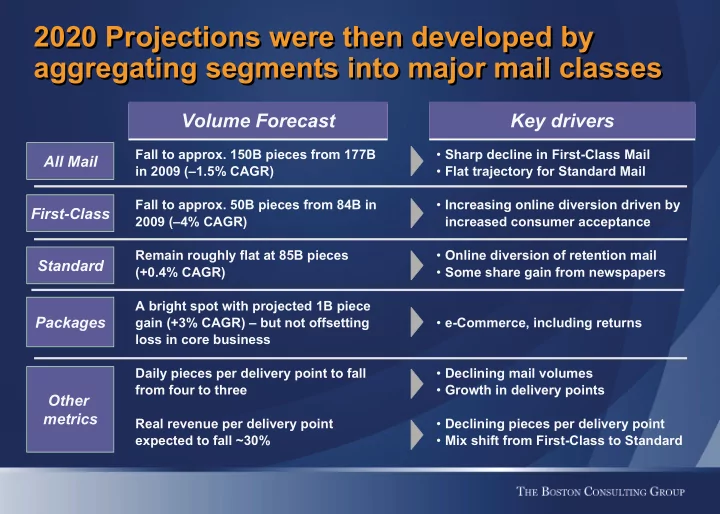

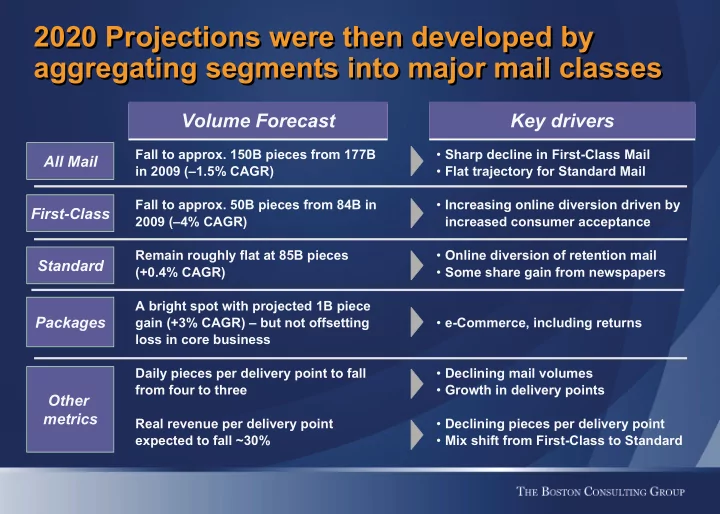

2020 Projections were then developed by 2020 Projections were then developed by aggregating segments into major mail classes aggregating segments into major mail classes Volume Forecast Key drivers Volume Forecast Key drivers Fall to approx. 150B pieces from 177B • Sharp decline in First-Class Mail All Mail in 2009 (–1.5% CAGR) • Flat trajectory for Standard Mail Fall to approx. 50B pieces from 84B in • Increasing online diversion driven by First-Class 2009 (–4% CAGR) increased consumer acceptance Remain roughly flat at 85B pieces • Online diversion of retention mail Standard (+0.4% CAGR) • Some share gain from newspapers A bright spot with projected 1B piece Packages gain (+3% CAGR) – but not offsetting • e-Commerce, including returns loss in core business Daily pieces per delivery point to fall • Declining mail volumes from four to three • Growth in delivery points Other metrics Real revenue per delivery point • Declining pieces per delivery point expected to fall ~30% • Mix shift from First-Class to Standard

We project a volume decline of at least 15% by We project a volume decline of at least 15% by 2020 vs. 2009 2020 vs. 2009 Pieces (B) 220 213 200 177 180 160 150 (-15%) Sender View 140 138 (-22%) Consumer View Worst-case broadband benchmark (EU leader) 120 118 (-34%) 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Fiscal year 2020 projection represents 30% decline off of 2006 peak 1. Sender view

2020 forecast sees ongoing decline in 2020 forecast sees ongoing decline in First-Class Mail First-Class Mail Pieces (B) 97 100 84 80 60 Sender View Consumer View 53 (-37%) Worst-case broadband benchmark (EU leader) 44 (-47%) 40 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Fiscal year Fiscal year 1. Sender view

Recommend

More recommend