Q2-2018 INVESTOR PRESENTATION For the quarter ended June 30, 2018 - PowerPoint PPT Presentation

Q2-2018 INVESTOR PRESENTATION For the quarter ended June 30, 2018 August 2018 Forward Looking Information This presentation may contain forward-looking statements and statements regarding the business and anticipated financial performance of

Q2-2018 INVESTOR PRESENTATION For the quarter ended June 30, 2018 August 2018

Forward Looking Information This presentation may contain forward-looking statements and statements regarding the business and anticipated financial performance of MCAN Mortgage Corporation and its subsidiaries. These statements are based on current expectations, and are subject to a number of risks and uncertainties that may cause actual results to differ materially from those contemplated by the forward-looking statements. Some of the factors that could cause such differences include legislative or regulatory developments, competition, technology change, global market activity, interest rates, changes in government and economic policy and general economic conditions in geographic areas where MCAN operates. Reference is made to the risk factors disclosed in MCAN’s 2018 Annual Information Form which are incorporated herein by reference. These and other factors should be considered carefully and undue reliance should not be placed on MCAN’s forward -looking statements. Subject to applicable securities law requirements, MCAN does not undertake to update any forward-looking statements. 2

Contents Second Quarter 2018 Highlights MCAN’s Outlook as at Q2 2018

Financial Highlights – Q2 2018 (for the quarter ended June 30, 2018) $1.2 .21 Billi lion $0.4 .47 $11.1 .1 Milli lion 14.5 .54% Corporate Assets Basic and diluted Net Income Return on Avg. (up 8% or $90mm earnings per share (up 24% or Shareholders’ from Mar-18) (up 21% or $0.08 $2.2mm from Equity [1] from Q2-17) Q2-17) (12.37% in Q2-17) • 3.17% spread of Mortgages (Corporate Portfolio) over Term Deposits for 2017, up from 3.07% in Q2 2017. • Impaired total mortgage ratio [1,2] decreased significantly to 0.02% at June 30, 2018 from 0.10% at March 31, 2018. • Consistent with the prior quarter, the Board of Directors declared a third quarter dividend of $0.37 per share payable on September 28, 2018 to shareholders of record as of September 14, 2018. 4 1 Non- IFRS measure as defined in MCAN’s Q2 -2018 MD&A 2 Represents impaired (stage 3) mortgages under IFRS 9 and impaired mortgages under IAS 39.

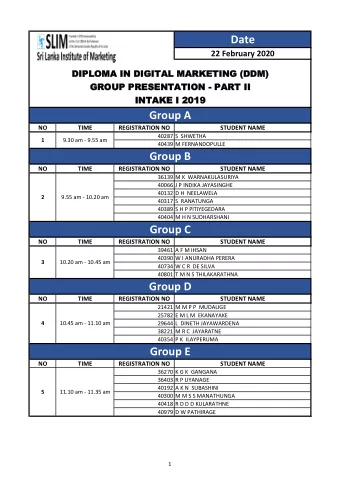

Financial Highlights – Q2 2018 (as at June 30, 2018) Current Year Prior Year YTD YTD Q2-2018 Q2-2017 Jun-2018 Jun-2017 Net Income $11.1 million $8.9 million $21.7 million $19.2 million Earnings per share $0.47 $0.39 $0.92 $0.83 ROE [1] 14.54% 12.37% 14.32% 13.37% Dividends per share $0.37 $0.32 $0.74 $0.62 Net Investment Income – $15.1 million $12.2 million $27.1 million $25.1 million Corporate Net Investment Income – $1.3 million $1.4 million $2.6 million $2.7 million Securitization 1 Return on Average Shareholders’ Equity (ROE) is defined as Non -IFRS measures as noted in 5 MCAN’s Q2 -2018 MD&A

Strong Capital Position (as at June 30, 2018) Regulatory Ratios Jun-18 Mar-18 Dec-17 OSFI CET 1, Tier 1 and Total Capital Ratio [2] 21.47% 21.29% 21.26% Leverage Ratio [2] 11.55% 11.74% 11.31% Tax Act Income Tax Assets to Capital Ratio [2] 4.60x [1] 4.33x [1] 4.60x [1] Income Tax Asset Capacity [2] was $293 million at June 30, 2018 compared to $356 million at March 31, 2018. This balance represents the additional amount of corporate assets in which we could invest within the rules of the Income Tax Act (Canada) that govern leverage for mortgage investment corporations. [1] Income Tax Assets managed to a level of 5.75 times Income Tax Capital on a tax basis, below the Tax Act prescribed maximum Income Tax Assets to Capital Ratio of 6.00 times 6 Non- IFRS measure as noted in MCAN’s Q2 -2018 MD&A; CET 1 = Common Equity Tier 1 [2]

Key Metrics: Quarterly Trend Charts (as at June 30, 2018) Return on average shareholders' equity 1 Net Income (%) ($ millions) 11.1 14.63% 10.8 14.54% 10.6 9.9 14.10% 8.9 13.63% 12.37% Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Basic and diluted earnings per share Book value per common share 1 ($ per share) ($ per share) 0.47 0.47 12.94 0.45 0.42 12.82 0.39 12.70 12.42 12.37 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 1 Taxable Income per share and Return on Average Shareholders’ Equity (ROE) are defined as 7 Non- IFRS measures as noted in MCAN’s Q2 -2018 MD&A

Geography of Corporate Portfolio (as at June 30, 2018) Single Family Mortgages Construction & Commercial Q2-18 (& Q1-18) Q2-18 (& Q1-18) British Quebec Columbia 3.6% 10.4% (3.4%) (10.3%) Alberta British 17.9% Atlantic Columbia (19.1%) Provinces 42.5% 3.9% (40.7%) Alberta (4.5%) 5.2% (7.8%) Other Provinces Quebec 2.8% 0.7% (3.1%) (0.5%) Ontario Ontario 61.4% 51.6% (59.6%) (51.0%) Total $338.5 million as at Q2-18 Total $580.5 million as at Q2-18 ($279.7 million as at Q1-18) ($579.6 million as at Q1-18) Source: MCAN’s Q2 -2018 Report 8

Arrears and Impaired Mortgages (quarterly history up to June 30, 2018) 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 Impaired Mortgages as % of Total Corporate Mortgages • Impaired total mortgage ratio [1] was 0.02%, improved from 0.10% at March 31, 2018. • Impaired corporate mortgage ratio [1] was 0.03%, compared to 0.22% at March 31, 2018. • Total mortgage arrears [1] were $21 million at June 30, 2018, compared to $19 million at March 31, 2018. [1] Non- IFRS measure as defined in MCAN’s Q2 - 2018 MD&A; Chart data source: MCAN’s Q2 - 2018 and prior years’ 9 annual reports.

MCAN’s Dividends: Attractive Yield Proven Performance as a High Yield Dividend Stock Indicated Gross Dividend Yield 10 Year History 14.00% 12.00% 10.00% Aug-18 8.11% 8.00% 6.00% 4.00% 2.00% 0.00% Aug-08 Aug-09 Aug-10 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 [1] Data Source: Bloomberg; MKP CN Equity - Dividend Indicated Yield – Gross; monthly data August 2008 up to August 14, 2018 10

A History of Regular Quarterly Dividends Regular Dividends - Quarterly History $0.37 $0.37 $0.37 $0.37 $0.28 $0.28 $0.28 $0.28 $0.29 $0.29 $0.29 $0.29 $0.30 $0.30 $0.32 $0.32 Source: MCAN’s Q2 2018 Report; MCAN’s annual and quarterly reports since Q4 2014 11

MCAN’s Outlook: Focus on Single Family • Canadian residential real estate markets continue to have a mixed performance as regional markets adjust to both regulatory changes and local economic conditions. We expect Canadian housing market conditions to experience volatility and uncertainty in 2018 and continue to face headwinds as consumers face a rising interest rate environment, making mortgages less affordable. • MCAN has historically repositioned itself during times of uncertainty to adapt its portfolio to changing market dynamics. At this time, we have decided to reposition our mortgage portfolio to focus more on single family mortgages (more moderate risk) and less on construction lending (comparatively higher risk) as we are currently seeing sales levels and property values weaken in construction housing market. • To assist with our single family growth plans, we have been reviewing the launch of new single family products through XMC Mortgage Corporation (“XMC”) and we have recommenced our program of acquiring uninsured single family mortgages from third parties. Through MCAP and other originators, we have accelerated discussions to acquire additional single family mortgages. Source: MCAN’s Q2 2018 Report 12

MCAN’s Outlook: Focus on Single Family • Given the competitive market conditions for single family lending market and the recent regulatory changes related to OSFI Guideline B‐20, we believe that there will be some challenge in originating adequate volumes to grow the single family portfolio. Additionally, we expect to experience competitive mortgage rate pressures in our single family lending business as we compete with other lenders for market share. As a result of this rebalancing, we expect to observe a reduction in historical spread levels and economics in our mortgage portfolio. • We expect to add additional resources and invest in new systems to ensure that there are sufficient processes and monitoring in place to support this growth and rebalancing. Collectively, we believe that this strategy may impact our net interest margins, while at the same time we believe that it will increase the strength of our balance sheet and improve our internal operating capabilities. • We currently have $293 million of available income tax asset capacity to take advantage of market opportunities. As uncertainty in the current market evolves, we believe that our strong capital position and asset capacity can be deployed if and when opportunities arise. Overall, we believe that our strategy in the near term is prudent given the current state of the economy and housing markets. Source: MCAN’s Q2 2018 Report 13

Thank You

Contact Information MCAN Mortgage tgage Corpor poratio tion 200 King Street West, Suite 600 Toronto, ON M5H 3T4 Tel. (416) 572-4880 mcanexecutive@mcanmortgage.com www.mcanmortgage.com 15

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.