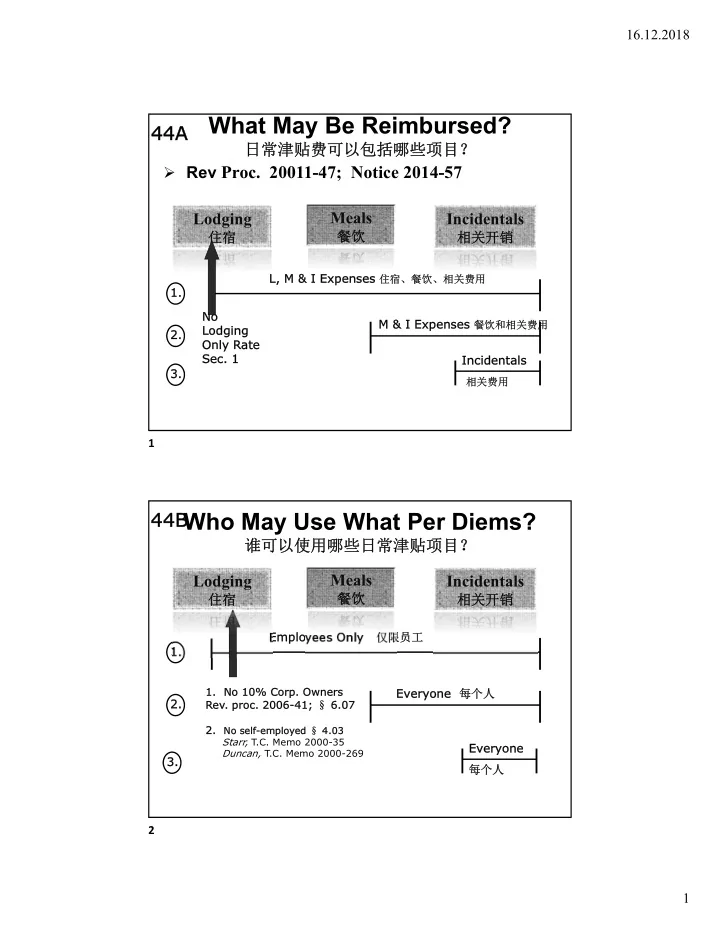

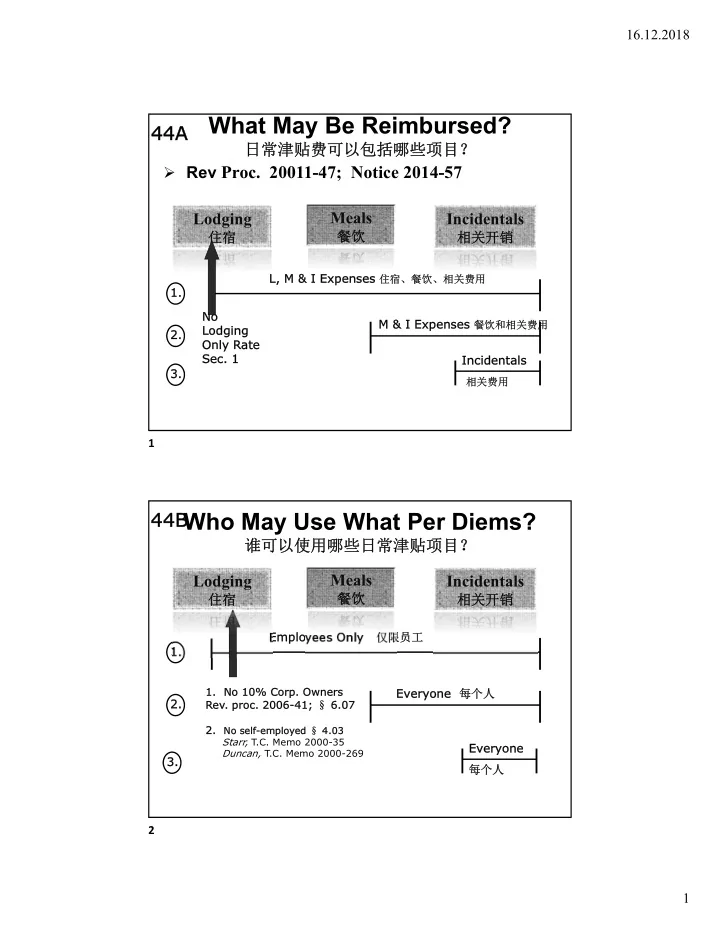

16.12.2018 What May Be Reimbursed? 44A 44A 日常津贴费可以包括哪些项目? Rev Proc. 20011-47; Notice 2014-57 Meals Lodging Incidentals 餐饮 住宿 相关开销 L, M & L, M & I Exp I Expenses 住宿、餐饮、相关费用 1. 1. No No M & I Expe M & I Expenses 餐饮和相关费用 Lodg Lodging 2. 2. On Only R ly Rate te Sec. 1 Sec. 1 Incidentals Incidentals 3. 3. 相关费用 1 44B 44B Who May Use What Per Diems? 谁可以使用哪些日常津贴项目? Meals Lodging Incidentals 餐饮 住宿 相关开销 Employees O ees Only ly 仅限员工 1. 1. 1. No 1. No 10% 10% Corp Corp. Owners wners Everyone Ev 每个人 2. 2. Rev. proc proc. 2006-41; 2006-41; § 6. 6.07 07 2. 2. No No self self-e -empl mployed § 4. 4.03 Starr, T.C. Memo 2000-35 Everyone Ev Duncan, T.C. Memo 2000-269 3. 3. 每个人 2 1

16.12.2018 44C 44C How Much (Per Diem Rate) Go t Go to slide slide 日常津贴抵扣额 47 47 Meals & Lodging Meals Incidentals & Incidentals 餐饮和相关费用 住宿、餐饮和相 关费用 1. Daily rate 1. 1. 1.Daily r ily rate based on based on Locat cation on 基于所在城市的每日标准额 每日标准额 2. High 2. gh-Low -Low Met Method od 2. 2. Hig High L Low w Method thod § 5.01 最高最低扣除法 能使用高低扣除法 High rate $259 - 65 M&I = 194 Low rate $172 - 52 M&I = 120 3. 3. Trans. s. Ind Industry $ 59 - CONUS However, cannot be used by $ 65 - OCNUS 不适用于 (1) self-employed; 个体户 30% v. 50% for 30% v 50% for (2) 10% corp. owners § 274(n) 274(n) l limit 公司 10% 10% 以上的股东 3 房产租赁 Leasing Real Estate 租赁合约 Rental Re Agreement Agre 小型股份制公司 S Corp 责任有限公司 LLC LL 无个人经营税 $$$ $$$ $$ $$ Non-self employment 无净投资收益所得税 No NII 无清算收益所得税 No tax on Liquidation 实体所有人 Owner Owner 4 2

16.12.2018 100 100 A $100,000 $100,000 A/B 合伙企业 Carries P/S Over 公司 Corp $100,000 Substitues 5 Step Up in Basis § 1014 Fair ir Mark rket V et Value at lue at Ti Time of me of Dea Death = = $100,00 $100 ,000 Basis was Bas s was $0 $0 6 3

16.12.2018 房产租赁 Leasing Real Estate What What if if Whole Whole Building? Building? When plac When placed in in service? service? What What if if one one floor? floor? 7 Mandatory Revaluation $ for $ for capital capital 合伙企业 inte interest st P/S Capit Capital inte interest st for services for services Profit Profits inte interest st for services for services IRC § 704(c) – Revalue Other Partners 8 4

16.12.2018 税法第 754 754 条 - 选择性权益成本调整 754 – Optional Basis Adjustment 两种方法 $$$ Tw Two 合伙企业 734(b) P/S Methods Methods 2 P1 Carol P2 Re Redemption 1 $$$ Cro Cross 743(b) Purchase hase 9 Mandatory Revaluation 10 5

16.12.2018 178 178 Admitting a Profits Interest A 责任 有限公司 LLC $100 10% 11 178 178 Example B Balance Sheet A/B FMV Assets Receivables $ 0 $ 30 10 Equipment 0 Goodwill 0 60 Liabilities Assume a Note payable ( 0) ( 0) one person --------- --------- partnership $ 100 $ 0 Net 10% --------- FMV of property $ 10 ====== 12 6

16.12.2018 178 178 Book Capital Accounts After Deemed Liquidation C 90% 10% Total Book Capital Acct $ 0 $ 0 $ 0 0 Revaluation 100 100 ( 0) 0 K-1 0 --------- --------- --------- Ending Book Capital Acct 100 100 0 ===== ===== ===== Xiaoyi’s Interest has no value if immediately liquidated Liquidating distributions must be based on capital accounts 13 178 178 D What if Partnership Increases in What if P rtnership Increases in Va Value? What if business substantially increases in value? § 83(b) Example: Service provider to receive 10% profits interest 3 Year Cliff Vesting FMV today – far less $10 maybe $1-$ 2 FMV three years later $1 million 14 7

16.12.2018 178 178 What if Ship Sinks? What if Ship Sinks? E No loss, not even a capital loss 15 Section 199A Sectio n 199A Individuals and some trusts and estates a 20% imaginary deduction Twenty thousand dollars 20,000 QBI Deduction 16 8

16.12.2018 Combined Business Income Combined Business Income Slide 341 20% of the Qualified Business Income 20% of the Qualified REIT and Publicly Traded Partnership (PTP) Income 17 Ceiling Ceiling Lesser of Slide 340 20% of Taxable Income or Combined Business Income QBI ded 5,600 Schedule C Income $28,000 Married Std deduction 24,000 --------- Taxable Income before 4,000 18 9

16.12.2018 Carry Forwards 207 207 A Types of Income Trade or § 212 Portfolio Business Rental Income § 162 Property § 46 46 3.8% 3.8% NOL NOL 1( 1( l) NII NII l) CF CF Pa Passive Capit Capit Invest In st CF CF Loss Loss al al ment ment Pre Pre CF CF After After Loss Loss Intere Intere 2018 2018 2018 2018 CF CF st CF st CF QTB QTB 19 Categories Categories Slide 336 Slide 338 Slide 337 1 3 2 S< 157,500 S 157,500 - 207,500 S> 207,500 J< 315,000 J 315,000 – 415,000 J> 415,000 SSTB SSTB QBI QBI QBI No wage/prop limit 20 10

16.12.2018 What What’s a a SSTB QTB Trade or Business § 162 Trade or Business or? § 469 Trade or business 21 从投资收入到营业收入 Passive to Trade or Business 活动类型 营业收入 Level 开发商 Trade or of Developer Business Activity income 酒店 Hotel and motel 灰色地带 商业房产 Commercial Real Estate Grey 住宅房产 Residential Real Estate 非营业收入 Non-business 投资土地 income Investing in Land 22 11

16.12.2018 Cases Cases Land: Herbert v. Commr., 30 T.C. 26 (1958) - No Residential Real Estate: Espinosa v. Commr., 107 T.C. 146 (1996) - No Swallows Holding, Ltd. v. Commr., 515 F. 3d 162 (3d Cir. 2008) – No Curphey v. Commr. 73 TC 766 (1980) Yes – 6 properties, directly managed Commercial Real Estate: Pinchot v. Commr, 113 F.2d 718 (2d. Cir. 1940) - Yes; 11 parcels – co-owner agent managed; Lewenhaupt v. Commr., 20 T.C. 151 (1953); aff’d, 221 F.2d 227 (9 th Cir. 1955) – Yes - 3 commercial; 1 residential; managed by agent Evelyn M. L. Neill, 46 B. T. A. 197 (1942) – No; 1 property, 1 tenant , net lease Eleck v. Commr. 30 T.C. 731 (1958); Yes; 1 property, 15 resid tenants; 3 commercial; personally managed then father 23 住宅大楼 Residential Property 6 个房产 6 rentals 没有管理公司 No management company 房租收入不需交纳个体经营税 Rental income not S.E. 24 12

16.12.2018 商业大楼 Commercial Property Go to Slide 484 出租的房产个数 Number of Properties Rented 日常经营管理 Day-to-day involvement or management company 租赁类型:三重净利租赁、短期租赁、长期租赁 Type of leases: triple net; short term, or long term 其他按照商业经营活动填报 - 税表 1099 Report as trade or business other purposes – Form 1099 25 Material Participation Not Required 403 403 A Go t Go to slide slide 407 407 小型股份制公司 In In S Corp Florida: Florida Activ Active Passiv ssive QBI QBI NII NII QBI QBI 50% 50% 50% 50% 26 13

16.12.2018 102 102 房产租赁 A Leasing Real Estate 租赁合约 Re Rental Agre Agreement 小型股份制公司 S Corp 责任有限公司 LLC LL 无个人经营税 $$$ $$$ $$ Non-self $$ employment 无净投资收益所得税 No NII 无清算收益所得税 No tax on Liquidation 实体所有人 Owner Owner 27 524 524 房产租赁 A Leasing Real Estate Only Tennant 无个人经营税 $$ $$ Non-self 租赁合约 employment Rental Re Agreement Agre 无净投资收益所得税 No NII 责任有限公司 LLC LL $$$ $$$ 无清算收益所得税 No tax on Liquidation 小型股份制公司 S Corp Aggregated QBI 实体所有人 Owner Owner 28 14

16.12.2018 Material Participation Not Required 528 528 A 小型股份制公司 小型股份制公司 Ta Tags S Corp S Corp Along Along 49% 49% 51% 51% 50% 50% 50% 50% 29 Material Participation Not Required 528 528 B 51% 51% 责任有限公司 LLC 小型股份制公司 S Corp Ta Tags Along Along 49% 49% 49% 49% 51% 51% 30 15

Recommend

More recommend