Q1 FY19 Result Presentation August 2018 Contents About Us Large - PowerPoint PPT Presentation

Q1 FY19 Result Presentation August 2018 Contents About Us Large Customer Base Our Journey Ongoing Expansion Vision 2025 Industry Overview Key Competitive Strengths Financial Highlights Location Advantage

Q1 FY19 Result Presentation – August 2018

Contents ❑ About Us ❑ Large Customer Base ❑ Our Journey ❑ Ongoing Expansion ❑ Vision 2025 ❑ Industry Overview ❑ Key Competitive Strengths ❑ Financial Highlights ❑ Location Advantage ❑ CSR Activities 2 2

About Us India’s Largest Phthalic Anhydride (PAN) manufacturer and one of the Leaders across the Globe PAN is a downstream product of Orthoxylene (OX) a basic Petrochemical PAN is a versatile intermediate in organic chemistry for production of Plasticizers, Unsaturated Polyester Resins, Alkyd Resins, Paints & CPC Pigments Plants are engineered with modern technologies and are designed on the low energy based processes Steam generated from the production process used for Company’s captive power requirements Usage of PAN is increasing in new generation products where R & D is ongoing We are a environmentally responsible Company IGPL produces Maleic Anhydride through wash water generated out of the production process of PAN. Maleic Anhydride is used in agro and food businesses IGPL also manufactures Benzoic Acid (BA) as a by product 3

Our Journey… IGPL started as 100% EOU in 1988 1988 technical collaboration with Lurgi Gmbh, Germany* Brownfield expansion of Commenced 2000 2000 1992 1992 PA 2 Plant commercial production of PA at our Plant in Taloja Brownfield expansion of PA 3 Plant Converted from 2014 2014 2009 2009 EOU to DTA Revenues s cr cros oss Rs. Rs. 1,00 1,000 cr crs. s. Acquired MA Plant from MPCL through Slump Sale 2017 2017 PAT cr cros osses s Rs. Rs. 100 100 cr crs. s. * For an initial period of 10 years PA – Phthalic Anhydride; MA – Maleic Anhydride; BA – Benzoic Acid; MTPA – Metric Tonnes per annum; MPCL – Mysore Petro Chemicals Ltd. 4

Vision 2025 “ To be the Largest Manufacturer of Phthalic Anhydride in the World ” 5

Key Competitive Strengths 05 01 STR TRONG STR TRATE TEGIC Sale CLIENTELE LOCATION 04 02 EF EFFICIENT T DOMINANT T RE RECOVERY MARK RKET T SHARE PROCESS 03 MARK RKET T LEADER 6

Location Advantage Majority of domestic sales is within Western India Proximity to One of the Largest Ports in India Ka Kandl dla a Port Jamna nagar ar Enjoys the advantage of being in close proximity to ports for exports, chemical belt in western India JNPT NPT Port where majority of downstream industries are located including procurement of Orthoxylene IGPL Plan lant at t MID MIDC - Taloja ja, Ma Maharashtra Che hemica cal Belt in n We Weste tern Ind ndia 7 Map not to scale. All data, information and maps are provided “as is” without warranty or any representation of accuracy, tim eliness or completeness.

Large Customer Base Turkey Kuwait USA Tunisia Nepal Egypt U.A.E Bangladesh Saudi Arabia India Nigeria Ethiopia Venezuela Uganda Sri Lanka Kenya Sales Br Sale Brea eakup Exp Export Sale Sales, , 17% 17% Domestic Sal Dom Sales, , 83% 83% 8

Ongoing Expansion Phthalic Anhydride (PA 4) Post expansion IGPL will be one amongst the top three PAN ORGANIC IC EX EXPANSION (P (PA 4) 4) manufacturers in the world With capacities of PAN increasing, there would also be increase in manufacturing capacities of MA and BA DOWNSTREAM EX DO EXPANSION Do Downstream Ex Expansio ion into Spec ecia ialty Pla lastic icizers Exp xpansion to come on-stream in in 2019 9

Industry Overview INDI DIAN MARK ARKET SI SIZE ZE Phthalic Anhydride is ~3,75,000 MTPA Maleic Anhydride (MA) is ~60,000 MTPA INDU DUSTRY Y GROWTH PA to grow domestically 5% - 6% annually, backed by the thrust on Infrastructure and GDP growth MA also expected to grow 6% - 7% in the next few years INFR FRASTRUCTURE RE DEVE DEVELOPMEN ENT Highest Budget by the government for Infrastructure Development at Rs. 3.96 lakh crores UNIQUE POSI SITION for or IGPL The Company is uniquely positioned to partake in the industry growth 10

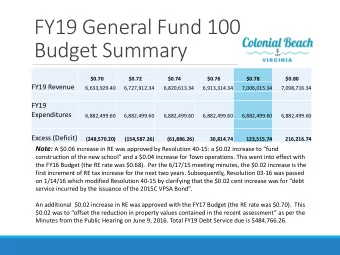

Financial Highlights – Q1 FY19 Revenue (Rs. Crores) ^ EBITDA (Rs. Crores) ^ PAT (Rs. Crores) * +19% +21% +3% 352 86 40 39 297 71 Q1 FY18 Q1 FY19 Q1 FY18 Q1 FY19 Q1 FY18 Q1 FY19 EBITDA (%) PAT (%) * + 40 bps -180 bps 24.4% 13.2% 24.0% 11.4% Q1 FY18 Q1 FY19 Q1 FY18 Q1 FY19 * PAT includes one time exceptional loss of Rs. 9.50 crores which is a write-off of the value of investments in JV by its subsidiary IGPL (FZE) ^ Includes Other Income 11

Financial Highlights Revenue (Rs Rs. Crores)# EB EBITDA (Rs Rs. Crores) and nd Mar argin % PAT (Rs Rs. Crores) and nd Mar argin in % 23.6% 12.8% 9.8% 16.5% 1,204 271 147 1,187 1,148 1,041 11.9% 6.3% 953 102 172 6.8% 5.0% 0.8% 113 60 0.3% 80 60 9 3 FY14 FY15 FY16 FY17 FY18 FY14 FY15 FY16 FY17 FY18 FY14 FY15 FY16 FY17 FY18 Net t De Debt (Rs Rs. Lakhs) & Net t De Debt / Equ Equity ROE % ROCE % RO 0.7 0.6 27.7% 42.6% 26.0% 0.3 180 0.2 20.6% 31.7% 0.1 135 24.3% 99 18.0% 82 11.2% 54 3.7% 1.2% FY14 FY15 FY16 FY17 FY18 FY14 FY15 FY16 FY17 FY18 FY14 FY15 FY16 FY17 FY18 The Financial Results for FY18 have been prepared in accordance with the Indian Accounting Standards (Ind AS) # Includes Other Income 12

Profit & Loss Statement – Q1 FY19 Particulars (Rs. Crores)* Q1 FY19 Q1 FY18 Y-o-Y FY18 Revenue from Operations^ 352 297 19% 1,148 Total Raw Material 226 189 728 Employee Expenses 16 12 56 Other Expenses 24 24 94 EBITDA^ 86 71 21% 271 EBITDA Margin (%) 24.4% 24.0% 23.6% Depreciation 6 6 26 EBIT 80 65 22% 246 EBIT Margin (%) 22.7% 22.0% 21.4% Finance Cost 2 5 15 Exceptional Loss 10 0 0 Profit before Tax 68 60 13% 231 Tax 28 21 84 Profit After Tax 40 39 3% 147 PAT Margin (%) 11.4% 13.2% 12.8% PAT includes one time exceptional loss of Rs. 9.50 crores which is a write-off of the value of investments in JV by its subsidiary IGPL (FZE) * Standalone ^ Includes Other Income 13

Balance Sheet - March 2018 Particulars (Rs. Crores)* Mar-18 Mar-17 Particulars (Rs. Crores)* Mar-18 Mar-17 Non Current assets Equity Property, Plant and Equipment 401 324 Equity Share Capital 31 31 Capital Work-In-Progress 26 11 Other Equity Goodwill 497 362 2 0 Other Intangible Assets 0 0 Total Equity 528 393 Intangible Assets under 1 0 Non Current Liabilities development Financial Liabilities Financial Assets Investments 49 19 Borrowings 29 60 Loans 1 0 Other Liabilities 38 0 Other Financial Assets 3 2 Provisions 3 2 Non Current Tax Assets 7 1 Deferred Tax Liabilities (Net) Other Non Current Assets 23 13 36 2 Total Non Current Assets 513 370 Total Non Current Liabilities 106 64 Current Assets Current Liabilities Inventories 94 97 Financial Liabilities Financial Assets Investments 40 0 Borrowings 0 2 Trade Receivables 139 150 Trade Payables 150 171 Cash and Cash Equivalents 5 5 Other Financial Liabilities 29 20 Other Bank Balances 17 25 Other Current Liabilities 13 8 Loans 1 0 Other Financial Assets 1 2 Provisions 1 1 Current Tax Assets 17 10 Total Current Liabilities 193 202 Total Current Assets 314 289 Total Equity and Liabilities 827 659 Total Assets 827 659 The Financial Results have been prepared in accordance with the Indian Accounting Standards (Ind AS) 14 * Standalone

CSR Activities ❑ Construction of a school in Vrindavan for providing education to the underprivileged children ❑ Educating the poor, annadhanam (feeding of poor), free /concessional health care to the needy apart from other charitable activities ❑ Sustainability of environment viz. transplantation of trees, water conservation projects, environment protection awareness campaign titled ‘Say no to plastic’, mobile toilet etc. ❑ Contribution to Charitable Trust and Community organisation i.e. old age homes, Blind Organization of India, etc. 15 15

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.