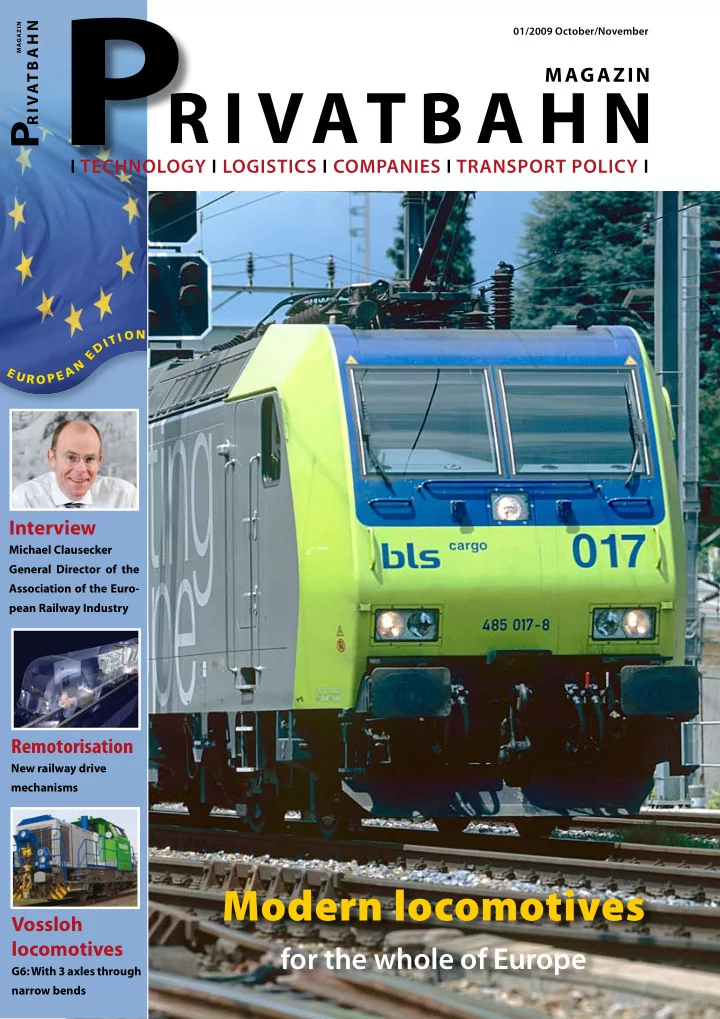

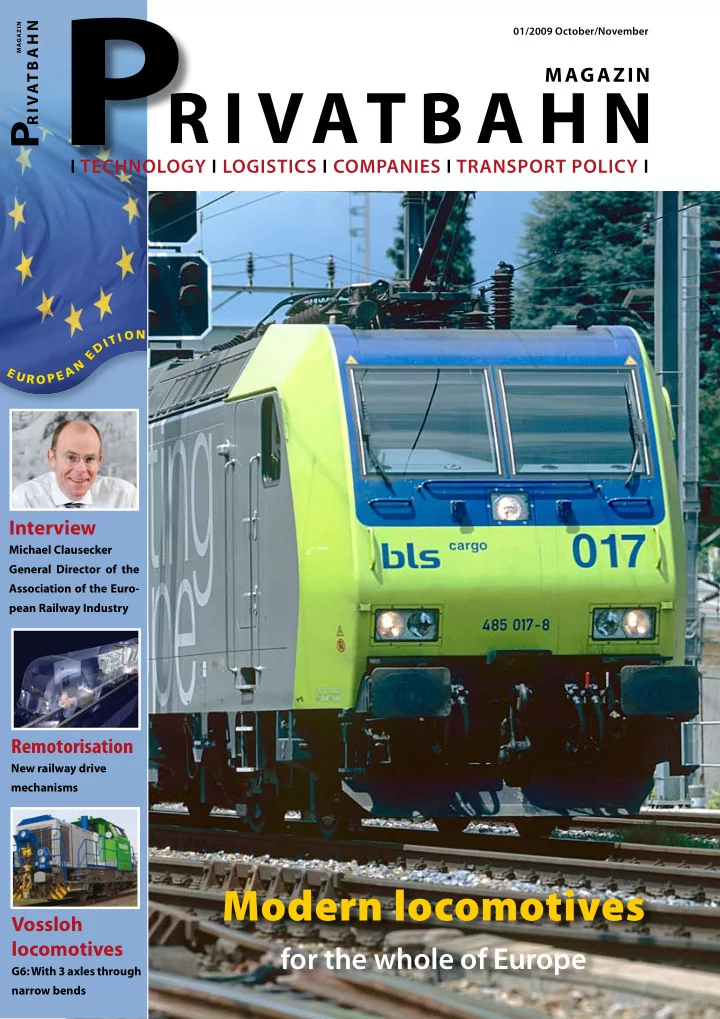

European_PriMa_Streifen_Blau:Eur P R I VAT B A H N MAGAZIN 01/2009 October/November MAGAZIN R I VAT B A H N P I TECHNOLOGY I LOGISTICS I COMPANIES I TRANSPORT POLICY I N O I T I D E N A E E U P R O Interview Michael Clausecker General Director of the Association of the Euro- pean Railway Industry Remotorisation New railway drive mechanisms Modern locomotives Vossloh locomotives for the whole of Europe G6: With 3 axles through 1 narrow bends P RIMA EUROPEAN EDITION 01.2009

Dr. Frank Thomas, partner of K&L Gates, in interview „We need a push for more competition and better financing“ PRIMA: Dr. Thomas, many traf- fjc services in the fjeld of the re - gional rail transport will be put out to tender in the years to come. However, a recent call for tenders in Berlin/Brandenburg showed that there is no real competition effect at the moment as a result of the current crisis of the fjnancial markets. Do you see any possibi- lities to support the regional rail transport permanently so that the achievements of previous years are not at stake? Dr. Frank Thomas: The recessi- on in Germany and the negative effects of the fjnancial crisis have clearly demonstrated that the German PTA’s have to reconsi- der certain elements of the tender Frank Thomas joined K&L Gates as a partner in January 2009. Prior to joining process to stabilize and further the fjrm, he was a partner in the Frankfurt offjce of an international law fjrm. Dr. Thomas has extensive experience in structured fjnance, asset fjnance and equip - increase the competition. One ment leasing with a particular focus on transport fjnance. of the key factors limiting the competition in regional passen- ger transport is the lack of attrac- allow the involvement of the fa- Dr. Frank Thomas: We clearly tive fjnancing and the mismatch vourable fjnancing conditions or realize a need for residual value between the concession periods credit risk of the public sector. risks to be shared between the and the useful life of respective Furthermore it will be important fjnanciers, the operator and the rolling stock. Most train opera- that the PTAs will provide fair PTA’s. In comparison with the tors will not have the capabilities and attractive tender conditions plain responsibility of the train to purchase new rolling stock and (e.g. fmeet size, asset specifjcation, operator to procure the rolling to take the asset risk, hence this risk sharing mechanism) to create stock, the additional agreement of development will need to be sup- more competition. a “further-use guarantee” has the ported by the PTA’s. This could advantage, that the rolling stock be achieved e.g. by offering PRIMA: There are consistent may be used until full amortisati- bankable further-use guarantees, calls for further-use guarantees on. The minimisation of the risk the formation of rolling stock for vehicles. How do you evalu- of further use after the expiry of pools or other structures which ate these claims? the concession agreement, gene- 12 P RIMA EUROPEAN EDITION 01.2009

Interview | Germany rally leads to favourable fjnan - to free up capital and increase structures. However, leasing has cing conditions. However, for liquidity. This could be for ex - established itself as a fmexible and the time being we have not seen ample structured in the form of important fjnancing tool during any bankable redeployment gu- a German closed- end KG funds. the past decade, so also fjnance arantees in the market. Further- Important aspects of operation leases, asset fjnance structures more there are certain insolven- are to ensure the non-discrimi- and to a limited amount tax leases cy law issues which needs to be natory access to the rail network will be used for fjnancing rolling considered when entering into a and the reduction of the technical stock in the future. Furthermore further-use guarantee. deviations in the EU. there will be a great demand for long term debt fjnancing and non- PRIMA: With regard to the eco- PRIMA: The liberalization and recourse facilities. By the way, nomic crisis and the concomitant the changing of the markets re- we will discuss future leasing- economic superiority of the na- quire customized rolling stock and fjnancing models during our tional railway, would it actually fjnancing. Which future leasing- annual rail fjnance conference on be appropriate to allude to a real and fjnancing models do you 5. November 2009 in Frankfurt. competition at all? think will prove most successful? The program can be downloaded on our website ww.klgates.com. Dr. Frank Thomas: It is obvi- Dr. Frank Thomas: New rol- ous that competition in regional ling stock will need fjnancing and PRIMA: Dr. Thomas, thank you passenger transport in Germany much of this will also in the futu- very much for your time. has at least stagnated in the last re come through operating lease Interview by Ulrich Vössing. 12 months. Deutsche Bahn as sta- te owned operator benefjts from the current market conditions and continues to dominate the market. However, according to offjcial fjgures of the Working Group of the PTAs for regional passenger rail transport ( Bundesarbeitsge- meinschaft der Aufgabenträger des SPNV) the market share of private operators is approx. 16%. In compression to other Europe- an states this seems to be a good level of competition which of course needs to be further incre- ased over the next years. PRIMA: The freight traffjc has problems. Which concrete con- cepts to you see to help the rele- vant companies? Dr. Frank Thomas: In the fjrst instance it will be important to increase the industry production and the export in the EU back to normal conditions. In the short- run sale-and-lease-back trans- actions for freight wagons and Deutsche Bahn as state owned operator benefjts from the current market condi - locomotives might be advisable tions and continues to dominate the market. Picture: DB AG 13 P RIMA EUROPEAN EDITION 01.2009

Recommend

More recommend