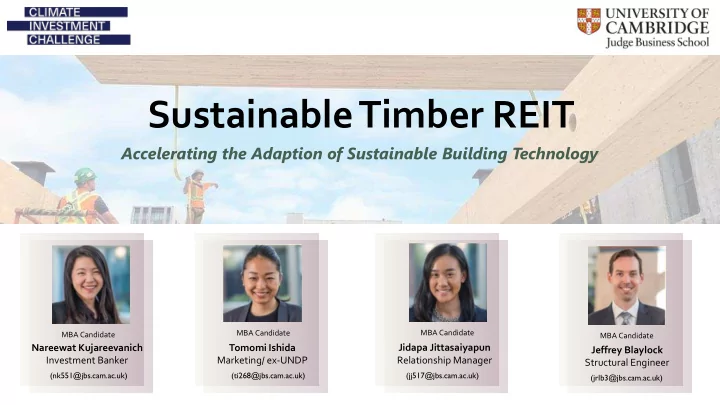

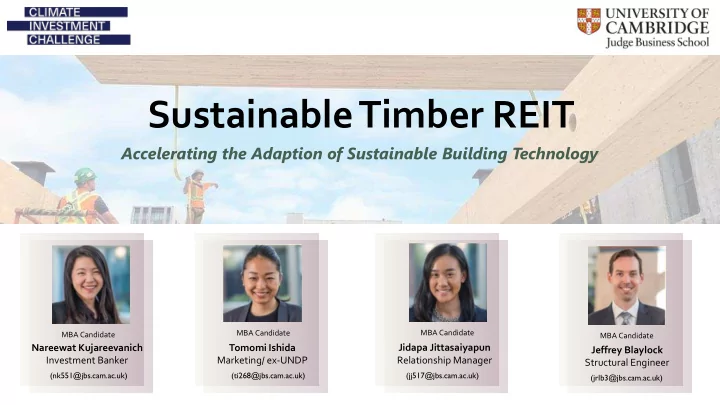

Sustainable Timber REIT Accelerating the Adaption of Sustainable Building Technology MBA Candidate MBA Candidate MBA Candidate MBA Candidate Nareewat Kujareevanich Tomomi Ishida Jidapa Jittasaiyapun Jeffrey Blaylock Investment Banker Marketing/ ex-UNDP Relationship Manager Structural Engineer 1 (jj517@jbs.cam.ac.uk) (nk551@jbs.cam.ac.uk) (ti268@jbs.cam.ac.uk) (jrlb3@jbs.cam.ac.uk)

Climate challenge in urban development Real estate development serving the demand for urbanization contributes significantly to global CO2. Urban Population CO2 Emissions +2.5 Billion +100 Billion tonnes

Real Estate Value Chain: Construction Material Supply Chain contributes enormous CO2 emission along the real estate value chain. Investment Development Use Material Supply Chain Construction 4

Timber is an alternative sustainable material to tackle the CO2 loophole along the real estate value chain Traditional Timber = Sustainable Construction Materials Construction Materials Tested technology • Precedents up to 18 storeys Positive • CO2e can be reduced by Masonry Concrete climate impact up to 50% • Competitive cost compared Competitive cost with traditional material Steel • Responsible forest No deforestation 6 management system

Timber is a proven solution for a sustainable urban developement Timber Building Further Benefits Sufficient Strength and Stability 80% lighter than concrete Strong Fire Protection 20% faster to construct 80% less site deliveries

This Proven Technology is being adopted globally 2017 2018 2019 Brock Commons, Canada 25 King St., Australia The MjösaTower, Norway Student Accommodation, 18-storeys Office, 10-storeys Residential, 18-storeys 10

Murray Grove, 9-storeys Dalston Works, 10-storeys The UK market has the potential for growth The Import Building, 10-storeys The Cube, 10-storeys 11

Sustainable Timber REIT unlocks existing bottlenecks and drive timber adoption worldwide Sustainable Timber REIT ❖ REIT investing in only timber buildings ❖ Partner with multi-developers with first right of refusal to buy timber buildings meeting REIT investment criteria . ❖ Grade A office or residential (built-to-rent) properties generating rental income at the time of acquisition

Sustainable Timber REIT unlocks existing bottlenecks and drive timber adoption worldwide Short Term Impact Long Term Impact Raise public awareness Mobilize capital of sustainable material to real estate from ESG investors to timber players building developer Drive timber cost down Incentivize partnered due to economies of scale developer to replace traditional materials Accelerate worldwide adoption with timber materials of timber buildings

Sustainable Timber REIT fulfills UN sustainable development goals

Investment highlight 1 Capture demand for grade A office & residential property 2 Competitive returns with potential carbon tax mitigation 3 Capitalize on growing green building market Sustainable Timber REIT 4 A lockstep between urbanization Tackle CO2 emission problem and carbon-neutral property development 5 Strong growth potential from partnership structure

A lockstep innovation provides a competitive financial return with tangible global climate impact Innovative verified technology Attractive investment Positive climate impact Scalability 17

This practical climate solution is ready for global adaption.

And now is the time to discuss what our future looks like. Thank You.

Appendix

Solution - Sustainable Timber REIT What is Sustainable Timber REIT ? How does Sustainable Timber REIT combat with CO2e? ✓ REIT investing specifically in only building constructed from timber material. REIT constantly acquires timber buildings from ✓ Financial tool to accelerate the adaptation of timber building partnered and contracted developers. worldwide. ✓ Financial vehicle to mobilize capital to timber building developer for further property development Large orders from developers increase timber material market size and production capacity. Why are timber buildings not widely constructed? Economies of scale pushes timber price down. Lack of awareness from property developers, contractors and tenants. Timber material eventually has a cost advantage Contractors do not have experiences and expertise over traditional materials. on timber materials. Timber material is widely used for construction and Cost is competitive but not lower than traditional reduce CO2e. materials such as concrete & metal 23 23

Fund Investment Profile and Investment Structure Multi-Sponsored REIT Investment Structure Fund Investment Profile Fund Objective To provide long-term capital appreciation and sustainable income Investment Geography United Kingdom Fund Size GBP 500 Million Fund Life 20 years Target Investors Institutional investors who want to integrate ESG factors into their investment portfolios Distribution Policy Semi-annually, if any. Subject to the availability of income, the Manager has the discretion to declare distribution at a higher frequency. Investment Criteria ✓ Grade A office building or built-to-rent residential properties (low-mid rise) in growing urbanization area ✓ Generating rental income at the time of acquisition ✓ Completely constructed timber buildings with occupancy rate of at least 95% and competitive rental revenue with at least 2% growth rate. ✓ Tenancy agreement are in place with minimum term of 3-5 years for office property and 0.5-1 year for BTR property ✓ Experienced property manager appointed 24

Financial Analysis UK REIT Dividend Yield Financial Assumption and Projected Return Average Total asset value at IPO GBP 714 million OFFICE REIT LISTED IN LSE 6.68 % Target capital structure Debt to total asset of 20-30% Dividend Yield 8.90% 7.70% 6.60% REIT NAV GBP 500 Million 3.50% GBP 214 Million (assuming D/A of 30%) • Interest rate 3-4% Debt value • Bullet and roll-over scheme DLN WKP GPOR BLND • GBP 25 - 30 Million p.a. • Annual growth rate of 2% (align with UK Projected net Average distributable cashflow inflation rate of 1.5% and JLL’s forecast RESIDENTIAL REIT LISTED IN LSE 5.07 % rental growth rate of 3.4%) Dividend Yield 5.54% 5.45% 4.82% 4.48% Appreciate 2% p.a. (align with UK inflation rate Projected NAV of 1.5% and JLL’s forecast rental growth rate of 3.4%) 5 - 6% depending on the weight between office Target dividend yield and residential properties and secured interest rate. Dividend yield will reflect investment risk RESI ESP PRSP DIGS Source : Bloomberg 28 Feb 2020, prior Covid-19 effect 25

Timber is a proven solution for a sustainable urban developement With existing precedents and years of research, the international building code will be amending the restriction on timber buildings by increasing the allowable height to 18-storeys. This will de-risk the use of mid-rise timber buildings and create an opportunity to change how we construct our cities Further Benefits Sufficient Strength and Stability Precedents to over 18 storeys Feasible for up to 35 80% lighter storeys using new mass than concrete timber technology 20% faster to construct Murray Grove Completed: 2009 Strong Fire Protection Increased thermal efficiency Charring creates protective layer around interior of large timber element Timber Cross-section 80% less site Mjøstårnet deliveries Completed: 2019 Protective Layer Brock Commons Completed: 2018 Source : Think Wood, 2019 26

Recommend

More recommend