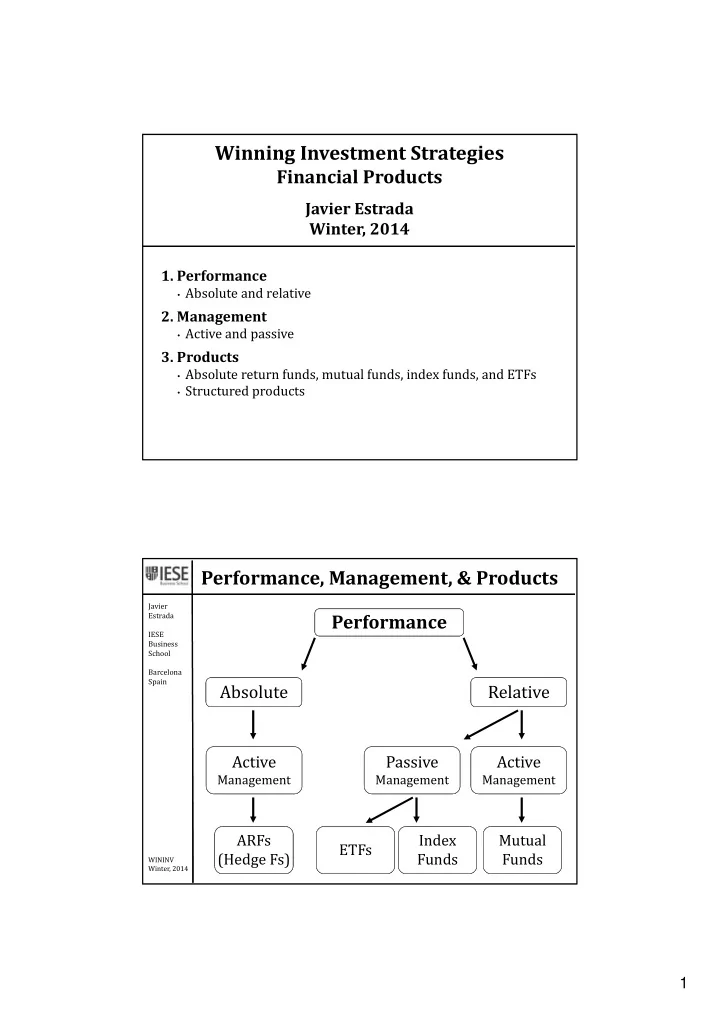

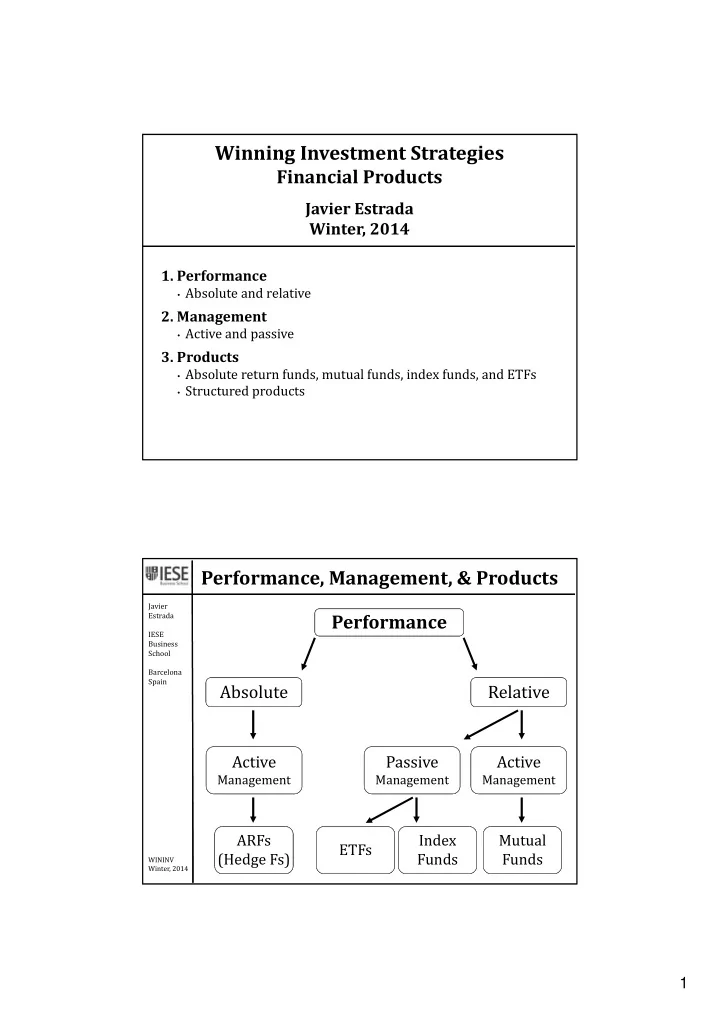

Winning Investment Strategies Financial Products Javier Estrada Winter, 2014 1. Performance • Absolute and relative 2. Management • Active and passive 3. Products • Absolute return funds, mutual funds, index funds, and ETFs • Structured products Performance, Management, & Products Javier Estrada Performance IESE Business School Barcelona Spain Absolute Relative Active Passive Active Management Management Management ARFs Index Mutual ETFs (Hedge Fs) Funds Funds WININV Winter, 2014 1

Performance Javier Estrada Absolute Relative IESE Business School Barcelona Spain There is no underlying There is an underlying benchmark benchmark Consider a fund that lost 20% in 2008 Do not provide access Provide access to specific assets to specific assets They are relatively They are relatively more expensive less expensive WININV Winter, 2014 Absolute Performance Javier Estrada Relevant characteristics IESE Business School Barcelona Spain There is no underlying benchmark (or it is 0) Do not provide access to specific assets They are relatively more expensive Absolute Return Hedge Funds Funds WININV Winter, 2014 Go 2

Relative Performance Javier Estrada Relevant characteristics IESE Business School Barcelona Spain There is an underlying benchmark Provide access to specific assets They are relatively less expensive And the most important thing … WININV Winter, 2014 Relative Performance Javier Estrada A critical distinction IESE Business School Active Passive Barcelona Spain Management Management Seeks to outperform Seeks to replicate/track the benchmark the benchmark Higher costs Lower costs (Relative to PM) (Relative to AM) WININV Winter, 2014 3

Relative Performance Javier Estrada ? Active Passive IESE Business Management Management School Barcelona Spain One of the most critical investment decisions Having chosen a benchmark, should investors attempt to … outperform replicate/track the benchmark? the benchmark? WININV Winter, 2014 Relative Performance Javier Estrada The challenges of ‘going active’ IESE Business School Barcelona Spain Ignoring costs, active management is a 0‐sum game (Considering costs, a negative ‐sum game) Then, over your chosen holding period, ask … can you really pick can you really stick the winners? with the winners? WININV Winter, 2014 Go 4

Mutual Funds Javier What are they? Estrada IESE Business Relevant characteristics School Barcelona Spain Provide access to specific assets (Virtually ‘unlimited’ choice) Provide diversification at a low cost (Lower than for the individual investor) Provide the expectation of outperformance (But remember the evidence on active management) They are more expensive than index funds and ETFs WININV Winter, 2014 Index Funds & ETFs Javier What are they? Estrada IESE Business Similarities School Barcelona Spain Provide access to specific assets (Virtually ‘unlimited’ choice) Provide diversification at a low cost (Lower than for the individual investor) Provide replication of the benchmark They are less expensive than mutual funds WININV Winter, 2014 Go 5

Index Funds & ETFs Javier Estrada Main differences: ETFs … IESE Business School Barcelona Spain are priced continuously track many more benchmarks offer active strategies do not allow transfers between products (?) WININV Winter, 2014 Go ETFs Javier Fundamental Estrada Bonds Indices IESE Business School Stocks Barcelona Levered (Ultra) Spain Regions Countries Sectors Short Sizes Styles Ultra‐short Real estate (REITs) Commodities Strategies WININV Winter, 2014 Go 6

ETFs Javier Estrada iShares www.ishares.com IESE Business School Vanguard www.vanguard.com Barcelona Spain www.statestreet.com State Street PowerShares www.powershares.com WisdomTree www.wisdomtree.com www.lyxor.com Lyxor And many others WININV Winter, 2014 Structured Products Javier Estrada Just two words … IESE Business School Barcelona Spain STAY AWAY !!! WININV Winter, 2014 Go 7

In Short Absolute and relative performance Javier Estrada Absolute performance implies active management IESE Business • It can be obtained with absolute return funds (HFs) School Relative performance can be obtained with actively Barcelona Spain or passively managed products • This is one of the most critical investment decisions It is not clear that active management adds value It is clear that active management has higher costs Relative performance and active management can be obtained with mutual funds Relative performance and passive management can be obtained with index funds and ETFs Structured products Stay away!!! WININV Winter, 2014 Appendix Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 8

Absolute Return Funds Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Absolute Return Funds Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 9

Absolute Return Funds Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Hedge Funds Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 10

Active Management Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Active Management Javier Estrada IESE Business School Barcelona Spain Remember underperformance! WININV Winter, 2014 11

Active Management Javier Estrada IESE Business School Barcelona Spain Remember reversals! WININV Winter, 2014 Active Management – Buffett Javier Estrada (Letter to Shareholders, 1996) IESE Business School “ Most investors, both institutional Barcelona Spain and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals.” WININV Winter, 2014 Back 12

Passive Management Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back ETFs Javier Estrada IESE Business School 1993: Barcelona Introduced by State Street (SPDR) Spain Aug/2012: $2.1 trillion, almost 5,000 products Source: ETF Landscape, BlackRock, Aug/2013. WININV Winter, 2014 Back 13

ETFs – Fundamental Indices Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 ETFs – To Stay Away From! Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 14

ETFs – To Stay Away From! Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Structured Products Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 15

Structured Products Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Structured Products Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 16

Recommend

More recommend