STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar EMPLOYER EDUCATION Account Adjustments and Backpostings 50-386, 10/20/E How To Use GoToWebinar employer_education@strsoh.org 1

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Agenda Account Corrections Flow Chart • Completing Payroll Adjustments • • Live Demonstration in Employer Self Service (ESS) • Submitting Payments • Additional Tools and Resources Account Corrections Flow Chart Submit a payroll adjustment (either in your own system or Is the ESS) using the current date correction and be sure to withhold and the result of a No report at the contribution rate settlement in effect at the time the agreement or money was earned. grievance? Submit a backposting using Yes the same pay date that the payroll Is the adjustment was correction created. (See ESS Send a copy of the No for the current Instructions or the settlement agreement or fiscal year? tutorial for step-by- grievance to STRS Ohio at step assistance.) report@strsoh.org for review and determination of next steps. Remit payment to STRS Ohio for the Does the correction amount. Also submit an online correction Yes No cash remittance create a credit? (unless paying through direct debit). Yes Notify your payroll representative if you prefer to receive a refund check (if greater than $25) or wish to apply the credit toward your next payroll payment. employer_education@strsoh.org 2

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Question 1 Is the correction the result of a settlement agreement Submit a payroll adjustment Is the (either in your own system or correction or grievance? ESS) using the current date and the result of a No be sure to withhold and report at settlement the contribution rate in effect at agreement or the time the money was earned. • Yes grievance? Yes Send a copy of the settlement agreement or grievance to STRS Ohio at report@strsoh.org for review and determination of next steps. Question 1 Is the correction the result of a settlement agreement Submit a payroll adjustment Is the (either in your own system or correction or grievance? ESS) using the current date and the result of a be sure to withhold and report at No settlement the contribution rate in effect at agreement or the time the money was earned. • No grievance? Yes Send a copy of the settlement agreement or grievance to STRS Ohio at report@strsoh.org for review and determination of next steps. employer_education@strsoh.org 3

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Completing Payroll Adjustments Use the same method you use for completing regular Submit a payroll adjustment Is the (either in your own system or correction payroll files ESS) using the current date and the result of a No be sure to withhold and report at settlement the contribution rate in effect at agreement or the time the money was earned. • Your payroll system grievance? • State software Yes • ESS Send a copy of the settlement agreement or grievance to STRS Ohio at report@strsoh.org for review and determination of next steps. EMPLOYER EDUCATION Payroll Adjustment Demonstration employer_education@strsoh.org 4

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Question 2 Submit a payroll adjustment Is the correction for the (either in your own system or Is the ESS) using the current date correction and be sure to withhold and current fiscal year? the result of a report at the contribution No settlement rate in effect at the time the agreement or money was earned. grievance? Yes • Submit a backposting Yes using the same pay date that the payroll adjustment was Is the created. (See ESS correction Send a copy of the Instructions or the No for the current settlement agreement or tutorial for step-by- fiscal year? grievance to STRS Ohio at step assistance.) report@strsoh.org for review and determination of next steps. Does the correction Yes create a credit? Question 2 Submit a payroll adjustment Is the correction for the (either in your own system or Is the ESS) using the current date correction and be sure to withhold and the result of a current fiscal year? No report at the contribution settlement rate in effect at the time the agreement or money was earned. grievance? • No Submit a backposting Yes using the same pay date that the payroll adjustment was Is the created. (See ESS correction Send a copy of the Instructions or the No for the current settlement agreement or tutorial for step-by- fiscal year? grievance to STRS Ohio at step assistance.) report@strsoh.org for review and determination of next steps. Does the correction Yes create a credit? employer_education@strsoh.org 5

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar EMPLOYER EDUCATION Backposting in ESS Demonstration Question 3 Submit a payroll adjustment (either in your own system or Is the ESS) using the current date correction and be sure to withhold and the result of a No report at the contribution rate settlement in effect at the time the agreement or Does the correction money was earned. grievance? create a credit? Submit a backposting using Yes the same pay date that the payroll Is the • Yes adjustment was correction created. (See ESS Send a copy of the No for the current Instructions or the settlement agreement or fiscal year? tutorial for step-by- grievance to STRS Ohio at step assistance.) report@strsoh.org for review and determination of next steps. Remit payment to STRS Ohio for the Does the correction amount. correction Also submit an online No Yes create a cash remittance (unless paying credit? through direct debit). Yes Notify your payroll representative if you prefer to receive a refund check (if greater than $25) or wish to apply the credit toward your next payroll payment. employer_education@strsoh.org 6

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Question 3 Submit a payroll adjustment (either in your own system or Is the ESS) using the current date correction and be sure to withhold and the result of a No report at the contribution rate settlement in effect at the time the agreement or Does the correction money was earned. grievance? create a credit? Submit a backposting using Yes the same pay date that the payroll Is the No • adjustment was correction created. (See ESS Send a copy of the No for the current Instructions or the settlement agreement or fiscal year? tutorial for step-by- grievance to STRS Ohio at step assistance.) report@strsoh.org for review and determination of next steps. Remit payment to STRS Ohio for the Does the correction amount. Also submit an online correction Yes No cash remittance create a credit? (unless paying through direct debit). Yes Notify your payroll representative if you prefer to receive a refund check (if greater than $25) or wish to apply the credit toward your next payroll payment. Submitting Payments Payment options Check (no longer accepted • starting July 1, 2021) • ACH credit or wire transfer • Direct debit in ESS Cash remittance form Complete online for ACH • credit or wire transfer Send paper form with check • Not required for direct debit • employer_education@strsoh.org 7

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar EMPLOYER EDUCATION Cash Remittance Form Available Resources Visit our website: www.strsoh.org/employer • Account Corrections Fact Sheet and flow chart • • Tutorials ESS Instructions • • Call toll-free: 888-535-4050 Send an email: report@strsoh.org • employer_education@strsoh.org 8

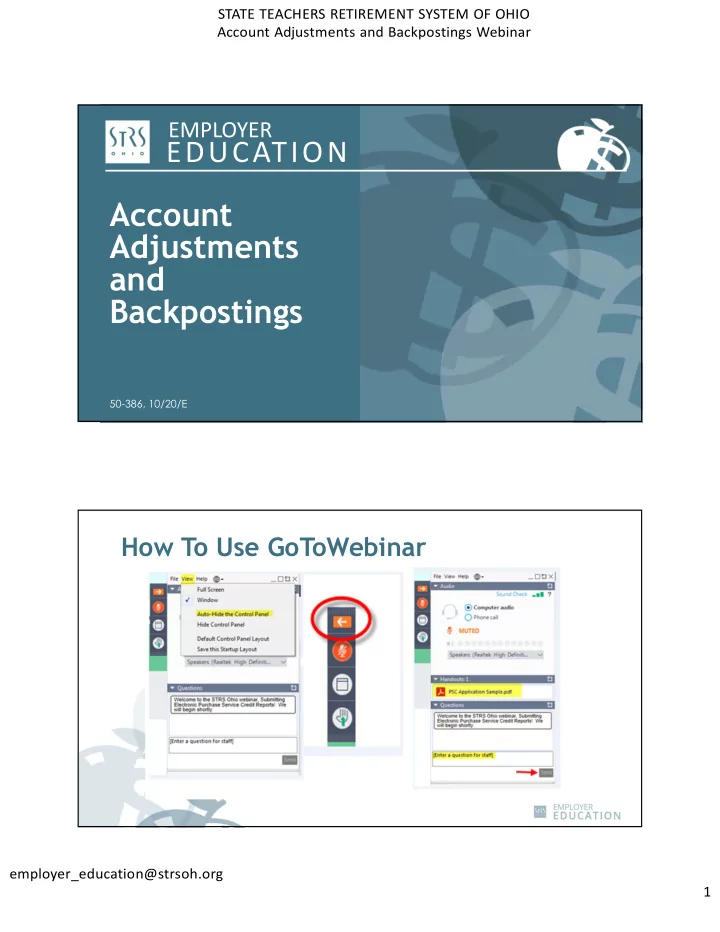

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Account Adjustments and Backpostings Webinar Thank You! Additional questions? • Webinar certificates of completion • • Please complete the evaluation after disconnecting from the webinar Exiting the Webinar Click “File” on the control panel and select “Exit — Leave Webinar” employer_education@strsoh.org 9

Recommend

More recommend