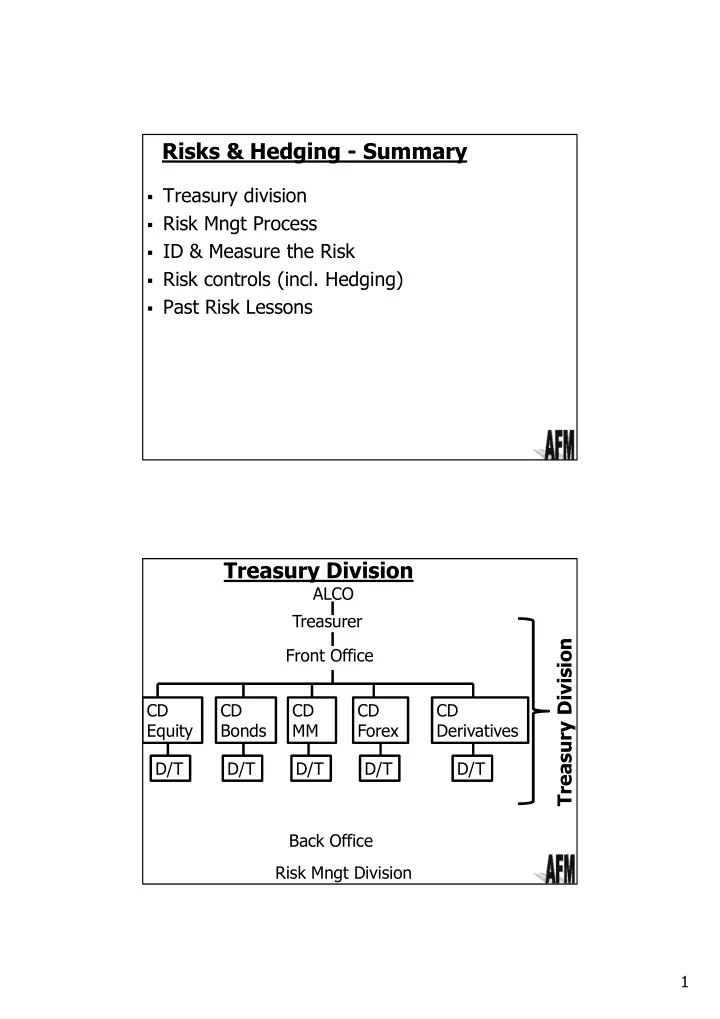

Risks & Hedging - Summary � Treasury division � Risk Mngt Process � ID & Measure the Risk � Risk controls (incl. Hedging) � Past Risk Lessons Treasury Division ALCO Treasurer Treasury Division Front Office CD CD CD CD CD Equity Bonds MM Forex Derivatives D/T D/T D/T D/T D/T Back Office Risk Mngt Division 1

Risk Mngt Process � ID Risk � Measure risk � Control Risk (incl. hedging) � Finance Risk ID & Measure Risk � Various Risk Defins � ID 5 risks that could affect Sasol. Use current economic & other relevant info � Risk interconnection a challenge � But need classification for controls � Various risks (see next slide) 2

ID & Measure Risk ID & Measure Risk Only when the tide goes out do � Mkt vs. other risks you discover who's been swimming naked. � Internal vs. External Warren Buffet � Financial vs. Non-financial Comp Risk � Impact of share repurchase Mkt Risk � Operational Risk – Trader character � ID Risk via due diligence � Example 5 – Measure (See revision first) 3

Revision – Long vs. Short Price B A C D Time Revision – Option Option Holder Writer Long Short Premium 4

ID & Measure Risk � Example 5 – Measure � Other risk measures � Gap Analysis Product Mkts Client Report Retail Corporate (R Mil) (R Mil) Int rec – Int pd = 41 – 55 = -14 Deposit Received xxxx xxxx ST Fixed xxxx xxxx Int Risk? ST Floating 55 xxxx LT Fixed xxxx xxxx LT Floating xxxx xxxx Loans Extended xxxx xxxx � Std dev ST Fixed 41 xxxx � Beta ST Floating xxxx xxxx LT Fixed xxxx xxxx � D M LT Floating xxxx xxxx Duration = Modified Duration See notes 5

Risk Controls � Procedure/Event Resp. Person Risk Cat Control � Start at top – Board of directors (King Report) � Types – ex ternal & in ternal � Future – twin peak model Acts � Mkt conduct Regulator Overseeing Bodies � Prudential Regulator � Regulators cover same fin insts. In-house Controls � Lack in-house controls � Disasters � � Misconception Derivatives Risk controls � Procedure/Event Resp. Person Risk Cat Control � Ex 8 � FM Controls � Derivative Hedging Long position R204 bonds Int. risk? Derivative Hedges - Futures & Options Short R204 futures today Long R204 puts today Short R204 call options today 6

Past Risk Lesson: Barings � Initially Leeson traded in futures using arbitrage opportunities between Singapore & Japan - low risk, low profits � Leeson controlled both back & front offices � Later on, traded in futures without arbitrage --> made losses (margin calls) --> covered up by back office + improved cash flow by writing options (20 000) --> Showed profits £28 mil, hid losses £180 mil � Mid Jan 95 - long 3000 futures (Nikkei index) Earthquake struck Japan --> Nikkei down 13% Futures margin calls +puts exercised on Leeson � To recover losses, Leeson held $ 7 bn position = contracts (17 000 Japan + 40 000 Singapore) + huge positions in Jap gvt bond + Euroyen 7

Recommend

More recommend