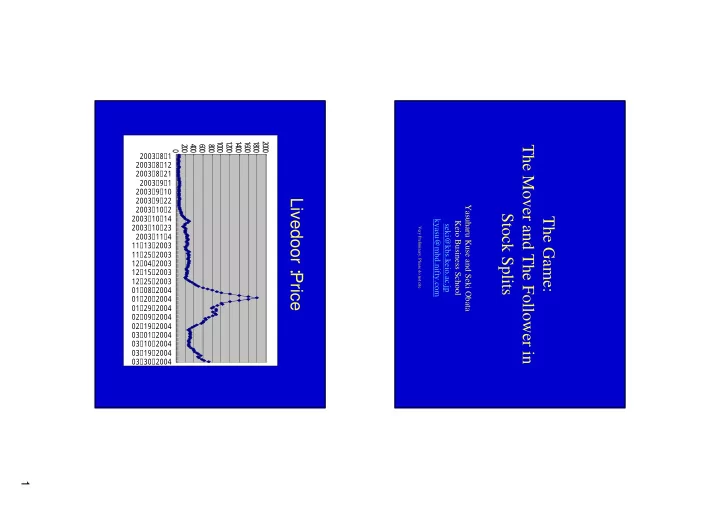

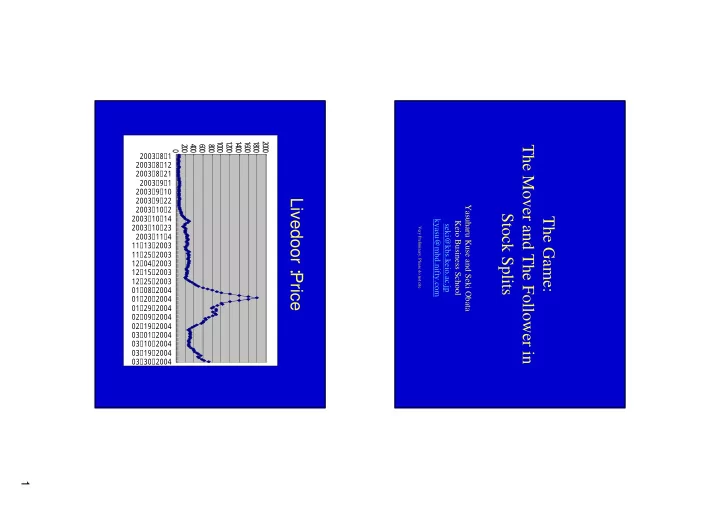

1 1 1 1 1 2 2 4 6 8 0 2 4 6 8 0 The Mover and The Follower in 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 0 0 3 / 8 / 1 2 0 0 3 / 8 / 1 2 2 0 0 3 / 8 / 2 1 2 0 0 3 / 9 / 1 2 0 0 3 / 9 / 1 0 2 0 0 3 / 9 / 2 2 Livedoor : 2 0 0 3 / 1 0 / 2 Yasuharu Kuse and Seki Obata 2 0 0 3 / 1 0 / 1 4 Stock Splits The Game: kyasu@mbd.nifty.com Keio Business School 2 0 0 3 / 1 0 / 2 3 seki@kbs.keio.ac.jp Very Preliminary. Please do not cite. 2 0 0 3 / 1 1 / 4 1 1 / 1 3 / 2 0 0 3 1 1 / 2 5 / 2 0 0 3 1 2 / 0 4 / 2 0 0 3 1 2 / 1 5 / 2 0 0 3 Price 1 2 / 2 5 / 2 0 0 3 0 1 / 0 8 / 2 0 0 4 0 1 / 2 0 / 2 0 0 4 0 1 / 2 9 / 2 0 0 4 0 2 / 0 9 / 2 0 0 4 0 2 / 1 9 / 2 0 0 4 0 3 / 0 1 / 2 0 0 4 0 3 / 1 0 / 2 0 0 4 0 3 / 1 9 / 2 0 0 4 0 3 / 3 0 / 2 0 0 4 1

1 2 3 4 5 6 7 8 9 Ex- Ex Ex- Ex Announce : Announce 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -date2:02/20/04 -date1: 12/24/03 0 0 0 0 0 0 0 0 0 date2:02/20/04 date1: 12/24/03 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 2 2 3 3 0 0 0 0 0 0 0 0 0 5 0 5 0 5 0 5 0 0 0 0 0 0 0 0 0 0 , , , , , , , 2 0 0 3 / 8 / 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 0 0 3 / 8 / 1 : 2 0 0 3 / 8 / 1 3 11/19/03 11/19/03 Livedoor: Margin Buy Balance 2 0 0 3 / 8 / 2 5 2 0 0 3 / 8 / 1 5 2 0 0 3 / 9 / 4 2 0 0 3 / 8 / 2 9 Livedoor: Trade Volume 2 0 0 3 / 9 / 1 7 2 0 0 3 / 9 / 1 2 2 0 0 3 / 9 / 3 0 2 0 0 3 / 9 / 2 6 2 0 0 3 / 1 0 / 1 0 2 0 0 3 / 1 0 / 2 3 2 0 0 3 / 1 0 / 1 0 2 0 0 3 / 1 1 / 5 2 0 0 3 / 1 0 / 2 4 1 1 / 1 7 / 2 0 0 3 2 0 0 3 / 1 1 / 7 1 1 / 2 8 / 2 0 0 3 1 2 / 1 0 / 2 0 0 3 2 0 0 3 / 1 1 / 2 1 1 2 / 2 2 / 2 0 0 3 2 0 0 3 / 1 2 / 5 0 1 / 0 7 / 2 0 0 4 2 0 0 3 / 1 2 / 1 9 0 1 / 2 0 / 2 0 0 4 2 0 0 4 / 1 / 2 0 1 / 3 0 / 2 0 0 4 0 2 / 1 2 / 2 0 0 4 2 0 0 4 / 1 / 1 6 0 2 / 2 4 / 2 0 0 4 2 0 0 4 / 1 / 3 0 0 3 / 0 5 / 2 0 0 4 2 0 0 4 / 2 / 1 3 0 3 / 1 7 / 2 0 0 4 0 3 / 2 9 / 2 0 0 4 2 0 0 4 / 2 / 2 7 2 0 0 4 / 3 / 1 2 2 0 0 4 / 3 / 2 6 2

Ex- Ex Ex- Ex Announce: 10/13/04 Announce: 10/13/04 0 8 / -date2: 12/22/04 -date1: 10/29/04 0 date2: 12/22/04 date1: 10/29/04 2 0 1 1 2 2 3 3 / 1 1 2 2 3 3 8 5 0 5 0 5 0 5 2 5 0 5 0 5 0 5 / 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 5 0 4 0 0 0 0 0 0 0 / 8 0 0 0 0 0 0 0 2 / 0 0 0 0 0 0 0 0 0 1 0 0 0 8 / 0 2 / 2 0 0 4 4 0 / 8 2 / 0 1 0 0 8 / 0 5 / 2 0 0 4 3 4 0 / 8 2 / 0 1 0 8 / 1 0 / 2 0 0 4 0 8 0 4 / 8 2 / 0 0 8 / 1 3 / 2 0 0 4 2 0 Zecoo: Trade Volume 3 0 4 / 8 2 / Zecoo : Price 0 0 8 / 1 8 / 2 0 0 4 2 0 6 4 0 / 8 2 / 0 8 / 2 3 / 2 0 0 4 0 3 0 1 4 0 / 9 2 0 8 / 2 6 / 2 0 0 4 / 0 0 0 3 0 4 / 0 8 / 3 1 / 2 0 0 4 9 2 / 0 0 0 8 0 4 0 9 / 0 3 / 2 0 0 4 / 9 2 / 0 1 0 3 4 0 9 / 0 8 / 2 0 0 4 0 / 9 2 / 0 1 0 6 0 9 / 1 3 / 2 0 0 4 4 0 / 9 2 / 0 2 0 0 9 / 1 6 / 2 0 0 4 2 0 4 / 9 2 / 0 2 0 9 / 2 2 / 2 0 0 4 0 8 1 4 / 0 2 / 0 0 0 9 / 2 8 / 2 0 0 4 0 1 1 4 / 0 2 / 1 0 / 0 1 / 2 0 0 4 0 0 0 6 1 4 / 0 2 1 0 / 0 6 / 2 0 0 4 / 0 1 0 2 4 1 / 0 1 0 / 1 2 / 2 0 0 4 2 / 0 1 0 5 4 1 / 1 0 / 1 5 / 2 0 0 4 0 2 / 0 2 0 0 1 4 1 0 / 2 0 / 2 0 0 4 / 0 2 / 0 2 0 5 1 0 / 2 5 / 2 0 0 4 1 4 / 1 2 / 0 0 0 1 1 / 0 2 / 2 0 0 4 2 4 / 2 0 0 4 3

Zecoo: Margin Buy Balance 1 6 , 0 0 0 1 4 , 0 0 0 1 2 , 0 0 0 1 0 , 0 0 0 8 , 0 0 0 6 , 0 0 0 4 , 0 0 0 2 , 0 0 0 0 6 3 0 7 3 0 7 4 1 8 5 2 9 / 1 2 2 / 1 1 2 / / 1 2 2 8 / / / 9 / / / 0 0 / / / / 8 8 8 / 9 9 9 1 1 0 0 0 4 / / / 4 / / / / / 1 1 1 0 4 4 4 0 4 4 4 4 4 / / / 0 0 0 0 0 0 0 0 0 0 4 4 4 2 0 0 0 2 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 0 0 0 2 2 2 What’s going on? • First, after announcement, price goes up • Then, price goes down by the ex-date of sp l its • After the ex-date, the price goes up again. • Finally, the price goes back to the base line, before announcement level. 4

What does it mean? • Neutral event on the price level – In a few months span, stock splits do not change the share price level on the average. • Risk increased – For a while, however, splits make volatility skyrocketed. • Investors love it. – Trade volume also tremendously increased. Stock Splits: Effects on the Price of Shares • Traditional view – No effect: efficient market should not react – Byun and Rozeff (2003) • Information view – Stock splits announcement conveys the information to the investors – positive or negative • Liquidity view – Small size orders possible, then the breadth of investors widen – positive • Supply side view – Profitable for brokers: suitable share price level – Schultz (2000) – positive 5

Stock Splits in Japan • Traditionally: the stock dividends – Some companies still cater to these investors. – In this case, effective dividends rate would goes up (because keeping the dividends size per share fixed). • Recent cases: different – shares without dividends – Large size of factor: typically 100 – Suddenly popular, especially among growth stocks and small cap Revisionist view Are Japanese investors different (crazy)? • Traditional stock dividends: information view is applicable – positive news: increase the dividends level • Recent wild event: no established view applicable – Liquidity view: the event is before the ex-dates (indeed lowering liquidity) – Supply side view: after the ex-dates, trade volume goes down to the original level • We need a different view 6

The Game • Our interpretation: this is just a game – Everybody knows that the price up and then down. – Rule of the game: how to make money in the up and down valley by the ex-dates. – However, most investors do not know when the game starts. – Furthermore, they do not know which game would be played: – Even after splits announcement, investors are not sure whether this split event for the particular stock become the game. How to make money in this game? • “Smart” Money: – Traditional finance theorists and Arbitrageur: – Sell short after announcement • Insiders: – Buy before announcement • Behavioral finance economists: – Write a paper 7

The Most profitable Strategy: The Mover • Smartest Money: The Mover – Buy first, then he blows a whistle and makes other investors start the game. • Arbitrageur: tough time since short sell restricted in most games • Insiders: even they are not sure whether the game starts or not. Stupid Individual investors • They might be smarter than Arbitrageur. – Join the game in the early stage and run, that is, early buy and sell before crush. – The great chance of making a large amount of profit: can be more profitable than arbitrage – However, it is very risky because they might fail to get out the game before the end. • They have the great reason to join the game – They can be rational if they are smarter than other game players. 8

Our Potential Contribution • Suggesting • Existence of inefficient market • The specific behavior of some investors – which makes market inefficient although those behaviors themselves not necessary irrational • Bubble: we might be able to understand – the mechanism of bubble – How to make or start a bubble – Why investors willingly join a bubble Data • Event – Stock splits in 2003 and 2004 among public companies traded in Japan. – 526 events 9

Variables • Dependent variable: – Peak Height : raw return from the announce day to the day with the highest price • Independent variables: – Splits factor: from 1.1 to 1000 – Float ratio: the ratio of the number of shares that a shareholder own in small size, less than 50 units – Short sell: the dummy for the stock without short sell restriction – Pre-return: raw return before the announcement (7 days) – Margin buy: the ratio of the accumulated amount of margin buying on the announce day to one on the average before – Trade Increase: the ratio of trade volume after announce day to one before Result • Peak is higher if • The larger splits factor • The higher float ratio • Short sell restricted • Higher Pre-return • Larger size of margin buy before the announcement (less significant) • Also • Trade volume increased more if the peak is higher 10

Recommend

More recommend