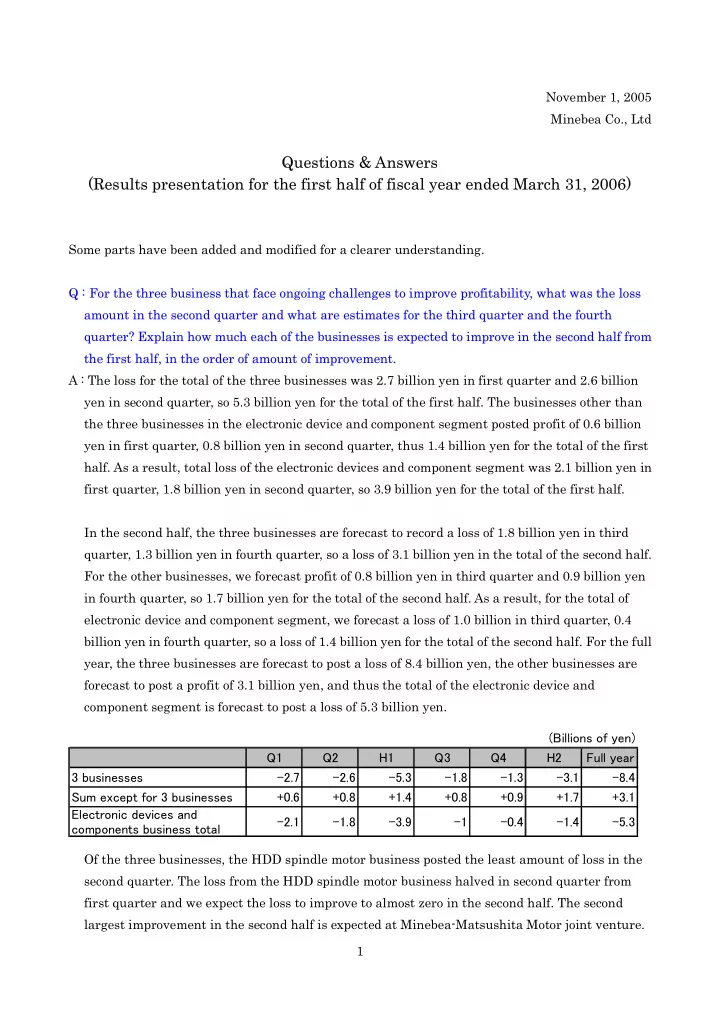

November 1, 2005 Minebea Co., Ltd Ques Questions & tions & Answers swers (Res (Results presen ults presentation for tation for the first h the first half of fisc lf of fiscal year en al year ended March ded March 31, 2006 31, 2006) Some parts have been added and modified for a clearer understanding. Q : : F For t the t e three b ee busines ness t that fa face ong ongoing ing challe lleng nges es t to im improve p e prof ofit itabilit ility, w what w was t the los e loss am amount i in t the se second qu quar arter an and w d what at ar are e estimates f s for t the t third qu d quar arter an and t d the f fourth quarter ter? E Explain how n how m much ea each of of t the b e busines nesses is is ex expected ed to imp to improv ove in t in the s e second nd ha half lf f from om the f the first ha t half lf, in t in the or e order of of a amount of ount of i improveme ement. t. A : The loss for the total of the three businesses was 2.7 billion yen in first quarter and 2.6 billion yen in second quarter, so 5.3 billion yen for the total of the first half. The businesses other than the three businesses in the electronic device and component segment posted profit of 0.6 billion yen in first quarter, 0.8 billion yen in second quarter, thus 1.4 billion yen for the total of the first half. As a result, total loss of the electronic devices and component segment was 2.1 billion yen in first quarter, 1.8 billion yen in second quarter, so 3.9 billion yen for the total of the first half. In the second half, the three businesses are forecast to record a loss of 1.8 billion yen in third quarter, 1.3 billion yen in fourth quarter, so a loss of 3.1 billion yen in the total of the second half. For the other businesses, we forecast profit of 0.8 billion yen in third quarter and 0.9 billion yen in fourth quarter, so 1.7 billion yen for the total of the second half. As a result, for the total of electronic device and component segment, we forecast a loss of 1.0 billion in third quarter, 0.4 billion yen in fourth quarter, so a loss of 1.4 billion yen for the total of the second half. For the full year, the three businesses are forecast to post a loss of 8.4 billion yen, the other businesses are forecast to post a profit of 3.1 billion yen, and thus the total of the electronic device and component segment is forecast to post a loss of 5.3 billion yen. (Billions of yen) Q1 Q2 H1 Q3 Q4 H2 Full year 3 businesses -2.7 -2.6 -5.3 -1.8 -1.3 -3.1 -8.4 Sum except for 3 businesses +0.6 +0.8 +1.4 +0.8 +0.9 +1.7 +3.1 Electronic devices and -2.1 -1.8 -3.9 -1 -0.4 -1.4 -5.3 components business total Of the three businesses, the HDD spindle motor business posted the least amount of loss in the second quarter. The loss from the HDD spindle motor business halved in second quarter from first quarter and we expect the loss to improve to almost zero in the second half. The second largest improvement in the second half is expected at Minebea-Matsushita Motor joint venture. 1

There was no improvement by the keyboard business as cost reduction was not sufficient to offset adverse effects of steep rise in plastic resin material costs. For the first half, of the three businesses, HDD spindle motor posted the least amount of loss, the next was Minebea-Matsushita Motor joint venture, then keyboard. We forecast similar situation in the second half. Q : : T The H e HDD s spind indle moto e motor b busines ness ma made a an imp improv oveme ement a t after ter a a la launc unch of h of a a new new p polic licy — to — to im improv ove p e profit ofitabilit ility w while m ile maint intain ining ing t the s e same lev level of l of volum lume. W What is is t the nex e next m measur ure t e to achiev hieve a e an a adeq equa uate lev te level of l of p prof ofit. it. T The g e gap b betw tween M n Mineb nebea a and a a c comp mpetitor etitor is is w wideni ning ng. T The e FDB motor motors f for 2 2.5-inch th that a are n e not s t sintered met ed metal ty type do n pe do not s t seem to eem to be s sufficien ent to n t to narrow ow th the g e gap. Wh p. What are mea e measures es, i , including pr produ oduct r t roadmaps ps, i into th to the f e futu ture? A : Because of our small market share, the gap between us and our competitor is difficult to narrow down just with FDB motors for 2.5-inch. In the area of 3.5-inch, staying competitive in the market of low-price-range-products is not easy, but because our product quality receives high assessment from customers, we will compete with regards to quality. We are confident we can make profit in the area of high-priced-products. As for volume, we do not plan to continue with monthly volume of 4.5 million to 5.0 million next fiscal year. We plan to increase production level to around 6 million by securing a certain level of share in the spindle motor market, which is growing along with HDDs. During these processes, we plan to establish fundamentally FDB technologies. Q : : You s u said id prof ofit c it can b n be g gene nerated ted f from om hig high-priced-mod models ls in the c in the current en ent environment w nment with th rela latively s stable s e sales les p pric ices es. Ha Have y you a u assumed p pric ice w e will d ll decline ne ine next fis fiscal y year? A : We have assumed some price decline. However, if prices fell more than forecast, we are confident we can generate profit by increasing monthly volume from 4.5-5 million to 6 million. Q : : F For the ke the keyboa oards, w what a are c e criter iteria ia us used ed in d in decision ma on makin king? You menti u mentioned ned tha that y you a u are e workin ing on c on cost r reductio ion in t n in the a e area ea of p of parts p proces essing ng a and log logistic ics. W What c crit iter eria ia d do y you s u set for the p the prof ofit ma it margin in? A : The condition required for the business to be continued is to generate profit. For the keyboard business, we could not foresee the current situation. By verifying, in a short time, to what level can the sales prices be raised, to what level can the raw material prices be lowered and to what level manufacturing cost can be reduced, we intend to consider the direction the business should take. Q : Q : Wh What do do y you pl plan to to do do wi with th th the jo joint v t venture str structure o of th the ke keyboard b busi siness wi ss with th H Huan Hsin G Hs in Group oup. P Personally lly, I t I think ink Mineb nebea s should ould t take m more init initia iative a and r run t un the op e oper eratin ing inde depe pendentl tly. 2

Recommend

More recommend