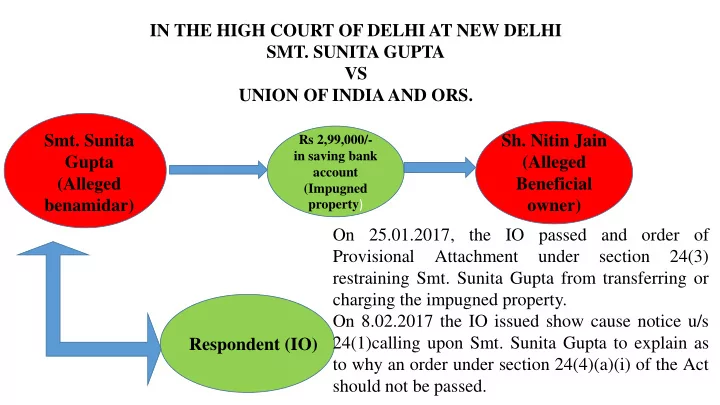

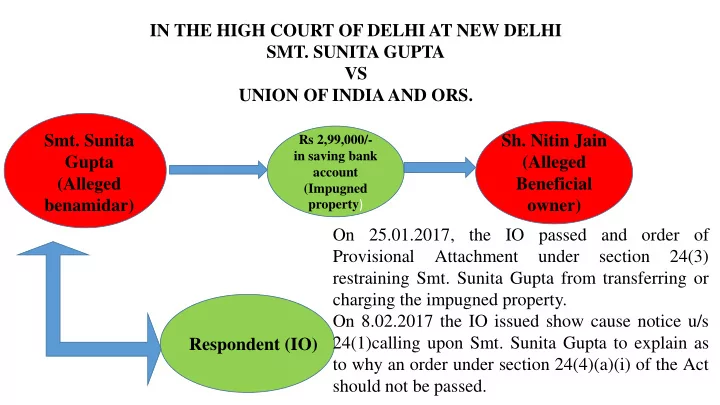

IN THE HIGH COURT OF DELHI AT NEW DELHI SMT. SUNITA GUPTA VS UNION OF INDIA AND ORS. Smt. Sunita Sh. Nitin Jain Rs 2,99,000/- in saving bank Gupta (Alleged account (Alleged Beneficial (Impugned benamidar) property ) owner) On 25.01.2017, the IO passed and order of Provisional Attachment under section 24(3) restraining Smt. Sunita Gupta from transferring or charging the impugned property. On 8.02.2017 the IO issued show cause notice u/s 24(1)calling upon Smt. Sunita Gupta to explain as Respondent (IO) to why an order under section 24(4)(a)(i) of the Act should not be passed.

On 21.05.2018 Ld. Adjudicating Authority passed an order holding that the property in question is not a benami property by concluding that IO cannot pass an order under section 24(3) prior to issuing a show cause notice under section 24(1). On 26.05.2018 the IO issued a fresh Show Cause Notice under section 24(1) of the Act, calling upon the petitioner to once again show cause that why the property should not be treated as benami. The said show cause notice is contested in the petition filed by Ms Sunita Gupta.

High Court held that:- The two essential conditions for issuing a show cause notice under section 24(1) of the Act are-: • that the IO must have reason to believe on the basis of material in his possession, that any person is a benamidar • He must record such reasons in writing.

The Court held that Adjudicating Officer was required to examine the material on record and after making such inquiries as necessary, take a view whether the properties are benami or not. It is well settled that if an order is set aside on account of violation of the principles of natural justice or on account of any procedural defect in the decision making process, the concerned authority is not precluded from reinitiating the proceedings after curing the procedural defects.

CONSEQUENCES AND IMPLICATIONS OF ABOVE JUDGEMENT: Legal and jurisdictional aspects may not be sincerely adhered to by the Initiating officers. The actions of the Initiating officer would become immune from any time limits and he will have multiple innings to pass the orders repeatedly related to the same properties or transactions.

The Adjudicating Authority has stopped dealing with legal issues while deciding the cases, taking shelter of the judgement of the High Court. The Adjudicating Authority is not even taking into account the order passed by Hon’ble MP High Court “ Kailash Assudani ” wherein it has been held that it is statutory duty of Adjudicating authority to decide all legal issues raised before it.

In the matter of Smt. Pamela Bhardwaj and Sh. Ramneek Singh Vs Initiating Officer, BPU Circle1(1), Chandigarh Graphical Representation of the transaction between alleged Benamidar and alleged beneficial owner. Appellant booked a flat executing 2. 1 . Mr. Flat Buyer Agreement in 2006 and paid the booking amount from his Ramneek bank account to the developer. Singh Kochar Impugned Flat After receiving the full (Alleged as consideration builder Benamidar) transferred and endorsed the property on 6-04-2012 in the name of Smt. Pamela In 2008, real market estate collapsed and Bhardwaj. the Appellant(Mr .Kochar) was unable to pay his outstanding dues and remaining due instalments for the impugned flat. 5. M/s Subsequently, builder also served the final notice for clearance of dues to Mr. Kochar, 4. Parsavnath else the booking amount was to be Developer Ltd . forfeited. 3. Since, the developer expressed his inability to execute Mrs. Pamela the transfer but assured the transfer of the title of the Bhardwaj (Alleged property after receiving full consideration, Mrs. Pamela At this time, Mr. Kochar found a Bhardwaj made the remaining payments from her bank as beneficial owner) buyer through his friend and account to the builder while the flat was still standing in executed Agreement to Sale dated the books of the builder in the name of Mr. Kochar. 1.06.2009 along with GPA.

Important observations and points of law decided by Hon‟ble Appellate Tribunal in aforesaid case vide its order dated 21.06.2019 If the person who has paid the consideration and thereafter taken the possession, it is difficult to hold that it is the case of benami transaction. Respondent (the IO) must bring material on record to show as to how benefit is derived by alleged beneficial owner even while not holding the property.

Undoubtedly, onus to prove passing of benefit test is upon shoulders of IO, which must be discharged for proving benami . The burden of proof of a fact is the most crucial aspect in any legislation and disputes or litigation arising in the implementation of the legislation. Entire thrust of the litigation and fate of the parties to the litigation depends on this fundamental issue.

Hon’ble Appellate Tribunal had relied upon the Supreme Court judgement of Smt. P. Leelavathi, supra given in 2019 where it is held that the initial burden of showing that a property is benami rests on the person making the allegation and the burden can be discharged by leading direct evidence or strong circumstantial evidence to that effect. It is well settled by the Courts that there is no room for proceeding simply on the basis of suspicion until backed by strong and incontrovertible evidence. This onus clearly vests on the shoulders of the Respondent.

The judgement Hon‟ble Supreme Court State of Bengal v. Mir Mohammad Omar & Ors. on 29 th Aug 2000 relied upon by the Respondent can by not stretch of imagination be extended to suggest that it shifts the burden of proof from the Initiating officer to the alleged beneficial owner or benamidar. It is only when the Initiating Officer discharges the said burden in terms of Section 91-92,101-102 and 106 and legal position laid down by Hon’ble Supreme Court in its various judgments which are directly on the issue of benami property.

The Respondent (IO) had contended that judgement of Supreme Court in the case of Villiammal v. Subramaninam, will not be applicable while interpreting the provisions of PBPT Act,1988 because these were rendered in the context of civil law wherein PBPT provisions were not discussed. The said contention has not been accepted by Appellate Tribunal and it was observed that there is no provision at all which shifts the burden of proof from the Initiating Officer to the Defendant. Thus, the principle of law laid down and clarified by Hon’ble Supreme Court and provisions contained in section 91,92,101 and 102 and other provisions of Indian Evidence Act are applicable here and thus burden f proof to prove a property as ‘ benami ’ is upon the Initiating officer, which has not been discharged.

It is also observed by the Tribunal that as per principle enshrined in section 106 of the Indian Evidence Act,1872 which states that “ when the question is whether any person is owner of anything of which he is shown to be in possession, the burden of proving that he is not the owner is on the person who affirms that he is not the owner” . It is also observed by the Tribunal that whoever desires any Court to give judgement as to any legal right or liability dependent on the existence of facts which he asserts, must prove that those facts exist and when a person is bound to prove the existence of facts which he asserts, it is said that the burden of proof lies on that person.

The sole belief of Respondent to make the transaction benami was relied upon the statement of appellant (Mr. Kochar) before Income tax Authorities. With regard to the validity of the statement, which was relied by the Respondent (IO) which is not recorded by him but by some other agency, it was held by the Tribunal that the statement taken was far different from the object, scope and operation of new benami law, and thus could not be made the sole basis to take action under Benami Law.

With regard to the weightage of the statement it was observed by the Tribunal that a statement which is based upon and is also matching with the contents of the documentary evidences has got more evidentiary value in the eyes of law as compared to a statement given just in air on the basis of memory only, and that too after a long time gap from the date of event. It has also been held by the Tribunal that cross examination of a witness whose statement is being relied by the respondent and he makes it as the sole basis of holding the transaction benami is the mandatory requirement which is a normal practice to meet the principles of natural justice.

M/s Virgo Buildestate Pvt. Ltd. versus Initiating Officer, DCIT, BPU circle., Jaipur Graphical Representation of the transaction between Bonafide purchaser and Jaipur Development Authority. Surrendered to Jaipur Development Authority for its Shri Pooran onward sale after conversion of land from agricultural to Impugned Mal Kanwat commercial use. Hence JDA (Alleged Land issued lease deed in Benamidar) accordance with Section 54B of JDA Act,1982. Jaipur Consideration paid through M/s Macro Development brokers whose brokerage Builders Pvt. Ltd. Authority(JDA) has been paid. and 2 others (Alleged beneficial M/s Virgo owners) Buildestate Pvt. Allotted in a bonafide Ltd. manner, the impugned land (Interested on 99 years’ lease for Party) development and resale. Appellant had already constructed, sold and given physical possession of the Flat/Independent Floor/Villas constructed on the impugned property to the bonafide buyers.

Recommend

More recommend