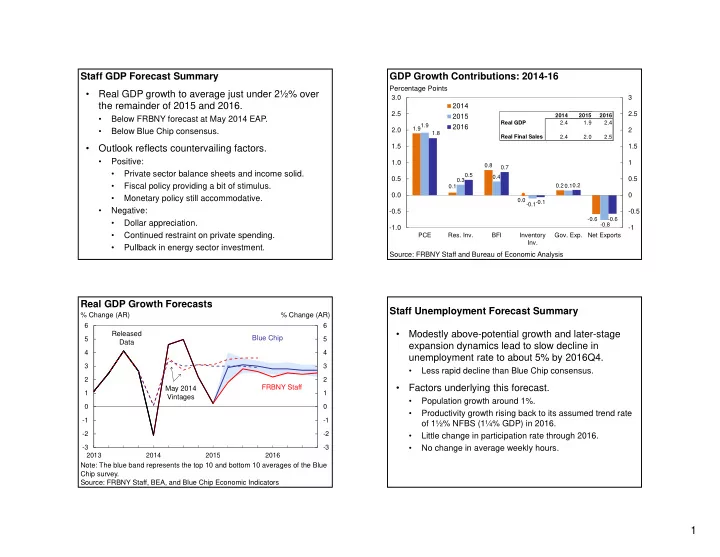

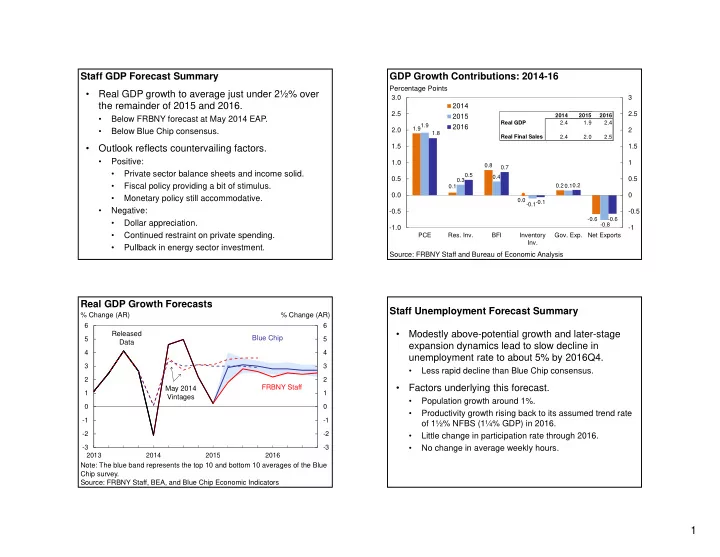

Staff GDP Forecast Summary GDP Growth Contributions: 2014-16 Percentage Points • Real GDP growth to average just under 2½% over 3.0 3 the remainder of 2015 and 2016. 2014 2.5 2.5 2015 2014 2015 2016 • Below FRBNY forecast at May 2014 EAP. Real GDP 2.4 1.9 2.4 1.9 2016 1.9 2.0 2 • Below Blue Chip consensus. 1.8 Real Final Sales 2.4 2.0 2.5 ` 1.5 1.5 • Outlook reflects countervailing factors. • Positive: 1.0 1 0.8 0.7 • Private sector balance sheets and income solid. 0.5 0.4 0.5 0.5 0.3 • Fiscal policy providing a bit of stimulus. 0.2 0.1 0.2 0.1 0.0 0 • Monetary policy still accommodative. 0.0 -0.1 -0.1 • Negative: -0.5 -0.5 -0.6 -0.6 • Dollar appreciation. -0.8 -1.0 -1 • Continued restraint on private spending. PCE Res. Inv. BFI Inventory Gov. Exp. Net Exports Inv. • Pullback in energy sector investment. Source: FRBNY Staff and Bureau of Economic Analysis Real GDP Growth Forecasts Staff Unemployment Forecast Summary % Change (AR) % Change (AR) 6 6 • Modestly above-potential growth and later-stage Released Blue Chip 5 5 Data expansion dynamics lead to slow decline in 4 4 unemployment rate to about 5% by 2016Q4. 3 3 • Less rapid decline than Blue Chip consensus. 2 2 FRBNY Staff • Factors underlying this forecast. May 2014 1 1 Vintages • Population growth around 1%. 0 0 • Productivity growth rising back to its assumed trend rate -1 -1 of 1½% NFBS (1¼% GDP) in 2016. -2 -2 • Little change in participation rate through 2016. -3 -3 • No change in average weekly hours. 2013 2014 2015 2016 Note: The blue band represents the top 10 and bottom 10 averages of the Blue Chip survey. Source: FRBNY Staff, BEA, and Blue Chip Economic Indicators 1

Unemployment Rate Forecasts Overall CPI Inflation Forecasts Percent Percent % Change (AR) % Change (AR) 8 8 4 4 May 2014 Blue Chip 3 Vintages 3 May 2014 7 7 2 2 Vintages FRBNY Staff 1 1 Released 0 0 6 6 Data FRBNY Staff -1 -1 Released Data -2 -2 5 5 -3 -3 Blue Chip -4 -4 4 4 2013 2014 2015 2016 2013 2014 2015 2016 Note: The blue band represents the difference between the top 10 and bottom Note: The blue band represents the difference between the top 10 and bottom 10 average of the Blue Chip survey. 10 average of the Blue Chip survey. Source: FRBNY Staff, BLS, and Blue Chip Economic Indicators Source: FRBNY Staff, BLS, and Blue Chip Economic Indicators Core PCE Inflation Forecasts Staff Inflation Forecast Summary % Change (AR) % Change (AR) 2.5 2.5 FOMC Objective • Outside of short-run oil price effects, inflation anticipated to rise gradually toward FOMC’s 2.0 2.0 longer-run goal. • PCE inflation projected to reach 2% in 2017. 1.5 1.5 • Roughly similar to Blue Chip consensus forecast. FRBNY Staff • Underlying assumptions. 1.0 1.0 Released • Anchored longer-run inflation expectations. Data 0.5 0.5 • Slow dissipation of remaining slack. May 2014 Vintage • Firming of global demand. • Stronger dollar holding down inflation over near term. 0.0 0.0 2013 2014 2015 2016 Source: FRBNY Staff and Bureau of Economic Analysis 2

Overall PCE Inflation Forecasts CPI Core Goods and Core Services Inflation % Change (AR) % Change (AR) 4 Quarter % Change 4 Quarter % Change 5 5 3 3 FOMC Objective Core Services 4 4 2 2 3 3 1 1 2 2 Released FRBNY Staff Data Core Goods 0 0 1 1 0 0 May 2014 -1 -1 Vintage -1 -1 -2 -2 -2 -2 -3 -3 -3 -3 2013 2014 2015 2016 2000 2002 2004 2006 2008 2010 2012 2014 Source: FRBNY Staff and Bureau of Economic Analysis 11 Source: Bureau of Labor Statistics Risks to FRBNY Staff Real Activity Outlook Dollar Exchange Rate and Nonoil Import Prices 12 Month % Change 12 Month % Change • More uncertainty around staff GDP growth forecast 20 8 Nonoil Import than the SPF for both 2015 and 2016. Prices 15 6 (Right Axis) • Risks roughly balanced in 2015 and 2016. 10 4 • Major risks 5 2 • Upside: 0 0 • More confident businesses and consumers lead to -5 -2 dynamics similar to earlier stages of typical Dollar expansion. -10 -4 (Left Axis) • Dollar depreciates more than expected. -15 -6 • Downside: • Global economy disappoints. -20 -8 2000 2002 2004 2006 2008 2010 2012 2014 • Unexpected tightening of financial conditions. Source: Federal Reserve Board, Note: Dollar is Board’s trade-weighted measure Bureau of Labor Statistics 3

Probability of Growth of Real GDP: 2014-2015 Risks to FRBNY Staff Inflation Outlook Percent Percent 60 60 • As with growth forecast, more uncertainty around FRBNY Staff staff inflation forecast than SPF. SPF • Inflation risks roughly balanced in 2015 and 2016. 45 45 • Upside: • Level and growth rate of potential GDP lower than currently estimated. 30 30 • Inflation expectations becoming unanchored on upside because overly accommodative policy. • Downside: 15 15 • Downside real risks induce more slack. • Stronger global disinflationary pressures push down longer-run inflation expectations. 0 0 < -3 -3 to -2 -2 to -1 -1 to 0 0 to 1 1 to 2 2 to 3 3 to 4 4 to 5 5 to 6 > 6 • Impact of further dollar appreciation. Source: Survey of Professional Forecasters and FRBNY Staff Probability of Growth of Real GDP: 2015-2016 Probability of Core PCE Inflation: 2015Q4/2014Q4 Percent Percent Percent Percent 60 60 60 60 FRBNY Staff FRBNY Staff SPF SPF 45 45 45 45 30 30 30 30 15 15 15 15 0 0 < 0 0 to 0.5 to 1.0 to 1.5 to 2.0 to 2.5 to 3.0 to 3.5 to > 4 0 0 0.4 0.9 1.4 1.9 2.4 2.9 3.4 3.9 < -3 -3 to -2 -2 to -1 -1 to 0 0 to 1 1 to 2 2 to 3 3 to 4 4 to 5 5 to 6 > 6 Source: Survey of Professional Forecasters and FRBNY Staff Source: Survey of Professional Forecasters and FRBNY Staff 4

Probability of Core PCE Inflation: 2016Q4/2015Q4 Percent Percent 60 60 FRBNY Staff SPF 45 45 30 30 15 15 0 0 < 0 0 to 0.5 to 1.0 to 1.5 to 2.0 to 2.5 to 3.0 to 3.5 to > 4 0.4 0.9 1.4 1.9 2.4 2.9 3.4 3.9 Source: Survey of Professional Forecasters and FRBNY Staff 5

Recommend

More recommend