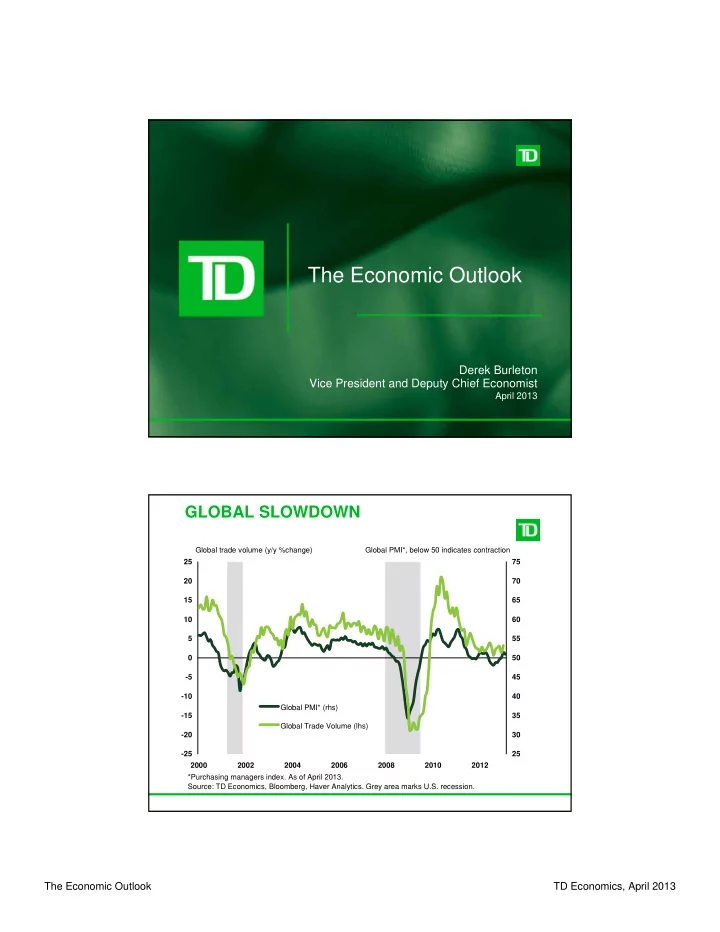

The Economic Outlook Derek Burleton Vice President and Deputy Chief Economist April 2013 GLOBAL SLOWDOWN Global trade volume (y/y %change) Global PMI*, below 50 indicates contraction 25 75 20 70 15 65 10 60 5 55 0 50 -5 45 -10 40 Global PMI* (rhs) -15 35 Global Trade Volume (lhs) -20 30 -25 25 2000 2002 2004 2006 2008 2010 2012 *Purchasing managers index. As of April 2013. Source: TD Economics, Bloomberg, Haver Analytics. Grey area marks U.S. recession. The Economic Outlook TD Economics, April 2013

GLOBAL GROWTH OUTLOOK Real GDP Y/Y % Chg. 6 5 2012 2013 2014 4 3 2 1 0 -1 Canada U.S. Europe Developing Economies Source: TD Economics. Forecast by TD Economics as of March 2013. EMERGING MARKETS STILL IN THE DRIVER’S SEAT GDP Growth, YOY % Chg. 10 Advanced Developing Forecast 8 6 4 2 0 -2 -4 -6 2002 2004 2006 2008 2010 2012E 2014F Source: IMF, Forecast by TD Economics as of March 2013. The Economic Outlook TD Economics, April 2013

COMMODITIES TO BE SUPPORTED BY IMPROVING GLOBAL DEMAND** US$/mmbtu US$/Barrel 15 140 Forecast 120 12 100 9 80 60 6 40 3 Natural Gas - Henry Hubb (lhs) 20 Crude Oil - WTI (rhs) 0 0 2002 2004 2006 2008 2010 2012 2014 Source: Haver Analytics, TD Economics. As of April 2013. HEAVY OIL DIFFERENTIAL HAS IMPROVED WTI-WCS Spread, $ 40 35 30 Average Spread Since May 2008 25 20 15 10 5 0 2008 2009 2010 2011 2012 Note: Prices are expressed as monthly averages. Source: Bloomberg and TD Economics. The Economic Outlook TD Economics, April 2013

FISCAL DRAG TO HOLD BACK US GROWTH U.S. real GDP growth; year-over-year % chg. 8 Without Fiscal Drag TD Forecast 6 Forecast 4 2 0 -2 -4 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Source: BEA, Forecast by TD Economics. As of March 2013. FEDERAL RESERVE HAS THE TAPS TURNED ON Federal Reserve balance sheet, $U.S. (Trillions) 3.5 Mortgage backed securities Treasury securities 3.0 Liquidity programs & other assets Agency securities 2.5 2.0 1.5 1.0 0.5 0.0 2007 2008 2009 2010 2011 2012 2013 Source: Federal Reserve Board; As of April 2013. The Economic Outlook TD Economics, April 2013

CONSUMER DELEVERAGING IS ABATING Consumer credit; year-over-year % change 10 Consumer credit Consumer credit net of defaults 8 6 4 2 0 -2 -4 -6 -8 -10 -12 2007 2008 2009 2010 2011 2012 2013 Includes auto loans, bankcard, retail credit Source: Equifax, Moody's Analytics, TD Economics. As of April 2013. HOUSE PRICES FINALLY TURNING A CORNER U.S. home prices; year-over-year % change 20 S&P Case-Shiller HPI* 15 CoreLogic HPI 10 5 0 -5 -10 -15 -20 2002 2004 2006 2008 2010 2012 Source: CoreLogic, S&P Case-Shiller, Haver Analytics. As of April 2013. *Twenty city composite. The Economic Outlook TD Economics, April 2013

CANADA’S LARGE MARKETS HAVE HELD UP RELATIVELY WELL Annual growth rate of employment, 2007-2012, % 3.5 2.9 3.0 2.5 2.3 2.1 2.0 1.8 1.7 1.4 1.5 1.2 1.1 1.0 0.5 0.0 Edmonton Ottawa/Gatineau Québec Calgary Toronto Vancouver Winnipeg Montréal Source: Statistics Canada. CONSUMERS AND GOVERNMENTS CAN NO LONGER BE THE ENGINES OF GROWTH Average annual contribution to real GDP growth, % 6 Business Investment and Exports Consumers, Governments and Residential Investment Forecast 4 2 0 -2 2004-2007 2008-2011 2012-2015 Source: Statistics Canada, Haver Analytics Forecast by TD Economics as of December 2012 The Economic Outlook TD Economics, April 2013

NON-RESIDENTIAL SECTOR AT THE TOP OF THE GROWTH LEADERBOARD Non-res Construction Manufacturing Wholesale Trade Prof. Services Primary Accom. & Food Svs. Retail Trade Financial Services Public Admin Res. Construction 2013-2014 average annual growth, % -2 -1 0 1 2 3 4 5 Source: Statistics Canada, TD Economics; Forecast as of December 2012. HOUSEHOLD DEBT TO GROW MORE IN LINE WITH INCOME Year-over-Year % Change % 180 14 Household Debt-to-Income Ratio (lhs) 160 12 Household Debt Growth (rhs) 140 10 Fcst* 120 8 100 80 6 60 4 40 2 20 0 0 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Source: Statistics Canada. Forecast by TD Economics as of March 2013. The Economic Outlook TD Economics, April 2013

INTEREST RATES TO REMAIN LOWER FOR LONGER % 7 US Federal Funds Target Rate 6 Bank of Canada Overnight Rate 5 Forecast 4 3 2 1 0 2000 2002 2004 2006 2008 2010 2012 2014 Source: Bank of Canada/Haver Analytics. Forecast by TD Economics as of March 2013. BOND YIELD CURVE TO GRADUALLY SHIFT UPWARDS Yield on Canadian bonds, % 3.5 Current End of 2013 3.0 End of 2014 2.5 2.0 1.5 1.0 0.5 0.0 Overnight 3-month 2-year 5-year 10-year 30-year Rate Source: Bloomberg, TD Economics. As of March 2013. The Economic Outlook TD Economics, April 2013

CANADIAN EXPORTS TO PICK UP MODERATELY IN 2013-14 Real exports, Y/Y% change 15 Forecast 10 5 0 -5 -10 Resources Other Goods and Services -15 -20 -25 2002 2004 2006 2008 2010 2012 2014 Source: Statistics Canada/Haver Analytics. Forecast by TD Economics as of April 2013. CANADIAN DOLLAR TO WEAKEN FURTHER US$/C$ 1.10 Forecast 1.00 0.90 0.80 0.70 0.60 2002 2004 2006 2008 2010 2012 2014 Source : Bank of Canada; Forecast by TD Economics as of April 2013. The Economic Outlook TD Economics, April 2013

CANADIAN CORPORATE BALANCE SHEETS ARE HEALTHY … Debt-to-Equity Ratio Quick Ratio* 1.0 1.2 Debt-to-Equity (lhs) Quick Ratio* (rhs) 0.9 1.0 0.8 0.8 0.7 0.6 0.6 0.4 0.5 0.2 0.4 0.0 1995 1998 2001 2004 2007 2010 Source: Statistics Canada. Q4 2012. *Quick Ratio = Liquid assets / Current liabilities … WHICH AUGURS WELL FOR LONGER- TERM CAPITAL SPENDING PLANS Annual % Change 15 Forecast 10 5 0 -5 Business Investment GDP Growth -10 -15 -20 2002 2004 2006 2008 2010 2012 2014 Source: Statistics Canada, Haver Analytics. Forecast by TD Economics as of March 2013. The Economic Outlook TD Economics, April 2013

BUT ALBERTA BUSINESSES TO HOLD OUT ON CAPITAL OUTLAYS IN 2013 Alberta Private and Public Capital Expenditure Intentions, Y/Y% Change 14 2012 Actual 12 2013 Expected Sectoral Breakdown 10 8 6 4 2 0 -2 -4 -6 Total Construction Machinery & Private Public Equipment Source: Statistics Canada. ALBERTA GOVERNMENT TARGETS RETURN TO SURPLUS IN 2014-15 Alberta Government Budget Balance, % of GDP Alberta Net Debt, % of GDP 4 10 Forecast Net Debt 2 5 Government Budget Balance 0 0 -2 -5 -4 -10 -6 -15 05-06 06-07 07-08 08-09 09-10 10-11 11-12 12-13f* 13-14f Source: 2012 and 2013 Government Budgets and Fiscal Updates, TD Economics. The Economic Outlook TD Economics, April 2013

MODEST JOB CREATION AHEAD IN EDMONTON Employment growth, % 7 Forecast 6 5 Canada Edmonton 4 3 2 1 0 -1 -2 2010 2011 2012 2013F 2014F Source: Statistics Canada, Forecast by TD Economics. JOBLESS RATE TO HOLD FAIRLY STEADY Unemployment Rate, % 9 Forecast 8 Canada Edmonton 7 6 5 4 3 2010 2011 2012 2013F 2014F Source: Statistics Canada, Forecast by TD Economics. The Economic Outlook TD Economics, April 2013

ROOM FOR HOUSING MARKET TO GROW Edmonton Existing Home Sales, Units Edmonton Existing Home Prices, Level 25,000 400,000 FCST 350,000 20,000 300,000 250,000 15,000 200,000 10,000 150,000 100,000 5,000 50,000 0 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: CREA, Forecast by TD Economics as of April 2013. ACTIVE DEVELOPMENT CYCLE IN THE REGION Edmonton Building Permits, 000's of C$ 500,000 450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: CMHC, Statistics Canada The Economic Outlook TD Economics, April 2013

TD Economics www.td.com/economics This report is provided by TD Economics for customers of TD Bank Group. It is for information purposes only and may not be appropriate for other purposes. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. The report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. The Economic Outlook TD Economics, April 2013

Recommend

More recommend