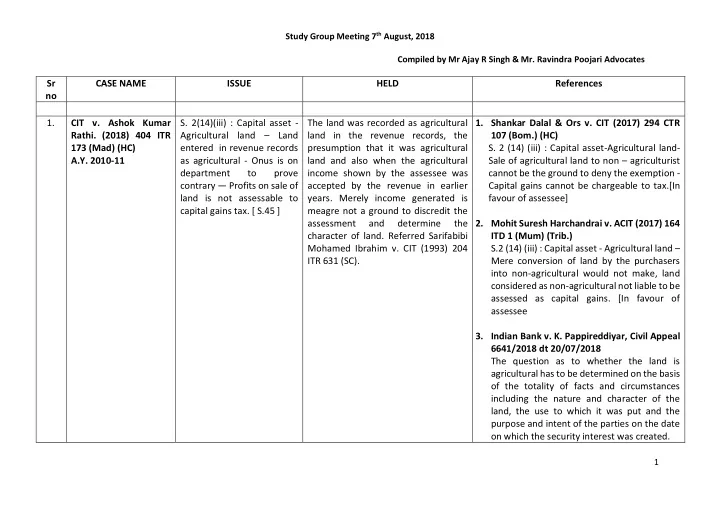

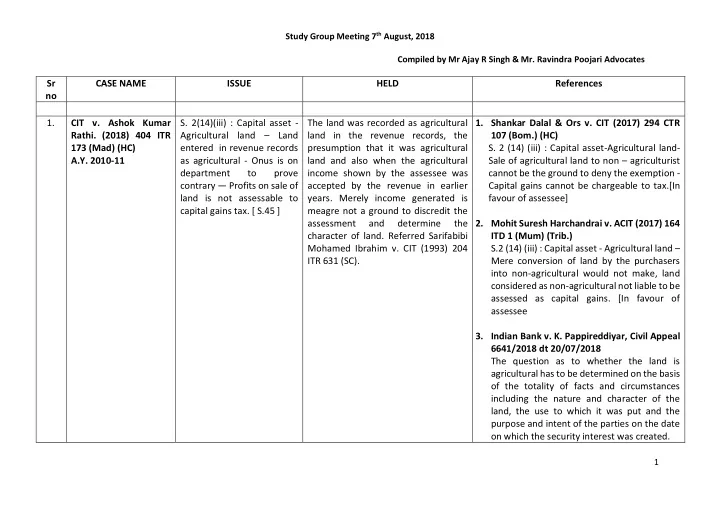

Study Group Meeting 7 th August, 2018 Compiled by Mr Ajay R Singh & Mr. Ravindra Poojari Advocates Sr CASE NAME ISSUE HELD References no 1. CIT v. Ashok Kumar S. 2(14)(iii) : Capital asset - The land was recorded as agricultural 1. Shankar Dalal & Ors v. CIT (2017) 294 CTR Rathi. (2018) 404 ITR Agricultural land – Land land in the revenue records, the 107 (Bom.) (HC) 173 (Mad) (HC) entered in revenue records presumption that it was agricultural S. 2 (14) (iii) : Capital asset-Agricultural land- A.Y. 2010-11 as agricultural - Onus is on land and also when the agricultural Sale of agricultural land to non – agriculturist department to prove income shown by the assessee was cannot be the ground to deny the exemption - contrary — Profits on sale of accepted by the revenue in earlier Capital gains cannot be chargeable to tax.[In land is not assessable to years. Merely income generated is favour of assessee] capital gains tax. [ S.45 ] meagre not a ground to discredit the assessment and determine the 2. Mohit Suresh Harchandrai v. ACIT (2017) 164 character of land. Referred Sarifabibi ITD 1 (Mum) (Trib.) Mohamed Ibrahim v. CIT (1993) 204 S.2 (14) (iii) : Capital asset - Agricultural land – ITR 631 (SC). Mere conversion of land by the purchasers into non-agricultural would not make, land considered as non-agricultural not liable to be assessed as capital gains. [In favour of assessee 3. Indian Bank v. K. Pappireddiyar, Civil Appeal 6641/2018 dt 20/07/2018 The question as to whether the land is agricultural has to be determined on the basis of the totality of facts and circumstances including the nature and character of the land, the use to which it was put and the purpose and intent of the parties on the date on which the security interest was created. 1

Study Group Meeting 7 th August, 2018 Compiled by Mr Ajay R Singh & Mr. Ravindra Poojari Advocates 4. Synthite Industrial Ltd. v. CIT (2018) 404 ITR 605 (Ker)(HC), Where assessee purchased a rubber estate and converted said land by cutting trees into housing plots, and sold same to several people for construction of villas, said land had ceased to be an agricultural land, and, consequently, assessee could not claim exemption from levy of capital gains. 2. Pr. CIT v M/s. Quest S. 37 (1) : Business expenditure The principle accepted by the Revenue 1. Radhasoami Satsang Vs. Commissioner of – Prorata allocation between Investment Advisors Income Tax, 193 ITR 321(SC) for 10 earlier years and 4 subsequent Pvt. Ltd. ITA No. 280 OF earning of capital gains and on application of the principles of consistency[In years to the AYs. 2007-08 and 2008-09 income – 2016, dtd:28/06/2018 professional favour of assessee] was that the entire expenditure is to (Bom) (HC) Allowable on the principle of be allowed against business income A.Y. 2008-09 consistency . Followed in : and no expenditure is to be allocated In taxation matters, the strict Municipal Corporation of City of Thane vs. to capital gains. Once this principle was rule of res judicata as Vidyut Metallics Ltd & Anr. (2007) 8 SCC 688 accepted and consistently applied and envisaged by section 11, followed, the Revenue was bound by CPC 1908 has no 2. Bharat Sanchar Nigam Ltd. Vs. Union of India application. However 282 ITR 273(SC) it. Unless of course it wanted to on application of the principles of consistency[In principle of consistency will change the practice without any favour of assessee] be applicable change in law or change in facts therein. 3. Kindly refer my Article on www.itatonline.com. 3. Jaya Aggarwal v. ITO S. 68 : Cash credits – Cash Cash withdrawn from Bank was 1. Jaspal Singh Sehgal v. ITO (2016) 47 ITR 193 (2018) 165 DTR 97 withdrawn from Bank was redeposited after seven months, (Mum)(Trib) (Delhi)(HC) redeposited after seven addition cannot be made as cash S. 68 : Cash credits -Onus is on AO to establish months, addition cannot be credits. Explanation given by assessee that cash withdrawn from bank is utilized A.Y. 1998-99 made as cash credits. that deposit was made out of sum 2

Study Group Meeting 7 th August, 2018 Compiled by Mr Ajay R Singh & Mr. Ravindra Poojari Advocates Explanation of Assessee withdrawn earlier was not fanciful and elsewhere – No unexplained cash credits in should be accepted. sham story and it was perfectly hands of assessee[In favour of assessee] plausible. One should not consider and reject an 2. CIT v. Manoj Indravadan Chokshi (2015) 229 explanation as concocted and Taxman 56 (Guj.)(HC) contrived by applying prudent Man’s S. 68 : Cash credits – Once source of cash behaviours test . Principle of deposit in bank account is explained, preponderance of probability as a test subsequent withdrawal is not required to be is to be applied and is sufficient to explained-Addition cannot be made as cash discharge onus. credits. [In favour of assessee] 3. Sumati Dayal Vs.CIT (1995) 214 ITR 801 (SC) 4. CIT v. Lalitkumar Bardia S. 127 : Power to transfer The notice dated 22.9.1999 issued 1. Tata Sons Ltd. v. ACIT (2017) 162 ITD 450 (2018) 404 ITR 63 cases – Assessment - u/s.158BC of the Act was issued by the (Mum.) (Trib.) (Bom.) (HC) Jurisdiction - Though the DCIT, who was not the Assessing S. 127 : Income tax authorities – Additional SLP dismissed(2018) assessee has taken part in Officer of the assessee. Consequently, ground on jurisdiction was admitted-Power to 401 ITR (st) 172 the assessment the notice being without jurisdiction, transfer cases – Assessment order passed proceedings, waiver will not all the proceedings subsequent without authority of law was held to be bad in A.Y. 1989-90, 1999- confer jurisdiction on thereto were without authority of law. law. [In favour of assessee] 2000 Assessing Officer. High Court further held that transfer of Irregular exercise of proceedings u/s.127 cannot be jurisdiction and absence of retrospective so as to confer jurisdiction. jurisdiction on a person who does not have it. Though the assessee has taken part in the assessment proceedings, waiver will not confer jurisdiction on Assessing Officer hence the order passed was held to be not valid . 3

Study Group Meeting 7 th August, 2018 Compiled by Mr Ajay R Singh & Mr. Ravindra Poojari Advocates 5. PCIT v. Sesa Resources S. 31 : Repairs - Expenditure The expenditure incurred by assessee 1. ABC Bearings Ltd v. ACIT (2017) 157 DTR 242 Ltd. (2017) 404 ITR 707 incurred on repair of vessels were 'current repairs' which was (Mum) (Trib) (Bom.) (HC) was to be allowable necessary to keep vessel in good S. 31 : Repairs - Expenditure on repairs and working condition and to keep them maintenance of existing assets without seaworthy. Increased expenditure did creating any new assets was held to be not result in an increase of capacity of revenue and not capital in nature . [S. 37 (1)] vessels or any new advantage or capital asset coming into existence. S. 36 (1) (iii) : Interest on The expression “ commercial borrowed capital – Advance CIT v. Mira Exim Ltd. (2018) 400 ITR 28 (Delhi) expediency” is an expression of wide of loan to sister concern the (HC) import and includes such expenditure purpose of business hence Interest on borrowed capital – Advance to as a prudent businessman incurs for interest was held to be director for the purpose of business - the purposes of business. The allowable . Disallowance of interest cannot be made. expenditure may not have been incurred under any legal obligation, CIT v/s. Gujarat Reclaim & Rubber Prod. 383 ITR but yet it is allowable as a business 236 (Bom) expenditure if it was incurred on grounds of commercial expediency . 6. CIT v. Mahindra and S. 28(iv) : Business income - S. 28(iv) of the IT Act does not apply on 1. CIT .v. Santogen Silk Mills Ltd. (2015) 231 Mahindra Ltd (2018) Waiver of loan - Remission the present case since the receipts are Taxman 525 (Bom.)(HC) 404 ITR 1 (SC) or cessation of trading in the nature of cash or money and S. S. 28(iv) : Business income-Value of any A.Y: 1976-77 liability – Loan waiver cannot 41(1) of the IT Act does not apply since benefit or perquisites- Converted in to be assessed as cessation of waiver of loan does not amount to money or not – Loan for capital asset-One liability, if the assessee has cessation of trading liability. It is a time settlement – Waiver of loan was held to not claimed any deduction matter of record that the assessee has be not assessable as business income. u/s 36(1)(iii) of the Act qua not claimed any deduction under S. 36 4

Recommend

More recommend