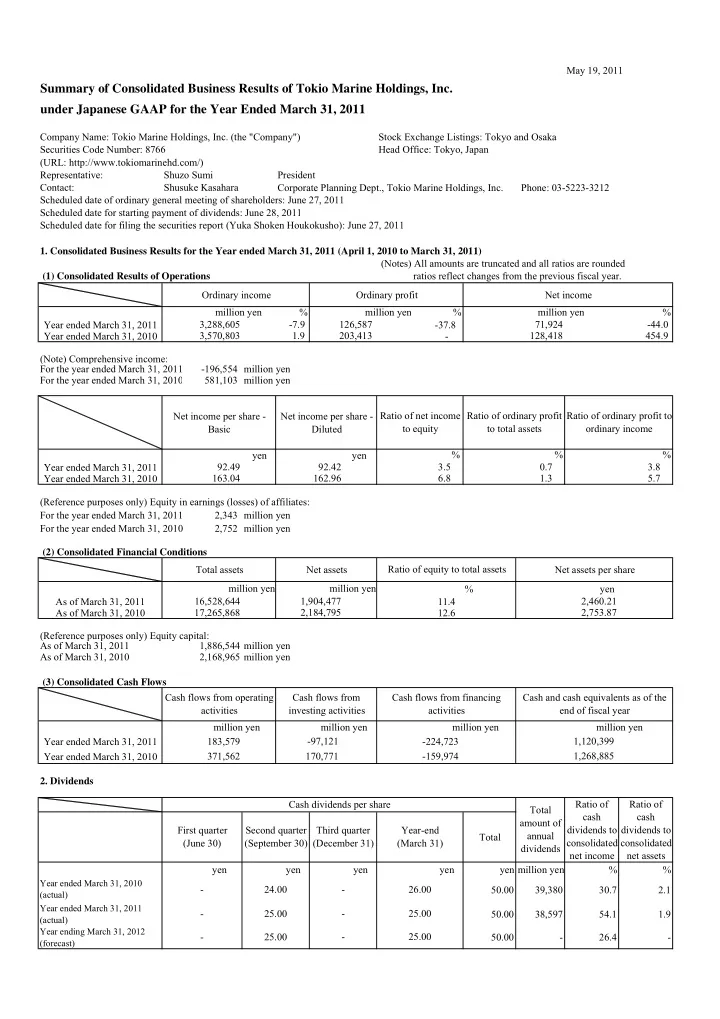

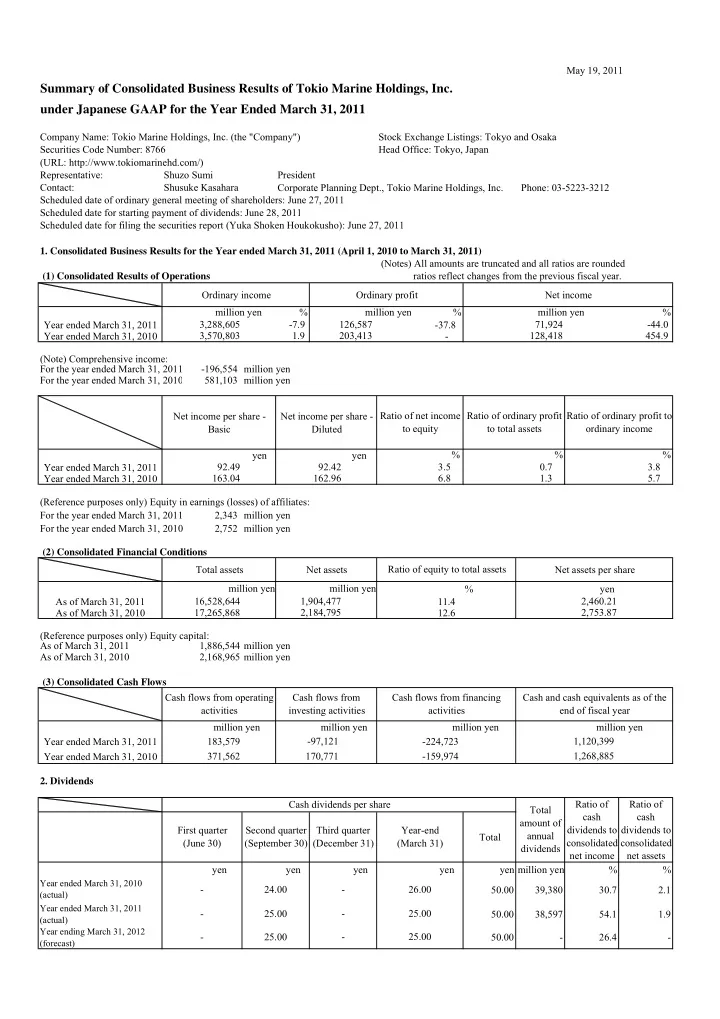

May 19, 2011 Summary of Consolidated Business Results of Tokio Marine Holdings, Inc. under Japanese GAAP for the Year Ended March 31, 2011 Company Name: Tokio Marine Holdings, Inc. (the "Company") Stock Exchange Listings: Tokyo and Osaka Securities Code Number: 8766 Head Office: Tokyo, Japan (URL: http://www.tokiomarinehd.com/) Representative: Shuzo Sumi President Contact: Shusuke Kasahara Corporate Planning Dept., Tokio Marine Holdings, Inc. Phone: 03-5223-3212 Scheduled date of ordinary general meeting of shareholders: June 27, 2011 Scheduled date for starting payment of dividends: June 28, 2011 Scheduled date for filing the securities report (Yuka Shoken Houkokusho): June 27, 2011 1. Consolidated Business Results for the Year ended March 31, 2011 (April 1, 2010 to March 31, 2011) (Notes) All amounts are truncated and all ratios are rounded ratios reflect changes from the previous fiscal year. (1) Consolidated Results of Operations Ordinary income Ordinary profit Net income million yen % million yen % million yen % Year ended March 31, 2011 3,288,605 -7.9 126,587 -37.8 71,924 -44.0 3,570,803 1.9 203,413 128,418 454.9 Year ended March 31, 2010 - (Note) Comprehensive income: For the year ended March 31, 2011 -196,554 million yen For the year ended March 31, 2010 581,103 million yen Ratio of net income Ratio of ordinary profit Ratio of ordinary profit to Net income per share - Net income per share - Basic Diluted to equity to total assets ordinary income yen yen % % % Year ended March 31, 2011 92.49 92.42 3.5 0.7 3.8 163.04 162.96 6.8 1.3 5.7 Year ended March 31, 2010 (Reference purposes only) Equity in earnings (losses) of affiliates: For the year ended March 31, 2011 2,343 million yen For the year ended March 31, 2010 2,752 million yen (2) Consolidated Financial Conditions Ratio of equity to total assets Total assets Net assets Net assets per share million yen million yen % yen As of March 31, 2011 16,528,644 1,904,477 11.4 2,460.21 17,265,868 2,184,795 2,753.87 As of March 31, 2010 12.6 (Reference purposes only) Equity capital: As of March 31, 2011 1,886,544 million yen As of March 31, 2010 2,168,965 million yen (3) Consolidated Cash Flows Cash flows from operating Cash flows from Cash flows from financing Cash and cash equivalents as of the activities investing activities activities end of fiscal year million yen million yen million yen million yen Year ended March 31, 2011 183,579 -97,121 -224,723 1,120,399 Year ended March 31, 2010 371,562 170,771 -159,974 1,268,885 2. Dividends Ratio of Cash dividends per share Ratio of Total cash cash amount of First quarter Second quarter Third quarter Year-end dividends to dividends to annual Total (June 30) (September 30) (December 31) (March 31) consolidated consolidated dividends net income net assets yen yen yen yen yen million yen % % Year ended March 31, 2010 - 24.00 - 26.00 50.00 39,380 30.7 2.1 (actual) Year ended March 31, 2011 - 25.00 - 25.00 50.00 38,597 54.1 1.9 (actual) Year ending March 31, 2012 - 25.00 - 25.00 50.00 - 26.4 - (forecast)

3. Consolidated Business Forecast for the year ending March 31, 2012 (April 1, 2011 to March 31, 2012) (Note) Ratios reflect changes from the same periods in the previous fiscal year. Ordinary income Ordinary profit Net income Net income per share million yen % million yen % million yen % yen For the six months ending 1,700,000 150,000 -1.3 1.2 95,000 -0.2 123.88 September 30, 2011 For the year ending March 3,350,000 1.9 220,000 73.8 145,000 101.6 189.09 31, 2012 4. Others (1) Significant changes with respect to the subsidiaries of the Company during the fiscal year ended March 31, 2011: None (Inclusion/exclusion of specific subsidiaries of the Company resulting in an accompanying change in the scope of consolidation) (2) Changes in accounting policies, procedures and presentations, etc. (a) Changes to reflect amendments of accounting standards and related matters: Yes (b) Changes other than (a): None Note: Please see "Changes in significant matters related to consolidated financial statements" for details. (3) Number of shares issued (common share) (a) Total number of the shares issued (including treasury shares) As of March 31, 2011 804,524,375 shares As of March 31, 2010 804,524,375 shares (b) Number of treasury shares held As of March 31, 2011 37,704,676 shares As of March 31, 2010 16,919,017 shares (c) Average number of shares outstanding During the year ended March 31, 2011 777,623,260 shares During the year ended March 31, 2010 787,605,852 shares (Reference purpose only) Summary of Non-consolidated Business Results of Tokio Marine Holdings, Inc. under Japanese GAAP for the Year Ended March 31, 2011 1. Non-consolidated Business Results for the Year ended March 31, 2011 (April 1, 2010 to March 31, 2011) (Note) Ratios reflect changes from the previous fiscal year. (1) Non-consolidated Results of Operations Operating income Operating profit Ordinary profit Net income million yen % million yen % million yen % million yen % Year ended March 31, 2011 127,806 295.4 121,630 354.4 121,621 353.4 80,226 - Year ended March 31, 2010 32,324 -76.3 26,768 -79.5 26,825 -79.4 44 -100.0 Net income per share - Net income per share - Basic Diluted yen yen 103.16 103.09 Year ended March 31, 2011 Year ended March 31, 2010 0.05 0.05 (2) Non-consolidated Financial Conditions Total assets Net assets Ratio of equity to total assets Net assets per share million yen million yen % yen As of March 31, 2011 2,482,926 2,481,451 99.9 3,234.16 2,492,379 2,491,142 3,161.53 As of March 31, 2010 99.9 (Reference purpose only) Equity capital: As of March 31, 2011 2,480,024 million yen As of March 31, 2010 2,490,040 million yen

2. Non-consolidated Business Forecast for the year ending March 31, 2012 (April 1, 2011 to March 31, 2012) (Note) Ratios reflect changes from the same periods in the previous fiscal year. Ordinary profit Net income Net income per share Operating income Operating profit million yen % million yen % million yen % million yen % yen For the six months ending 25,000 22,000 28.68 -56.7 -59.7 22,000 -59.7 22,000 -59.6 September 30, 2011 For the year ending March 32,000 -75.0 25,000 -79.4 25,000 -79.4 25,000 -68.8 32.60 31, 2012 *Disclosure regarding the execution of the audit process This “Summary of Consolidated Business Results” is outside the scope of the external auditor’s annual audit procedure required by the Financial Instruments and Exchange Act. The audit process has not been completed as of the date of the disclosure in the “Summary of Consolidated Business Results”. *Notes concerning the business forecast and other items Any business forecasts contained in this document are based on information available to the Company as of the date of this document and certain assumptions and actual results may materially differ from the forecasts depending upon various factors. For key assumptions for the business forecasts and other related information, please refer to "Business Results" on page 2 of the Appendix.

Recommend

More recommend