A Look Behind the Numbers: State of the Childrens Savings Field - PowerPoint PPT Presentation

A Look Behind the Numbers: State of the Childrens Savings Field March 14, 2018 www.savingsforkids.org Welcome www.savingsforkids.org Housekeeping This webinar is being recorded and will be available online and emailed to those who

A Look Behind the Numbers: State of the Children’s Savings Field March 14, 2018 www.savingsforkids.org

Welcome www.savingsforkids.org

Housekeeping • This webinar is being recorded and will be available online and emailed to those who registered • All attendees are muted to ensure sound quality • Ask a question any time by typing the question into the text box of the GoToWebinar Control Panel • If you experience any technical issues, email gotomeeting@prosperitynow.org www.savingsforkids.org

( formerly CFED ) Our mission is to ensure everyone in our country has a clear path to financial stability, wealth and prosperity. www.savingsforkids.org

Campaign for Every Kid’s Future Join today to help achieve our vision of 1.4 million Children’s Savings Accounts by 2020! www.savingsforkids.org

Objectives of Today’s Webinar • Highlight findings from the CSA Program Survey • Share commonalities/differences among CSA programs across the country • Provide design ideas to organizations considering CSAs in the future www.savingsforkids.org

Today’s Agenda • Overview of CSA Program Survey • Participating CSA Program Criteria • Highlights from 2017 CSA State of the Field • Discussion • Audience Q&A • Next Steps and Close www.savingsforkids.org

Today’s Speakers www.savingsforkids.org

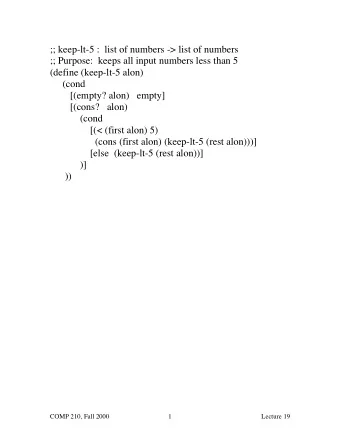

Prosperity Now's CSA Program Survey •Children’s Savings team conducts an annual program survey • Survey fielded August-September 2017 • Analysis includes 54 programs using responses and publicly available information In addition, interviews with CSA programs conducted November-December 2017 as part of CFPB field scan www.savingsforkids.org

CSA Program Criteria • Long-term savings or investment accounts for children (0-18 years of age) • Used for asset building purpose, usually postsecondary education expenses • Provide incentives to build savings (e.g., seed deposit and matches) • Account withdrawals are generally restricted • In addition, programs had to be: • In operation OR • In development and planning to enroll participants by the end of 2017 www.savingsforkids.org

CSAs By the Numbers www.savingsforkids.org

State of the Field Highlights www.savingsforkids.org

Participating Children • More than 382,000 Annual Enrollment in CSA Programs children have a CSA as of the end of 13% 2017 – a 22% increase from 2016 • 87% of CSA programs enroll fewer than 2,000 children per year • 7 large programs 87% account for nearly 86% of total children Fewer than 2,000 2,000 or more with CSAs www.savingsforkids.org

Program Manager • 65% of CSA programs Organizations Running CSA are managed by Programs nonprofits, and 33% 2% are run by government agencies 33% • 67% (253,893) of CSA participants are enrolled in programs 65% operated by government agencies Nonprofit Government agency Other www.savingsforkids.org

Account Type • 54% of programs use Types of Accounts Used by CSA Programs 529 accounts; 35% use savings accounts 11% • 86% (322,925) of CSA participants have 529 accounts 54% 35% 529 account Savings account Other www.savingsforkids.org

Enrollment • 74% of programs are Method of Enrollment in CSA opt-in, while 26% Programs automatically enroll participants 26% • 84% (318,270) of CSA participants are in programs with opt-out enrollment 74% Opt-in Opt-out www.savingsforkids.org

Funding • 69% of programs Funding Types for CSA Programs receive support from the 69% philanthropic Community and other foundations community 46% Individual donors (including 35% Corporations/businesses community and other foundations) 17% Local funding • Around one-third of 15% 529 Plans programs receive 10% State funding at least one type of 8% government Federal funding support www.savingsforkids.org

Incentives • From 2016 to 2017 survey, programs offering savings matches dropped from 71% to 52% • $50 is the most common initial deposit offered Types of Incentives Used by CSA Programs 70% Initial deposit 52% Savings match 43% Benchmark incentive 19% Prize-linked savings 0% 10% 20% 30% 40% 50% 60% 70% 80% www.savingsforkids.org

Discussion www.savingsforkids.org

Implications • CSA programs should pursue both public and private funding sources to create scalable CSA programs • Automatic enrollment facilitates the operation of large-scale programs and makes programs more inclusive • More research is needed on incentives so that programs will be able to select and incorporate incentives that are most effective for their participants www.savingsforkids.org

Audience Q&A What questions do you have? Share them in the Questions box! www.savingsforkids.org

Today’s Speakers www.savingsforkids.org

Next Steps • Explore our many resources • Join the Campaign for Every Kid’s Future • Attend our upcoming webinars • Save the date for the 2018 Prosperity Summit • Stay in touch! www.savingsforkids.org

CSA Resources CSA Directory/Map www.prosperitynow.org/map/childrens-savings Investing in Dreams (Step-by-step CSA design guide) www.prosperitynow.org/topics/savings Campaign Website (FAQs, program info, policy, research) www.savingsforkids.org www.savingsforkids.org

Future CSA Webinars CSAs for Your Community: Tailoring CSA Programs to Meet Diverse Needs May 15 (2-3 pm EDT) CSAs in the City: Assessing Municipal and Countywide Opportunities July 17 (2-3 pm EDT) Housing Assistance and CSA programs: Making the Connection October 16 (2-3 pm EDT) www.savingsforkids.org

Plug in to the Prosperity Now Community Sign up for listservs and working groups, volunteer to facilitate peer discussions, serve in a leadership role and more! Campaign for Every Kids Future — Children’s Savings Accounts Adult Matched Savings Network Racial Wealth Equity Network Financial Coaching Network Taxpayer Opportunity Network Medical Financial Partnership Network Campaign for Every Kids Future — Children’s Savings Accounts Affordable Housing Network Innovations in Manufactured Housing (I’M HOME) Network Visit any of the networks above at prosperitynow.org/getinvolved to get started. www.savingsforkids.org

Take action with Prosperity Now Campaigns! Sign up to stay informed about the latest developments and opportunities to take action by joining one of our four federal policy campaigns. CONSUMER SAFETY NET TURN IT HOMEOWNERSHIP PROTECTIONS RIGHT-SIDE UP Homeownership is Consumer Safety net programs The vast majority of key to building protections create help protect tax incentives go to wealth. Together, we fairer, more vulnerable individuals those at the top, not will advocate for transparent financial and families from to those who need it products and policies markets. Together, falling deep into most. Together, we that provide more we will ensure poverty. Together, we will turn our upside- affordable homes to consumers keep the will protect programs down tax code right- more people. safeguards they like SNAP, IDAs and side up. deserve. more to help those in need when they need it most. Visit https://prosperitynow.org/take-action to learn more and join. www.savingsforkids.org

The Assets Learning Conference… is now the Prosperity Summit! Join us September 5-7 for the 2018 Prosperity Summit! https://prosperitynow.org/events/save-date-2018-prosperity-summit Members of Prosperity Now Community Networks & Campaigns receive a special early bird discount. Become a member today! www.savingsforkids.org

Stay in Touch! Monica Copeland Senior Program Manager mcopeland@prosperitynow.org 202.372.0078 Diego Quezada Program Associate dquezada@prosperitynow.org 202.601.1007 www.savingsforkids.org

Thank You! Please take our survey following the webinar www.savingsforkids.org

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.