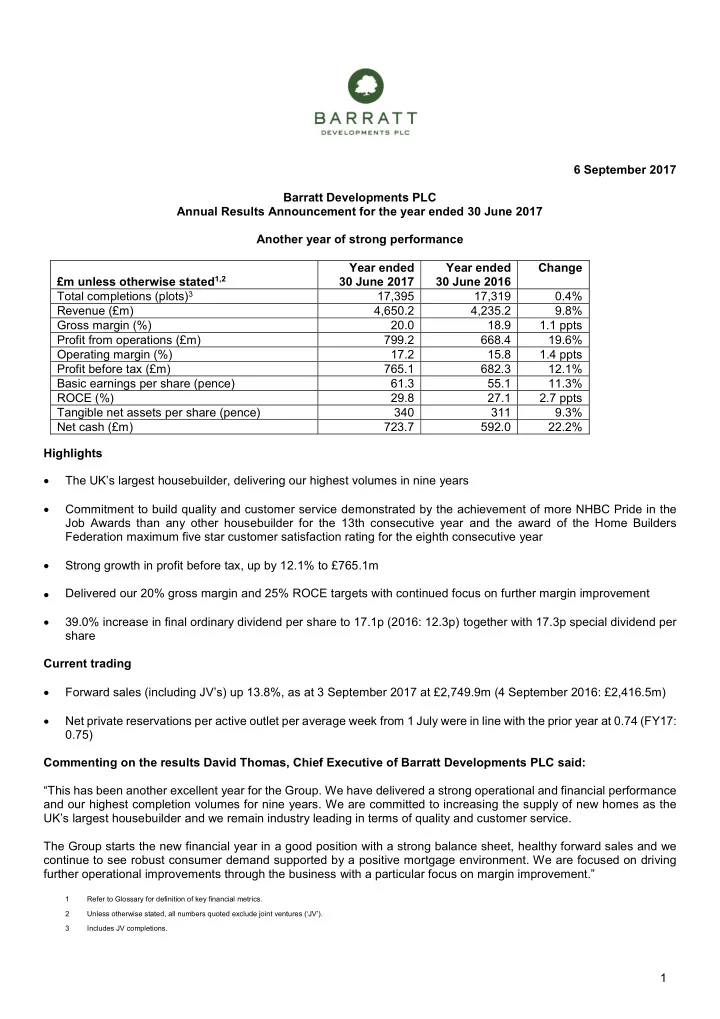

6 September 2017 Barratt Developments PLC Annual Results Announcement for the year ended 30 June 2017 Another year of strong performance Year ended Year ended Change £m unless otherwise stated 1,2 30 June 2017 30 June 2016 Total completions (plots) 3 17,395 17,319 0.4% Revenue (£m) 4,650.2 4,235.2 9.8% Gross margin (%) 20.0 18.9 1.1 ppts Profit from operations (£m) 799.2 668.4 19.6% Operating margin (%) 17.2 15.8 1.4 ppts Profit before tax (£m) 765.1 682.3 12.1% Basic earnings per share (pence) 61.3 55.1 11.3% ROCE (%) 29.8 27.1 2.7 ppts Tangible net assets per share (pence) 340 311 9.3% Net cash (£m) 723.7 592.0 22.2% Highlights The UK’s largest housebuilder, delivering our highest volumes in nine years Commitment to build quality and customer service demonstrated by the achievement of more NHBC Pride in the Job Awards than any other housebuilder for the 13th consecutive year and the award of the Home Builders Federation maximum five star customer satisfaction rating for the eighth consecutive year Strong growth in profit before tax, up by 12.1% to £765.1m Delivered our 20% gross margin and 25% ROCE targets with continued focus on further margin improvement 39.0% increase in final ordinary dividend per share to 17.1p (2016: 12.3p) together with 17.3p special dividend per share Current trading Forward sales (including JV ’ s) up 13.8%, as at 3 September 2017 at £2,749.9m (4 September 2016: £2,416.5m) Net private reservations per active outlet per average week from 1 July were in line with the prior year at 0.74 (FY17: 0.75) Commenting on the results David Thomas, Chief Executive of Barratt Developments PLC said: “ This has been another excellent year for the Group. We have delivered a strong operational and financial performance and our highest completion volumes for nine years. We are committed to increasing the supply of new homes as the UK’s largest housebuilder and we remain industry leading in terms of quality and customer service. The Group starts the new financial year in a good position with a strong balance sheet, healthy forward sales and we continue to see robust consumer demand supported by a positive mortgage environment. We are focused on driving further operational improvements through the business with a particular focus on margin improvement.” 1 Refer to Glossary for definition of key financial metrics. 2 Unless otherwise stated, all numbers quoted exclude joint ventures (‘JV’). 3 Includes JV completions. 1

Certain statements in this document may be forward looking statements. By their nature, forward looking statements involve a number of risks, uncertainties or assumptions that could cause actual results to differ materially from those expressed or implied by those statements. Forward looking statements regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Accordingly undue reliance should not be placed on forward looking statements. There will be an analyst and investor meeting at 9.00am today at Deutsche Bank, 1 Great Winchester Street, London, EC2N 2DB. The presentation will be broadcast live on the Barratt Developments corporate website, www.barrattdevelopments.co.uk, from 9.00am today. A playback facility will be available shortly after the presentation has finished. A listen only function will also be available. Dial in: 0800 279 7204 International dial in: +44 (0) 330 336 9411 Access code: 6162686 Further copies of this announcement can be downloaded from the Barratt Development PLC corporate website www.barrattdevelopments.co.uk or by request from the Company Secretary's office at: Barratt Developments PLC, Barratt House, Cartwright Way, Forest Business Park, Bardon Hill, Coalville, Leicestershire, LE67 1UF. For further information please contact: Barratt Developments PLC Jessica White, Chief Financial Officer 01530 278 259 Analyst/investor enquiries Chloé Barnes, Investor Relations 020 7299 4895 Media enquiries Tim Collins, Head of Corporate Communications 020 7299 4874 Brunswick Jonathan Glass/Wendel Verbeek 020 7404 5959 2

Chairman’s statement This has been another excellent year for the Group across all key operational and financial performance metrics. We achieved record profits, completion volumes were at their highest level for nine years and we remain industry leading in terms of quality and customer service. We have delivered our FY17 financial targets of 20% gross margin and 25% ROCE, and we are committed to further progress. Improving our profit margin remains a priority for the Group and we have a number of initiatives underway to further increase efficiency, reduce costs and simplify our business. We remain the largest housebuilder in the UK, delivering 17,395 homes in the year reflecting the strength of our housebuilding operations. Our sites were awarded 74 NHBC Pride in the Job Awards for site management this year, more than any other housebuilder for the 13th year in a row. We were also awarded the Home Builders Federation maximum five star rating for the eighth consecutive year – the only major housebuilder with this record. We have now won 56 Built for Life accreditations for excellence in the design of homes and neighbourhoods, more than all the other housebuilders combined. These are significant achievements and are testament to our continuing focus on leading the future of housebuilding by putting customers first and at the heart of everything we do. Political and economic environment Whilst the General Election in June 2017 created some uncertainty, Government support for housebuilding and a commitment to tackle the country’s housing shortage remain. The Government’s Housing White Paper published in February contained many positive measures, particularly those aimed at speeding up the planning system and bringing forward more land for new homes. Following the outcome of the EU referendum, the Board continues to monitor carefully the potential impacts of the vote to leave the EU on our business. Market conditions remain good with a wide availability of attractive mortgage finance, which, alongside Help to Buy, continues to support robust consumer demand. The Group is in a strong position, with a substantial year end net cash balance, healthy forward sales position and an experienced management team. Consequently, we remain confident in the strong fundamentals of the housing sector and our business. Our employees The outstanding progress made during the year would not have been possible without the capability and dedication of our Senior Management team and employees whom I would like to thank on behalf of the Board. We ensure that we reward all of our employees appropriately so that we can recruit and retain the best people whilst motivating them to continue to perform year on year. Corporate Governance Underpinning any successful Company, is good corporate governance. Corporate governance is the basis of good management practice and we place it at the heart of everything we do. It is embedded in our policies, procedures and processes throughout our business from Board level to our divisional operations. Last year the Government published a Green Paper on Corporate Governance. The Financial Reporting Council (FRC) announced a fundamental review of the UK Corporate Governance Code to take into account their work done around corporate culture and succession planning. The review will also take account of the issues raised in the Government’s Green Paper and the BEIS Select Committee inquiry. We have begun to explore the various proposals in the Green Paper and the FRC review with our advisors. We have already taken steps to establish a forum at which employee representatives from across the business will have the opportunity to express the views of the workforce on key topics such as culture, diversity, training and remuneration. This will ensure that best practice is embedded in our business and that we can effectively respond to, and implement, any changes that may be required as new regulation or legislation is introduced. We will continue to ensure that good corporate governance remains embedded within the culture and values of the business as a whole whilst adapting our policies, processes and procedures in light of any changes proposed by the Government and the FRC. Through the Nomination Committee, we will ensure that we continue to have robust succession planning in place for both Board members and Senior Management. We continue to cooperate fully with the Metropolitan Police on the ongoing investigation we instigated regarding possible misconduct in the London business. As stated in October 2016, Barratt does not anticipate any material adverse financial effect and our London business is operating well. 3

Recommend

More recommend