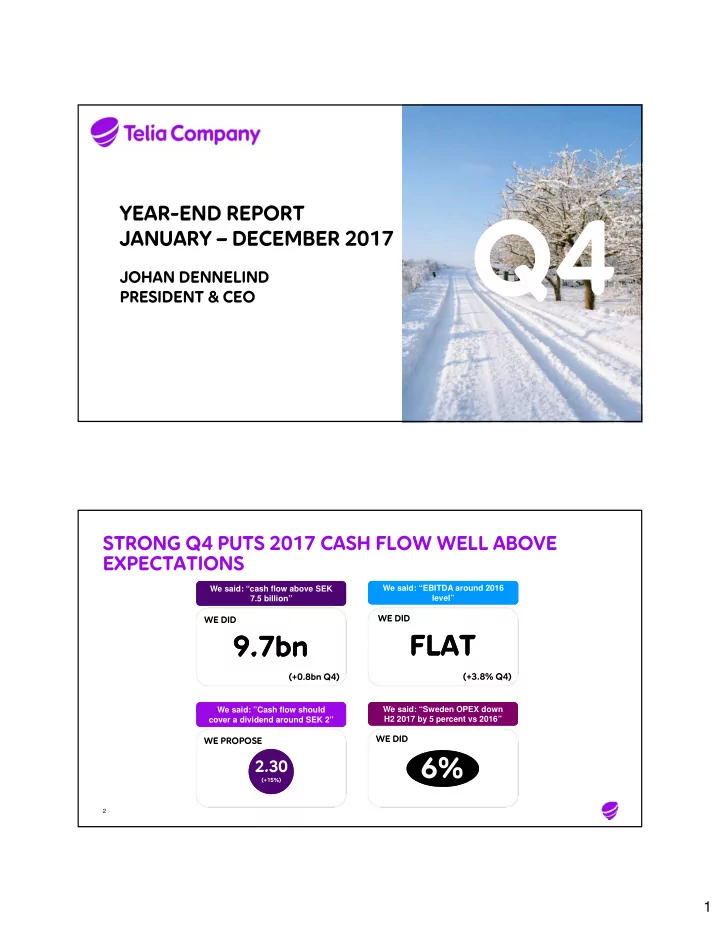

Q4 YEAR-END REPORT JANUARY – DECEMBER 2017 JOHAN DENNELIND PRESIDENT & CEO STRONG Q4 PUTS 2017 CASH FLOW WELL ABOVE EXPECTATIONS We said: “EBITDA around 2016 We said: “EBITDA around 2016 We said: “cash flow above SEK We said: “cash flow above SEK 7.5 billion” 7.5 billion” level” level” WE DID WE DID 9.7bn 9.7bn FLAT +3.8% FLAT +0.8bn Q4 Q4 (+0.8bn Q4) (+3.8% Q4) We said: “Sweden OPEX down We said: “Sweden OPEX down We said: ”Cash flow should We said: ”Cash flow should cover a dividend around SEK 2” cover a dividend around SEK 2” H2 2017 by 5 percent vs 2016” H2 2017 by 5 percent vs 2016” WE DID WE PROPOSE 6% 2.30 (+15%) 2 1

GOOD UNDERLYING EBITDA DEVELOPMENT SERVICE REVENUE DEVELOPMENT EBITDA DEVELOPMENT Organic growth, external service revenues Organic growth, excluding adjustment items 7% 7% Service revenues EBITDA Service revenues excl. fiber installation revenues EBITDA excl. fiber installation revenues* 3.8% -1.0% -1.0% -2.3% -2.3% Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 • Service revenue growth in 5 of 7 markets • EBITDA growth in 5 of 7 markets • Lower fiber installation and Telia Carrier revenues • Strong performance in Finland and the Baltics impacted growth negatively by almost 2 p.p. • Growth excluding fiber was around 7 percent 3 * On average ~70% EBITDA margin on fiber installation revenues in Sweden COST MANAGEMENT SUPPORTS EBITDA IN SWEDEN SWEDEN OPEX DEVELOPMENT* SWEDEN UNDERLYING EBITDA** Reported currency, SEK billion & adjusted OPEX Reported currency, adjusted EBITDA EBITDA growth OPEX R12 OPEX y-o-y growth EBITDA growth excl. fiber installation revenues 10% and pension one-off 8.5 8.3 8.3 8.2 8.1 8.1 5% 3% 0% 0% -4% -6% -5% 6 -10% Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 • The ambition announced Q2 2017 to take down • Positive underlying EBITDA adjusted for fiber OPEX by 5 percent H2 y-o-y* was more than installation revenues and pension one-off Q4 2016 realized * Adjusted external OPEX, excluding a one-off item in Q4 2016 related to pensions 4 ** Adjusted EBITDA excluding fiber installation revenues and for a positive one-off item in Q4 2016 related to pensions 2

CONVERGENCE IN SWEDEN VIA CUSTOMER EXPERIENCE TELIA LIFE DEMAND FOR SIMPLIFICATION … >20GB 53 million LARGE LARGE MOBILE BROADBAND MOBILE BROADBAND PERSONAL TECHNICIAN PERSONAL TECHNICIAN C MORE STANDARD C MORE STANDARD CHROMECAST CHROMECAST MOBILE 4G ROUTER MOBILE 4G ROUTER • Leading the way on convergence in Sweden through customer experience • Large untapped potential ahead as we refine the ...IN OUR CUSTOMERS’ DIGITAL LIFE portfolio step by step • Simplification & customer experience to drive 5 POSITIVE ON REVENUES & STRONG EBITDA GROWTH MOBILE DEVELOPMENT SERVICE REVENUES* & EBITDA** Organic growth, ARPU growth in local currency SEK million, reported currency & organic growth +1.5% +1.5% Total mobile service revenues 3,087 Mobile ARPU 2,934 6.3% +10.1% +10.1% 4.5% 1,137 1,000 Q4 16 Q4 17 Q4 16 Q4 17 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Service revenues EBITDA • Solid development on mobile • Continued solid mobile service revenue trend • Double-digit EBITDA growth on the back of • ARPU uplift in both B2B and B2C due to price revenue growth and solid cost control increases and portfolio management 6 = Organic growth * External service revenues ** Excluding adjustment items 3

GEARING UP IN B2B & B2C CONVERGENCE IN FINLAND M&A TO EXPAND PORTFOLIO ICE HOCKEY RIGHTS FOR B2C DATA CENTER BUILD • Largest open data center to support • B2B convergence capabilities • Exclusive content to build superior customers’ digital agenda strengthened via M&A B2C proposition • First customer contracts signed • Around SEK 0.7 billion revenues • Liiga starts autumn 2018 annually in the acquired businesses 7 NEW FOOTPRINT TAKING SHAPE CONTINUING TO BUILD … RECENT DIVESTMENTS FULL STAKE DIVESTED FULL STAKE DIVESTED … AND STRENGTHENING THE NORDIC/BALTIC FOOTPRINT 8 4

TARGET TO TAKE DOWN COSTS BY SEK 1.1 BILLION 2018 2018 COST TARGET OVERVIEW Targeted saving by market • Net savings of SEK 1.1 billion targeted in 2018 vs. 2017- 1.1bn initiative launched mid 2017 100% • Limited net effect in Finland as gross savings are offset by M&A • Other mainly related to group functions 80% Other • Key programme streams LED* 60% • Vendor consolidation & near-shoring Norway 40% Finland • Transfer of customers online (sales & support) Sweden 20% • Use of robotics 0% • Optimized SAC spend 9 * Lithuania, Estonia, Denmark DIVIDEND PROPOSAL FOR 2017 Equal to 9.96bn SEK 2.30 in pay-out +15% 3.00 3.00 3.00 vs 2016 2.85 2.85 2.30 2.00 2011 2012 2013 2014 2015 2016 2017 Excluding Eurasia cash flow 10 5

SO WE ARE LOOKING FORWARD... 1 2 3 TAILWIND FROM TAILWIND FROM NWC & CAPEX NWC & CAPEX THE 2018 THE 2018 LEGACY REVENUE LEGACY REVENUE COST PROGRAMS COST PROGRAMS SUPPORTING SUPPORTING FUNDAMENTALS … FUNDAMENTALS … HEADWIND HEADWIND & SYNERGIES & SYNERGIES CASH FLOW CASH FLOW (M&A 2017) (M&A 2017) MAINTAINED HIGH CASH FLOW 2018 MAINTAINED HIGH CASH FLOW 2018 … LEADS TO … LEADS TO FURTHER CASH FLOW GROWTH 2019/20 FROM CORE METRICS FURTHER CASH FLOW GROWTH 2019/20 FROM CORE METRICS 11 OUTLOOK FOR 2018 Around SEK 9.7 billion OPERATIONAL FCF* Operational FCF together with dividends from associated companies should cover a dividend around the 2017 level (a SEK 2.30 dividend/share equals SEK 9.96 billion) EBITDA** In line or slightly above the 2017 level of SEK 25.4 billion * Free cash flow from continuing operations, excluding licenses and dividends from associated companies ** Based on current structure, i.e. including M&A made so far, excluding adjustment items, in local currencies 12 6

JANUARY – DECEMBER 2017 Q4 YEAR-END REPORT CHRISTIAN LUIGA EXECUTIVE VICE PRESIDENT & CFO EBITDA GROWTH DESPITE SERVICE REVENUE DECLINE SERVICE REVENUE DEVELOPMENT Q4 EBITDA DEVELOPMENT Q4 Organic growth, y-o-y, external service revenues Organic growth, y-o-y, excluding adjustment items -2.3% -2.3% +3.8% +3.8% • Lower legacy and fiber installation revenues in Sweden • Overall solid execution on costs more than compensated for revenue pressure • Solid mobile supported revenues in Finland • Positive development across the Baltics 14 7

STABLE UNDERLYING B2C BUT PRESSURE ON FIBER AND B2B SERVICE REVENUES BY SEGMENT B2C MOBILE TRENDS Organic growth, external revenues Organic growth, external revenues B2C incl. fiber installation revenues B2C mobile service revenue growth B2C excl. fiber installation revenues B2C mobile ARPU B2C 5% -0.3% -0.3% 3% B2B -4.1% -4.1% -5.6% -5.6% Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 • Flat B2C development excluding fiber installation • B2C mobile continues to develop positively revenues • ARPU uplift from positive subscription base mix • Fiber installation revenues down SEK 224 million development • Challenging B2B comparison 15 FIBER ROLL-OUT IN SWEDEN CONTINUES TO BE A DRAG FIBER INSTALLATION REVENUE TREND FIBER CAPEX TREND Reported currency, y-o-y growth Reported currency, SEK million Fiber installation revenues 1,250 1,000 39% 750 500 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 250 -47% 0 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 • Slow fiber roll-out pace also in Q4 • More rural locations and phasing effects in Q4 • Permits still an issue and execution has become more challenging 16 8

STABLE UNDERLYING PERFORMANCE IN NORWAY SERVICE REVENUES* & EBITDA** ORGANIC EBITDA** DEVELOPMENT SEK million, reported currency & organic growth SEK million, organic EBITDA and margin Special items Q4 2017 +0.1% +0.1% Organic EBITDA 1,000 50% Organic EBITDA margin 2,149 2,036 40% 750 -4.3% -4.3% Phonero 30% 500 20% 865 851 250 10% 0 0% Q4 16 Q4 17 Q4 16 Q4 17 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Service revenues EBITDA • Flat revenue growth supported by increase in • Absolute organic EBITDA continues to be fairly Wholesale stable • Limited Phonero synergies in the quarter • Q4 impacted by seasonality and a few special cost items • Almost 40,000 B2C subscriptions acquired 17 = Organic growth * External service revenues ** Excluding adjustment items STRATEGY EXECUTION AND EBITDA GROWTH DELIVERING ON THE STRATEGY IN LED FINANCIAL DEVELOPMENT 2017 Organic growth, y-o-y • Telia One launched in Service revenues* Lithuania & Estonia • Increase loyalty EBITDA** 5.7% 5.6% 5.8% • Drive cross-sell 3.2% • Improved experience -0.3% -2.0% Estonia Lithuania Denmark • ”My Telia” in Denmark FY2017 FY 2017 FY 2017 improved • Simplifies subscription management online • Increased efficiency across including continued synergy realization in Estonia and Lithuania • Less need for support • Estonia and Lithuania also supported by strong • Improved experience revenue development 18 * External service revenues ** EBITDA excluding adjustment items 9

Recommend

More recommend