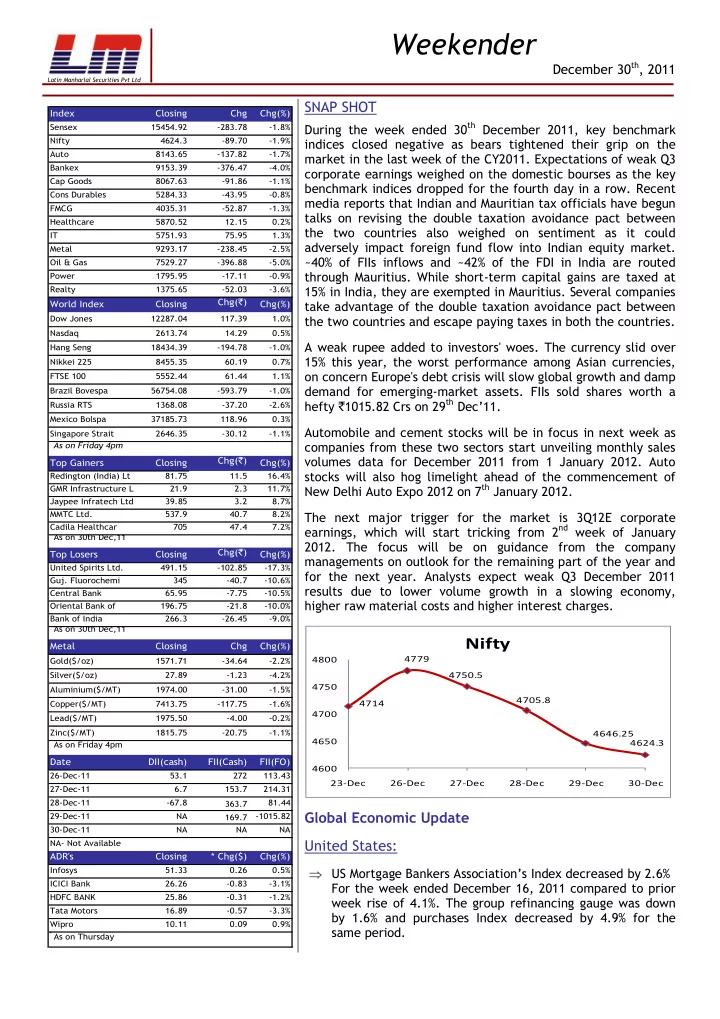

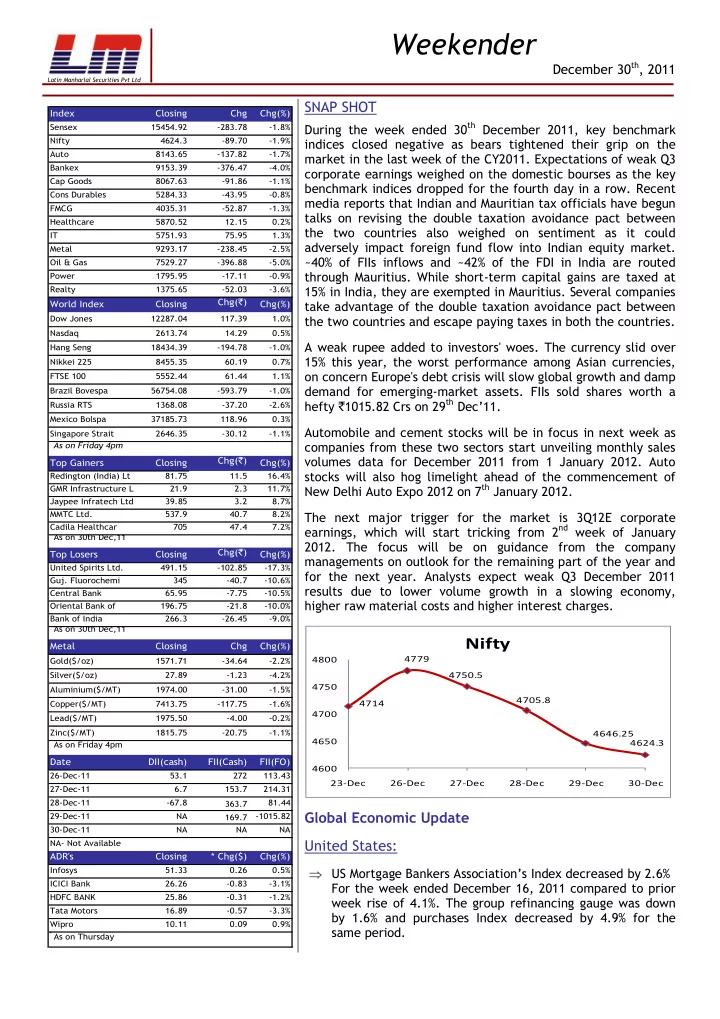

Weekender December 30 th , 2011 Latin Manharlal Securities Pvt Ltd SNAP SHOT Index Closing Chg Chg(%) During the week ended 30 th December 2011, key benchmark Sensex 15454.92 -283.78 -1.8% Nifty 4624.3 -89.70 -1.9% indices closed negative as bears tightened their grip on the Auto 8143.65 -137.82 -1.7% market in the last week of the CY2011. Expectations of weak Q3 Bankex 9153.39 -376.47 -4.0% corporate earnings weighed on the domestic bourses as the key Cap Goods 8067.63 -91.86 -1.1% benchmark indices dropped for the fourth day in a row. Recent Cons Durables 5284.33 -43.95 -0.8% media reports that Indian and Mauritian tax officials have begun FMCG 4035.31 -52.87 -1.3% talks on revising the double taxation avoidance pact between Healthcare 5870.52 12.15 0.2% the two countries also weighed on sentiment as it could IT 5751.93 75.95 1.3% adversely impact foreign fund flow into Indian equity market. Metal 9293.17 -238.45 -2.5% ~40% of FIIs inflows and ~42% of the FDI in India are routed Oil & Gas 7529.27 -396.88 -5.0% through Mauritius. While short-term capital gains are taxed at Power 1795.95 -17.11 -0.9% Realty 1375.65 -52.03 -3.6% 15% in India, they are exempted in Mauritius. Several companies Chg( ` ) World Index Closing Chg(%) take advantage of the double taxation avoidance pact between Dow Jones 12287.04 117.39 1.0% the two countries and escape paying taxes in both the countries. Nasdaq 2613.74 14.29 0.5% A weak rupee added to investors' woes. The currency slid over Hang Seng 18434.39 -194.78 -1.0% 15% this year, the worst performance among Asian currencies, Nikkei 225 8455.35 60.19 0.7% on concern Europe's debt crisis will slow global growth and damp FTSE 100 5552.44 61.44 1.1% demand for emerging-market assets. FIIs sold shares worth a Brazil Bovespa 56754.08 -593.79 -1.0% hefty ` 1015.82 Crs on 29 th Dec ’ 11. Russia RTS 1368.08 -37.20 -2.6% Mexico Bolspa 37185.73 118.96 0.3% Automobile and cement stocks will be in focus in next week as Singapore Strait 2646.35 -30.12 -1.1% * As on Friday 4pm companies from these two sectors start unveiling monthly sales volumes data for December 2011 from 1 January 2012. Auto Chg( ` ) Top Gainers Closing Chg(%) stocks will also hog limelight ahead of the commencement of Redington (India) Lt 81.75 11.5 16.4% New Delhi Auto Expo 2012 on 7 th January 2012. GMR Infrastructure L 21.9 2.3 11.7% Jaypee Infratech Ltd 39.85 3.2 8.7% MMTC Ltd. 537.9 40.7 8.2% The next major trigger for the market is 3Q12E corporate Cadila Healthcar 705 47.4 7.2% earnings, which will start tricking from 2 nd week of January * As on 30th Dec,11 2012. The focus will be on guidance from the company Chg( ` ) Top Losers Closing Chg(%) managements on outlook for the remaining part of the year and United Spirits Ltd. 491.15 -102.85 -17.3% for the next year. Analysts expect weak Q3 December 2011 Guj. Fluorochemi 345 -40.7 -10.6% results due to lower volume growth in a slowing economy, Central Bank 65.95 -7.75 -10.5% higher raw material costs and higher interest charges. Oriental Bank of 196.75 -21.8 -10.0% Bank of India 266.3 -26.45 -9.0% * As on 30th Dec,11 Nifty Metal Closing Chg Chg(%) 4779 Gold($/oz) 1571.71 -34.64 -2.2% 4800 Silver($/oz) 27.89 -1.23 -4.2% 4750.5 4750 Aluminium($/MT) 1974.00 -31.00 -1.5% 4705.8 Copper($/MT) 7413.75 -117.75 -1.6% 4714 4700 Lead($/MT) 1975.50 -4.00 -0.2% Zinc($/MT) 1815.75 -20.75 -1.1% 4646.25 4650 * As on Friday 4pm 4624.3 Date DII(cash) FII(Cash) FII(FO) 4600 26-Dec-11 53.1 272 113.43 23-Dec 26-Dec 27-Dec 28-Dec 29-Dec 30-Dec 27-Dec-11 6.7 153.7 214.31 28-Dec-11 -67.8 81.44 363.7 Global Economic Update 29-Dec-11 NA -1015.82 169.7 30-Dec-11 NA NA NA United States: NA- Not Available ADR's Closing * Chg($) Chg(%) Infosys 51.33 0.26 0.5% US Mortgage Banke rs Association’s Index decreased by 2.6% ICICI Bank 26.26 -0.83 -3.1% For the week ended December 16, 2011 compared to prior HDFC BANK 25.86 -0.31 -1.2% week rise of 4.1%. The group refinancing gauge was down Tata Motors 16.89 -0.57 -3.3% by 1.6% and purchases Index decreased by 4.9% for the Wipro 10.11 0.09 0.9% same period. * As on Thursday

Research Desk Latin Manharlal Securities Pvt Ltd US Consumer Confidence rose to an eight month high in GDR's Closing * Chg($) Chg(%) month of December. The Conference Board’s index RIL 26.22 -2.12 -7.5% increased to 64.5 from revised 55.2 reading in November. SBI 61.95 -0.9 -1.4% Initial Jobless claims increased by 15,000 to 381,000 from L&T 18.88 -0.49 -2.5% earlier week revised figure of 366,000 for the week ended 12/02/201 Banking Data Chg( `Crs ) Chg(%) December 24,2011 1( `Crs) Credit growth 4235421 46377 1.1% Continuing claims increased by 34,000 to 3.601 million for the week ended Dec 17, 2011 from earlier revised claims of Deposit growth 5710061 62797 1.1% 3.567 million of previous week. ECONOMIC CALENDAR Date Economic Data Previous UK & Europe: UNITED STATES 4-Jan MBA Mortgage Applications -2.60% UK’s house prices fell 2.10% a nd 0.20% on YoY and MoM basis respectively for the month of December. 5-Jan Total Vehicle Sales 13.59M 5-Jan Initial Jobless Claims 381K UK service output fell the most in six months in the month 5-Jan Continuing Claims 3601K of October. Service output fell 0.7% on MoM basis, however 6-Jan Unemployment Rate 8.60% it rose 1.1% on YoY basis. UNITED KINGDOM Germany’s CPI projection stands at 2.10% and 0.7% on YoY 47.60 3-Jan PMI Manufacturing and MoM basis respectively for the month of December. 4-Jan Mortgage Approvals 1.60% GERMANY Asia: 6.90% 3-Jan Unemployment Rate (s.a) Japan Jobless rate stood at 4.5% for the month of 52.70 4-Jan PMI Services November remaining unchanged from what was recorded in JAPAN month of October . 305.5B 4-Jan Japan Buying Foreign Bonds Jap an’s Industrial production dropped by 4.00% and 2.60% 5-Jan Vehicle Sales (YoY) 24.10% on YoY and MoM basis respectively for the month of November. CURRENCY, CRUDE & G-SEC Primary Articles Inflation USD-JPY USD - INR 78.1 53.4 7.74% 77.97 77.94 6.92% 53.2 77.88 5.48% 77.9 53.2 53.1 53.1 53.0 3.78% 77.64 77.7 53.0 2.70% 77.5 52.8 52.7 77.39 77.3 52.6 19-Nov 26-Nov 3-Dec 10-Dec 17-Dec 26-Dec 27-Dec 28-Dec 29-Dec 30-Dec 26-Dec 27-Dec 28-Dec 29-Dec 30-Dec Govt.Yield Crude($/bbl) 101.34 101.4 8.85% 8.70% 100.9 8.70% 8.57% 100.3 8.52% 99.9 8.55% 8.45% 99.61 99.65 99.8 8.34% 99.36 8.40% 99.2 8.25% 26-Dec 27-Dec 28-Dec 29-Dec 30-Dec 2-Dec 9-Dec 16-Dec 23-Dec 30-Dec 2

Recommend

More recommend