2014 Back 13

Alternatives Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Alternatives – Art Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 14

Alternatives Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Alternatives – Commodities Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 15

Alternatives – Commodities Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Alternatives – Commodities Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 16

Alternatives – Real Estate Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Source: Global Property Guide Alternatives – Real Estate (REITs) Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 17

Bonds – 10 ‐ Year Maturity Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Stocks – Size & Style Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 18

Recommend

More recommend