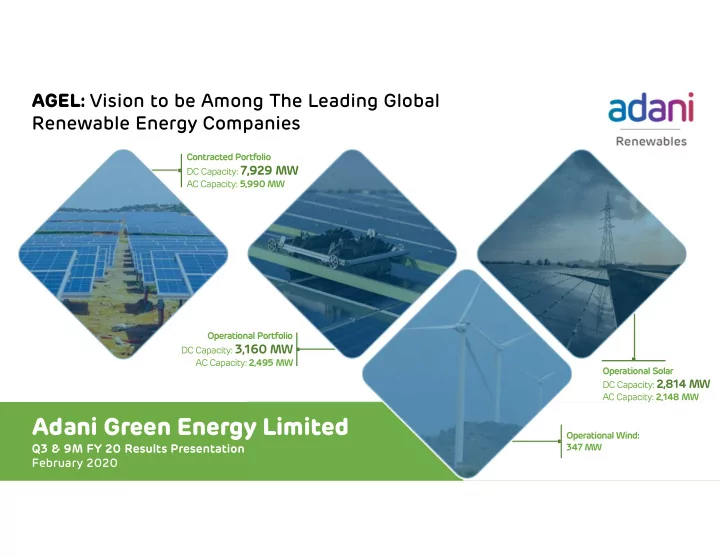

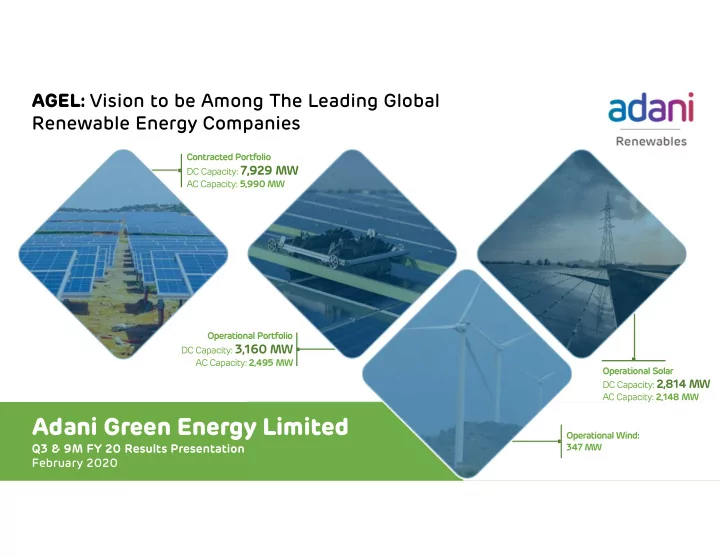

AGEL: Vision to be Among The Leading Global Renewable Energy Companies Contracted Portfolio DC Capacity: 7,929 MW AC Capacity: 5,990 MW Operational Portfolio DC Capacity: 3,160 MW AC Capacity: 2,495 MW Operational Solar DC Capacity: 2,814 MW AC Capacity: 2,148 MW Adani Green Energy Limited Operational Wind: 347 MW Q3 & 9M FY 20 Results Presentation February 2020

Contents 01 Adani Group 02 AGEL: Portfolio & Growth Strategy 03 Industry Developments & ESG 04 Highlights for Q3 & 9M, Operational & Financial Performance 05 Strategic Priorities Appendix AGEL Q3 & 9M FY 20 Results Presentation 2 February 2020

01 Adani Group Amongst the Largest Infrastructure & Utility Portfolio of the World AGEL Q3 & 9M FY 20 Results Presentation 3 February 2020

ADANI: leading utility & infrastructure platform (1988 – 2019) News and Updates ESG • Adani Group, at a portfolio level to meet COP21 targets 7 years before schedule • Would achieve 32% of the generation from renewable capacity by 2023 • & 32.5% of the total investments from demand response system by 2023 Equity • TOTAL SA forms JV with Adani Gas (buys 37.4% equity stake) • QIA to buy 25.1% equity stake in AEML Debt • Renewable Second Bond in Oct 2019 (USD 362.5 Mn, 20 year paper) • ATL Second Bond in Nov 2019 (USD 500 Mn, 16.5 year paper) Infrastructure & Utility Platform Transports & Logistics - India largest commercial port (~200 mtpa) Energy & Utility - Largest generation IPP (~20 GW – 30% renewables ) • Largest gas & electricity distribution portfolio Locked in Growth 2020 – Airports & Roads • Water & Data Centre Business AGEL Q3 & 9M FY 20 Results Presentation 4 February 2020

Adani: Leading Infrastructure and Utility Portfolio Transport & Logistics Portfolio Utility & Power Portfolio 62.3% 100% 100% 75% 75% 75% 75%* Adani Adani Power Adani Green Adani Gas APSEZ AAPT SRPCL 75% Transmission (APL) (AGEL) (AGL) (ATL) Port & Logistics Port Rail Transmission IPP Renewables Gas Distribution & Distribution AEL 1 100% 100% 100% 100% (Incubator) AAHL ATrL AWL Data Centre Airports Roads Water USD 28.1bn 2 ▪ No 1 in Ports, Transmission & Distribution and IPP (Thermal and renewables) in India ▪ Independent verticals with independent boards - Integrating ESG into value creation ▪ Addressable market size (customers): ~3.2mn in Adani Transmission, ~10mm in Adani Gas & ~125mn in Airports APSEZ: Adani Ports and Special Economic Zone Limited; AAPT: Adani Abbot Point Terminal Pty Ltd; SRPCL: Sarguja Rail Corridor Private Limited; ATL: Adani Transmission Limited; APL: Adani Power Limited; AGEL: Adani Green Energy Limited; AGL: Adani Gas Limited; AAHL: Adani Airports Holdings Limited; ATrL: Adani Transport Limited; AWL: Adani Water Limited Note: (1) Part of Adani Enterprises Limited (AEL) which is a listed entity; (2) Market Cap. as on December 31, 2019 * Adani Family shareholding as of 31 Dec 2019; Green colour represent public traded listed vertical AGEL Q3 & 9M FY 20 Results Presentation 5 February 2020

Adani: Repeatable, Robust and Proven Business Model Phase Development Operations Post operations Capital Phase Site development Construction O&M & technology management ▪ Return based ▪ Resource ▪ Template based ▪ RONC based ▪ Reduction of cost disciplined bidding assessment design analytics and of debt ▪ Connectivity ▪ Strong project ▪ Project life-cover strategy intelligence ▪ Target off-taker mix ▪ Real-time Activity permits management skills based debt funding ▪ Target fuel mix ▪ Land acquisition ▪ Strong vendor ▪ Investor reporting diagnostics ▪ Cluster based engagement and engagement management ▪ Portfolio with high ▪ Successfully ▪ Complex ▪ Best-in-class ▪ Operations phase quality sovereign developing large developments on performance funding consistent equivalent off- scale remote site time & budget e.g. with asset life takers locations Kamuthi Solar ▪ Diversified fuel mix APSEZ, ATL, AGEL & Performance AEML – only private sector Infrastructure assets in India with IG Rating Low capital cost, time bound & quality completion providing long term stable Cash flow & enhanced RoE AGEL Q3 & 9M FY 20 Results Presentation 6 February 2020

…Applied Consistently to Drive Value Key Business Model Successfully Applied Across Infrastructure and Utility Platform Attributes Development at scale and within time and budget India’s Largest Longest Private HVDC Largest Private 648 MW Ultra Mega Largest Single Location Commercial Port Line in Asia integrated Utility in India Solar Power Plant Private Thermal IPP APSEZ ATL AEML AGEL APL Highest Margin Highest availability Consistently high supply Constructed and Competitive capex / MW Excellence in O&M among Peers in among Peers reliability of 99.99% Commissioned in as compared to Peers leading to superior the World 9 months returns EBITDA margin EBITDA margin EBITDA margin 65% (1),(2) 91% (1),(3) 90% (1),(4) Private Banks, Bonds, Diverse financing 38% 14% sources – only Indian PSU, infrastructure portfolio PSU, 55% with four Investment Private 31% Grade (IG) issuers Banks, 31% Bonds, 31% March 18 1. Data for FY19 September 19 2. Excludes forex gains/losses 3. EBITDA = PBT + Depreciation + Net Finance Costs – Other Income AGEL Q3 & 9M FY 20 Results Presentation 7 4. EBITDA Margin represents EBITDA earned from power sales and exclude other items February 2020

02 Adani Green Energy Limited Portfolio Growth Strategy AGEL Q3 & 9M FY 20 Results Presentation 8 February 2020

AGEL: Robust Business Model with Rapid Growth & Predictable Returns .. Diversified Portfolio 1 Total Portfolio Project Capex / EBITDA Execution strength 5,990 1 MW and ~6.0x 11 states pan-India (2,495 MW Operational/ 44% solar ; 28% wind ; 28% hybrid 6.16x (fully Built basis) 3,495 MW Under Construction) presence Off-taker profile 100% Contracted Capacity Strong Generation Predictable Sovereign: 71% annuity PPA life: 25 years P50-P90 CUF (NTPC / SECI) returns Tariff profile: 100% fixed Sub-sovereign: 29% Solar generation 9M FY20 EBITDA margin Asset base International Rating Robust As built 2 : US$ 2.4bn RG1: BB+ 89% financial performance RG2: BBB-/Baa3/BBB- for 9M FY20 Fully built: US$ 5.0bn Note: 1 – Including both operating and under construction projects; 2 – As of H1FY20 ; US$/INR: 71.39; EBITDA – Earnings before interest, tax, depreciation and amortization, NTPC – National Thermal Power Corporation, SECI – Solar Energy Corporation of India, CUF – Capacity Utilization Factor, PPA – Power Purchase Agreement RG1: Restricted Group-1 comprises three SPVs - 930MW ac created for USD 500mn Green Bond, issuance in May 2019 AGEL Q3 & 9M FY 20 Results Presentation 9 RG2: Restricted Group-2 comprises three SPVs- 570MW ac which was created for USD 362.5mn Green Bond, issuance in October 2019 February 2020

…With Large Diversified Portfolio: 70% with SECI and NTPC 5,990 1 MW Portfolio | 2,495 MW Operational Strong PPA counterparties Operational Under Implementation State Govt. Offtakers Wind 29% Solar 175 100 Solar-Wind 100 5,990 Hybrid MW Govt. of India ▪ SECI AA+ 220 Owned Offtakers Domestic Rating 71% 1,740 ▪ NTPC BBB- Int’l Rating 335 Diversified Resource Mix 1,580 12 • Presence 20 100 across Solar Wind multiple 66 Projects Hybrid 100 states 28% reduces 11 States 50 Solar resource risk 810 44% 5,990 • Wind, Solar MW 648 and Hybrid 100% to further Wind de-risk 25 Year PPAs 28% portfolio Only Large Listed Pure-Play Renewable Power Producer in India Additionally, AGEL has announced acquisition of 205 MW operational solar assets from Essel Group entities on 29 th August, 2019 1. AGEL Q3 & 9M FY 20 Results Presentation 10 February 2020

2.5 GW Strong Execution Track Record... Execution track record: 2.5 GW Operational portfolio… Operational 800 MW COD in 2495 MW FY 20 operational up to Dec19 2,770 1,958 1,970 808 313 FY16 FY17 FY18 FY19 FY20E EBITDA 1 Operational Capacity Avg Tariff Project Cost Capex / EBITDA Portfolio (MW) (INR/kWh) (INR/ MWh) (INR Cr) Solar 2,148 4.82 2,193 27,530 6.04 Wind 2&3 347 3.49 345 19,736 5.97 Total 2,495 4.64 2,538 26,446 6.03 Note: 1. Estimated first full year operational EBITDA assuming P50 for Solar and P75 for wind, at plant level and does not include Indirect corporate overheads 2. Includes 75 MW MSEDCL Project at Kutch, Gujarat commissioned in December 19 and 3*50 MW of OEM Wind commissioned in July 19 / August 19 3. AGEL has entered into definitive agreements to acquire 100% interest in 3*50 MW commissioned Wind projects of an OEM, on fulfilment of PPA milestones. Additionally it has agreed to buy AGEL Q3 & 9M FY 20 Results Presentation 11 further 50 MW wind projects from OEM, subject to execution of definitive agreement in near future February 2020

Recommend

More recommend