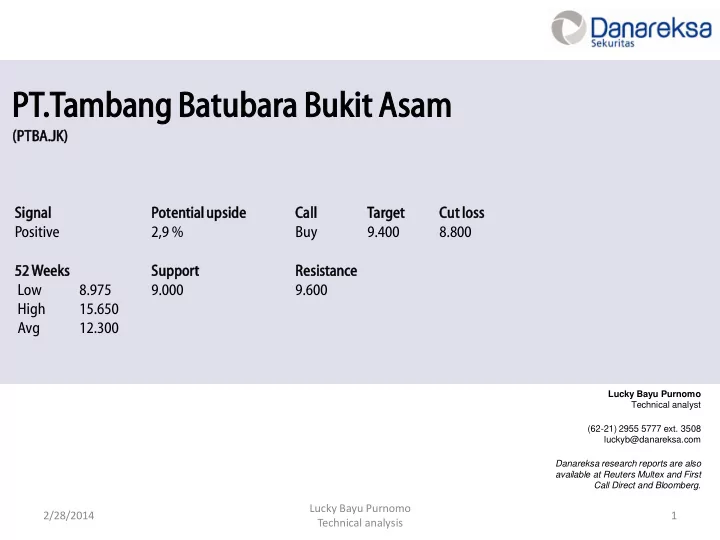

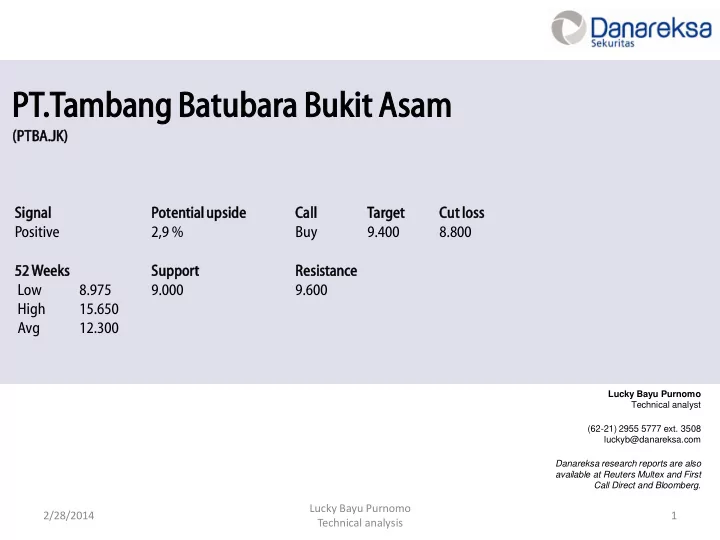

PT.Tam amban bang Bat atubar ara a Bukit t Asam (PTBA.JK) K) Signal Poten entia tial upside e Call Ca Target et Cut Cu t loss Positive 2,9 % Buy 9.400 8.800 52 Weeks ks Support Resista stance ce Low 8.975 9.000 9.600 High 15.650 Avg 12.300 Lucky Bayu Purnomo Technical analyst (62-21) 2955 5777 ext. 3508 luckyb@danareksa.com Danareksa research reports are also available at Reuters Multex and First Call Direct and Bloomberg. Lucky Bayu Purnomo 2/28/2014 1 Technical analysis

Jakarta Composite Index MIning Key Point • Red box explains the JCI chart movement still on the potential reversal, with the mining sector and PTBA PTBA Lucky Bayu Purnomo 2/28/2014 2 Technical analysis

Key Point • Coal price potential up trend, By Technical analysis indicator Lucky Bayu Purnomo 2/28/2014 3 Technical analysis

Jakarta Composite Index Key Point MIning Key Point • Since 1 February 2013 • Jakarta Composite Index increase 2 % • Red box explaining that the condition was corrected by JCI • Mining sector decrease 29 % down trend movement and the mining sector with stock movement PTBA • PTBA decrease 39 % PTBA Lucky Bayu Purnomo 2/28/2014 4 Technical analysis

Key Point • Waiting for golden cross, Base on momentum since August 2013 • Stochastinc still on the oversold moment, explain the potential accumulation • MACD testing the zero line, explain the potential accumulation • Major Trend of PTBA still on the down trend movement, explain the trading plan it must be accumulation for short term trade 9.938 9.400 Price target 8.896 Lucky Bayu Purnomo 2/28/2014 5 Technical analysis

Key Point • RSI, Waiting for golden cross, Base on momentum since November 2013 • Stochastinc still on the oversold moment, explain the potential accumulation • Minor trend of PTBA still on the sideways trend , explain the trading plan it must be accumulation for short term trade Lucky Bayu Purnomo 2/28/2014 6 Technical analysis

DISCLAIMER The information contained in this report has been taken from sources which we deem reliable. However, none of P.T. Danareksa Sekuritas and/or its affiliated companies and/or their respective employees and/or agents makes any representation or warranty (express or implied) or accepts any responsibility or liability as to, or in relation to, the accuracy or completeness of the information and opinions contained in this report or as to any information contained in this report or any other such information or opinions remaining unchanged after the issue thereof. We expressly disclaim any responsibility or liability (express or implied) of P.T. Danareksa Sekuritas, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action , suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither P.T. Danareksa Sekuritas, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or mis-statements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. The information contained in this report is not be taken as any recommendation made by P.T. Danareksa Sekuritas or any other person to enter into any agreement with regard to any investment mentioned in this document. This report is prepared for general circulation. It does not have regards to the specific person who may receive this report. In considering any investments you should make your own independent assessment and seek your own professional financial and legal advice. Lucky Bayu Purnomo 2/28/2014 7 Technical analysis

Recommend

More recommend