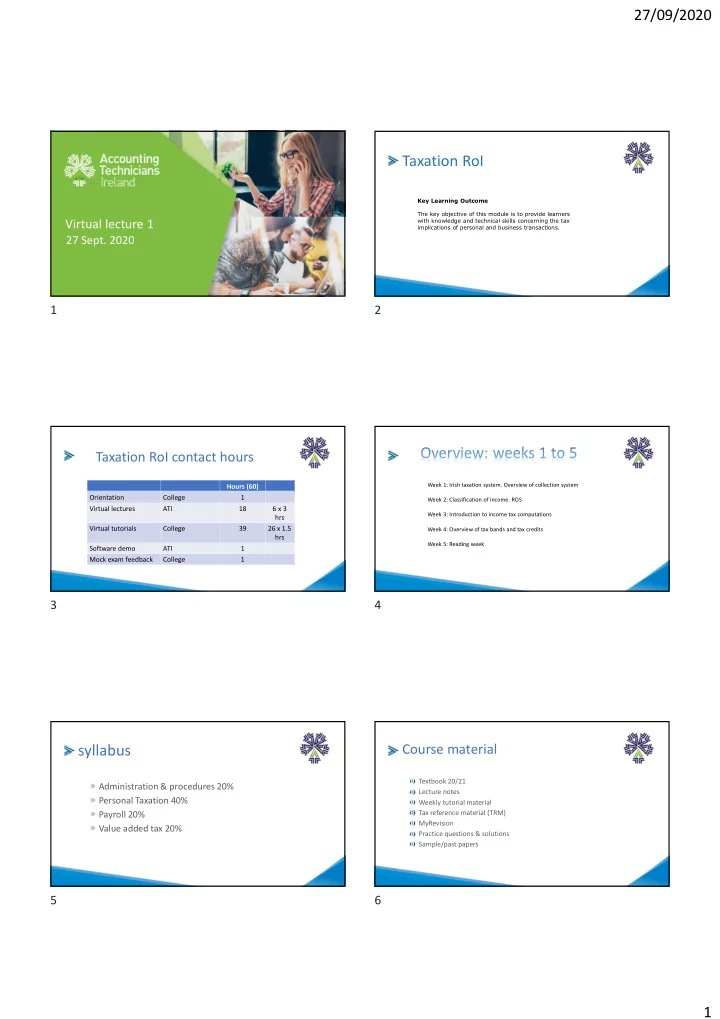

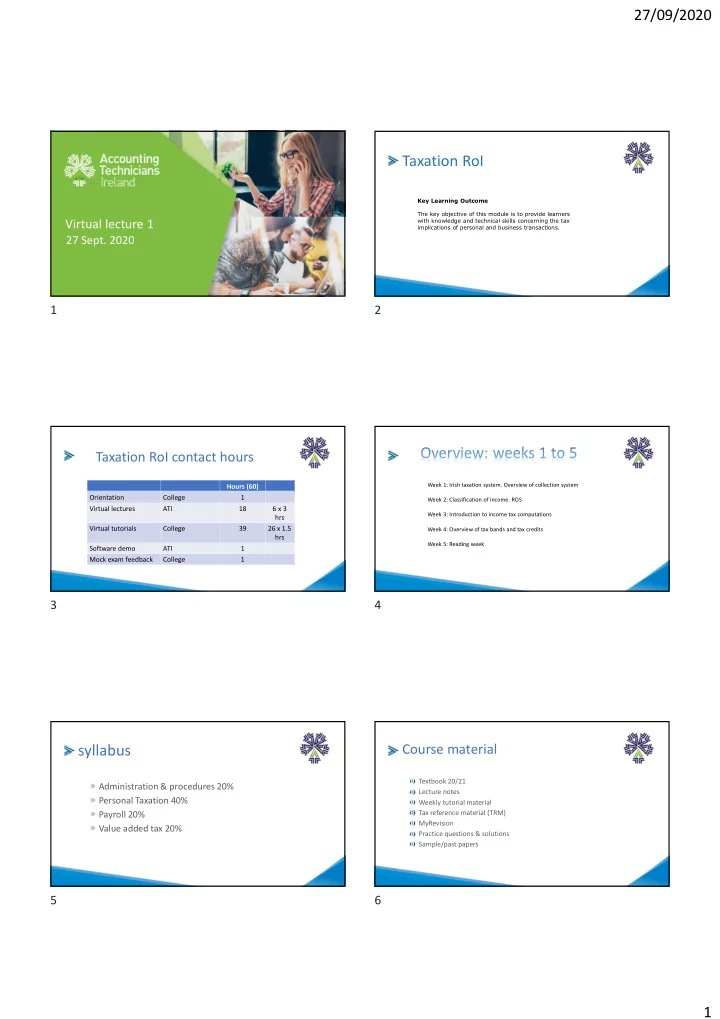

27/09/2020 Taxation RoI Key Learning Outcome The key objective of this module is to provide learners with knowledge and technical skills concerning the tax Virtual lecture 1 implications of personal and business transactions. 27 Sept. 2020 1 2 Taxation RoI contact hours Week 1: Irish taxation system. Overview of collection system Hours (60) Orientation College 1 Week 2: Classification of income. ROS Virtual lectures ATI 18 6 x 3 Week 3: Introduction to income tax computations hrs Virtual tutorials College 39 26 x 1.5 Week 4: Overview of tax bands and tax credits hrs Week 5: Reading week Software demo ATI 1 Mock exam feedback College 1 3 4 syllabus Course material Textbook 20/21 Administration & procedures 20% Lecture notes Personal Taxation 40% Weekly tutorial material Payroll 20% Tax reference material (TRM) MyRevision Value added tax 20% Practice questions & solutions Sample/past papers 5 6 1

27/09/2020 Taxation exam Examination topics Payroll The Paper consists of six questions which will examine all key syllabus elements to ensure that learning outcomes Income Tax computation are achieved Self-employed computation Section A - three compulsory questions VAT Section B - three questions - answer two General/Theory All questions carry equal marks Multi-choice 7 8 20/21 exam Examiner liaison day Week 1 -Irish Exam location taxation system Format: book, input 9 10 Definition of taxation • A tax is a compulsory financial charge, or some other type of levy imposed on an individual or legal entity by a governmental organisation in order to fund government and other public expenditure. Origins of tax • Failure to pay, along with evasion of or resistance to taxation, is usually punishable by law. 11 12 2

27/09/2020 Tax Law Types of tax Direct taxation Income tax Corporation tax Taxes consolidation act 1997 Capital gains tax VAT consolidation act Capital acquisitions tax Case law Indirect taxation Value Added tax (VAT) Stamp duty Customs duty Our course and exam based on 2020 tax legislation Excise duties 13 14 Revenue commissioners Mandate/work Statute/Government European Union Week 1 - Tax Assessing and collecting taxes and duties collection system Administering the customs regime Co-operation with other state agencies Agency work for other departments Collection of PRSI for DSP Provision of policy advice 15 16 Office of the Revenue Tax collection system Commissioners Self-assessment 16 divisions Applies to the income of chargeable persons. Regional divisions The taxpayer makes direct payments to the Collector General. Large cases division Collector General Tax appeals commission (TAC ) 17 18 3

27/09/2020 Tax collection system Tax collection system These are amounts of tax deducted from a payment Withholding taxes at source by the person making the payment and are generally deducted at a flat rate. Pay as You Earn (PAYE) is deducted at source Where they are deducted, they are normally from all income earned from employment. available as a tax credit for the individual receiving The employer has a responsibility to calculate and deduct the correct amount of Income Tax, the payment against his total Income Tax liability for PRSI and Universal Social Charge from an the year. employee’s earnings and pay this amount over to the Revenue Commissioners each month. If an employee has no other sources of income, all their tax will be collected and paid Examples are: through this system. Deposit interest retention tax (DIRT) Relevant contracts tac (RCT) Professional services withholding tax (PSWT) Dividend withholding tax (DWT) 19 20 Self-assessment ‘Pay & File’ Chargeable persons include Chargeable persons fall within the ‘Pay & File’ system, which means that they have a number of tax obligations each year: • All self-employed individuals. – File an Income Tax return for the previous year of assessment, – Self-assess, i.e. calculate their Income Tax liability, • Individuals receiving income from sources where some or all of the tax cannot be collected through the PAYE system, for example; – Make the following tax payments – Profits from rents (schedule D case V) 1. Preliminary Income Tax for the current year of assessment. – Investment income (schedule D case III, case IV/Schedule F) 2. Balance of Income Tax for the previous year of assessment. – Foreign income and foreign pensions – Maintenance payments made to separated spouses / civil partners The chargeable person must meet these obligations without being requested by the – Fees and other income not subject to the PAYE system Revenue Commissioners to do so. Penalties can be charged by the Revenue Commissioners if the chargeable person fails to do • All Proprietary Directors (15%) so. The system is therefore referred to as a ‘self-assessment’ system. 21 22 Preliminary tax Preliminary tax is an advance payment of the Income Tax liability for the current tax year. The taxpayer is obliged to calculate an estimate of his tax liability for the current year and pay that amount to the Collector General before 31 October of that year. Week 2 – Options available to an individual to choose from when deciding how much to pay: 1. 90% of the final (self-assessed) Income Tax liability for the current year. classification of 2. 100% of the (self-assessed) tax liability for the previous year. income 3. 105% of the (self-assessed) tax liability for the pre-preceding year (if paying by direct debit). The taxpayer may choose the lowest payment calculated using the three options. 23 24 4

27/09/2020 Tax year Main classifications The income tax year is the same as the For taxation purposes income is separated by source calendar year: 1 st January to 31 st December Categorised first into schedules Then subdivided into cases 25 26 Exempt income SCHEDULE CASE SOURCE OF INCOME Schedule D Case I Income from a trade (e.g. a self-employed carpenter) Schedule D Case II Income from a profession (e.g. a self-employed solicitor) Schedule D Case III Investment income not subject to tax at source Foreign income – foreign employments, foreign rental income and Certain income is exempt for Income Tax. The following exceptions are foreign investment income the most common: Schedule D Case IV Irish deposit interest subject to DIRT Covenant income received Other miscellaneous income (e.g. proceeds from illegal activities) Social Welfare Child Benefit Payments Statutory Redundancy Payments Schedule D Case V Irish rental income Lottery and Betting winnings Life Assurance Proceeds Interest paid on An Post Saving Certificates and Instalment Saving Scheme Schedule E n/a Irish employments, pensions and directors’ fees Qualifying Artists Income up to a certain limit Income from Qualifying Childcare services up to €15,000 per annum Certain rental income up to €14,000 per annum Schedule F n/a Dividends from Irish resident companies 27 28 ROS ROS includes facilities to: • File returns online Week 2 – • Make payments by laser card, debit instruction or by online banking for Income Tax Revenue Online • Obtain online details of personal/clients Revenue accounts • Calculate tax liability Services (ROS) • Conduct business electronically • Claim repayments 29 30 5

27/09/2020 ROS ROS Advantages of Electronic Filing for Customers Payment methods available to taxpayers using ROS: Avoidance of duplication of effort and substantially reduced compliance costs Reduction in paper handling, photocopying and compliance costs •ROS Debit Instruction (RDI) More effective and efficient use of time More accurate processing of returns •Laser / Debit / Credit card Access to your own Revenue account from your own PC 24-hour, 365-day access to Revenue •Online Banking Calculation facilities to assist customers . Instant acknowledgement of returns Faster processing of returns and payments Speedier repayments 31 32 Income tax computation The computation will consist of the following sections: A. Income All income, including exempt income, should be shown gross in this section. Week 3 – IT Also included will be any allowances and other tax reliefs which can be deducted gross from income. B. Calculation of Total Tax 20% standard rate, 40% higher rate and 33% for DIRT. computations C. Non-refundable Tax Credits Most of these are listed on page 141 of the TRM (Tax Reference Material). D. Recoverable Tax Credits Usually amounts of tax already deducted E. Tax Payable (Repayable) B minus C & D 33 34 Calculation of Total Tax Personal tax computations Full Pro-forma There are currently two rates of Income Tax that apply, 20% is the standard rate of tax and 40% is the higher rate of tax. Textbook pages 18 - 19 The amount of income taxed at the standard rate is determined by an individual’s tax band (also known as the standard rate cut off point). 35 36 6

Recommend

More recommend