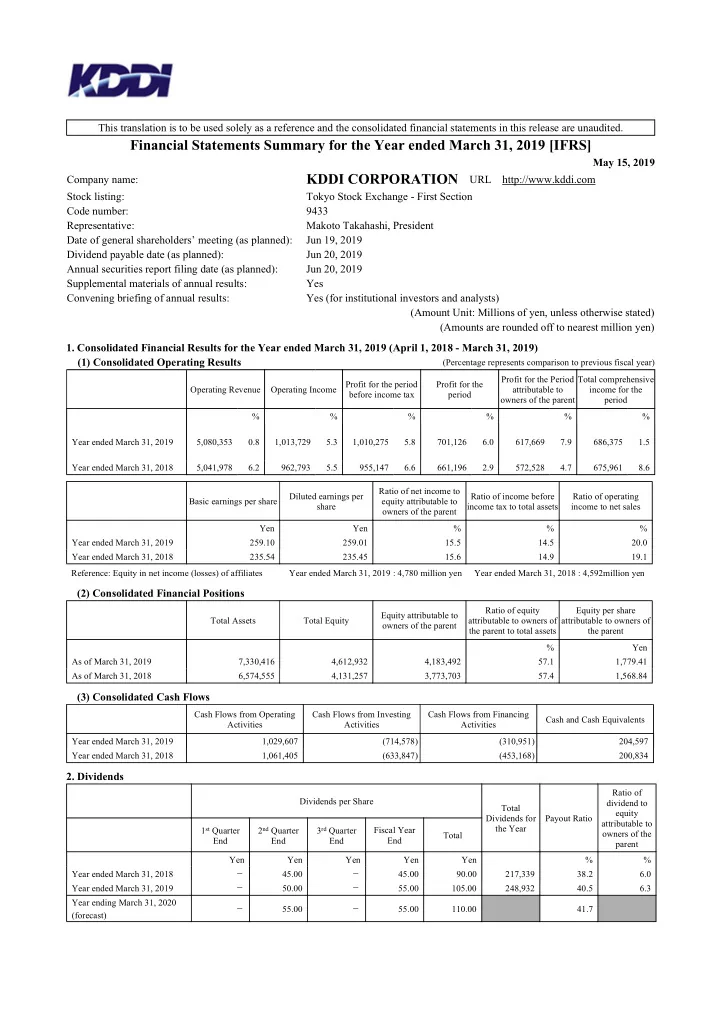

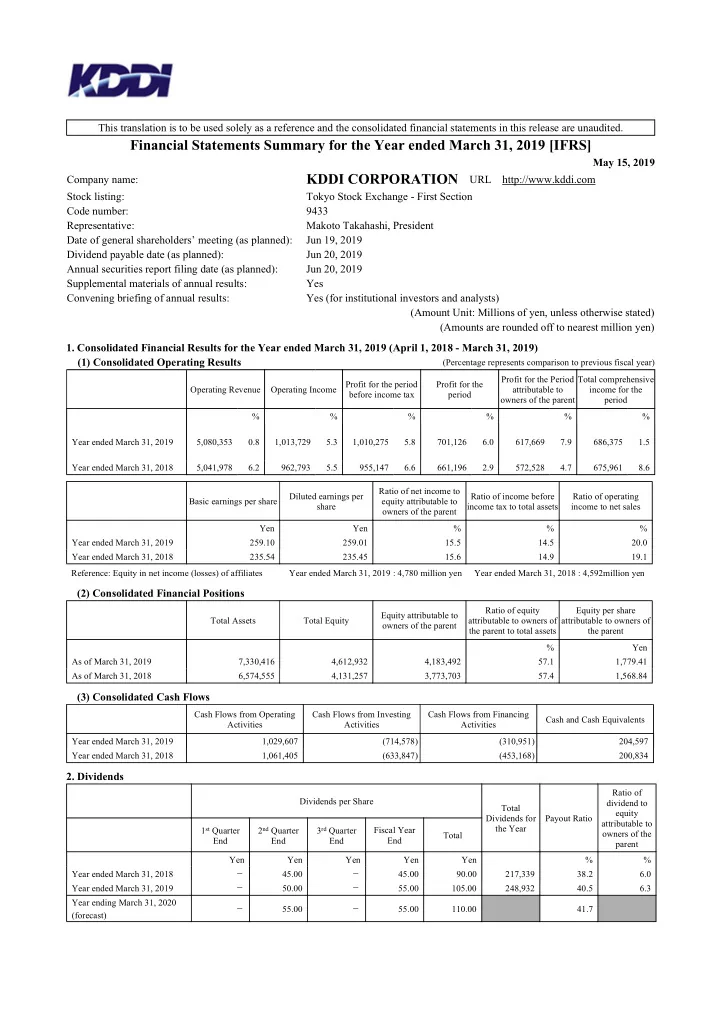

This translation is to be used solely as a reference and the consolidated financial statements in this release are unaudited. Financial Statements Summary for the Year ended March 31, 2019 [IFRS] May 15, 2019 KDDI CORPORATION URL http://www.kddi.com Company name: Stock listing: Tokyo Stock Exchange - First Section Code number: 9433 Representative: Makoto Takahashi, President Date of general shareholders’ meeting (as planned): Jun 19, 2019 Dividend payable date (as planned): Jun 20, 2019 Annual securities report filing date (as planned): Jun 20, 2019 Supplemental materials of annual results: Yes Convening briefing of annual results: Yes (for institutional investors and analysts) (Amount Unit: Millions of yen, unless otherwise stated) (Amounts are rounded off to nearest million yen) 1. Consolidated Financial Results for the Year ended March 31, 2019 (April 1, 2018 - March 31, 2019) (Percentage represents comparison to previous fiscal year) (1) Consolidated Operating Results Profit for the Period Total comprehensive Profit for the Operating Income Profit for the period Operating Revenue attributable to income for the before income tax period owners of the parent period % % % % % % Year ended March 31, 2019 5,080,353 0.8 1,013,729 5.3 1,010,275 5.8 701,126 6.0 617,669 7.9 686,375 1.5 Year ended March 31, 2018 5,041,978 6.2 962,793 5.5 955,147 6.6 661,196 2.9 572,528 4.7 675,961 8.6 Ratio of net income to Diluted earnings per Ratio of income before Ratio of operating Basic earnings per share equity attributable to share income tax to total assets income to net sales owners of the parent Yen Yen % % % Year ended March 31, 2019 259.10 259.01 15.5 14.5 20.0 Year ended March 31, 2018 235.54 235.45 15.6 14.9 19.1 Reference: Equity in net income (losses) of affiliates Year ended March 31, 2019 : 4,780 million yen Year ended March 31, 2018 : 4,592million yen (2) Consolidated Financial Positions Ratio of equity Equity per share Equity attributable to Total Assets Total Equity attributable to owners of attributable to owners of owners of the parent the parent to total assets the parent % Yen As of March 31, 2019 7,330,416 4,612,932 4,183,492 57.1 1,779.41 As of March 31, 2018 6,574,555 4,131,257 3,773,703 57.4 1,568.84 (3) Consolidated Cash Flows Cash Flows from Operating Cash Flows from Investing Cash Flows from Financing Cash and Cash Equivalents Activities Activities Activities Year ended March 31, 2019 1,029,607 (714,578) (310,951) 204,597 Year ended March 31, 2018 1,061,405 (633,847) (453,168) 200,834 2. Dividends Ratio of Dividends per Share dividend to Total equity Payout Ratio Dividends for attributable to the Year 1 st Quarter 2 nd Quarter 3 rd Quarter Fiscal Year Total owners of the End End End End parent Yen Yen Yen Yen Yen % % Year ended March 31, 2018 - 45.00 - 45.00 90.00 217,339 38.2 6.0 Year ended March 31, 2019 - 50.00 - 55.00 105.00 248,932 40.5 6.3 Year ending March 31, 2020 - 55.00 - 55.00 110.00 41.7 (forecast)

3. Consolidated Financial Results Forecast for the Year ending March 31, 2020 (April 1, 2019 - March 31, 2020) (Percentage represents comparison to previous fiscal year) Profit for the Period Operating Revenue Operating Income Basic earnings per share attributable to owners of the parent % % % Yen Entire Fiscal Year 5,200,000 2.4 1,020,000 0.6 620,000 0.4 263.71 Notes (1) Changes in significant consolidated subsidiaries (which resulted in changes in scope of consolidation): None (2) Changes in accounting policies, accounting estimates 1) Changes in accounting policies required under IFRSs: Yes 2) Other changes in accounting policies: Yes 3) Changes in accounting estimates: None (3) Numbers of Outstanding Shares (Common Stock) 1) Number of shares outstanding (inclusive of treasury stock) As of March 31, 2019 2,532,004,445 As of March 31, 2018 2,587,213,525 2) Number of treasury stock As of March 31, 2019 180,953,773 As of March 31, 2018 181,809,302 3) Number of weighted average common stock outstanding For the year ended March 31, 2019 2,383,892,430 (cumulative for all quarters) For the year ended March 31, 2018 2,430,661,810 Note: The 4,322,928 shares of the Company’s stock owned by the executive compensation BIP Trust account and the stock- granting ESOP Trust account are included in the total number of treasury stock as of March 31, 2019. Explanation for appropriate use of forecasts and other notes 1. The forward-looking statements such as operational forecasts contained in this statements summary are based on the information currently available to KDDI and certain assumptions which are regarded as legitimate. Actual results may differ significantly from these forecasts due to various factors. Please refer to P.9 “1. Consolidated Business Results (4) Outlook for the Year ending March 31, 2020” under [the Attachment] for the assumptions used and other notes. 2. On May 15, 2019, KDDI will hold a financial result briefing for the institutional investors and analysts. Presentation materials will be webcasted on the same time as the release of this earnings report, and the live presentation and Q&A summary will be also posted on our website immediately after the commencement of the financial result briefing. In addition to the above, KDDI holds the briefing and the presentations on our business for the individual investors timely. For the schedule and details, please check our website.

[the Attachment] Index of the Attachment 1. Overview of Consolidated Business Results ………………………………………………………………………………… 2 (1) Overview of Consolidated Operating Results …………………………………………………………………………… 2 (2) Overview of Consolidated Financial Position …………………………………………………………………………… 8 (3) Overview of Consolidated Cash Flows ………………………………………………………………………………… 8 (4) Outlook for the Year ending March 31, 2020 …………………………………………………………………………… 9 (5) Profit Distribution ……………………………………………………………………………………………………… 10 (6) Business Risks …………………………………………………………………………………………………………… 10 2. The Status of the Group ……………………………………………………………………………………………………… 11 3. Basic Perspective on Selection of Accounting Standards …………………………………………………………………… 12 4. Consolidated Financial Statements and Notes ……………………………………………………………………………… 13 (1) Consolidated Statement of Financial Position …………………………………………………………………………… 13 (2) Consolidated Statement of Income ……………………………………………………………………………………… 15 (3) Consolidated Statement of Comprehensive Income …………………………………………………………………… 16 (4) Consolidated Statement of Changes in Equity …………………………………………………………………………… 17 (5) Consolidated Statement of Cash Flows ………………………………………………………………………………… 19 (6) Going Concern Assumption ……………………………………………………………………………………………… 21 (7) Notes to Consolidated Financial Statements …………………………………………………………………………… 21 1. Reporting entity ………………………………………………………………………………………………………… 21 2. Basis of preparation …………………………………………………………………………………………………… 21 3. Significant accounting policies ………………………………………………………………………………………… 26 4. Changes in accounting policies ………………………………………………………………………………………… 38 5. Segment Information …………………………………………………………………………………………………… 41 6. Impairment of property, plant and equipment, goodwill and intangible assets ………………………………………… 44 7. Per Share Information ………………………………………………………………………………………………… 45 8. Business Combination ………………………………………………………………………………………………… 46 9. Significant subsequent events ………………………………………………………………………………………… 49 - 1 -

Recommend

More recommend