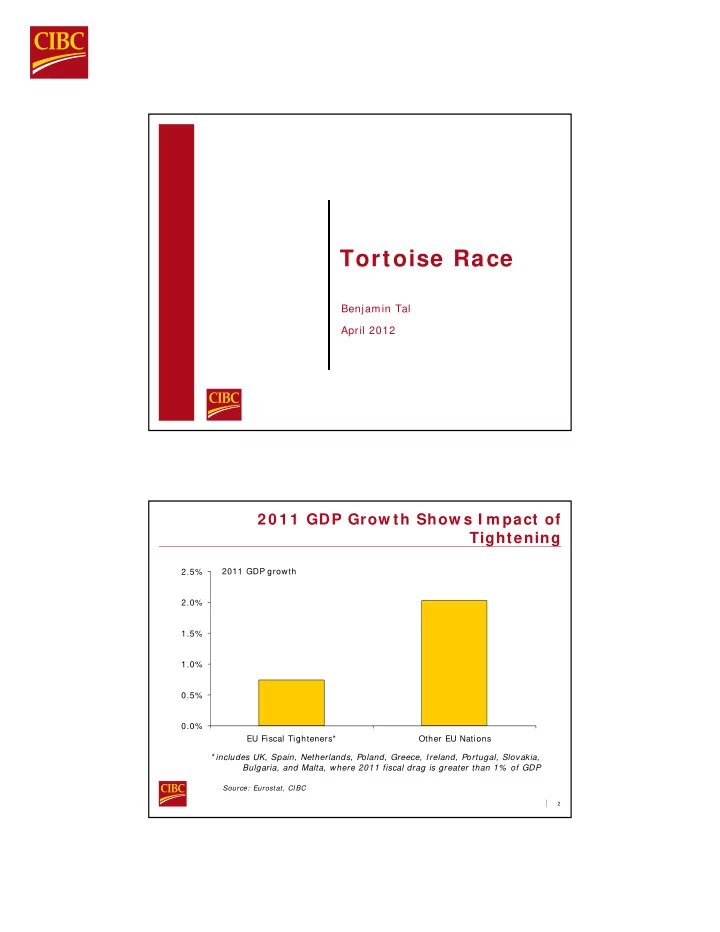

Tortoise Race Benjamin Tal April 2012 2 0 1 1 GDP Grow th Show s I m pact of Tightening 2011 GDP growth 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% EU Fiscal Tighteners* Other EU Nations * includes UK, Spain, Netherlands, Poland, Greece, Ireland, Portugal, Slovakia, Bulgaria, and Malta, where 2011 fiscal drag is greater than 1% of GDP Source: Eurostat, CIBC | 2

On the Ground I ndicators Still Suggest “Soft Landing” 35 y/ y % chg 30 25 20 15 10 5 0 -5 -10 -15 Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- 07 07 08 08 09 09 10 10 11 11 12 Electricity Use (R ) Railway Freight Volum es (R ) | 3 BC Lum ber Exports to China cubic m etres 200 y/ y % chg 180 160 140 120 100 34- 80 m onth 60 low 40 20 0 Jan-11 Apr-11 Jul-11 Oct-11 Source: BC Stats-Ministry of Labour, Citizens’ Services & Open Government, Statistics Canada | 4

Even a Soft Landing Could Jar Com m odity Markets China's share of world dem and (% ) 70 60 50 40 2000 2010 30 20 10 0 I ron Ore Copper Oil Coal | 5 Deleveraging US Ho u se h o ld De b t Ou tsta n d in g to Disp o sa b le I n co m e Ra tio 140 % Getting 130 closer… 120 110 100 trendline 90 80 70 60 88 90 92 94 96 98 00 02 04 06 08 10 Source: Federal Reserve Board, CIBC | 6

Credit Quality I m proving Av e r a ge Cr e dit Scor e of Consum e r Loa n Lowe st Scor e Qua r tile De linque ncy Ra te 615 Ba ck to Nor m a l 6 614 % 613 5 612 611 4 610 609 3 608 607 2 606 1 605 07 08 09 10 11 07 08 09 10 11 Source: CIBC, Federal Reserve Board | 7 US Manufacturing, Still Expanding 70 Ex pansion 65 60 55 50 45 Contr action 40 35 30 07 08 09 10 11 12 Source: Institute for Supply Managem ent, CIBC | 8

Our I ndicator of Corporate Strength Has Never Been Higher Com pone nts of Com posite I ndica tor of Cor por a te Str e ngth Cor por a te Ca na da 's* I ndica tor Str e ngth 1.5 Debt-to-Equity Ratio Cash to Credit Ratio 1.0 Profit Margin 0.5 Return on Equity Return on Capital 0.0 Exports Diversification - -0.5 Com m odities Exports Diversification - -1.0 Countries -1.5 Business Bankruptcy Rate 90Q2 95Q2 00Q2 05Q2 10Q2 Business Confidence * non-financial corporate sector | 9 Corporate Cash Piles Building Corporate Cash Holdings as 0.70 Proportion of Credit 0.60 0.50 0.40 0.30 0.20 0.10 0.00 90Q1 92Q3 95Q1 97Q3 00Q1 02Q3 05Q1 07Q3 10Q1 | 10

CI BCW M Metropolitan Econom ic Activity I ndex 20 15 10 5 0 95Q1 99Q1 03Q1 07Q1 11Q1 Av er age of 25 CMAs Winnipeg | 11 Population Grow th 2 0 1 1 Q1 - 2 0 1 2 Q1 y / y % chg 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 Winnipeg C anada | 12

Num ber of Households w ith Heavy Debt Load on the Rise 36 % 34 32 30 28 26 24 22 07 08 09 10 11 | 13 Heavy Borrow ers % of Households w ith Debt % of Dollars 83.0 BC ALTA 79.2 74.2 ONT 73.2 Canada Winipeg 70.2 MAN/ SASK 67.0 58.8 ALTC QUE 62.7 0 5 10 15 20 25 30 35 40 45 | 14

Heavy Borrow ers Accounted For All The I ncrease in Debt Since 2 0 0 7 Co n tr ib u tio n to Ch a n g e in He a v y Bo r r o w e r s' De b t T o ta l Ho u se h o ld De b t Gr o w th Ra te ( 2 0 0 7 - 2 0 1 1 ) sin ce 2 0 0 7 25 % 101.4 % 20 15 10 5 -1.4% 0 Heav y debt Medium & Light Mor tgage Total Debt load debt Load less Mortgage Heavy Borrowers are those with > = 1.6 debt to gross incom e ratio. Source: Canadian Financial Monitor, CIBC | 15 Real Household Credit 12.0 y / y % chg 10.0 8.0 Av g 4.3% 6.0 Av g 7.8% ? 4.0 2.0 0.0 92 94 96 98 00 02 04 06 08 10 | 16

I nflation-Adjusted Mortgage Outstanding 14.0 y / y % chg 12.0 10.0 8.0 6.0 4.0 2.0 0.0 90 93 96 99 02 05 08 11 | 17 THANK YOU

Recommend

More recommend