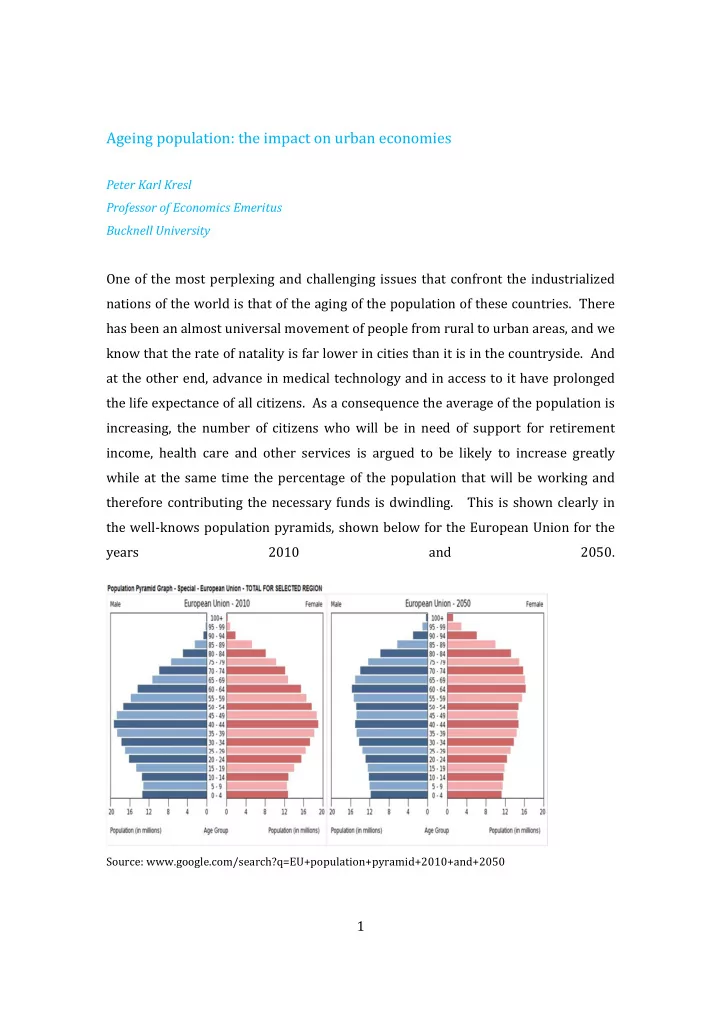

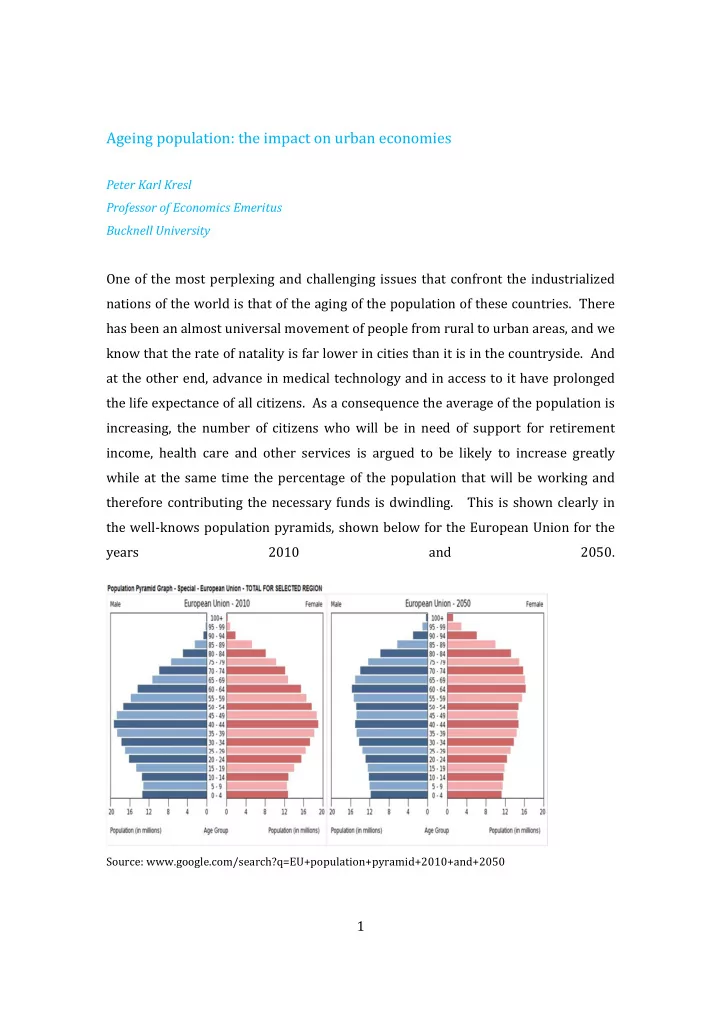

Ageing population: the impact on urban economies Peter Karl Kresl Professor of Economics Emeritus Bucknell University One of the most perplexing and challenging issues that confront the industrialized nations of the world is that of the aging of the population of these countries. There has been an almost universal movement of people from rural to urban areas, and we know that the rate of natality is far lower in cities than it is in the countryside. And at the other end, advance in medical technology and in access to it have prolonged the life expectance of all citizens. As a consequence the average of the population is increasing, the number of citizens who will be in need of support for retirement income, health care and other services is argued to be likely to increase greatly while at the same time the percentage of the population that will be working and therefore contributing the necessary funds is dwindling. This is shown clearly in the well-knows population pyramids, shown below for the European Union for the 2050. years 2010 and Source: www.google.com/search?q=EU+population+pyramid+2010+and+2050 1

Between the two years, the relationship between the working age population, roughly the 20-65 year old cohort (workers) and that of those 65 and older (seniors) has changed for the worse. That is to say that the working citizen of the EU county will have to pay for his/her own living costs as will as an increased burden for those who are no longer working. This is shown clearly by the age dependency ratios shown below. Each EU senior will have less than two workers generating the tax revenues for his/her support, while in the US workers fare much better with three of them supporting each senior. The total age dependency figures, relating workers to the total of seniors and those under age 20, are even more favorable for US workers. While the US and EU figures are closer together, this is because the US has more young people as a share of the population and they will then be the next generations of taxpayers. One consequence of these figures could be a desire on the part of EU workers to escape their burden by emigration to the US, Canada, Australia or New Zealand, the so-called ‘lands of recent settlement’. Age dependency ratios - 2050 Old age US 32.6 3.06 workers per 65+ EU 50.42 1.98 “ Total (Old age + Young age) US 61.6 1.62 workers per 65+ and under 15 EU 75.01 1.33 “ It is quite natural that many would consider this situation to be that of a ‘ticking time bomb’, with the fiscal situation blowing up in Europeans’ faces. However it is the position of this author that this is to some extent a mistaken fear. 2

The European Commission and the US Bureau of the Census have argued that the current and coming generations of seniors should properly be describes as being ‘healthier, wealthier, better educated and more mobile’ that ever in human history’. 1 This being the case, the ticking time bomb might better be referred to as a resource to be exploited. The following figures depicting the “life-long net contribution to society” of individuals can be used to clarify this notion. 2 The common understanding is represented by the excess of ‘cost to society’ over ‘contribution to society’ at the left of the figure – the years between birth and employment. During these years we give pleasure, one hopes, to our parents but make no other contribution to society, while we require resources to feed, cloth, entertain and educate us. With employment the contribution to society exceeds the cost to society Life-long net contribution to society - 1 Contribution to society (-) (+) (-) Cost to society Age 20 40 60 80 90 The area "abc" is the potential gain to an urban economy from an aging population Blue line above the black line indicates a net cost to society. Black lilne above the blue line indicates a net contribution to society. 1 US Census Bureau, “Dramatic Changes in U.S. Aging Highlighted in New Census, HIH Report,” Washington: Department of Commerce, US Census Bureau, March 9, 2006, pp. 1-2; Commission of the European Communities, Confronting Demographic Change: A New Solidarity Between the Generations (Green Paper), Brussels: Commission of the European Communities, March 16, 2005, p. 9. 2 This analysis can be found in: Peter Karl Kresl and Daniele Ietri, The Aging of the Population and Urban Economies , Cheltenham: Edward Elgar Publishers, 2010. 3

as we provide for our own needs and contribute taxes for government services. Upon retirement, at age 65 perhaps, the cost to society falls and our demands for social services increase to the degree that we impose a net cost to society. Our youth and age are supported, ideally, by our taxes paid during our working years. For workers for whom the ‘healthier, wealthier, better educated and more mobile” description holds true we see from the second figure that our contribution to society rises while the cost to society falls, for reasons to be examined shortly, leaving a net positive contribution to society far beyond the year of retirement until perhaps the age of 75 or 80 – the area on the right marked (+). This casts an entirely different light on the situation – perhaps for at least some of the seniors this age group can better be considered to be a resource to be tapped. Life-long net contribution to society - 2 Contribution to society b (+) c (-) ( +) a (-) Cost to society Age 20 40 60 80 90 The area "abc" is the potential gain to an urban economy from an aging population Blue line above the black line indicates a net cost to society. Black line above the blue line indicates a net contribution to society. Recognition of this enables one to suggest that there are actually four categories of seniors. First, those who are in the healthy, wealthy, educated and mobile group. It has been said that ‘retirement begins when the dog dies and the children leave home’. Research tells us that upon retirement seniors tend to move 4

from a big house in the suburbs to an apartment or condo in the city center. This brings a rejuvenation of the city center through an aging of the population. These seniors also tend to spend their time and money on cultural events – look at the audience of a classical music concert or the visitors to an art museum, and on life- long educational learning activities. Both of these activities add to the city’s identification as a city of culture or of learning or of research – all important for the city’s competitiveness. Finally, it must be noted that these seniors do not save, they spend – important for aggregate demand. Second, are other white-collar professional workers, ranging from accountants to travel agents. This cohort has adequate income due to their salaries and employer programs. They will require some health maintenance, they are interested in social groups and travel, but they are somewhat less interested in culture and education. Third, are workers in mining and manufacturing who had rough working experiences and have bodies that have been stressed by physical labour. Their income will be inadequate and they will require governmental assistance. They will probably tend to be sedentary and observers in need of social assistance, rather than active participants in activities. Fourth, are individuals who have been state-dependent since birth, due to a mental or physical condition or an unfortunate childhood situation that has made it difficult if not impossible for them the be active participants and contributors in society’s economic activity. When we consider seniors as composed of these four groups rather than as a uniform dependent population cohort, we can see that the determination of the fiscal impact on society will be more nuanced than is commonly thought. The issue becomes: what will be the population of each of the four cohorts in the years to come and what demands will they place on social and public services? While I have yet to do a statistical survey of this question, the following would appear to be a good approximation of what one would find. The skilled, education-based jobs will increase so that Category 1 seniors will increase the most. White-collar jobs should also increase a bit, so it is likely that Category 2 seniors will also increase in number. 5

Recommend

More recommend