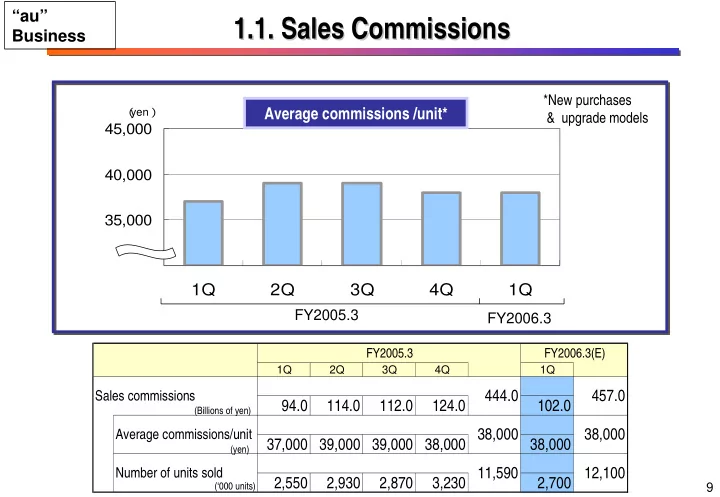

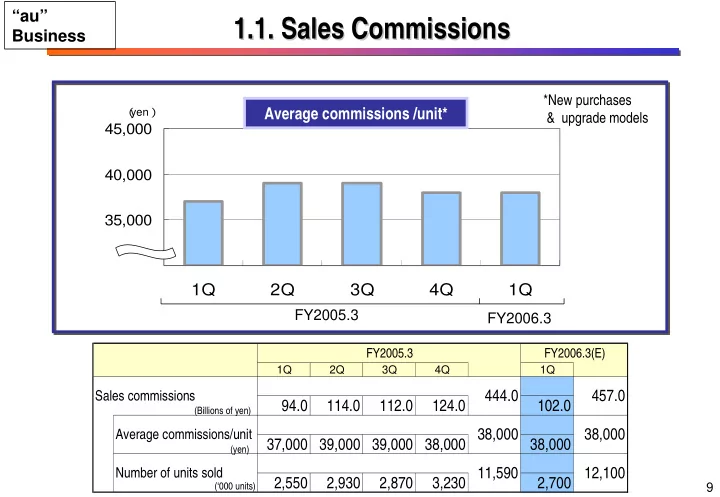

“au” 1.1. Sales Commissions Sales Commissions 1.1. Business *New purchases ( yen ) Average commissions /unit* & upgrade models 45,000 40,000 35,000 30,000 0 1Q 2Q 3Q 4Q 1Q FY2005.3 FY2006.3 FY2005.3 FY2006.3(E) 1Q 2Q 3Q 4Q 1Q 444.0 457.0 Sales commissions 94.0 114.0 112.0 124.0 102.0 (Billions of yen) Average commissions/unit 38,000 38,000 37,000 39,000 39,000 38,000 38,000 (yen) 11,590 12,100 Number of units sold 2,550 2,930 2,870 3,230 2,700 (‘000 units) 9

“au” 1.2. Net Adds & Churn Rate Net Adds & Churn Rate 1.2. Business Net Adds Churn Rate ( Market share ) ( ’000subs ) 100% 500 2.0% 80% 400 1.51% 1.49% Net Adds share 1.40% 1.37% Net Adds 1.5% 1.26% 60% 300 1.0% 40% 200 Improved 0.5% 0.14 points yoy 20% 100 Total-sub share 0.0% 0% 0 1Q 2Q 3Q 4Q 1Q 3/'04 6/'04 9/'04 12/'04 3/'05 6/0'5 full-year/FY2005.3 1Q/FY2006.3 FY2005.3 FY2006.3 Share of : <50.4%> <53.8%> Net Adds <1.44%> Full-year <22.5%> <22.8%> Total subs Note: Churn rate is calculated for ordinary handsets which exclude module-type terminals. 10

“au” 1.3. Trend of Trend of ARPU ARPU 1.3. Business ( yen ) WIN ARPU Total ARPU 14,000 11,550 11,190 12,000 10,570 10,160 9,970 10,000 Total 7,260 7,300 7,190 7,050 8,000 7,150 6,960 7,270 6,810 6,970 6,640 6,480 6,000 Voice 5,570 5,540 5,470 5,240 5,180 5,020 4,000 4,400 2,000 3,920 3,600 3,520 3,490 Data 1,720 1,730 1,720 1,780 1,810 1,790 0 FY2006.3 1Q 2Q 3Q 4Q 1Q 1Q 2Q 3Q 4Q 1Q Full-year F FY2005.3 FY2006.3 FY2006.3 FY2005.3 yoy change Full-year total ARPU <¥ 7,170> total ▲ ¥ 210 ( ▲ 2.9% ) of Voice <¥ 5,430> of Voice ▲ ¥ 300 ( ▲ 5.4% ) of Data <¥ 1,740> of Data + ¥ 90 ( + 5.2% ) 11

“au” 2. Measures to Expand Sales of WIN . Measures to Expand Sales of WIN 2 Business Infrastructure Handsets Expanded lineup � Planned EV-DO service coverage End-Sept. 2005: 99.9% nationwide More WIN models in the total lineup � EV-DO Rev.A: commercial launch planned during CY2006 Content & Charges Applications (Double Teigaku) August 1, 2004~ � Late Nov. 2004~: EZ Chaku Uta Full TM � Mid-June 2005~: EZ-TV May 1, 2005~ Double Teigaku “Light” � Sept. 2005 planned: EZ FeliCa 〃 ~ (in all WIN handsets after FY2006) PCSV flat-rate 12 Note: PCSV stands for PC site viewer.

“au” 3. Update on . Update on WIN WIN (1) (1) 3 Business ■ Expanded flat-rate plan to even wider customer base through commencement of Double Teigaku “Light” in May 2005. 3/’06 Target approx. 7,660k Growth of WIN & Flat-rate Subs ( ‘000 subs ) 100% 5,000 87% 83% * 83% 81% 79% 77% 80% 4,000 4,319 Flat-rate take-up ratio Total subs (left) 60% 3,000 3,252 (right) 40% 2,000 2,032 20% 1,000 1,191 343 573 0% 0 3/'04 6/'04 9/'04 12/'04 3/'05 6/'05 Note: Flat-rate take-up ratio at end-June includes Double Teigaku “Light ” subs in line with the launch of service in May 2005. Former Packet-Discount WIN subs, who were automatically shifted into Double Teigaku “Light” after May 2005, account for 6% at end-March 2005. 13

“au” 3. Update on WIN (2) . Update on WIN (2) 3 Business ■ WIN has continued to capture high-end users from other companies with proportion of new subscriptions at around half. Breakdown of WIN Subs ARPU ( yen ) 12,000 9,970 10,000 Total 7,050 8,000 Upgrades New subscription 6,480 6,000 Voice 5,240 49% 51% 4,000 2,000 3,490 1,810 Data 0 Total WIN ARPU Note: Percentage of the simple total of subs who sign up in 1Q/FY06.3. Note: ARPU of 1Q/FY06.3. 14

“au” 3. Update on WIN (3) . Update on WIN (3) 3 Business ■ During launching period, WIN had a negative effect with data high-end users shifting to flat-rate but post-switched ARPU turns to be on a upward trend since DoubleTeigaku (Two-tiered flat-rate plan) was introduced. Cahnges of ARPU : 1X → WIN Increase due to (yen) more low-end 1,500 users 1,000 Change to Introduce Double Teigaku flat-rate 500 0 12/'03 4/'04 8/'04 12/'04 4/'05 ▲ 500 ▲ 1,000 ▲ 1,500 ▲ 2,000 Decrease ▲ 2,500 mainly due to Note: Comparison of pre- and post-switch monthly ARPU for the high-end users month when users switched to WIN. 15

“au” 4. Provision of Attractive Content . Provision of Attractive Content (1) (1) 4 Business ■ Steady growth in Chaku-uta Full TM ; total downloads topped 10 million on June 15. No. of Cumulative D/Ls of Chaku-uta Full TM June15 ( ’000 D/Ls ) 10 million 12,000 10,000 Apr. 3 5 million 8,000 6,000 Jan. 5 4,000 1 million 2,000 0 11/'04 12 1/'05 2 3 4 5 6 16

“au” 4. Provision of Attractive Content . Provision of Attractive Content (2) (2) 4 Business ■ Promote churn-in to “au” and increased data ARPU through rich downloadable content such as Chaku-uta Full TM , which is popular among younger agegroups. Breakdown of Chaku-uta Full TM Subs Subs Using Upper Limit of Double Teigaku ( Note 2 ) ( Note 1 ) 10s & 20s: (Age) approx. 60% 100% 50s+ 5% 83% 80% 40s 12% 58% 60% 30s 21% 40% 20s 37% 20% 10s 25% 0% Chaku-uta Full 0% 10% 20% 30% 40% Non-users users Note 1: June 2005 results. Note 2: May 2005 results for Double Teigaku subs who have Chaku-uta Full compatible handsets. 17

“au” 4. Provision of Attractive Content . Provision of Attractive Content (3) (3) 4 Business ■ Commenced DUOBLOG on May 19; the number of bloggers is on the rise, reaching 19,000 users on a cumulative basis at end-June. Growth of DUOBLOG ( ’000 P V s ) ( users ) 2,000 20,000 No. of bloggers 1,500 15,000 Total Page Views/day 1,000 10,000 500 5,000 0 0 5/19 5/26 6/2 6/9 6/16 6/23 6/30 18

“au” 4. . Provision of Provision of Attractive Content Attractive Content (4) (4) 4 Business ■ Increase chance of contact with mobile phones among larger agegroups and boost data ARPU by enhancing communication-oriented content such as blog. Blog Market Forecast DUOBLOG Readers ( Note 2 ) ( Note 1 ) 20s & 30s: ( users in millions) approx. 60% 10.0 7.87M 50s+ 7% 8.0 40s 14% 6.0 in 2yrs 3.35M 30s 31% 4.0 bloggers 2.0 20s 33% 0.0 10s 15% 2005/3 2007/3 No. of ( 16.51M ) ( 34.55M ) 0% 10% 20% 30% 40% blog readers Note 1: Results during May 19 - June 12, 2005 (based on unique users). Note 2: Source: “Analysis on Current Status and Forecast on Blogs/SNS” issued by MIC on May 17, 2005. (SNS: Social Networking Service). 19

Recommend

More recommend