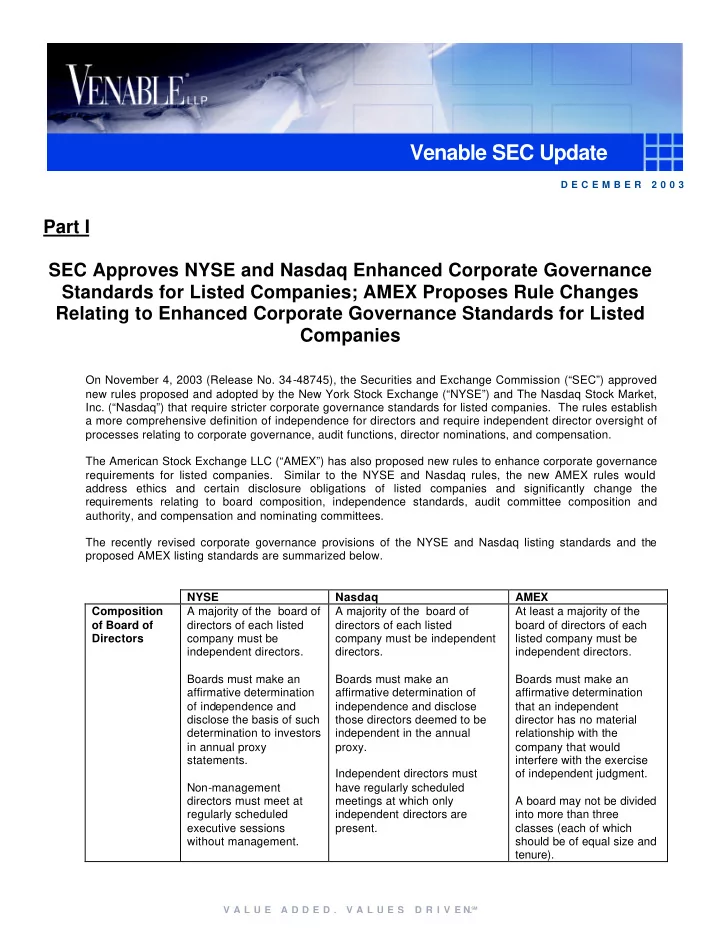

Venable SEC Update D E C E M B E R 2 0 0 3 Part I SEC Approves NYSE and Nasdaq Enhanced Corporate Governance Standards for Listed Companies; AMEX Proposes Rule Changes Relating to Enhanced Corporate Governance Standards for Listed Companies On November 4, 2003 (Release No. 34-48745), the Securities and Exchange Commission (“SEC”) approved new rules proposed and adopted by the New York Stock Exchange (“NYSE”) and The Nasdaq Stock Market, Inc. (“Nasdaq”) that require stricter corporate governance standards for listed companies. The rules establish a more comprehensive definition of independence for directors and require independent director oversight of processes relating to corporate governance, audit functions, director nominations, and compensation. The American Stock Exchange LLC (“AMEX”) has also proposed new rules to enhance corporate governance requirements for listed companies. Similar to the NYSE and Nasdaq rules, the new AMEX rules would address ethics and certain disclosure obligations of listed companies and significantly change the requirements relating to board composition, independence standards, audit committee composition and authority, and compensation and nominating committees. The recently revised corporate governance provisions of the NYSE and Nasdaq listing standards and the proposed AMEX listing standards are summarized below. NYSE Nasdaq AMEX Composition A majority of the board of A majority of the board of At least a majority of the of Board of directors of each listed directors of each listed board of directors of each Directors company must be company must be independent listed company must be independent directors. directors. independent directors. Boards must make an Boards must make an Boards must make an affirmative determination affirmative determination of affirmative determination of independence and independence and disclose that an independent disclose the basis of such those directors deemed to be director has no material determination to investors independent in the annual relationship with the in annual proxy proxy. company that would statements. interfere with the exercise Independent directors must of independent judgment. Non-management have regularly scheduled directors must meet at meetings at which only A board may not be divided regularly scheduled independent directors are into more than three executive sessions present. classes (each of which without management. should be of equal size and tenure). V A L U E A D D E D , V A L U E S D R I V E N. SM

2 S E C U P D A T E D E C E M B E R 2 0 0 3 Definition The following individuals The following individuals do not The following individuals of do not qualify as qualify as independent directors would not qualify as independent directors under the newly adopted independent directors Independent Director under the newly adopted Nasdaq rules: under the most recently NYSE rules: proposed AMEX rules: • An individual who is or • An officer or employee of the • Current officers and was an employee (or listed company or its employees of the listed whose immediate subsidiaries, or any other company or its parent family member is or individual having a or subsidiaries. • was an executive relationship that would An individual who is or officer) of the listed interfere with the exercise of was employed by the company during the independent judgment in listed company or any past three years. carrying out the parent or subsidiary of • An individual who responsibilities of a director. the company during the • An individual who is, or at receives or received past three years. • (or whose immediate any time during the past An individual who family member three years was, employed accepts (or whose receives or received) by the listed company or by immediate family more than $100,000 any parent or subsidiary of member accepts) any per year in direct the listed company payment from the listed • An individual who accepted compensation from company (or any the listed company or has a family member who parent or subsidiary of (except for certain accepted from the listed the company) in excess permitted payments) company (or any parent or of $60,000 during the during the past three subsidiary of the company) a current or three years. payment in excess of previous fiscal years • An individual who is or $60,000 (except for certain except for certain was affiliated with or permitted payments, payments for employed by (or including board investments, services whose immediate compensation) in any single or benefits. • family member is or fiscal year during the past An individual who is (or was affiliated with or three years. whose immediate • An individual who is a family employed by) a family member is) a present or former member of an individual who partner, controlling internal or external is or was employed as an shareholder or auditor of the listed executive officer by the listed executive officer of any company during the company or by any parent or organization to which past three years. subsidiary of the company or from which the listed • An individual who is or during the past three years. company made or • An individual who is (or has was during the last received payments that three years employed a family member who is) a exceed the greater of (or whose family 5% of the recipient’s partner, controlling member is or was so gross revenues or shareholder or an executive employed) as an $200,000 in any of the officer in or of any executive officer of past three fiscal years. organization to which the • another company company made, or from An individual who is an where any of the which the listed company immediate family listed company’s received, payments for member of an present executives property or services in the individual who is or has serve on that current or any of the past been employed by the company’s three fiscal years that listed company (or any compensation exceed the greater of 5% of parent or subsidiary of committee. the recipient’s gross the company) as an • An individual who is or revenues for that year or executive officer during was an executive $200,000 (except for any of the past three officer or an employee permitted payments). years. V A L U E A D D E D , V A L U E S D R I V E N. SM

Recommend

More recommend